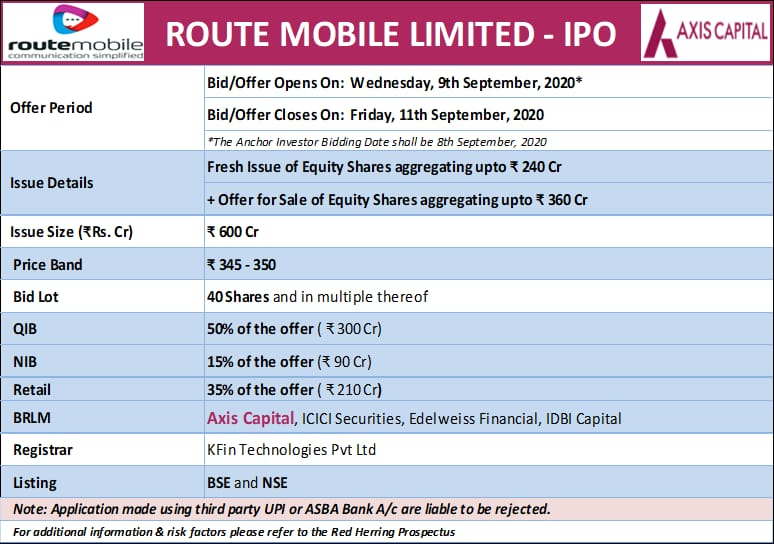

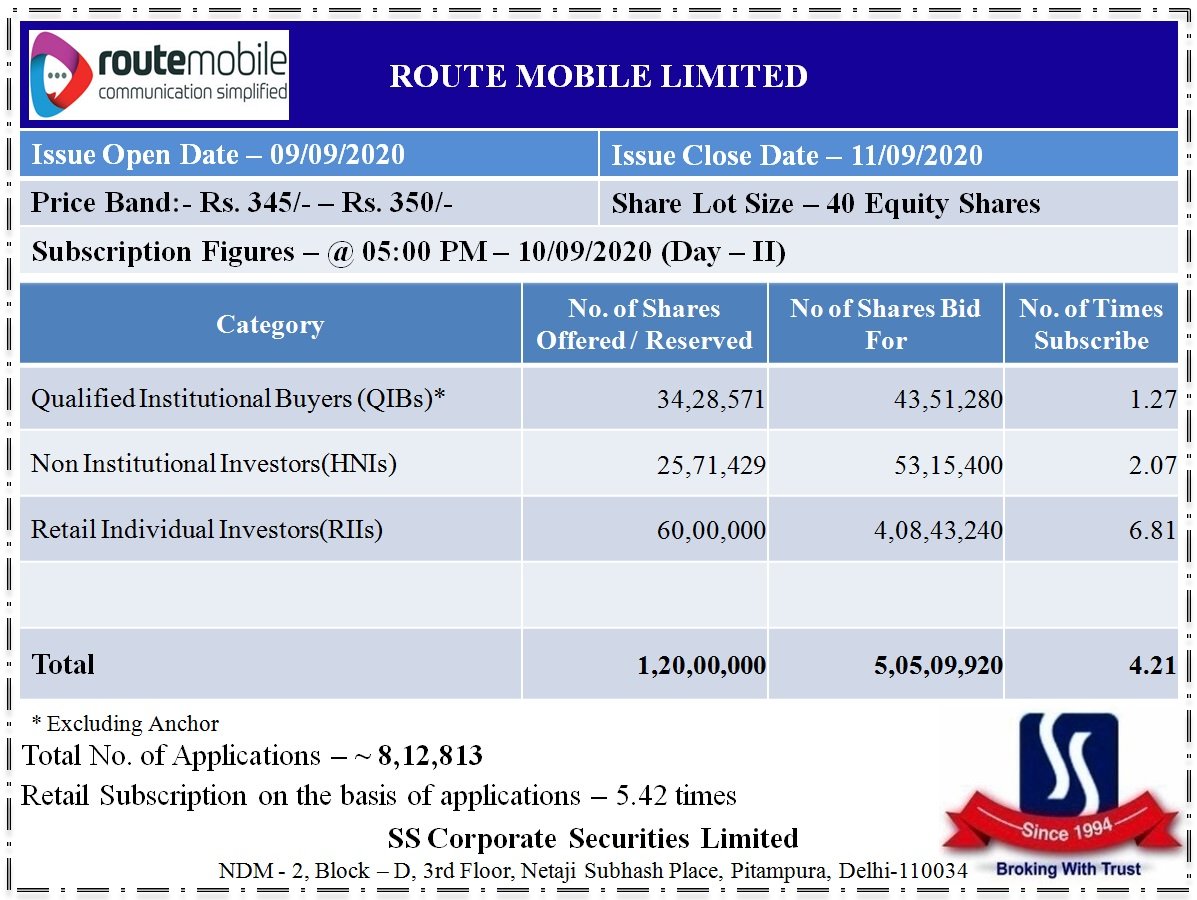

ROUTE MOBILE #IPO

#GMP 170 (+/- 5)

#Kostak 675 (+/- 25)

subscribed 4.2x at end of day 2

retail 6.8x

HNI 2.1x

QIB: 1.2x

#GMP 170 (+/- 5)

#Kostak 675 (+/- 25)

subscribed 4.2x at end of day 2

retail 6.8x

HNI 2.1x

QIB: 1.2x

ROUTE MOBILE #IPO

#GMP 145 (+/- 5)

#Kostak 605 (+/- 25)

subscribed 57.2x at 3:18 PM final day

retail 12.4x

HNI 150.6x

QIB: 65.7x

#GMP 145 (+/- 5)

#Kostak 605 (+/- 25)

subscribed 57.2x at 3:18 PM final day

retail 12.4x

HNI 150.6x

QIB: 65.7x

ROUTE MOBILE #IPO

#GMP 170 (+/- 5)

#Kostak 605 (+/- 25)

subscribed 74.4x at end of final day

retail 12.8x

HNI 195.6x

QIB: 91.1x

Has timing changed? seeing almost no bids for happiest minds and route IPO after 4PM @ipo_mantra

#GMP 170 (+/- 5)

#Kostak 605 (+/- 25)

subscribed 74.4x at end of final day

retail 12.8x

HNI 195.6x

QIB: 91.1x

Has timing changed? seeing almost no bids for happiest minds and route IPO after 4PM @ipo_mantra

Route Mobile Limited IPO – Listing Update

Listing Date: Monday 21-Sept-2020

Symbol: ROUTE

Script Code: 543228

ISIN: INE450U01017

Issue Price: Rs. 350/- per share

Exchange: BSE & NSE

#IPO

BSE Listing Circular: bseindia.com/markets/Market…

Listing Date: Monday 21-Sept-2020

Symbol: ROUTE

Script Code: 543228

ISIN: INE450U01017

Issue Price: Rs. 350/- per share

Exchange: BSE & NSE

#IPO

BSE Listing Circular: bseindia.com/markets/Market…

HAPPY LISTING!!

will not be surprised if stock doubles on listing! #IPO

Listing of Route Mobile Limited on 21st September 2020

Symbol ROUTE

Series Equity “EQ” B

BSE Code 543228

ISIN INE450U01017

Face Value Rs 10/-

Issue Price for the issue Rs. 350/- per share

will not be surprised if stock doubles on listing! #IPO

Listing of Route Mobile Limited on 21st September 2020

Symbol ROUTE

Series Equity “EQ” B

BSE Code 543228

ISIN INE450U01017

Face Value Rs 10/-

Issue Price for the issue Rs. 350/- per share

• • •

Missing some Tweet in this thread? You can try to

force a refresh