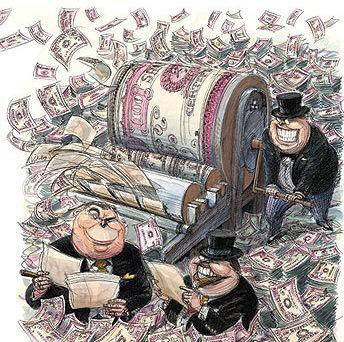

What in the world is driving this market? Answers across Twitter have become complex monetary and fiscal theories with fancy charts and academic writings flying around. But what if the answer is much more simple than people assume?

Stabilization: Fed/Treasury financial stability actions

Inflation: Bank lending

Rotation: Agriculture, Financials and Retail in 2021.