Hello folks, as told reviewing credit spread vs diagonal.

First of all understand why otm credit people do even after risk reward very bad. First of all better than naked as hedge loss limited and margin benefits in both.

First of all understand why otm credit people do even after risk reward very bad. First of all better than naked as hedge loss limited and margin benefits in both.

https://twitter.com/sanjufunda/status/1298967607538671619

Credit spread/dia. traded by professional when view sideways to minor directional even some room on opposite side as well. If purely directional then go 4 debit as risk low reward high.

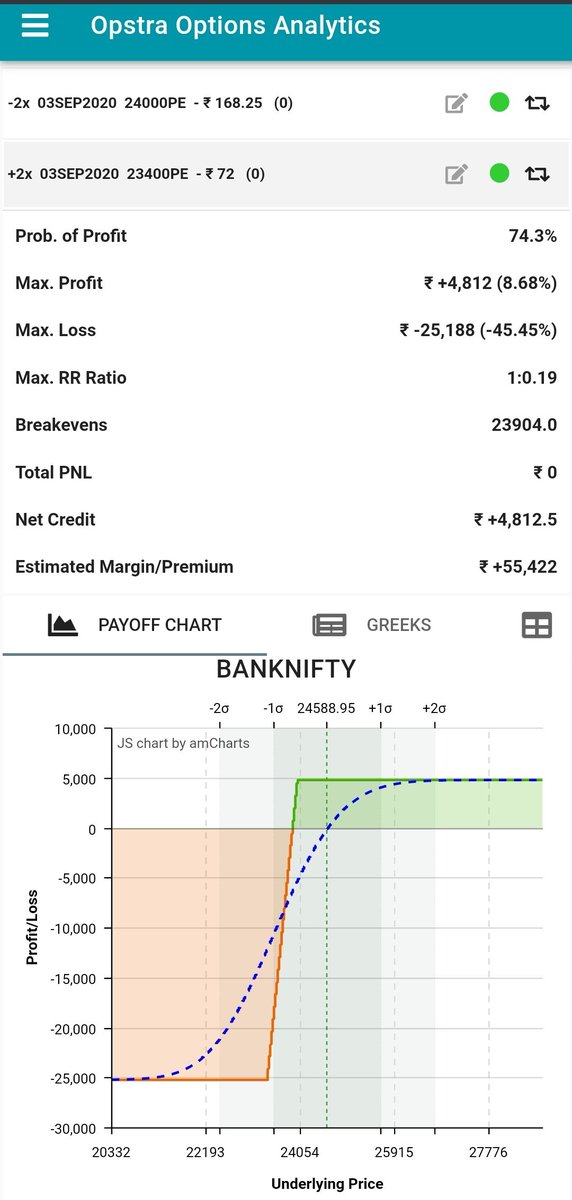

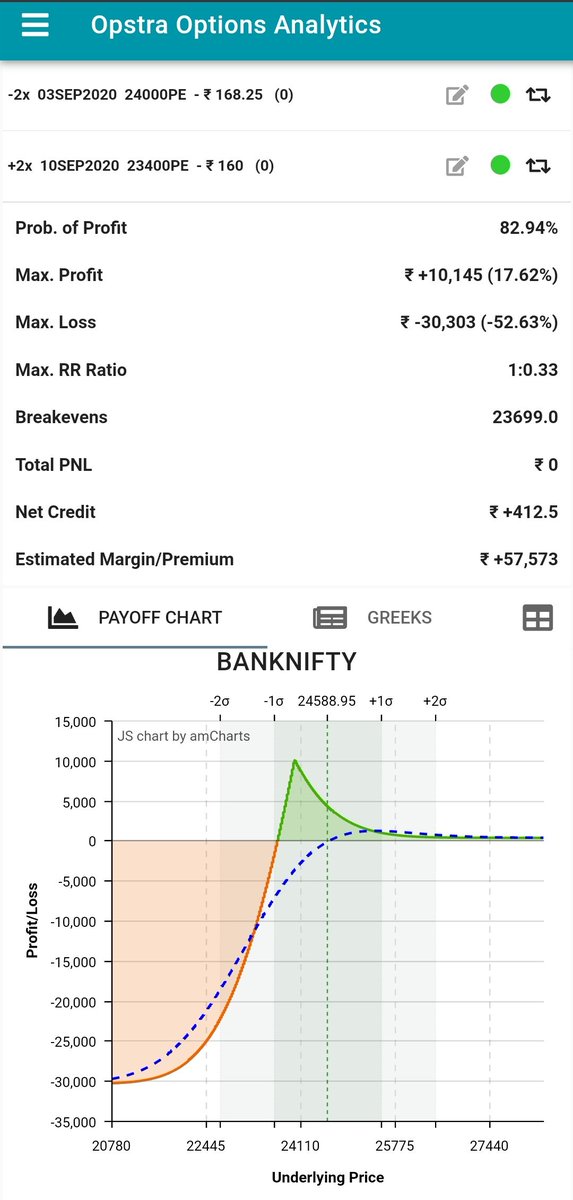

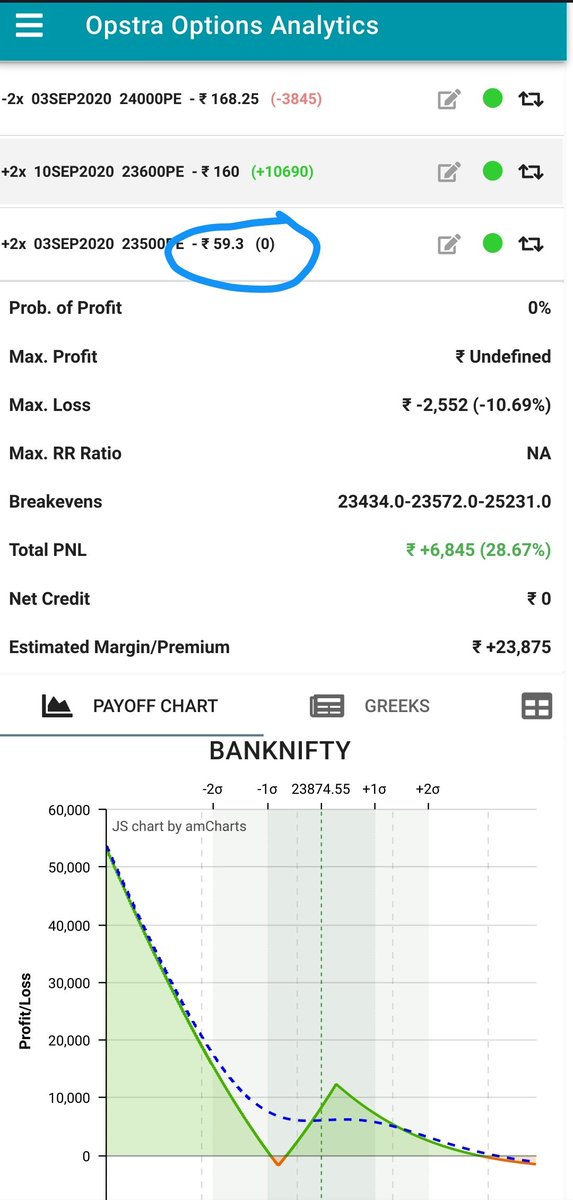

I m talking about zero credit diagonal only go as per snap of example and see wat i m telling.

I m talking about zero credit diagonal only go as per snap of example and see wat i m telling.

1. First of all if we compare diagonal hv better probability of profit than Credit.

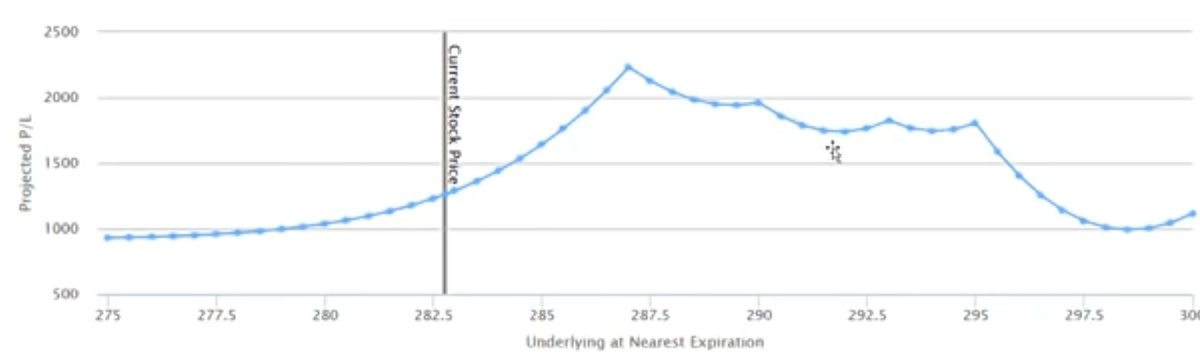

2. Max profit also big in diagonal but if hit max zone, if sideways then almost same profit but pure trendy market hv to shift diagonal or winning leg. Only moving is drawback which not big issue.

2. Max profit also big in diagonal but if hit max zone, if sideways then almost same profit but pure trendy market hv to shift diagonal or winning leg. Only moving is drawback which not big issue.

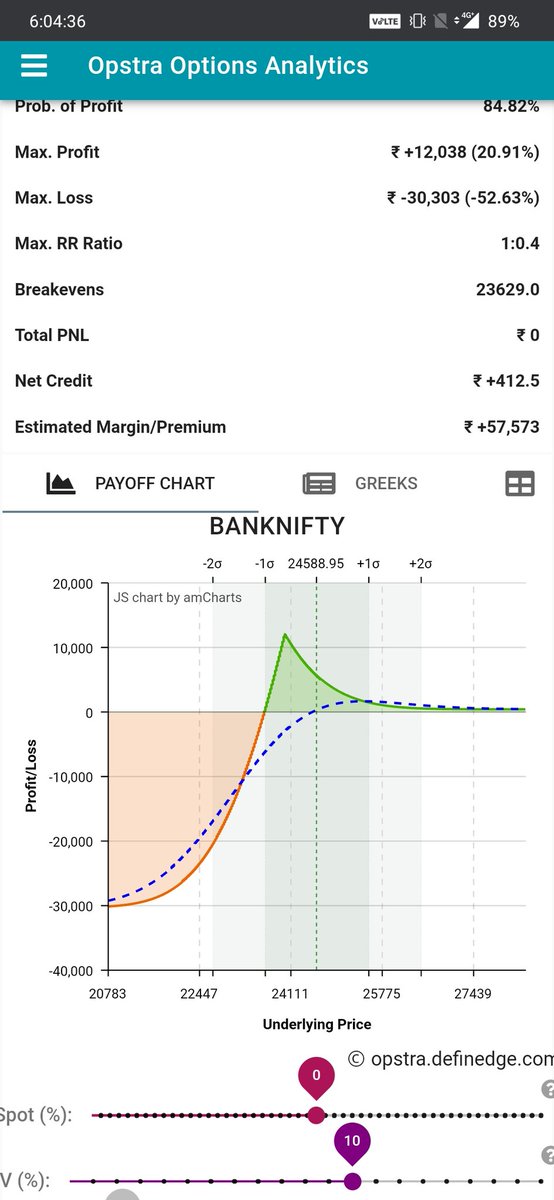

3. Mostly i suggest go for put diagonal than call diagonal bcoz of iv mostly spike if fall happened. So wat ever u r seeing max profit increase and breakeven also lift. In pic increase iv by 10%. So if market goes against u r also in favor position due to vega.

4. If market goes against we hv enough credit on wrong side for any kind of adjustment but in credit only people can accept stop due to low premium cant be adjusted.

5. If we compare breakeven diagonal win by far margin.

6. Directional both hv no loss situation. But diagonal hv to manage for more credit either by move winning leg or avg multiple positions.

7. Margin benefits almost same for both.

6. Directional both hv no loss situation. But diagonal hv to manage for more credit either by move winning leg or avg multiple positions.

7. Margin benefits almost same for both.

So this is the conclusion why i suggest zero credit or credit diagonal far better than credit spread.

Stay learning and earning curve up, stay healthy 👍

#diagonal #OptionsTrading

Stay learning and earning curve up, stay healthy 👍

#diagonal #OptionsTrading

Note: multiple diagonal looks like that but its happen with time only.

Note: vega effect can change profile completely so careful about large iv dropped is major drawback.

Note: vega effect can change profile completely so careful about large iv dropped is major drawback.

Extra advice for maximize ur profit, u can sell additional otm call or put against it either position in favor or not every Wednesday (mini expiry) and Thursday (expiry) on opposite side. Keep proper stop!

Now this is magical as u know position in ur favor still want to try max profit till expiry normally i dont advice but we r at best situation and tomorrow expiry best to convert ur position almost no risk trade with buying downside risk almost nill.

Also once upside move continue in favor simply convert position as risk free projection and take another diagonal with new support.

• • •

Missing some Tweet in this thread? You can try to

force a refresh