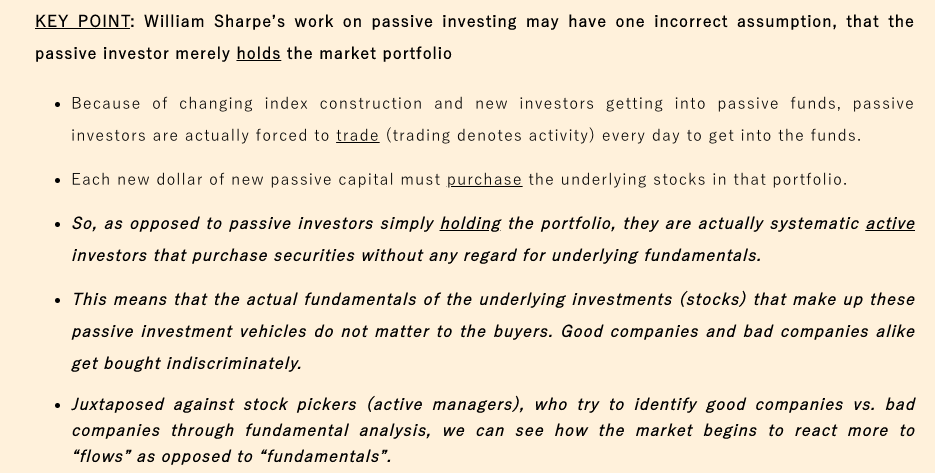

Had a few aha moments thanks to the work of Mike Green @profplum99 & @HorizonKinetics

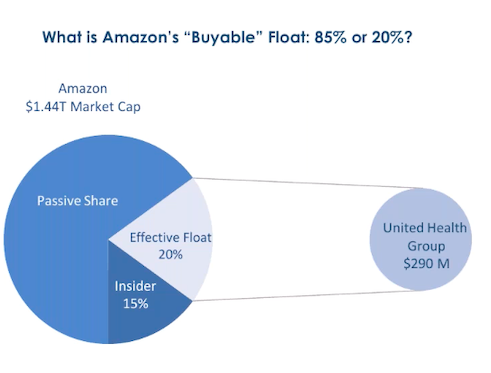

1. Passive being ‘buy and hold’ is misleading as really they are actually systematic active investors at any price

Positive flows = buy at any price

Negative flows = sell at any price

thelykeion.com/notes-policy-i…

ttmygh.podbean.com/e/teg_0003/

And watch this presentation:

horizonkinetics.com/market-comment…

Will put you in the top 1% for understanding the implications of passive investing