Oscillating economic recovery in July in the midst of state lockdowns and monsoons. Check out our latest edition of Macroeconomics of India Series with @tulsipriya_rk #macroIndiaupdate #EconTwitter

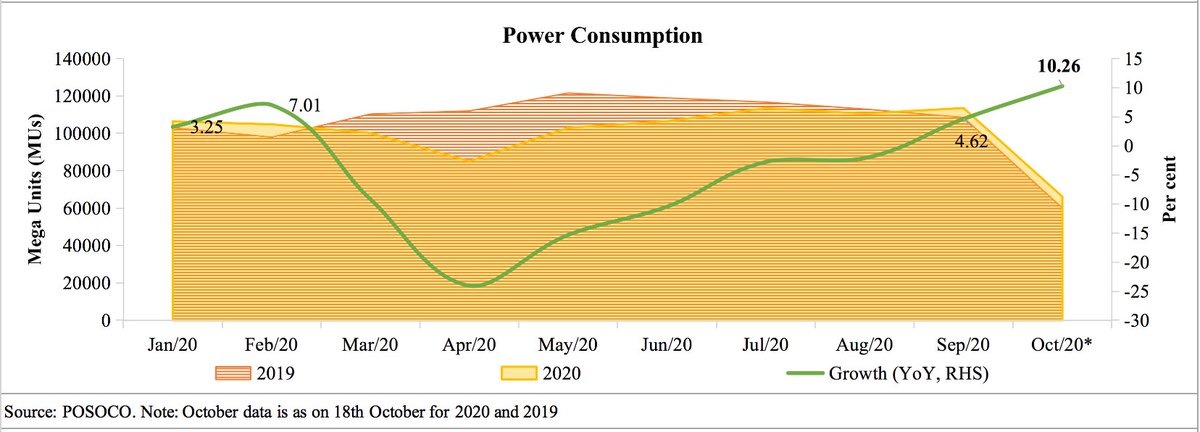

Real activity upswing in latest fortnight after plateauing in first half of July

Real activity upswing in latest fortnight after plateauing in first half of July

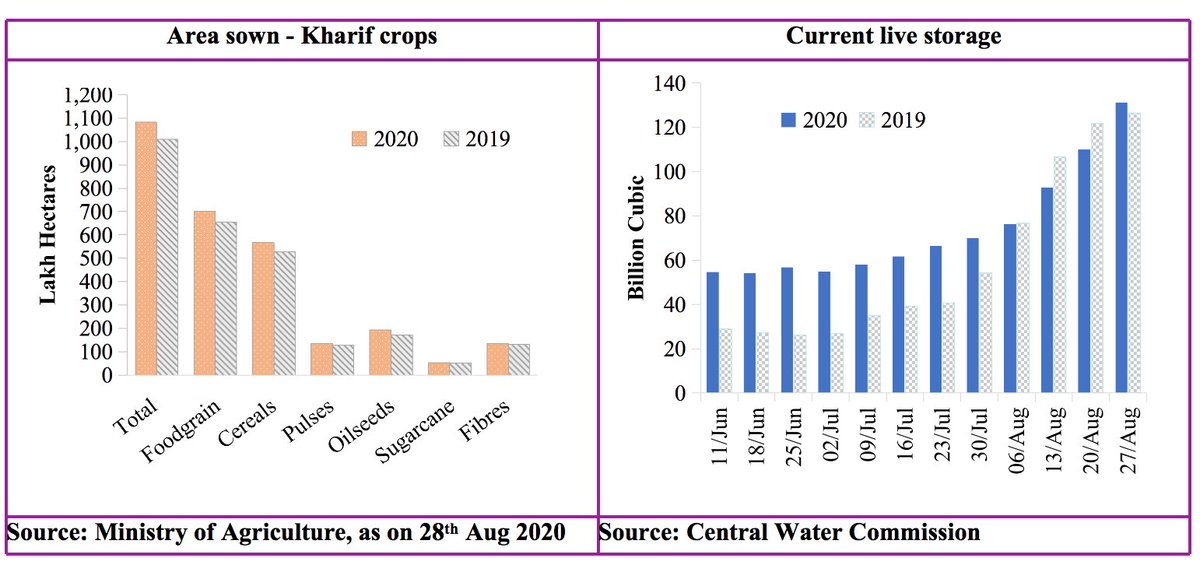

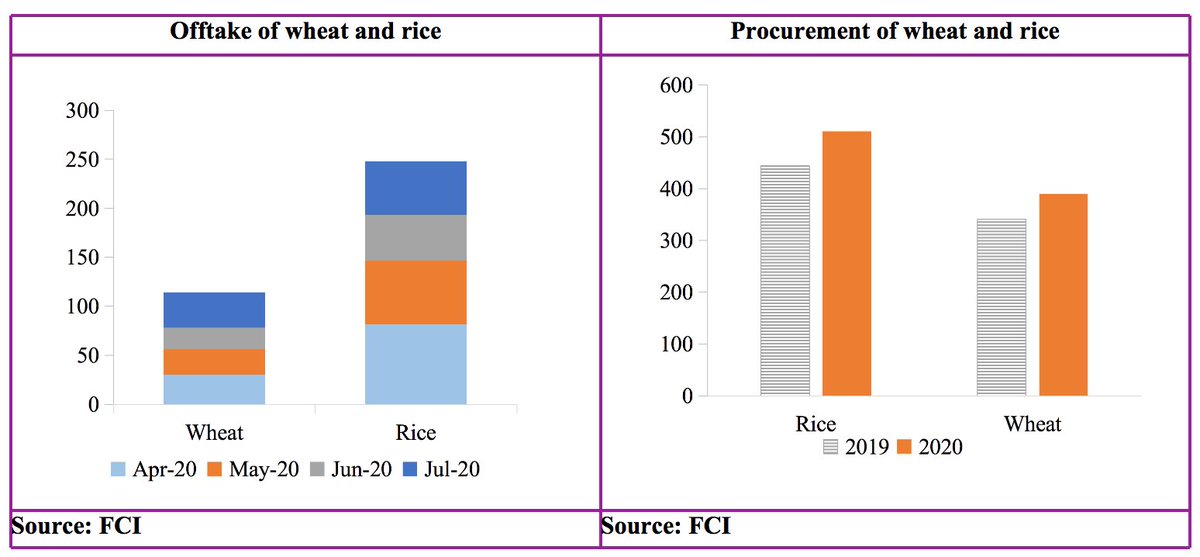

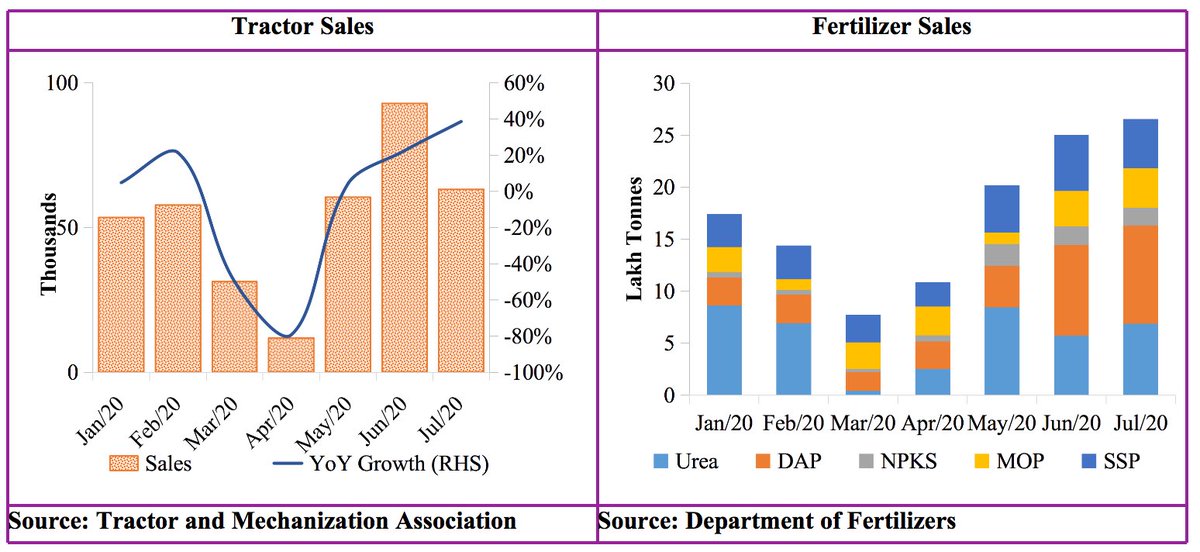

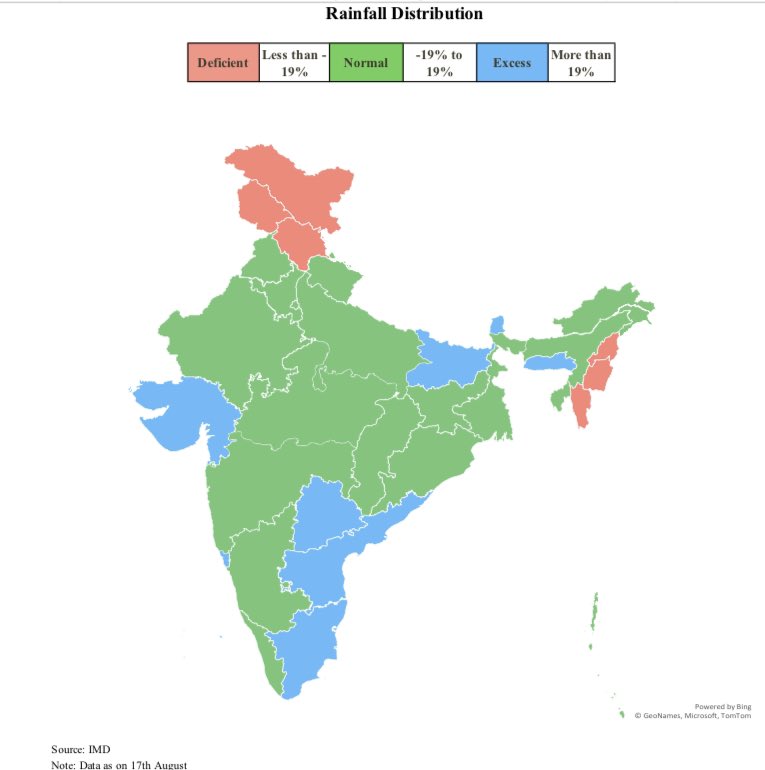

Agricultural prospects strengthened with healthy monsoon and reservoir levels. States receive normal or excess rainfall as on 2nd Aug. Strong and broad-based kharif sowing growth in latest fortnight @tulsipriya_rk

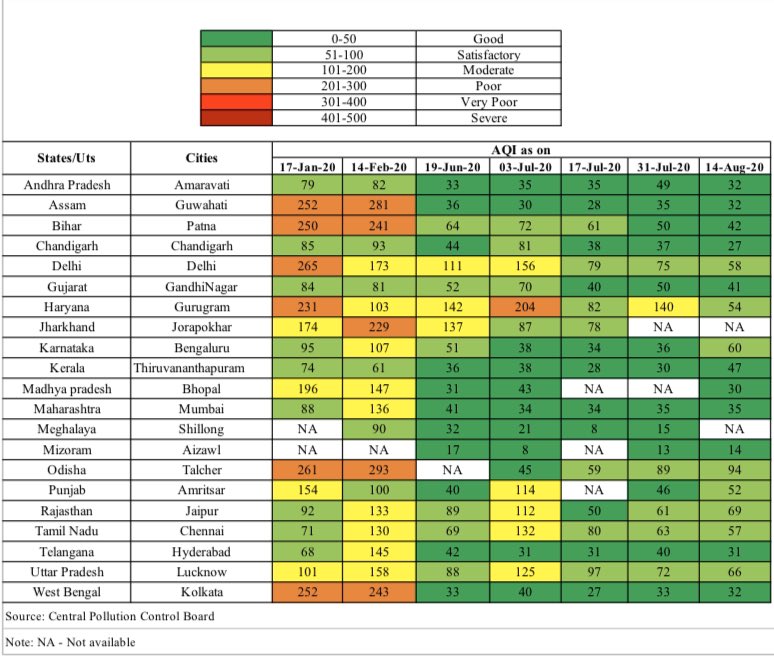

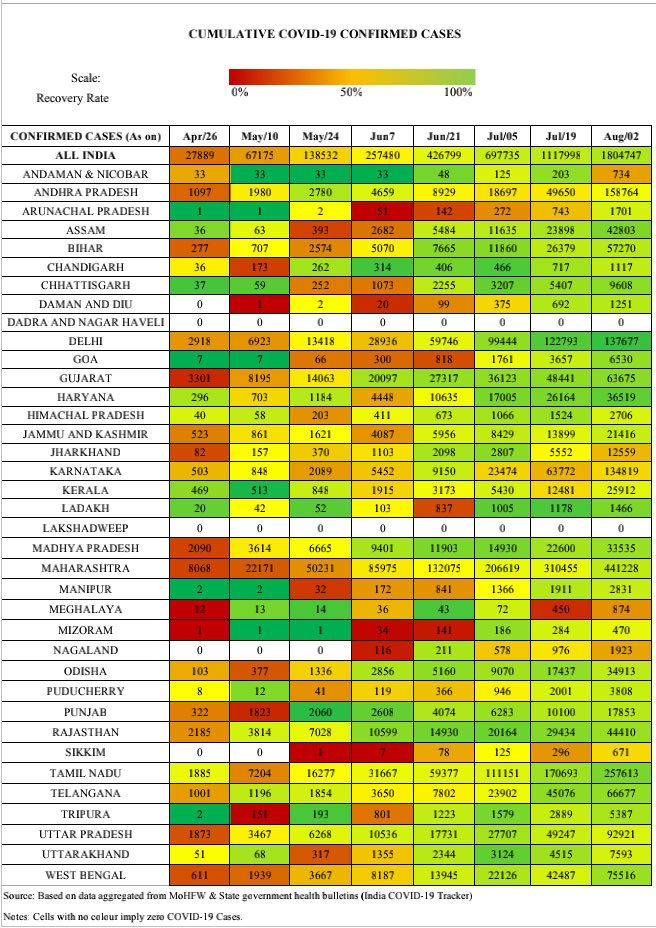

Economic recovery crucially linked to COVID curves. Strong second wave in KA and AP in first half of July, lockdowns imposed in TN, KA, JH, AS, WB and MZ. Recoveries improving and hotspot death rates decline in second half of July @tulsipriya_rk

Global economic recovery fragile. Manufacturing pickup in July barring India and Russia. Services activity drops in China.

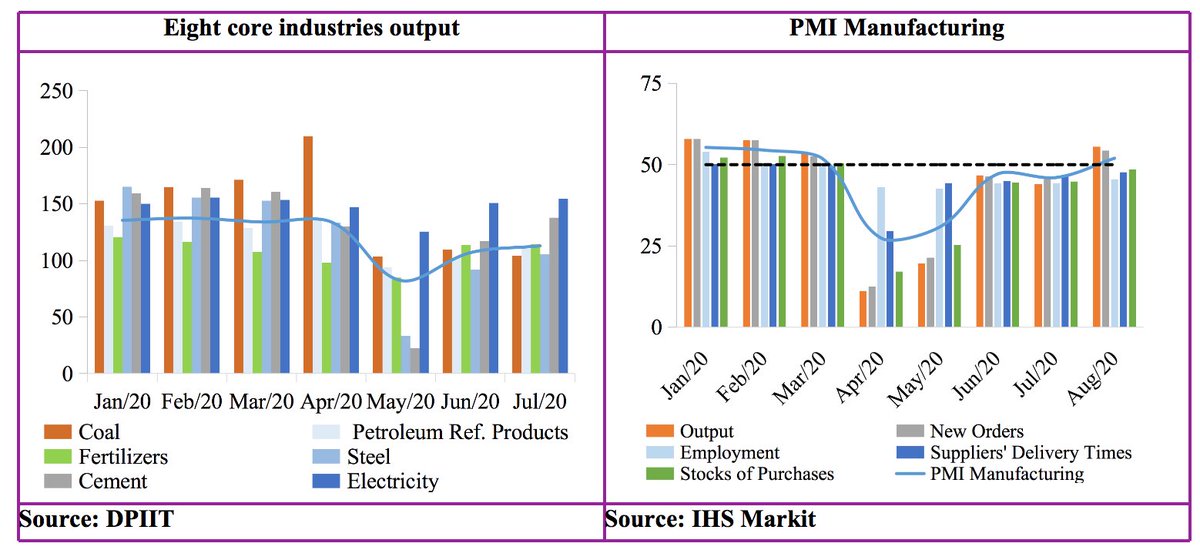

PMI manufacturing India contracts to 46 in July relative to 47.2 in June. services growth constrained, PMI improves moderately to 34.2. @tulsipriya_rk

PMI manufacturing India contracts to 46 in July relative to 47.2 in June. services growth constrained, PMI improves moderately to 34.2. @tulsipriya_rk

Railway passengers activity gradually picking up, aviation activity continues to be muted by July-end.

@tulsipriya_rk

@tulsipriya_rk

Rural economy: MGNREGA work demand dipped in July to 2.4 crore persons. 27.4 crore person days work generated in July, ~ 40% higher YoY.

@tulsipriya_rk

@tulsipriya_rk

Food inflation- Mandi arrivals for major agri commodities decreased in second half of July relative to previous fortnight, retail prices remained elevated barring sugar, tur and onion @tulsipriya_rk . Persisting supply chain disruptions, food inflationary pressures continued

FER swell to record USD 522.6 billion as on 24th July amid currency accretion and rise in value of gold reserves. Active RBI intervention to restrict excess rupee appreciatn. Rupee appreciated to 74.8 INR/USD in July second half with FPI equity inflows, FPI debt outflow continued

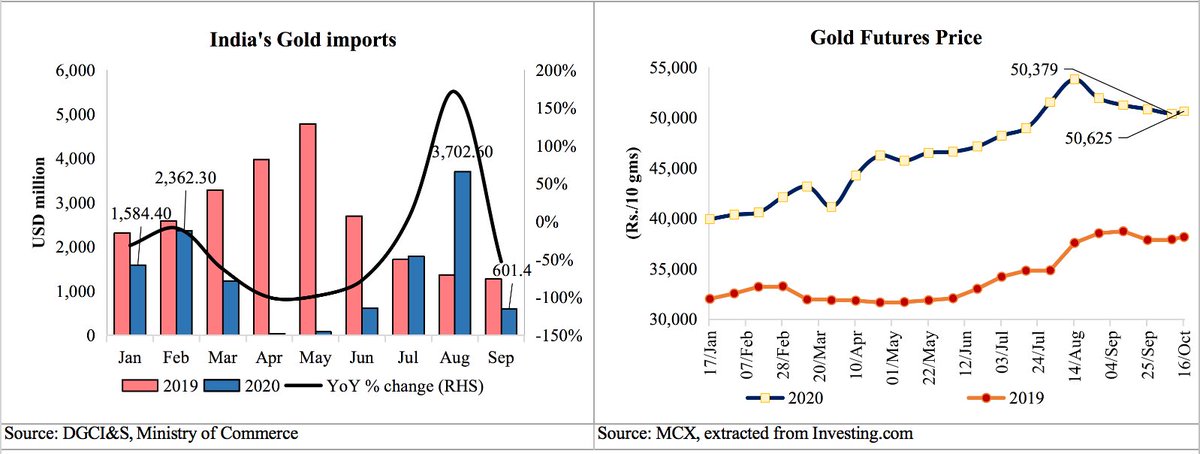

External demand: Crude oil prices fell in second half of July amid stalled recovery in global oil markets, petrol and diesel prices remained unchanged, Delhi diesel price fell with state VAT reduction. Gold surging with massive global liquidity injections flowing into gold ETFs.

Global demand recovery tepid: composite PMIs pick up in July and move into expansionary territory but at slower rate than previous months, like US. China’s activity slows. UK witnessed fastest rise in services in five years in July @tulsipriya_rk

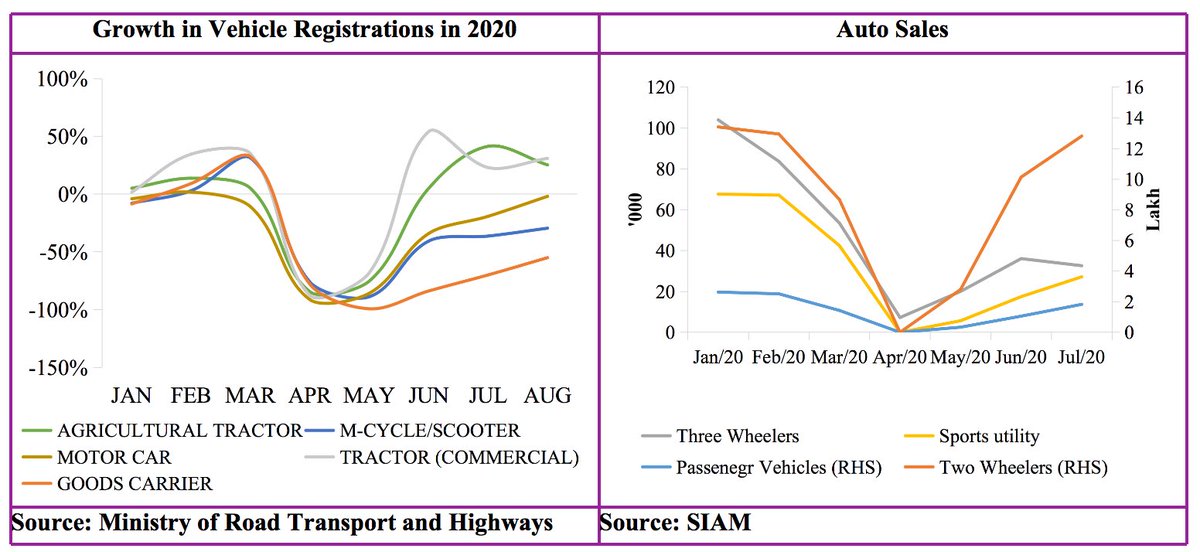

Private consumption outlook picked up in July with Vehicle registrations in July reaching 65% of Pre-Covid sand previous year levels. @tulsipriya_rk

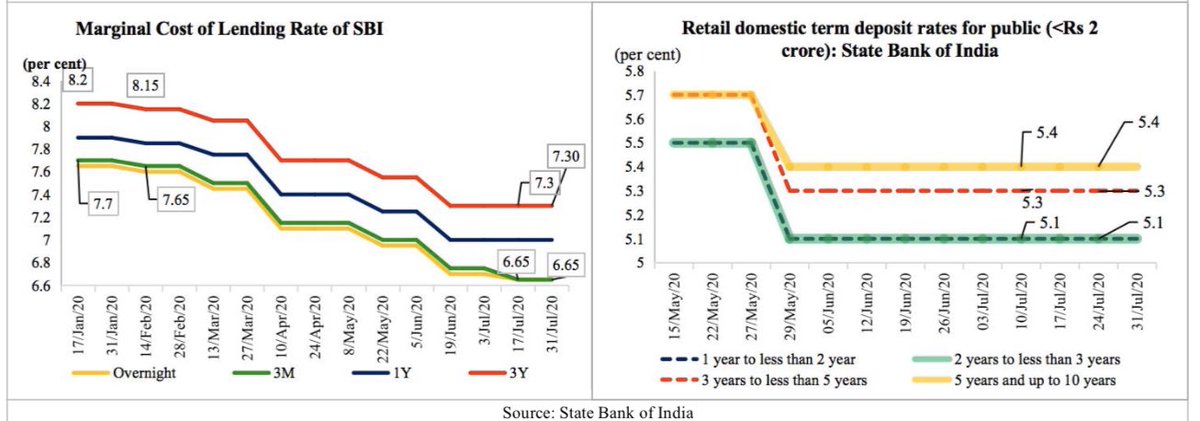

Monetary: average daily liquidity absorptn declined to Rs. 4.1 lakh crore in wk ending 26July compared to prev wk, much lesser funds parked in reverse repo. Policy and lending rates unchanged in second half of July. MP transmission improving since pandemic policy rate cuts

Monetary: growth of bank credit to commercial sector continued to be tepid at 5.9% in fortnight ending 17th July, declined by 0.6% compared to previous fortnight @tulsipriya_rk

Banks continued to prefer holding G-Secs. Excess SLR portfolio of banks continued to be high, moderately reducing to 10.4 per cent in fortnight ending 17th July @tulsipriya_rk

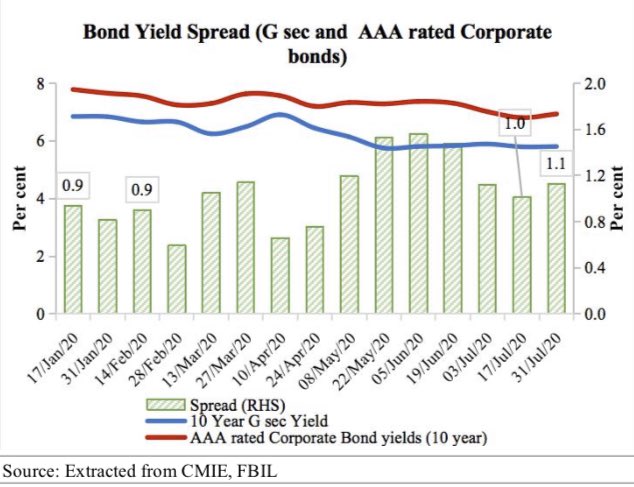

10 year credit spreads eased since May and June with RBI’s open market purchases. 10 year G-Sec yield stable at 5.8 percent( avg) in fortnight gone by. AAA Corporate bond yields increased to 6.9 per cent, thereby widening 10 year spread in fortnight gone by. @tulsipriya_rk

Centre’s cumulative FD for FY 2020-22 widened to Rs. 6.6 lakh crore, 83.2 per cent of BE. YoY contractn in GST collections, improved to 9% in Jun and 14% in July compared to 38% in May. Lower payments in July vs Jun amid bunched payments in Jun, filing relaxations till Sep.

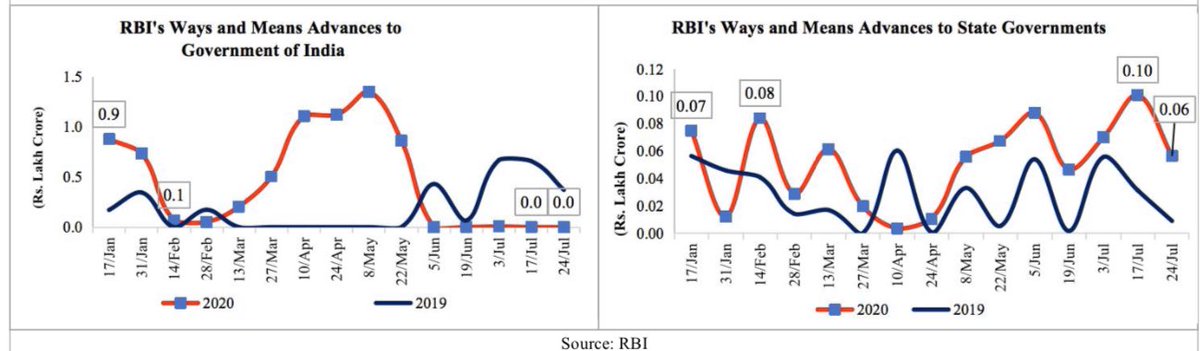

Centre and states gross and net market borrowings in wk ending 24 July continued to be elevated relative to previous year and previous wk levels. Centre didn’t borrow from WMA for four consecutive fortnights, states borrowed 6.3 times more YoY in wk ending 24 July@tulsipriya_rk

• • •

Missing some Tweet in this thread? You can try to

force a refresh