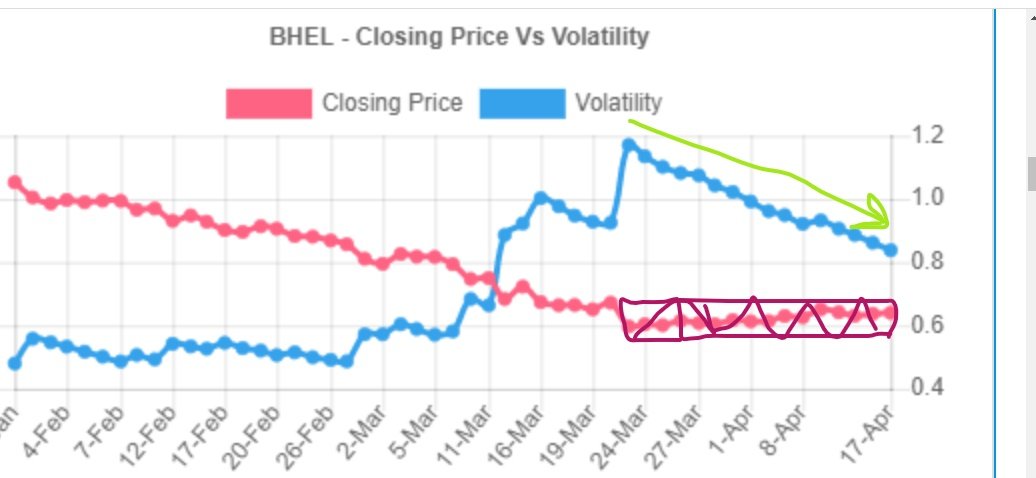

When Data & Aata is coming together....its necessary to see the building up picture.

#NIFTYMEDIA

*** B/O of down sloping channel with significant volume..

*** Crossover of 50 & 200 DEMA.

Find your stocks in the sector.

#NIFTYMEDIA

*** B/O of down sloping channel with significant volume..

*** Crossover of 50 & 200 DEMA.

Find your stocks in the sector.

Non FNO, where i am looking for.

A deep consolidation, Away from limelight, A penny stock where we see unprecedented volume in recent past.

A deep consolidation, Away from limelight, A penny stock where we see unprecedented volume in recent past.

Just for info..it has just come out today...

What do you think stock will do.....

From loss making Company turned in profit .

What do you think stock will do.....

From loss making Company turned in profit .

So far up by

10% from the results announcement.

10% from the results announcement.

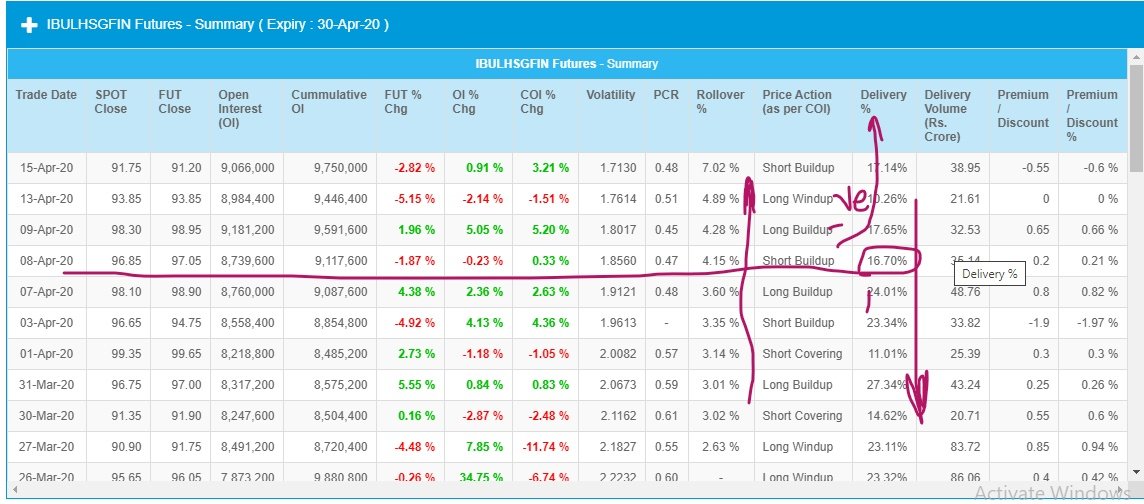

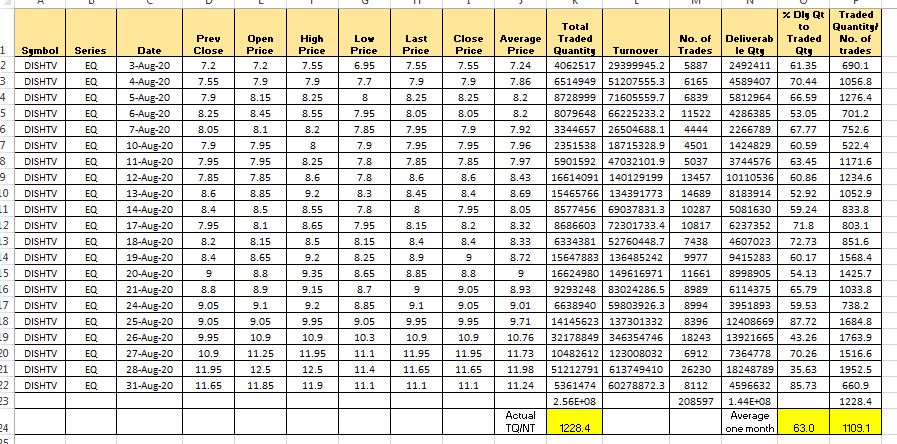

#DISHTV

Weekend study.

*** Delivery vol. & % data shown buying by strong player with greater no. of Traded quantity /no. of trades than its monthly average..

*** Media index shown better Relative Strength than NIFTY 500.

Weekend study.

*** Delivery vol. & % data shown buying by strong player with greater no. of Traded quantity /no. of trades than its monthly average..

*** Media index shown better Relative Strength than NIFTY 500.

Stock performance in last 15 days.

*** Stock accumulation & delivery % increasing is simple yet powerful indication.

*** Quarterly results were known to Insiders (Every time).

Up move awaited.

25% ++

Before After

*** Stock accumulation & delivery % increasing is simple yet powerful indication.

*** Quarterly results were known to Insiders (Every time).

Up move awaited.

25% ++

Before After

• • •

Missing some Tweet in this thread? You can try to

force a refresh