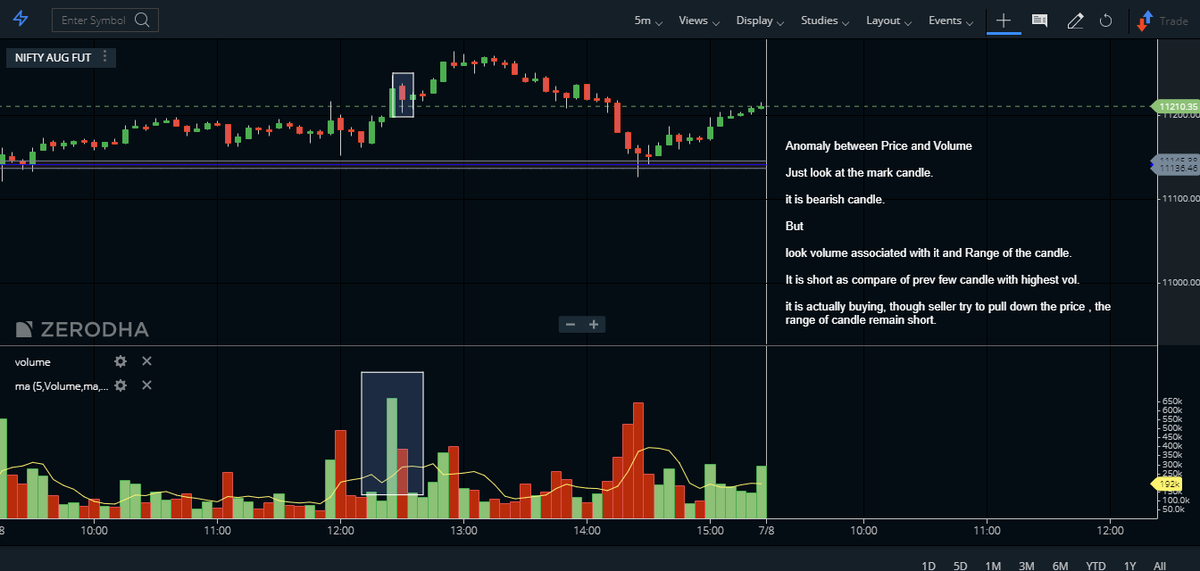

( Practical use)

*We all know that #BB is give us volatility of stock.

* It works on standard deviation principle

* Price always wave between Upper and Lower band.

*After Volatility contraction price , move in quicker way.

* To identify this #volatility contraction, we use #BB

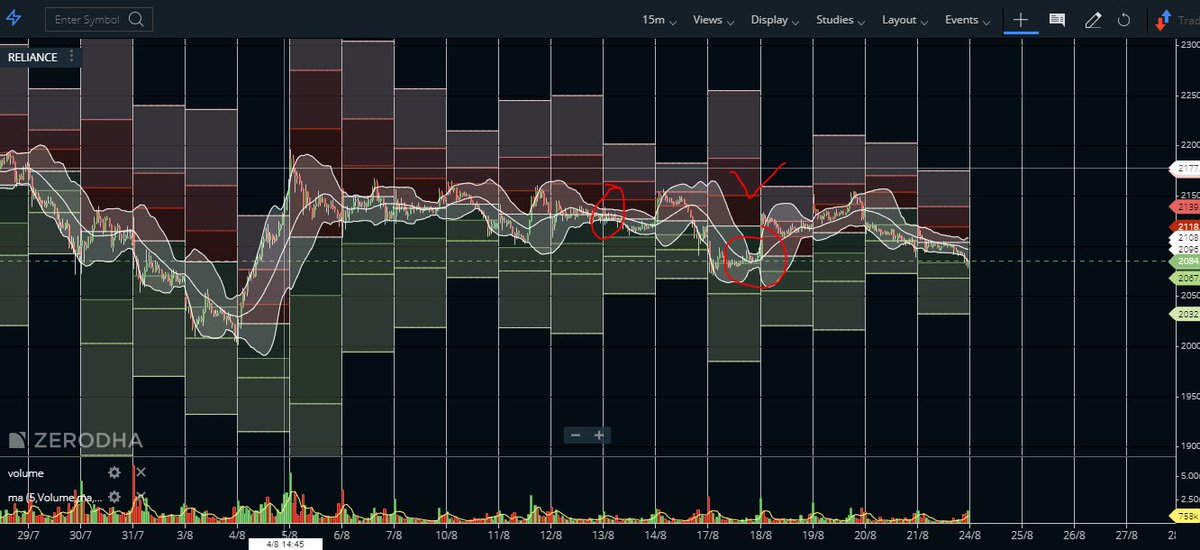

Examples show that round is volatility contraction. Price stuck in range and volatility is cooled off.

many false signal will be generated.

So here is the secret.

Dont just trap in just #Bollingerbands

I am sharing secret to use it with #ketlner Channel

#bollingerbands is 2 standard deviation.

#keltner Channel is also worked on volatility , but it takes "ATR".

Now here the catch, Most of the time 2SD is higher than 1ATR.

But , when 1ATR become higher than 2SD, IT IS REAL VOLATILITY CONTRACTION.

#keltner channel is always inside the #bollingerbands.

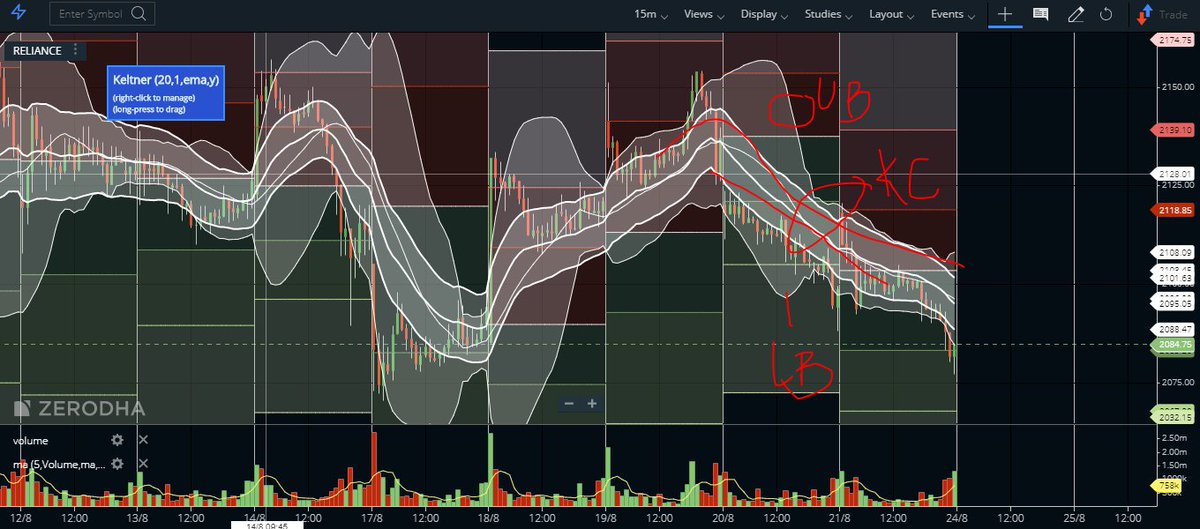

#Bollingerbands #squeeze (volatility contraction) happened when

" #bollingerbands comes inside #keltner channel"

for normal case , Point 1 is to be assume as #bollingerbands #squeeze but no..it is not..look price is almost there.

Point no 2. where

#Keltner channel (1 ATR) came out from #bollingerbands.

Bingo..

The real squeeze.

The real squeeze happened.

and on 18th Aug .

Boom.

Mind well, it gives you contraction, not direction.

sometime, expansion is so violent that we are unable to catch it.

Point 1 is tradable but point 2 was so quick move that we may trapped

#tcs

#biocon

#maruti

#titan

#mcdowell

#iciciprudi

Study purpose....

given trend , but

most of volatility contraction , expand so fast , we couldnt able to catch it. like #titan