🎉Excited for this "guarded launch" for Delphi by @akropolisio!

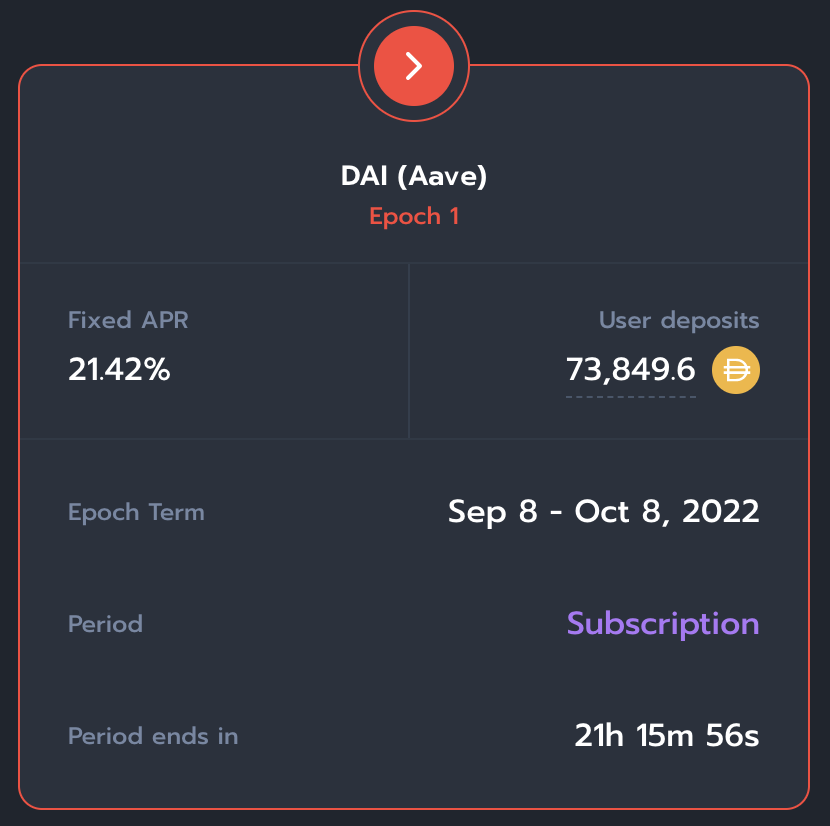

⚒️This will be on a shortlist that I recommend for those getting started with DeFi because the platform makes it all stupidly easy to #yieldfarm and provides for use a new DCA (dollar-cost-averaging) tool. #Ethereum

⚒️This will be on a shortlist that I recommend for those getting started with DeFi because the platform makes it all stupidly easy to #yieldfarm and provides for use a new DCA (dollar-cost-averaging) tool. #Ethereum

https://twitter.com/akropolisio/status/1297977849815736320

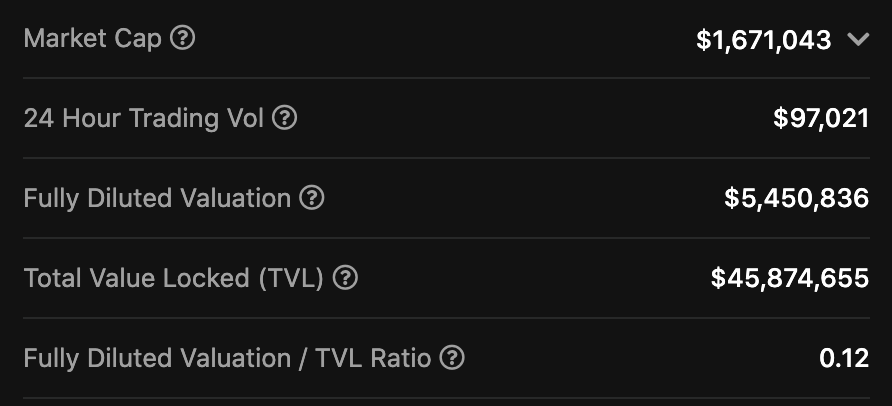

🌽Here's the most important info to #yieldfarm aside from the continued incentives paying those LPs in @BalancerLabs, @UniswapProtocol @mooniswap AKRO pools...

https://twitter.com/akropolisio/status/1297977851581550593?s=20

🎬I'll be making more tutorials on this in the coming days but what a pretty DeFi product to use.

👋Lmk what you think of @akropolisio's Delphi! delphi.akropolis.io/savings

👋Lmk what you think of @akropolisio's Delphi! delphi.akropolis.io/savings

• • •

Missing some Tweet in this thread? You can try to

force a refresh