1/ JUST BACK from an amazing #roadtrip across my beautiful native state. Here’s #YellowstoneFalls from Artist’s Point—yep, this is real.

Next—warning, I’ll post photos of historically important firearms at Buffalo Bill Museum in Cody, #Wyoming to illustrate 2 points about tech.

Next—warning, I’ll post photos of historically important firearms at Buffalo Bill Museum in Cody, #Wyoming to illustrate 2 points about tech.

2/ Point #1: after centuries of no major advancement in firearms tech, a MASSIVE innovation occurred w/in a 10-yr period right before the US civil war & it’s visible in this exhibit. Invention of the repeating rifle changed the world—literally. Details abt why aren’t important...

3/ ...for this tweetstorm. What matters is that the invention MASSIVELY advanced tech in the industry by rendering everything that came before it utterly obsolete.

The analogy to payment/ledger technology is obvious. This is what #blockchain is doing to legacy payment systems.

The analogy to payment/ledger technology is obvious. This is what #blockchain is doing to legacy payment systems.

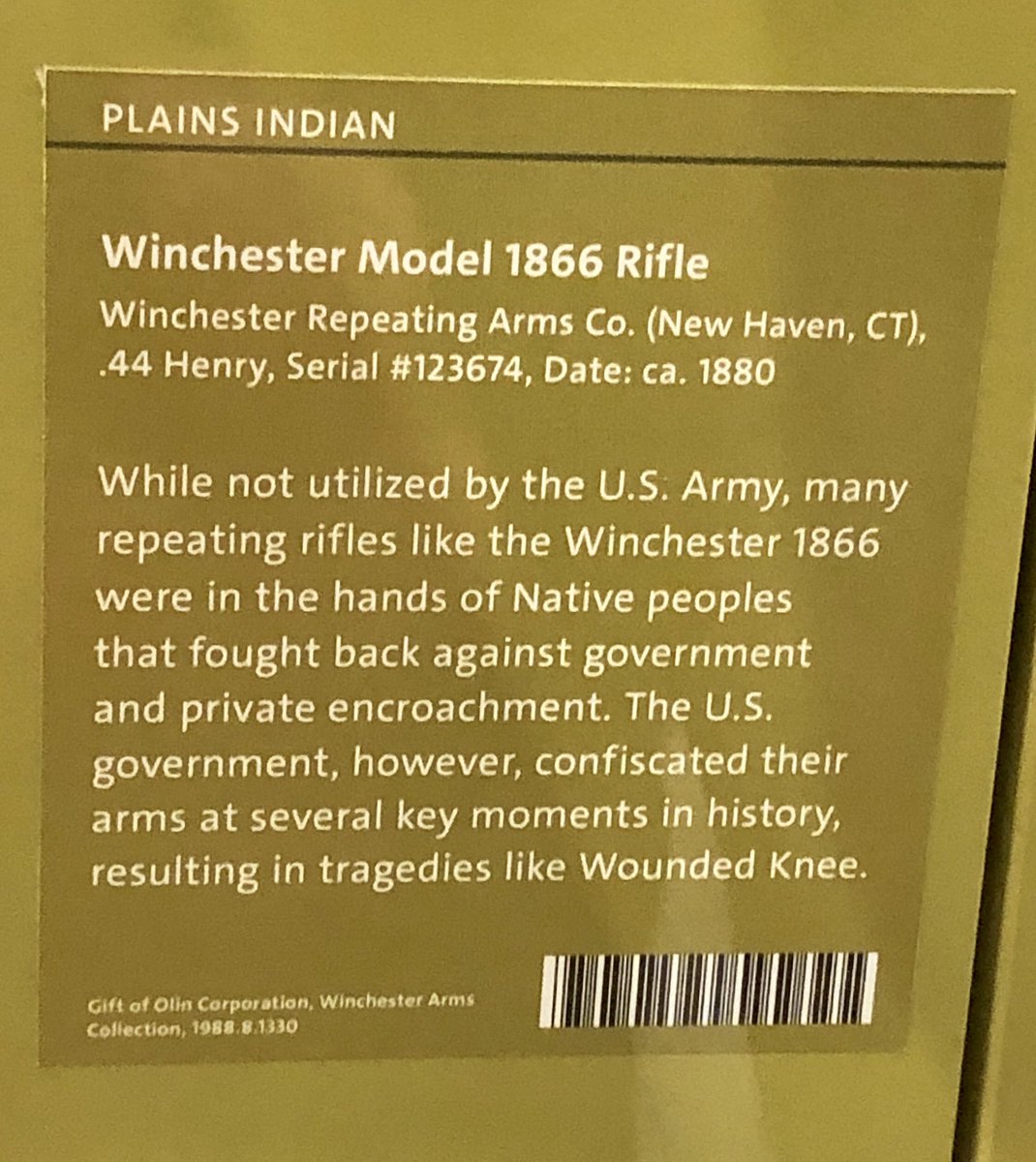

4/ Point #2: When govts are slow to adopt new tech they may pay a big price. The rifle on the left was used by the US military at Battle of Little Bighorn. It was outdated but US govt didn’t realize it at the time. Native Americans had traded for repeating rifles (4th from left)

5/ ...& their superior technology was a major factor in their massacre of the US Army at Little Bighorn (also known as Custer’s Last Stand) in 1876. Thereafter the US govt adopted the new tech, and history changed again. The battle over which side controlled the superior tech...

6/ ...went back & forth. Ultimately the US Army won.

The point? Tech matters. It sometimes changes course of history by creating an inflection point. I think we’re approaching one of those inflection points in money & payments now—tho it will only be clear in retrospect.

The point? Tech matters. It sometimes changes course of history by creating an inflection point. I think we’re approaching one of those inflection points in money & payments now—tho it will only be clear in retrospect.

• • •

Missing some Tweet in this thread? You can try to

force a refresh