(thread)

6month’s old bull, it’s KEY to look back if any assumptions into how to trade this $silver $gold bull market can be adjusted & improved, as we just have the 1st inning of a lifechanging event.

Which makes option trading far less interesting than holding penny stocks.

Juniors are lifetime options without timevalue.

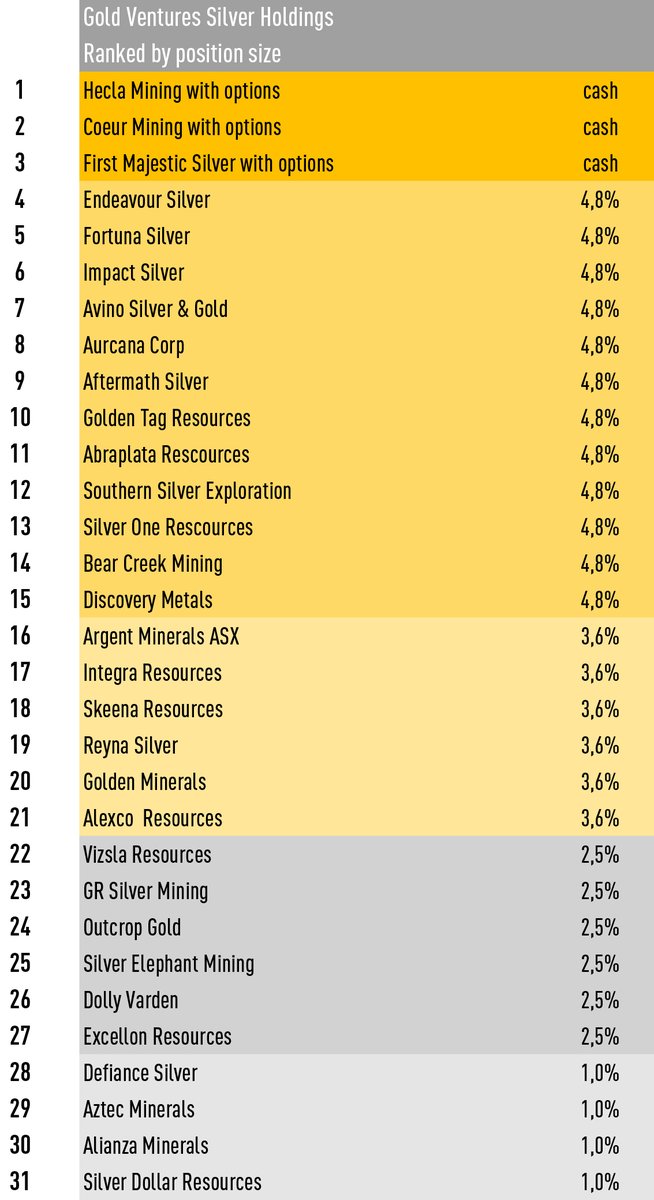

Avoid majors and midtiers for maximum upside, BUT spread out to a lot of positions.

Results are extreme, yesterday another 9.27%

That way you can have more chance to hit homeruns. Statistical research show it’s best to have around 55-75 positions for a balance between management and hitting the jackpot, as stated back here:

it’s clear we are in a blow-off mode now, we don’t know where it tops, but what we do know from historical evidence

Always keep the core for riding without FOMO.

This helps for MY personal MENTAL health: you get the feeling, you are always doing the right thing, however in tiny steps.

Currently long 93% miners, physical, and a 5% hedge in place.