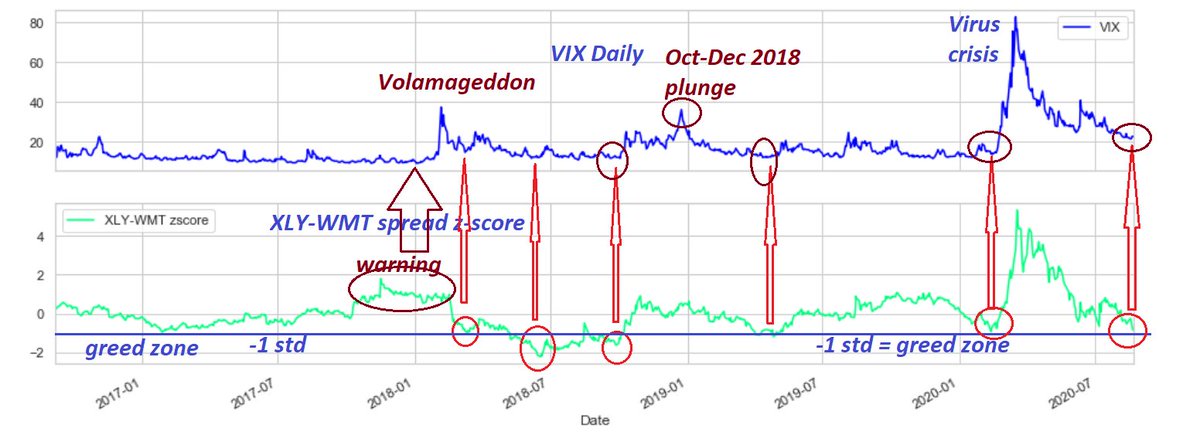

$XLY & $WMT spread z-score

entry

z < -1 std => long 1/3 of total lots

long WMT & short h * XLV

z < -2 std => long 2/3 of total lots

profit

z > 0 std => out 1/3 lots

z > +1 std => out 1/3 lots

z > +2 std trailing 1/3 lots

stop

z < -3 std. out.

when XLY-WMT z-score < -1 std (greed zone), #VIX spiking secured in 1-2 wks time-frame

should be confirmed by many of my other breadth & Jaws indicators

also huge warning, when VIX crushed, but the spread rising. stealthy sector rotation in Jan 2018

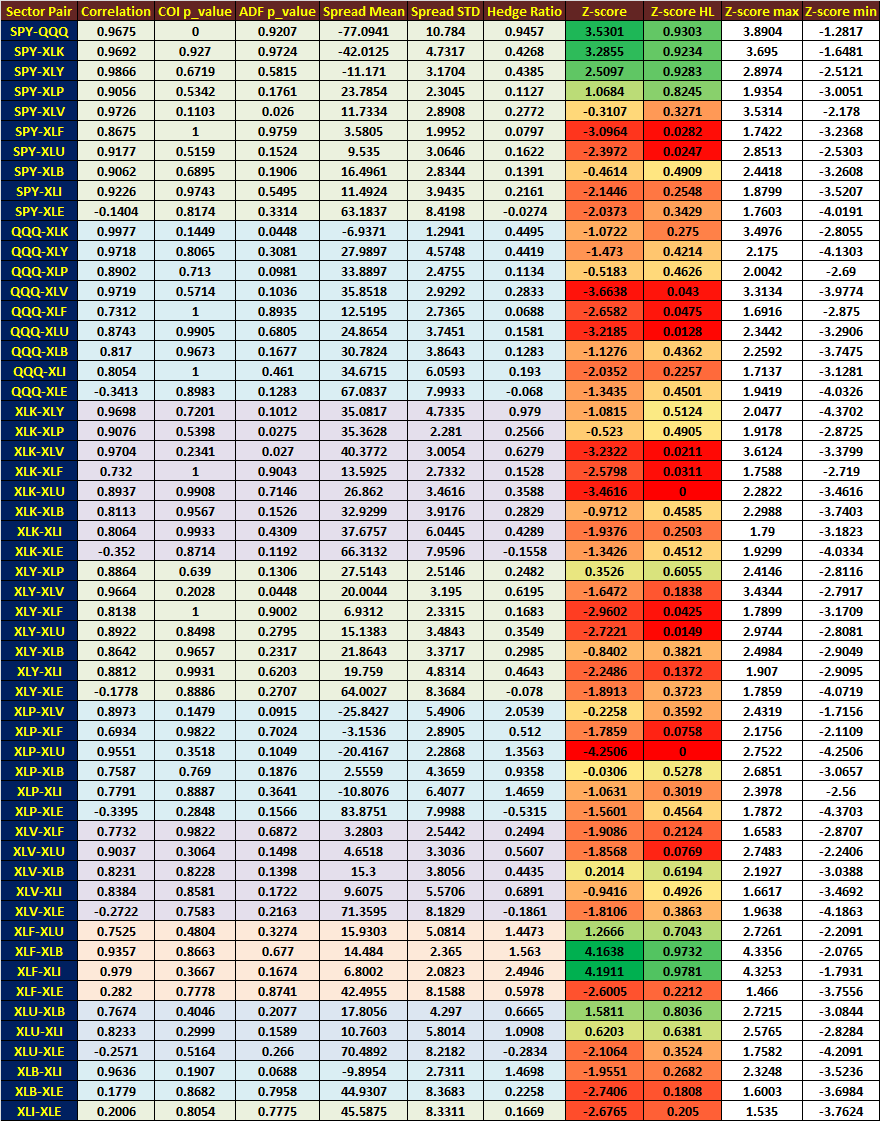

1 XLY-WMT spread z-score

2 $VIX

3 > 0.7

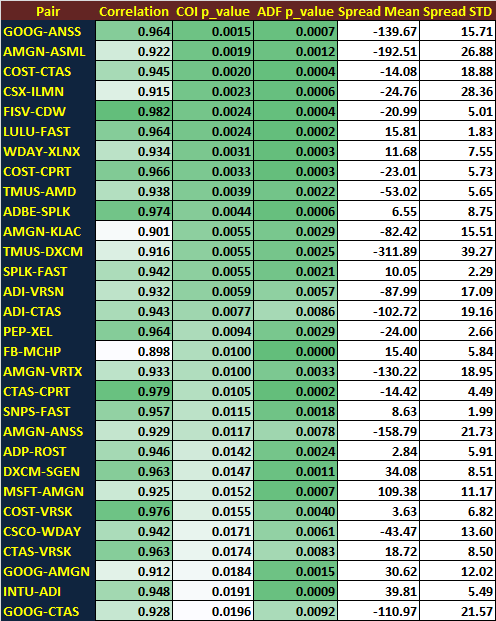

tradeable corr & z-score

how about I scan tons of other similar growth/value sectors & stocks, charting their spread z-score & corr with VIX & Sector ETF? along with PCR

Hmm greatest breadth indicator ever?🧐