We explore 2 themes in this week's "That's Our Two Satoshis" digital assets market recap via @arca:

1) #Bitcoin is unequivocally a global macro asset following reactions to Powell's speech.

2) The 2020 rally is much more sustainable than 2017

ar.ca/blog/crypto-ma…

Thread 👇

1) #Bitcoin is unequivocally a global macro asset following reactions to Powell's speech.

2) The 2020 rally is much more sustainable than 2017

ar.ca/blog/crypto-ma…

Thread 👇

Bitcoin moved in lockstep with other macro assets last week following Fed Chairman Powell's speech. Bitcoin and gold tracked each other almost perfectly, with a 3-day correlation of 0.76 before, during, and after Powell’s speech.

Irony: many investors left Wall Street and came to digital assets specifically to get away from the “don’t fight the Fed” manipulated equity & debt markets, and yet a few years later, Bitcoin investors are now hanging on every word from Powell too.

https://twitter.com/EconguyRosie/status/1299325659546869762

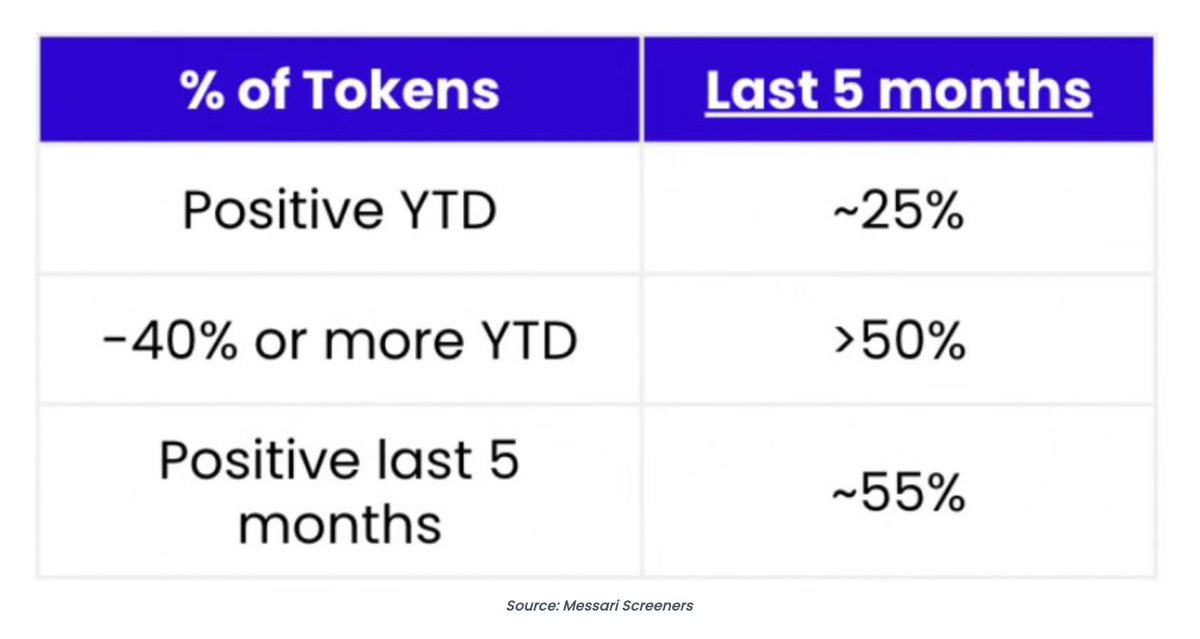

Meanwhile, small cap, value-accruing digital assets continue to outperform large-cap, legacy "cryptocurrencies" that accrue no value. While some are comparing the euphoria to 2017, today’s market resembles nothing close to that of 2017.

The biggest difference between 2017 and 2020 is that many of the tokens today are being created AFTER a company has already found product market fit, which creates much more sustainable growth.

Instead of tokens issued simply to fund pipe dream “decentralized projects” with low probabilities of success, many of today’s leading tokens are used to enhance already thriving ecosystems and to grow customer bases faster.

Blockchain technology itself is revolutionary.

But these hybrid equity/utility tokens (or pass-thru tokens) are evolutionary.

We believe pass-thru tokens are amongst the most novel capital formation & bootstrapping instruments ever created.

But these hybrid equity/utility tokens (or pass-thru tokens) are evolutionary.

We believe pass-thru tokens are amongst the most novel capital formation & bootstrapping instruments ever created.

• • •

Missing some Tweet in this thread? You can try to

force a refresh