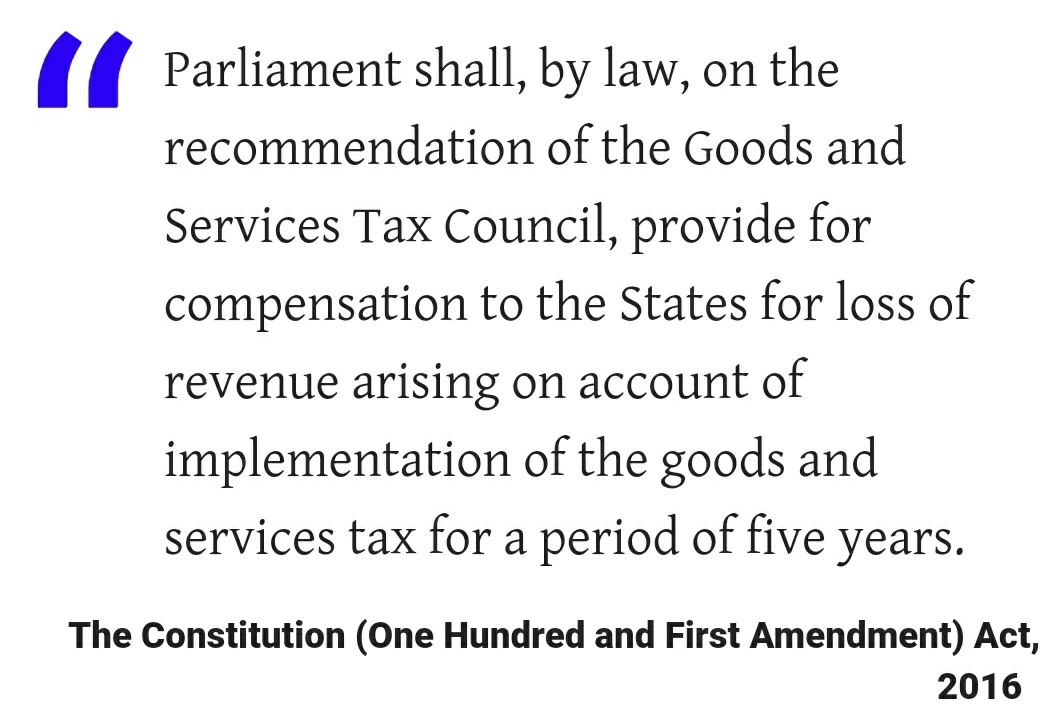

The constitutional amendment states that compensation shall be provided to the States

"...for loss of revenue on account of implementation of the goods and services tax..."

The centre has interpreted this narrowly...

Due to low tax revenue collection it expects to face a compensation cess shortfall of Rs 2.35 lakh crore.

It computed this based on previous shortfall data.

It offered 2 options. But 1 choice.

Dear states, please go borrow.

bloombergquint.com/gst/compensati…

1. That it's reneging on its word.

"In principle and the form of the commitment which was made was that of compensation (revenue), not borrowing."

- @Subhashgarg1960

bloombergquint.com/gst/making-sta…

Because levy of compensation cess will now extend beyond 2022.

The hope of fewer and lower rates...pushed further back.

How will that impact their expenditure decisions?

Will it push them to reform, divest state PSUs, find new sources of revenue?

Or will citizens suffer?

bloombergquint.com/gst/three-econ…

By @HaseebDrabu

#mustread 👇🏽

bloombergquint.com/gst/gst-compen…