Full-time trader for 9 years now. Have a habit of hanging out in hated corners of the market that are "uninvestable"

13 subscribers

How to get URL link on X (Twitter) App

Next would be how to exit investments well.

Next would be how to exit investments well.

"The reversal, fueled by a quadrupling in the cost of the key raw material polysilicon, threatens to delay projects and slow uptake of solar power just as major governments are finally throwing their weight behind it in an effort to slow climate change."

"The reversal, fueled by a quadrupling in the cost of the key raw material polysilicon, threatens to delay projects and slow uptake of solar power just as major governments are finally throwing their weight behind it in an effort to slow climate change."

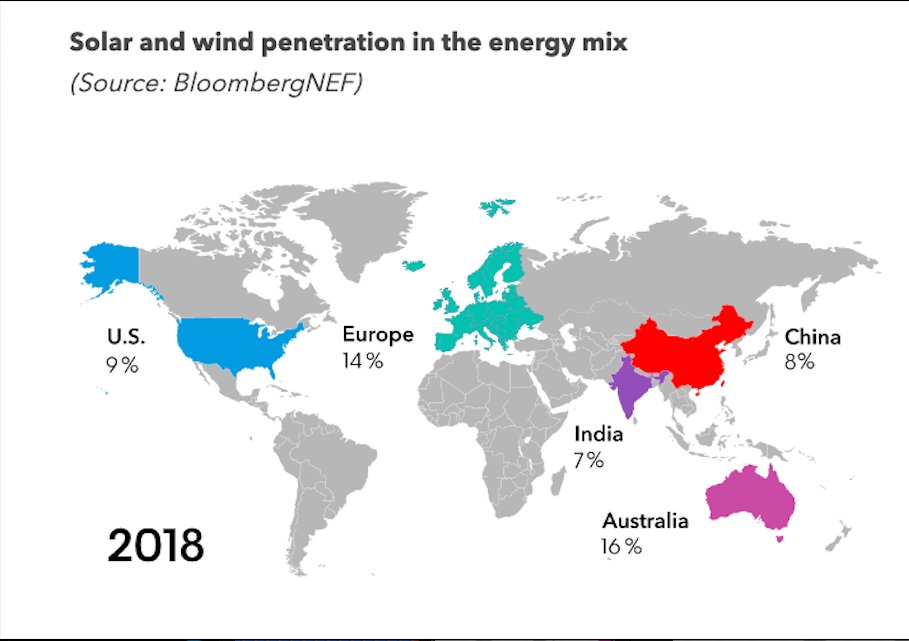

Renewables/EVs barely make a dent in primary energy (the often cited 20% renewables figure comes from adding in traditional biomass).

Renewables/EVs barely make a dent in primary energy (the often cited 20% renewables figure comes from adding in traditional biomass).

"The Princeton paper proposes Net Zero primary energy by 2050 (not just decarbonization of electricity,

"The Princeton paper proposes Net Zero primary energy by 2050 (not just decarbonization of electricity,

"In the Netherlands where green campaigners won a court battle in the Hague to force Shell to cut its carbon emissions by 45% in the next 10 years."

"In the Netherlands where green campaigners won a court battle in the Hague to force Shell to cut its carbon emissions by 45% in the next 10 years."

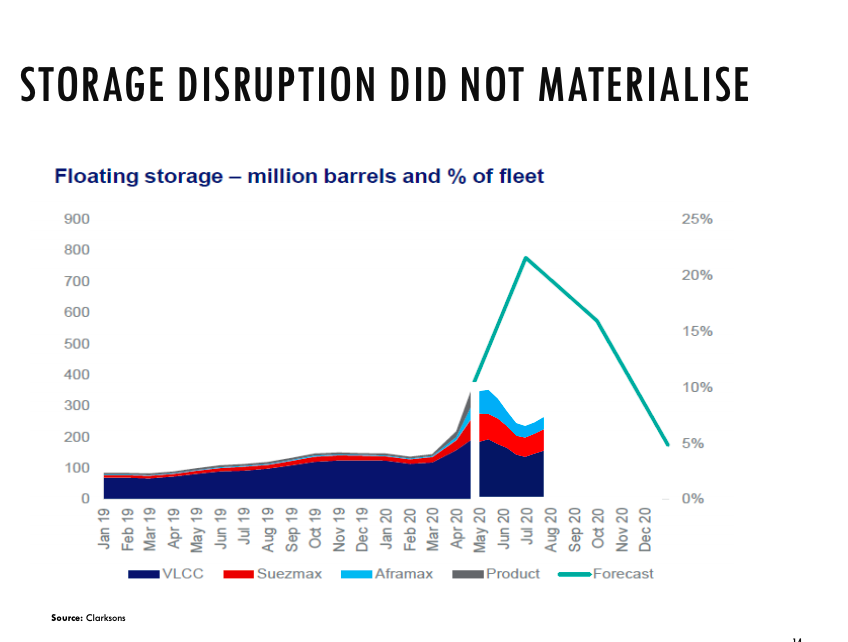

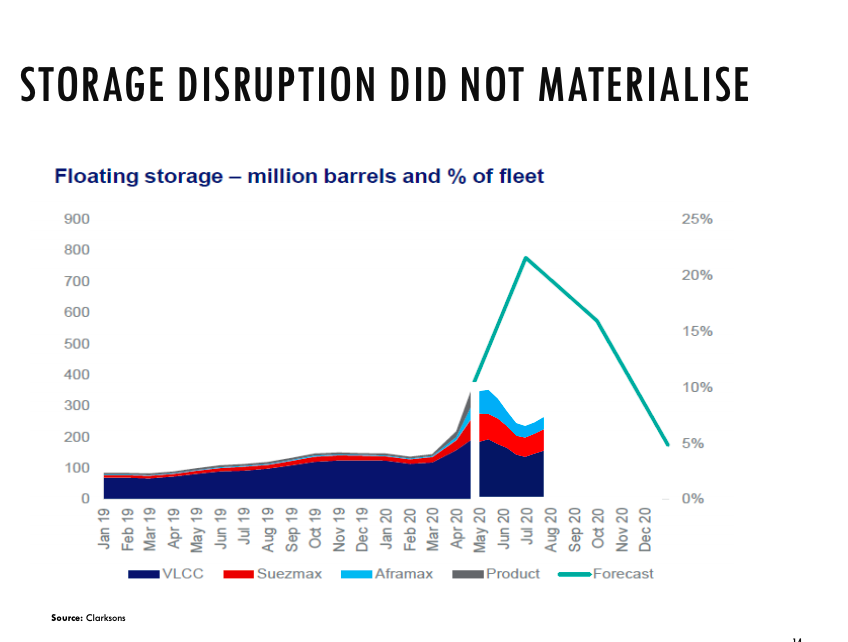

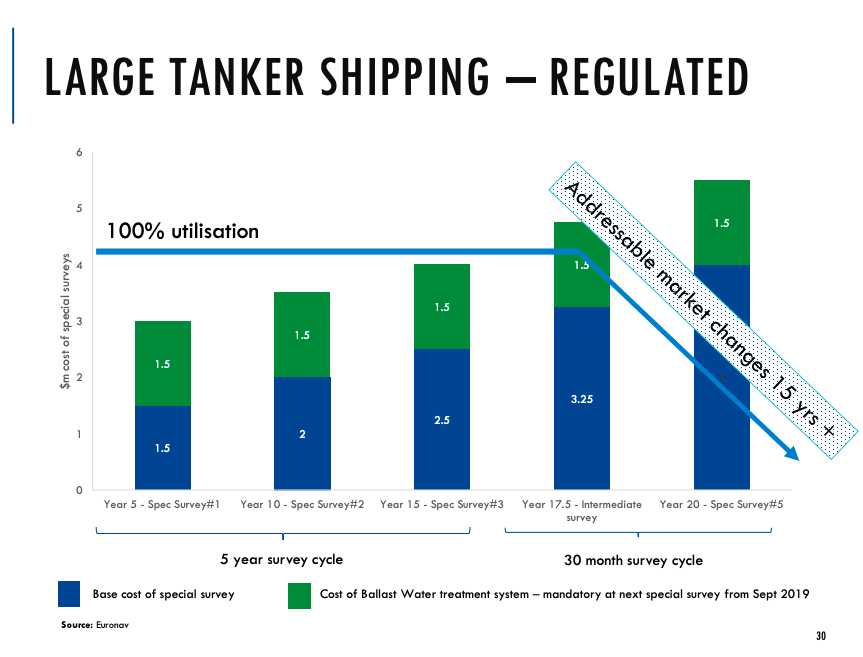

First point to understand is the average life of a VLCC is <20years

First point to understand is the average life of a VLCC is <20years

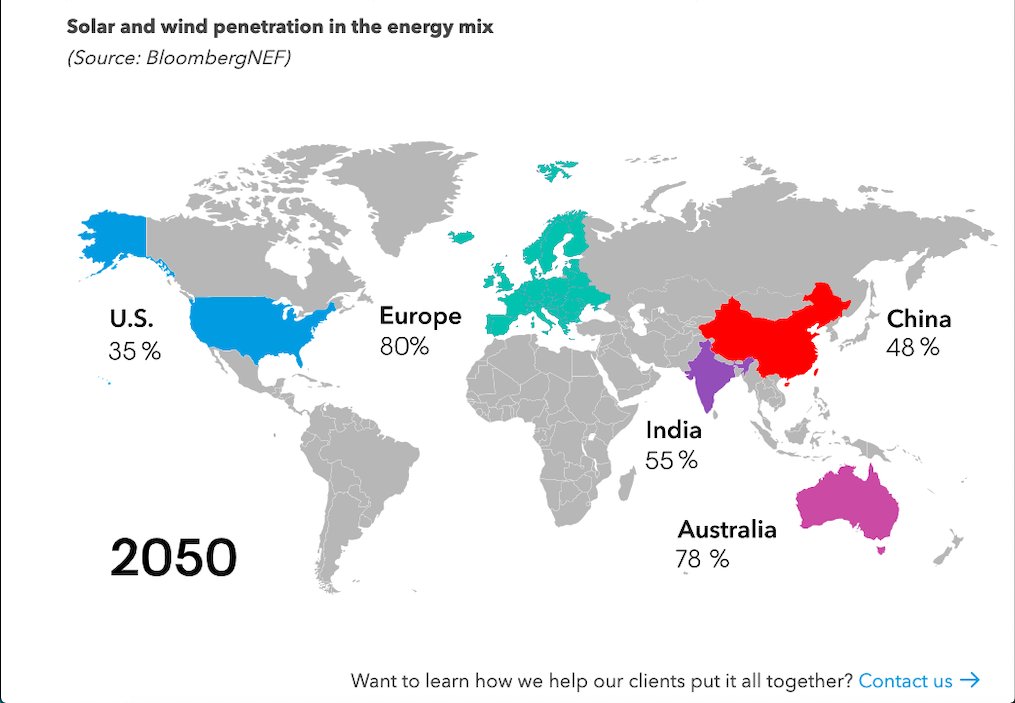

For China to reach 48% and India 55% will require an enormous build-out of wind and solar while shutting down coal plants.

For China to reach 48% and India 55% will require an enormous build-out of wind and solar while shutting down coal plants.

Following on from the above chart: "what if it takes another decade?"

Following on from the above chart: "what if it takes another decade?"

Coal still accounts for almost 40% of global electricity production

Coal still accounts for almost 40% of global electricity production