Always compare full body range with volume.

If range of candle is big , should resembles volume..

Big range --->high volume

Small range--> low volume

If it is not that happening, then it is alert. It is against price and action law..

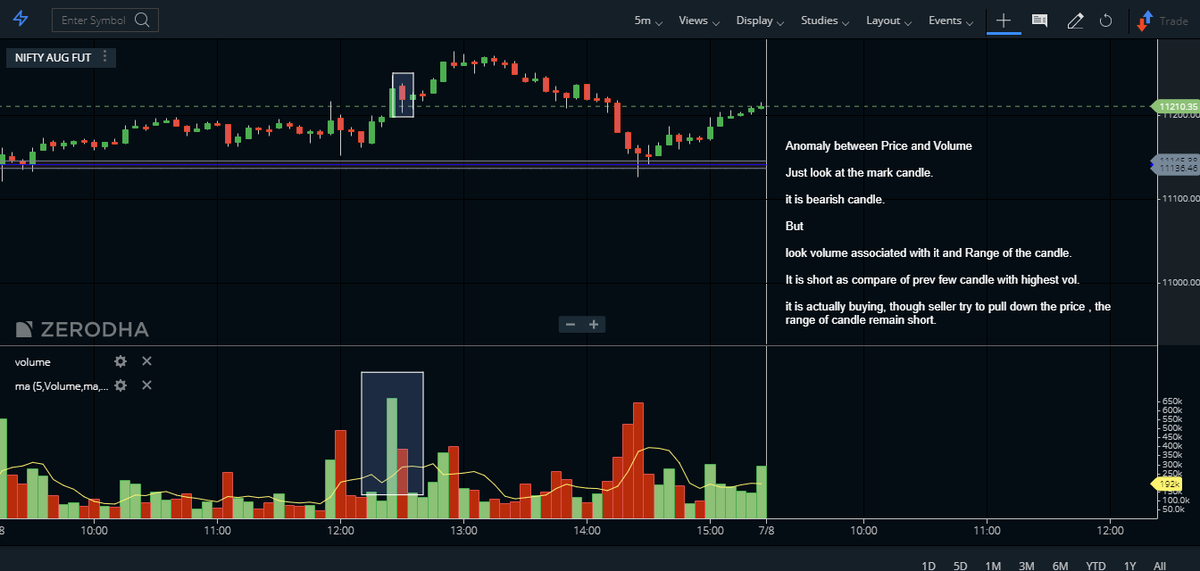

Topic:- Stopping Volume or Topping out volume

Very important phenomena observed today during trading.

Stopping volume:-

Vol- Inc

Price- dec

Range of candle -dec

Last cand would be hammer.

range of candle remains short.

Always train your eyes to see these kind of candle with HIGH volume..

it is the best thing you can see on chart.

#itc look what happened today in it.

wide range bullish candle, but little volume. it means market is not willing to participate in the trend.

It is early sign of reversals.

But wait, also pay attention to range of each candle..it should be deceasing

See example.

If not then it is warning sign..

See in this example..

Volume is less and price range is so high..it is fake buying..don't participate in this kind of rally.

They are very powerful.

It is the candle which tell you upcoming future trend.

If you are getting more wick near VWAP then it is selling.

If u r getting more tail candle near a certain zone, then it is buying.

Remember, u need to see follow up buying after that..

See this wonderful example.

Look in this example, when the stock faced the resistance at that time volume and now..when it is facing..volume is high ...so there is. Something happening..

And then breakout..

If earlier buying happened with 100 vol & this time the same range candle is formed with 50 vol..

Then don't buy it..

Same is applied for sell.

"Comparative volume" is very good tool to avoid fake trade.

These are good examples.

don't take any trade.

3. Here high range candle, with two candles are having wick ..selling is visible. but again not compliment with volume.

No trade.

4. Buy signal with good volume and hammer candle.

1. initial candle is not tradable. but look at No. 1.

confidently can take trade.

Price inc--vol inc-- range is also inc....Ultra bullish

2. hammer with low volume in uptrend bullish sign.

3. again same pattern.

No. 1 is important here.

Hammer and Inverted hammer.

Uptrend:-

Inv Ham-good volume -Sell (No.1)

Inv Ham-low volume- Ignore

Uptrend :-

Ham-low volume-supporting buying

Ham- high volume - Sell call

Ham-high volume-buy signal.(No.2)

Hammer -low volume - Supporting sell (No 3)

Downtrend :-

Inv hammer with low volume - supporting sell

Inv hammer with high volume- Buy call

Price is always complimented by volume.

Cut in short, Price and Volume are the prime supreme.

They are the breath of the market.

Take the example of #tatamotors and #hindalco.

you will fin WRC with volume during its pathway.

Keep learning.

Understand that price and volume are the basic data for any indicator.

Pay attention to it first..

Price and volume must compliment eachother, if not then no meanings of any signal of indicator.

Don't just see the chart.

Participate in discussion.

Be Vocal.😋

#institution #bigbrother do their work silently and smartly.

We need to find their footprint.

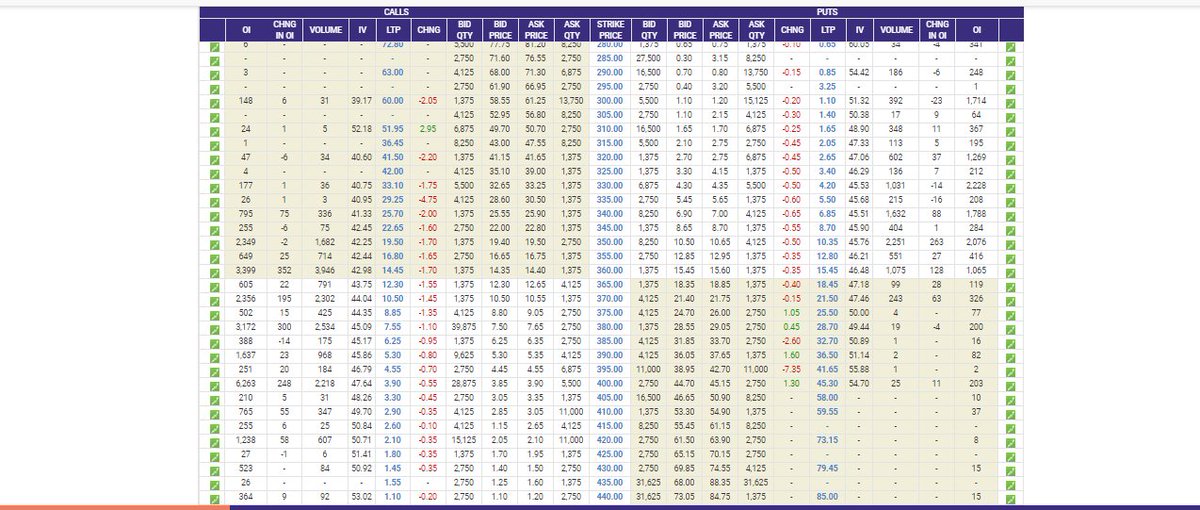

I have attached #chart.

Apply our knowledge in #PriceVolume

#comment

#RT if useful.