(1) Strong H1 with TPV +35% (2) Largest DCB payments company & recent acquisition of Fortumo cements global leadership (3) Op gearing emerging (4) Identity side set to scale FY21 (5) New e-wallets provides access to 2bn potential customers with nil in forecasts👇🏻

(1) 2x “ahead” trading updates in FY20 with EBITDA raised +110% from original estimates (2) Fixed costs with large drop-through (3) Increased licence deals with large drop-through in H2 (4) Significant US growth as states open up online gaming

(1) H1 beat (2) Op gearing emerging as observed in H1 with revs +28% but op profit +98% (3) Predictable revenues with 88% reoccurring (4) FCF yield c.12% (5) £6m raise to drive growth via new equity release product👇🏻(5) FV of catalogue iP worth 3x share price

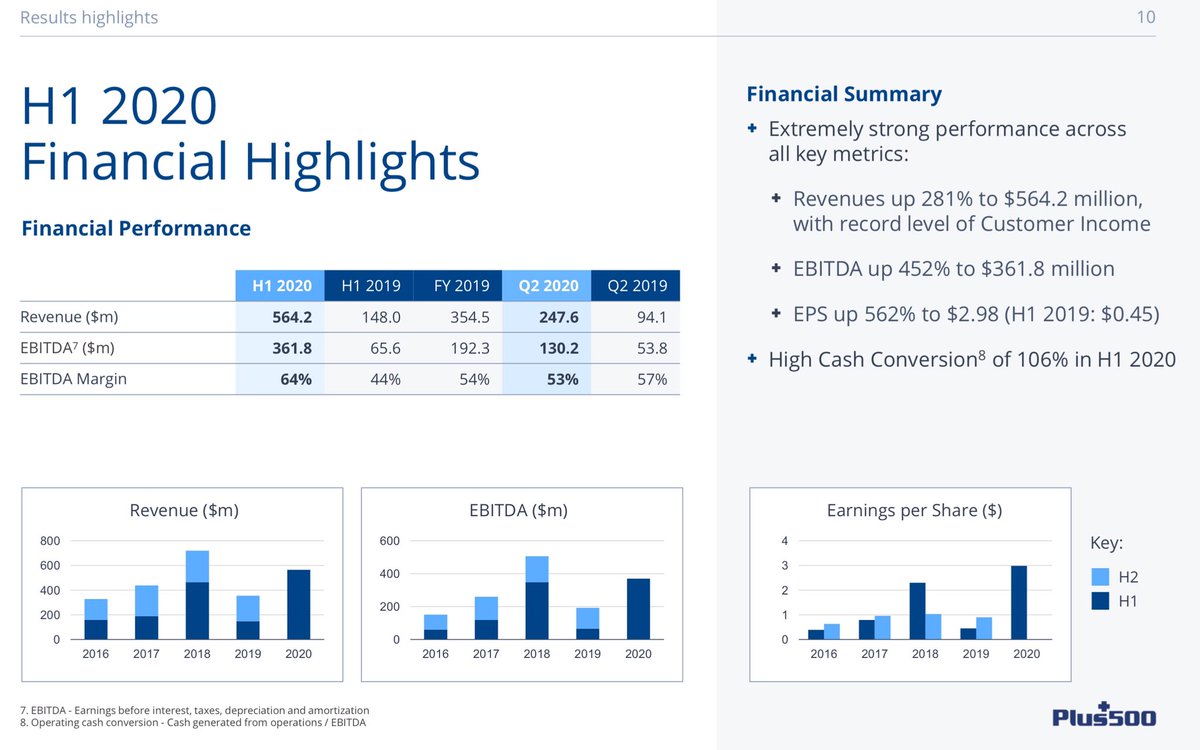

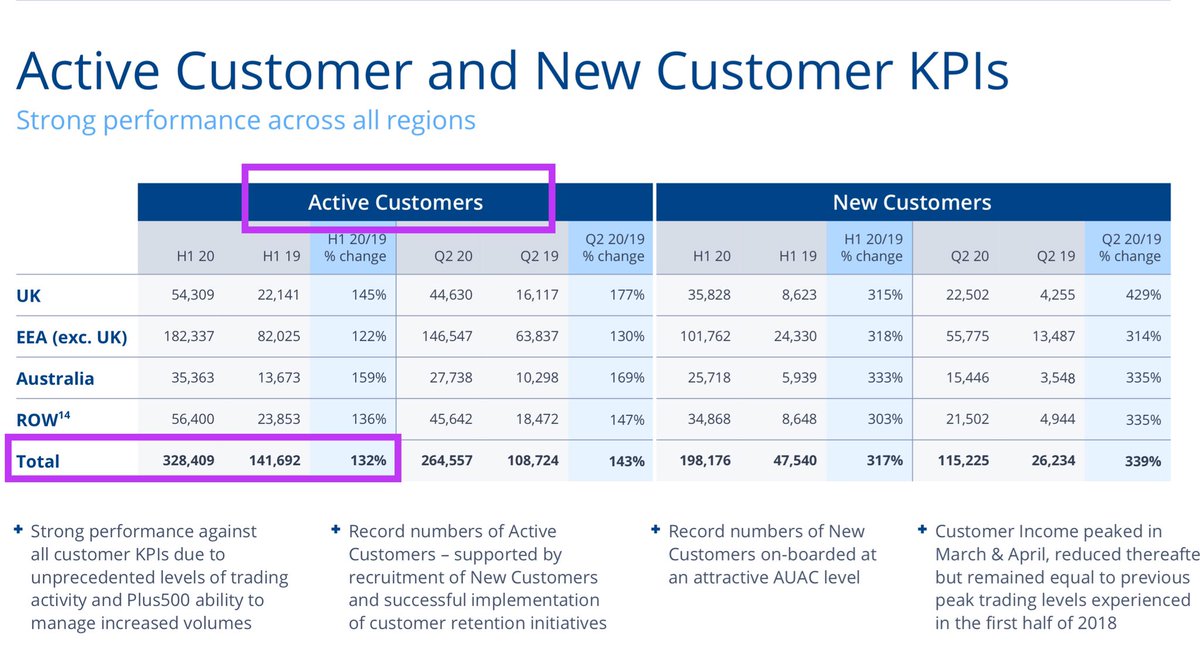

(1) Several H1 upgrades (2) 190k additional customers added in H1 which should help H2👇🏻(3) Tax rate reduced from 23% to 12% with $100m rebate (4) Share buyback & possibility of special dividend (5) Broker forecasts look incredibly low for FY

(1) Significantly ahead in Q1 (2) Beneficiary of acceleration in Digital Transformation for UK (3) Strong B/S & cash generation (4) 10-15% organic growth PA (5) Targeting £100m rev & £12-14m by March 2023

(1) 3x upgrades for FY20 (2) Strong B/S with net cash c.£6m (3) GM’s >60% (4) Student numbers to double (5) Ambitious - Wey 2.0 strategy accelerating growth following surge in demand for on-line education through disruption to traditional Education system pandemic

(1) Resilient H1 during the pandemic (2) Good earnings visibility (3) ARR +18% YoY (4) Clareti now 70% of revs & CAGR 59% in 5yrs. Only valued at 3.9x ARR (5) Legacy business also growing (6) Strong B/S (7) Disruptor winning against legacy vendors with old tech

(1) Resilient business model (2) Predictable annuity style revs via annual domain renewals + growth from new registrations (3) Strong cash gen (4) Fixed costs & a benefiary of op gearing (5) Domain sector consolidation driving up valuations

(1) V low valuation of 1.5x ARR (ex cash) despite £6m ARR & 81% GM's (2) Recurring revenues of 85% (3) Large contract renewals in H1 (4) Director buying (5) High op gearing (6) £7m raise to drive growth with ambition to triple ARR by FY23👇🏻

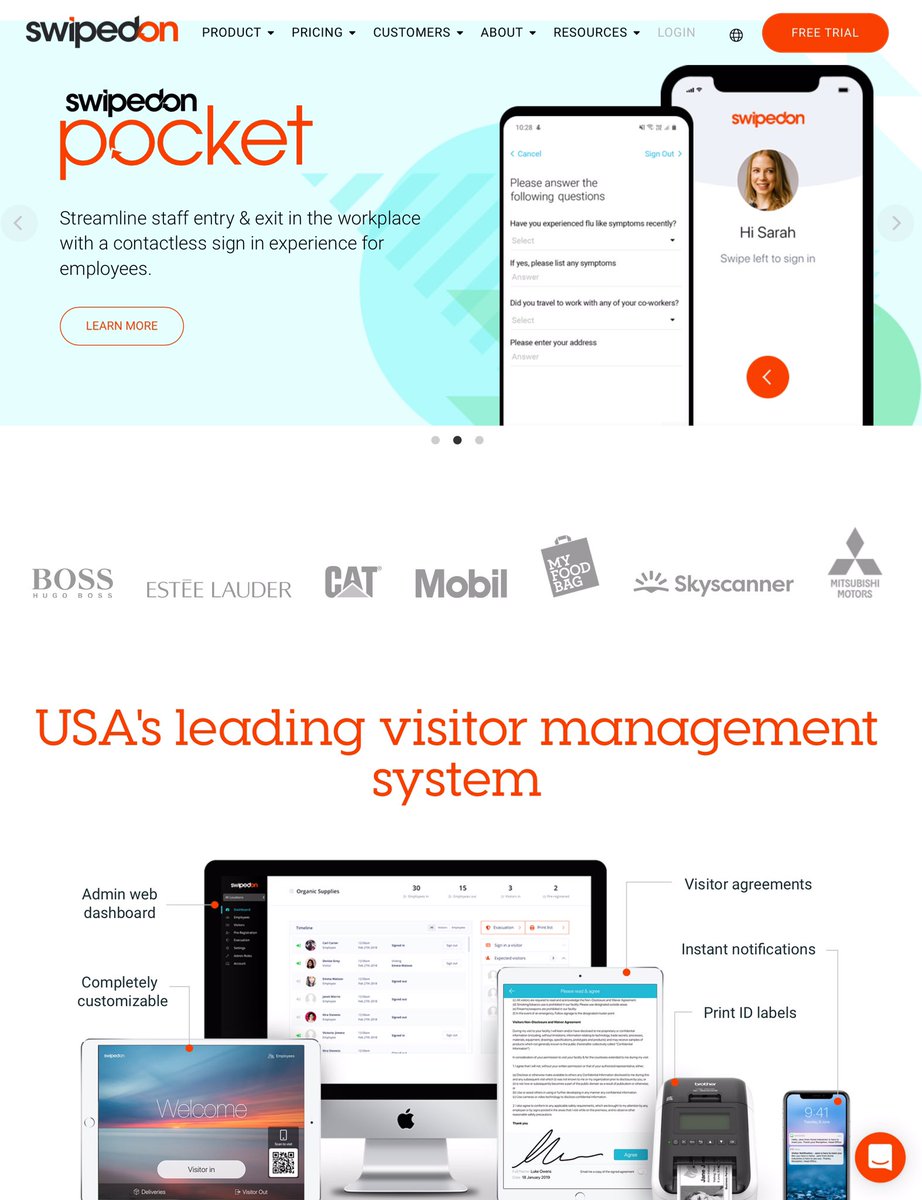

(1) Optimistic outlook for FY & also significant contract wins in H1 (2) Delivers 90% recurring revs with 90% GM's (3) Op gearing emerging, new wins drop through to bottom line (4) Blue chip customer base (5) Partners with Samsung & O2 (6) Profitable & cash gen👇🏻

(1) 5x upgrades FY19 (2) Solid H1 despite lockdown (3) Cash generative through the pandemic (4) Potential windfall via VW emissions case (est.£5m-£25m) (5) 20k case backlog estimate worth c.£200m cashflow (6) Considering 2x small earnings enhancing acquisitions

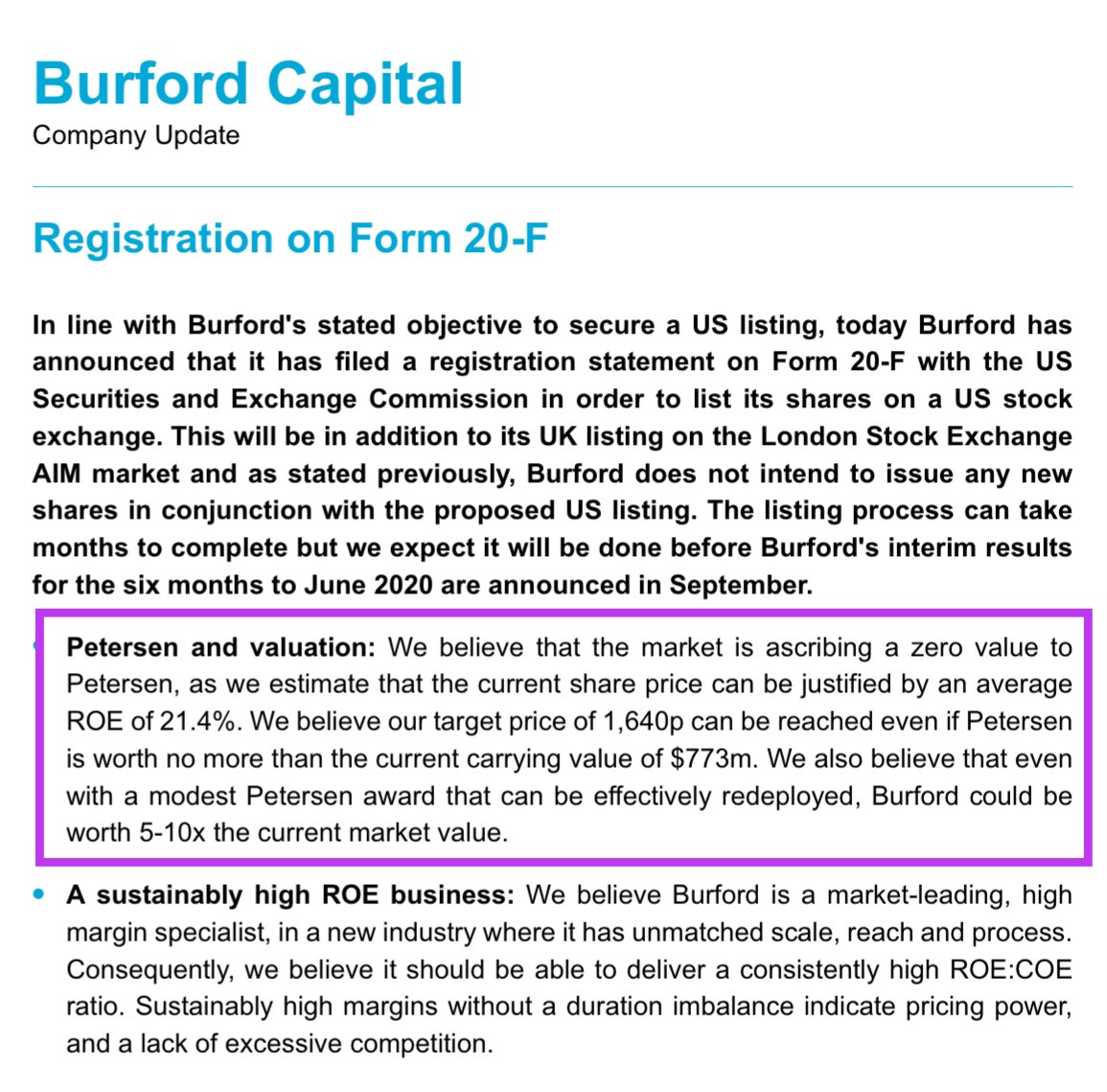

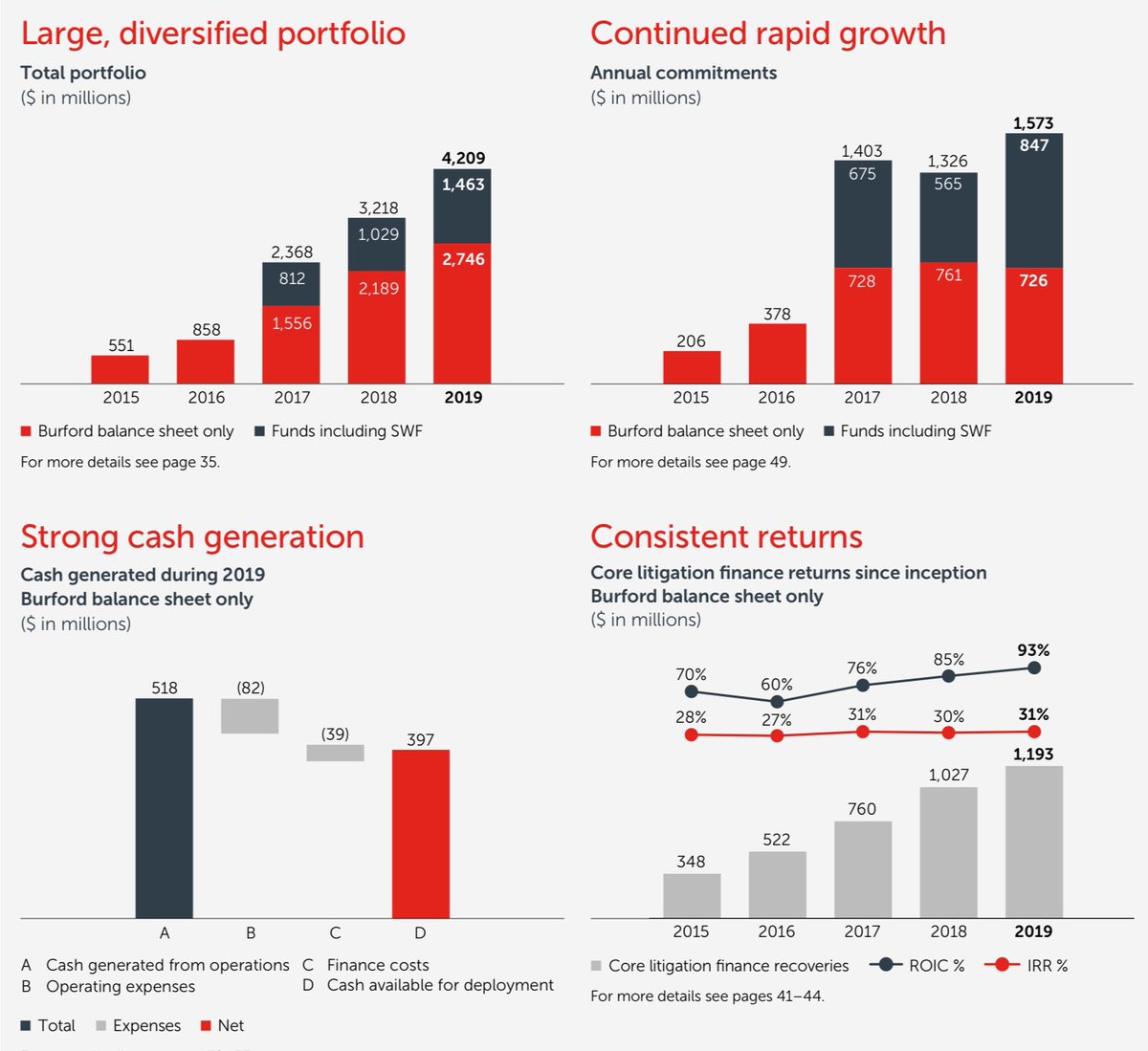

(1) Potential re-rating on US Listing (2) Brokers est. company may be worth 5-10x m/cap with Petersen valued at $773m on B/S with Potential Value $1bn-$5.6bn👇🏻(3) Op Margins 78% (4) $1.6bn committed in 2019 to drive future returns (5) Strong cash gen

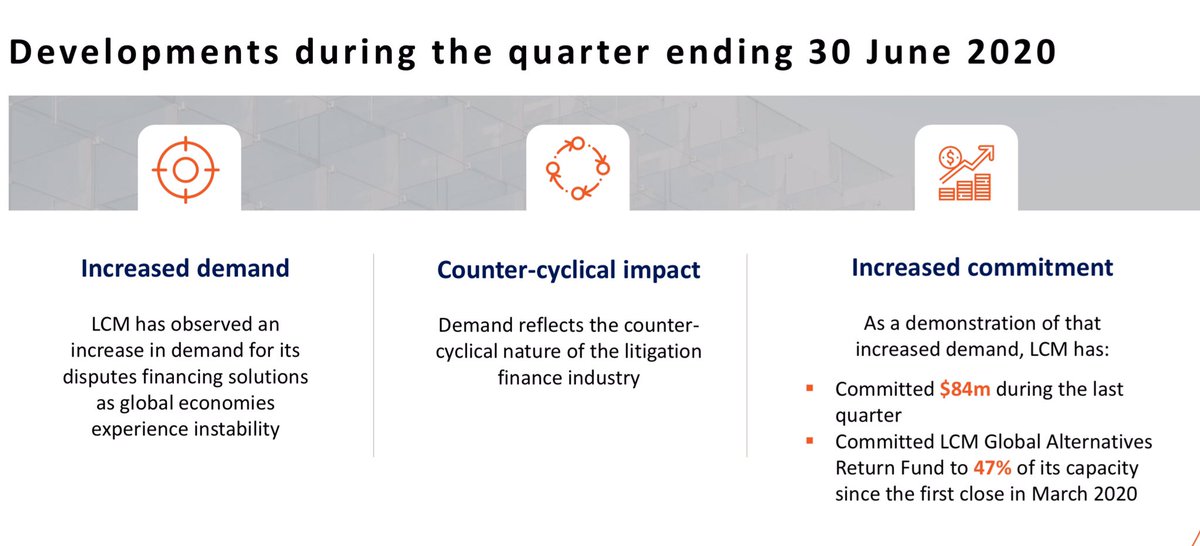

(1) Seeing increase in demand for dispute financing (2) 9yr ROCI 134% & IRR 78% (3) Launched 3rd party fund raising $150m taking advantage of bouyant market (4) Adding global legal partnerships (5) Market leader in new corporate portfolio transactions

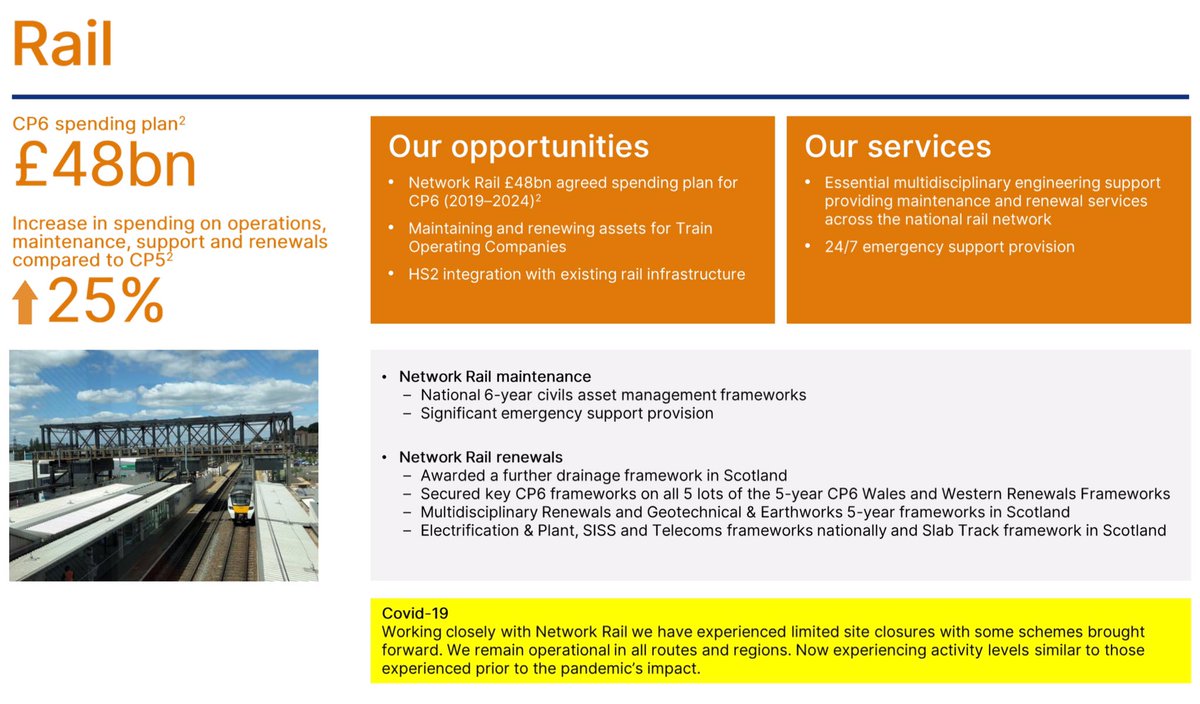

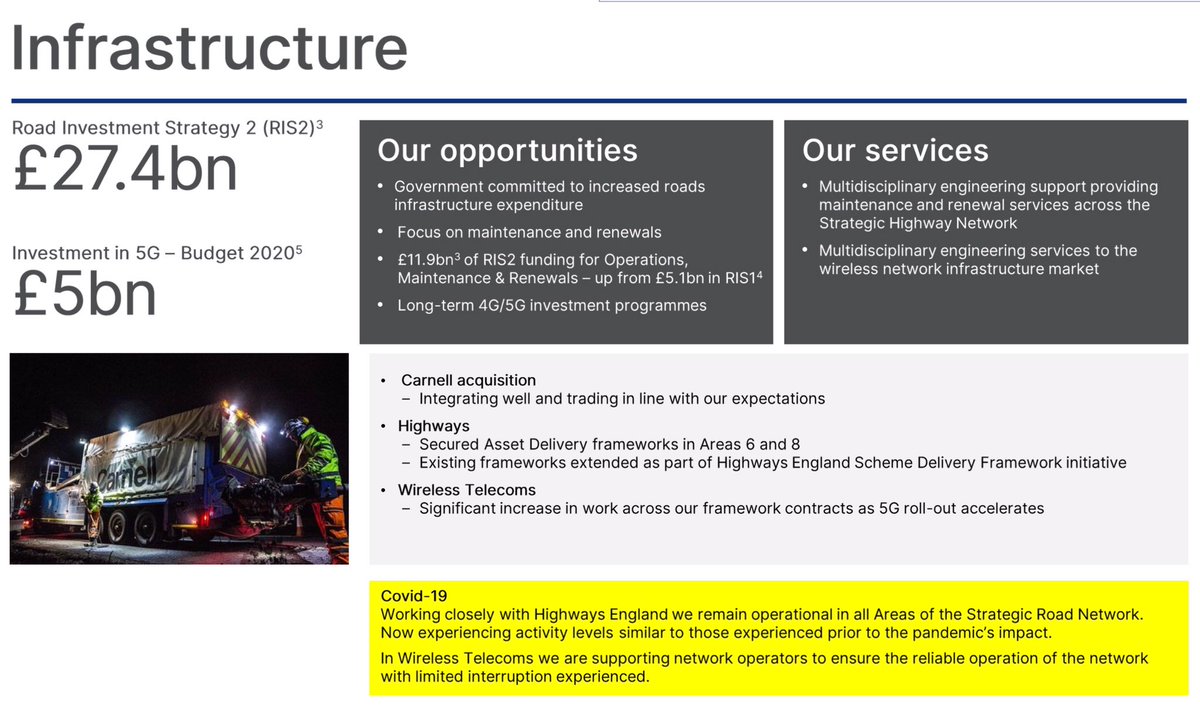

(1) Robust trading during lockdown (2) Op margin improvement (3) Strong cash gen (4) Benefiting from increased Rail spend (HS2, CP6)👇🏻(5) Infrastructure spend ramped up by Govt (5G rollout & Highways) (6) Also deliver flood & coastal protection

(1) Strong H1 despite the pandemic (2) Valued at 0.5x reserves vs 1.7x for #BREE (3) Op margin improvement (4) Strong cash generation with FCF yield of 11% (5) Heavy materials sector will benefit from UK infrastructure spend (6) @rhomboid1MF & @Arregius hold 😃👍🏻

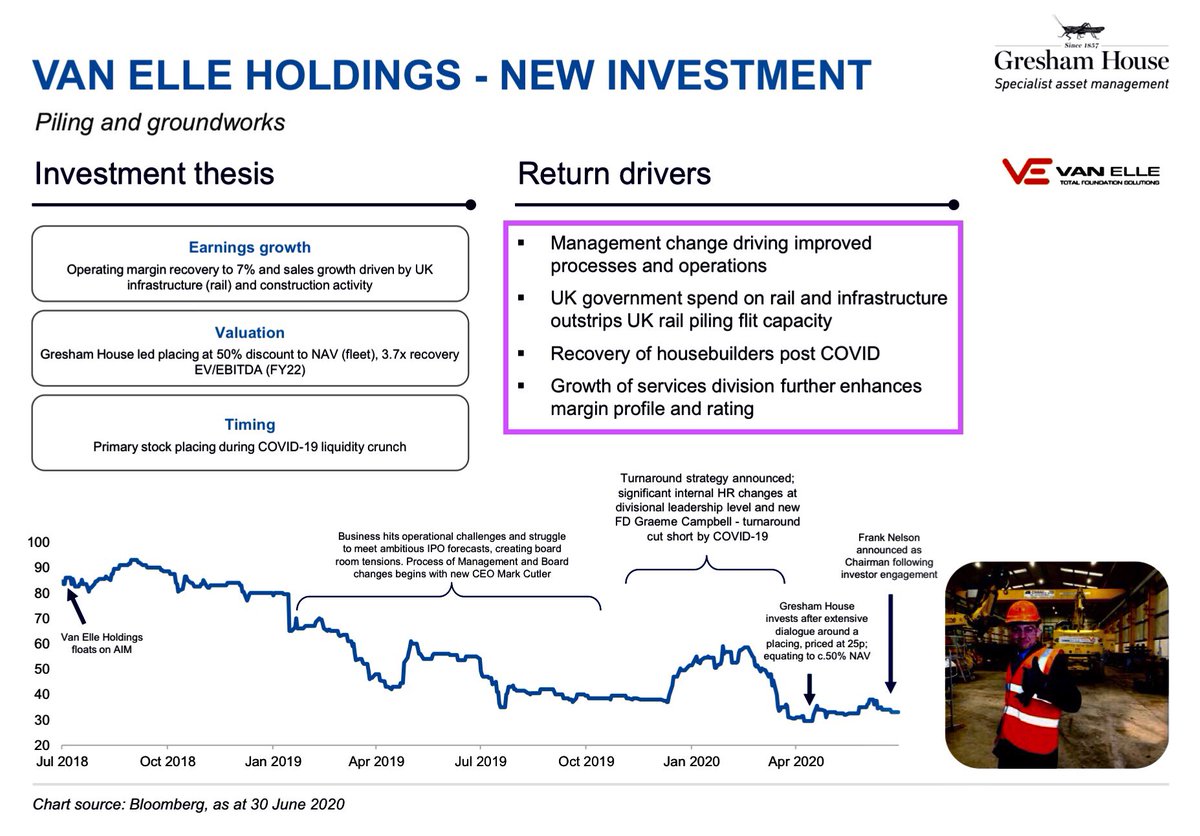

(1) Trading below NAV (2) Focus on op margin improvement (3) Beneficiary of housebuilding recovery & increased Rail spend [HS2, CP6] (4) Thanks @CapitalPmh for excellent broadcast

Now met mgmt & v impressed #VANL at 15min 45👇🏻

voxmarkets.co.uk/articles/gresh…

(1) Shares fallen [-60%] in last 2 years (2) Company overhaul & new mgmt headed by Ian Johnson who is a turnaround specialist (3) NIOX impacted by lockdown but recovering (4) Cash £12m at end May (5) Chris Mills with a large position (6) Thanks to @MGinvestor 🙏🏻

(1) Shares fallen [-50%] in 12mths (2) First Connected Home sale of £1m+ (important as high margin + SaaS recurring revs)(3) GM improvement plan implemented (4) Legislative drivers in Scotland & potentially post-Greenfell (5) Big beneficiary of US$ weakness

(1) Shares fallen [-40%] in 12mths (2) Potential NASDAQ lisiting (3) Strong B/S (4) Core business allows development of [a] CRISPR screening [b] BioProduction [c] Base Editing (5) Excellent analysis from @hareng_rouge that brought #HZD to my attention..see below👇🏻

(1) Now fully financed to produce SOP by Q1 FY21 (2) Strong ESG credentials (3) Should deliver 63% EBITDA margin & high cash conversion (4) Offtake agreements in place for 92% SoP (5) Strong management team that have previously delivered👇🏻

(1) They own 35.7% of HomeSend & Mastercard remaining 64% (2) X-Border payments scaling up with 93% QoQ growth in Q2 (3) Mastercard consolidation??? ... shares tucked away as I’m hopeful they’ll be acquired by MC at a reasonable premium

Please DYOR

Portfolio performance to follow this weekend

/END