There are gurus claiming “PE has zero informational value”.

People are giving examples of where Amazon or BestBuy or Asian Paints & other such companies were trading in 90s.

1/

What you are trying to estimate is potential cash generation ability of a business.

2/

A startup could be in losses for years and hence PE is not relevant.

A disruptive technology could have extremely high growth.

3/

This is what is being preached by lot of FMs.

4/

You also have to look at cash conversions. No formulas here. You have to assess the business and the price from various angles.

5/

Buffett in 1996 AGM referred to Gillette/Coca Cola as “inevitables”.

Fan of the big man but IMHO there are NO “inevitables”.

6/

There are many businesses that will never be cheap enough. But there is no business, none, zero that can never be over priced.

7/

8/

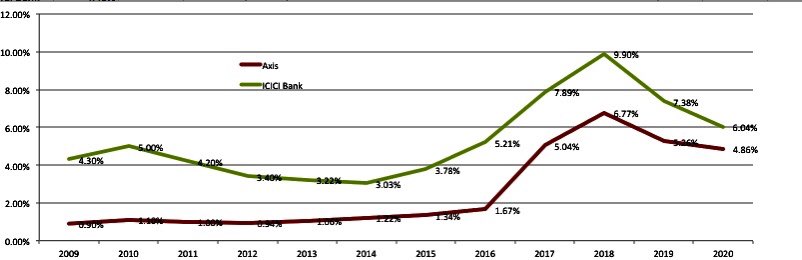

For these stocks the PE IS telling a story, there IS a lot of information in that number.

9/

But if he could change enough to buy Tech may be he has changed his exit strategy as well.

10/10