washingtonpost.com/opinions/trump…

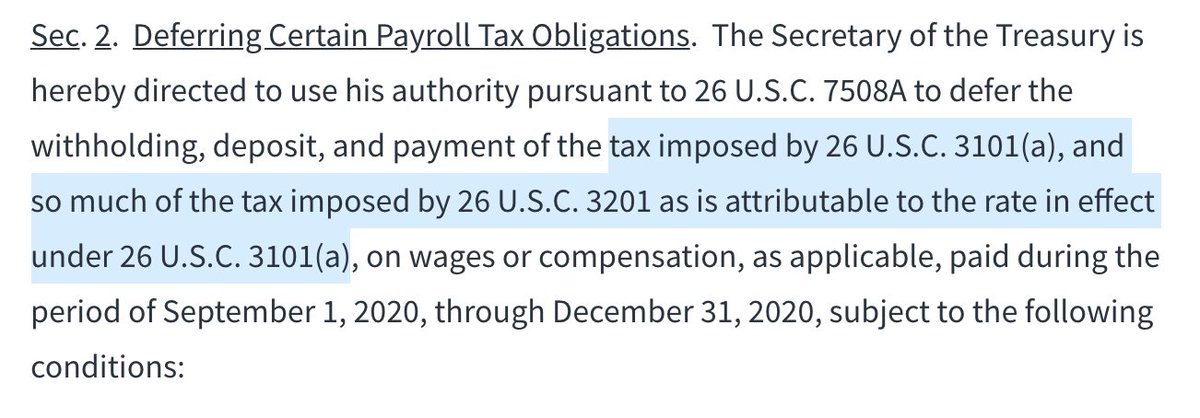

But a payroll tax *deferral* is incredibly stupid. washingtonpost.com/opinions/trump…

Scenario 1: Congress forgives taxes, turns deferral into cut. But these taxes fund Soc Sec, so this is controversial. And if Congress could pass difficult bills, we probably wouldn't be in current situation washingtonpost.com/opinions/trump…

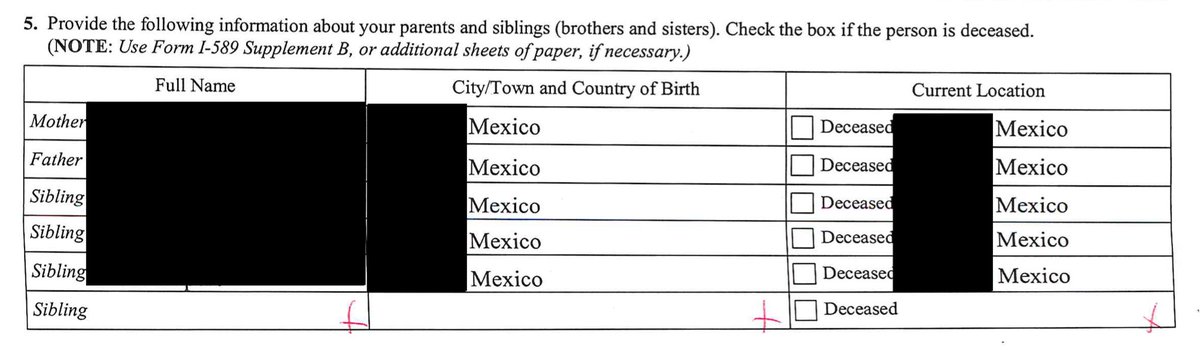

Pretty likely they won't even realize they owe these taxes though washingtonpost.com/opinions/trump…