Maybe it's taken... from you?

Thread

[1/18]

[4/18]

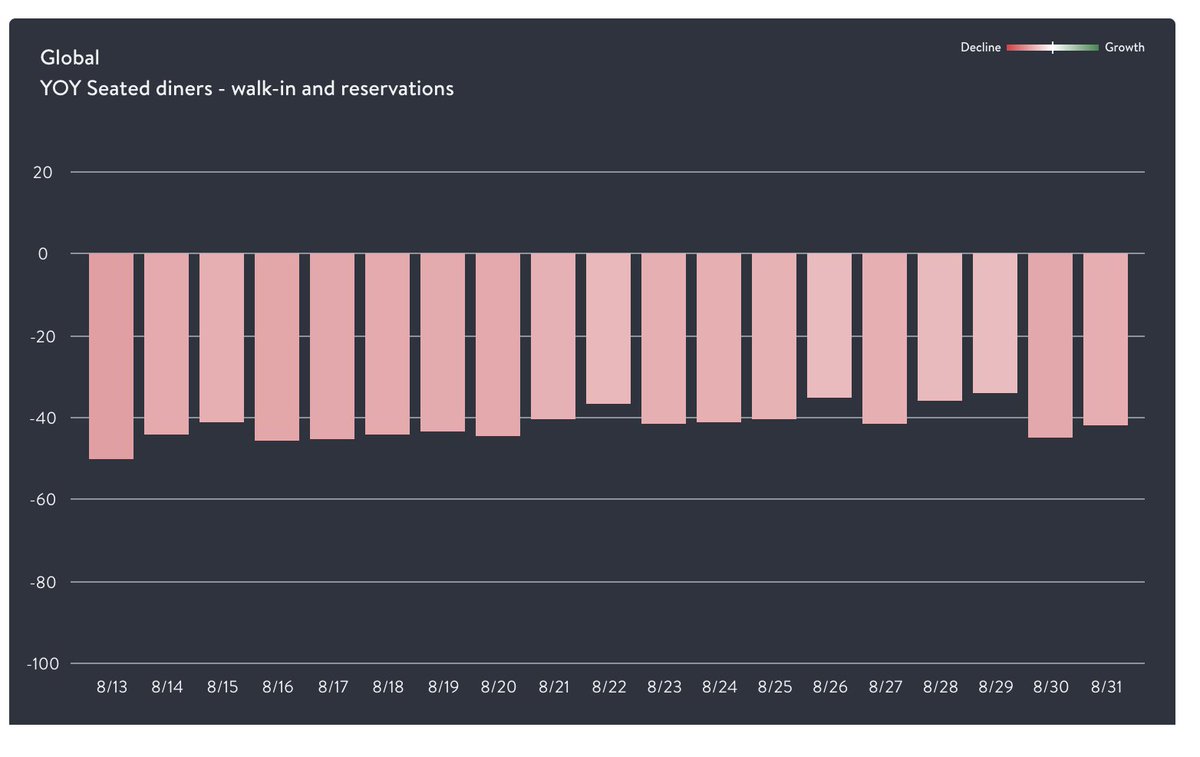

opentable.com/state-of-indus…

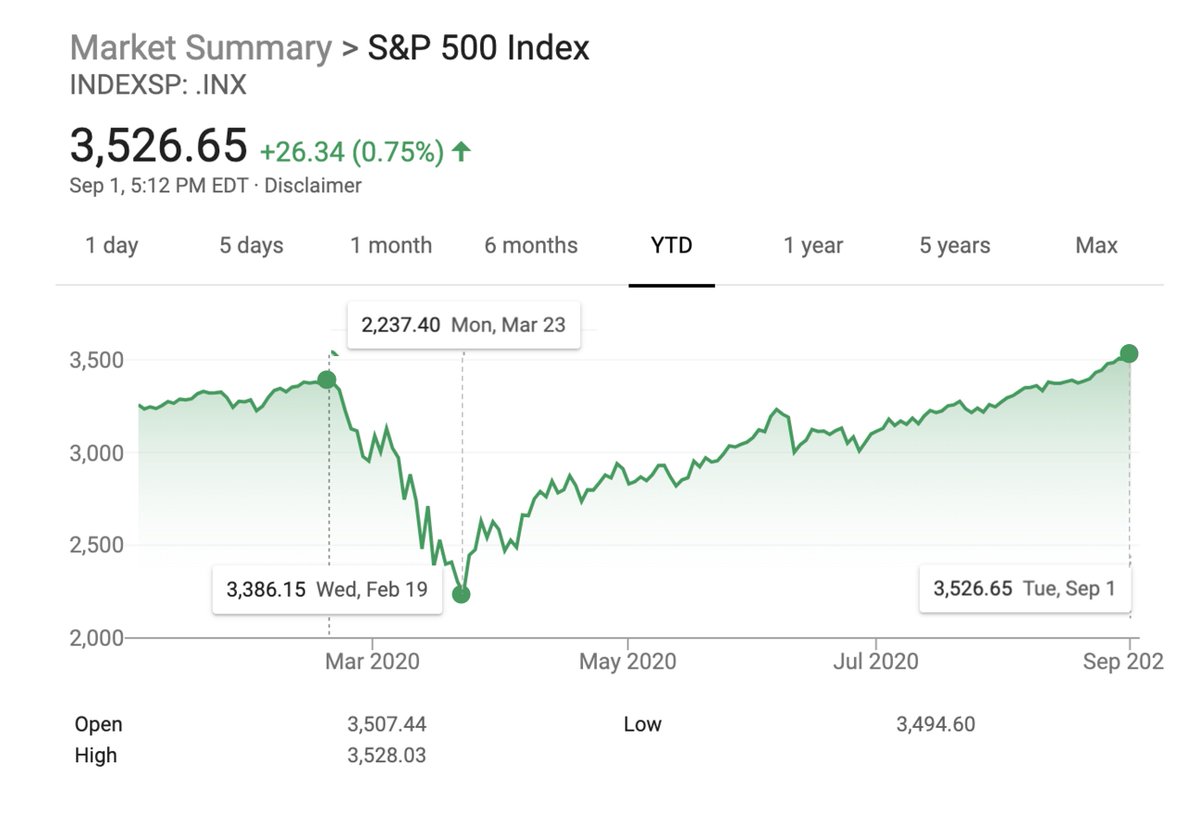

In fact that's where it was heading until March 23th. What happened that day?

[5/18]

federalreserve.gov/newsevents/pre…

"The Federal Reserve is committed to using its full range of tools to support households, businesses, and the U.S. economy overall in this challenging time"

But don't be fooled.

What's really going on?

[6/18]

In the 2008 crisis, it bought mostly government bonds and also securities from distressed businesses such as banks and insurance companies.

[7/18]

history.com/topics/21st-ce…

They're not just lending to the government and banks. They're also lending to big corporations (by buying their debt), and also have programs for small and medium companies.

And they're spending more overall.

brookings.edu/research/fed-r…

It's as if you had to pay the bank for it to keep your money.

[9/18]

[10/18]

cnn.com/2020/03/25/pol…

Layoffs will come on 10/1

abcnews.go.com/Travel/wireSto…

[11/18]

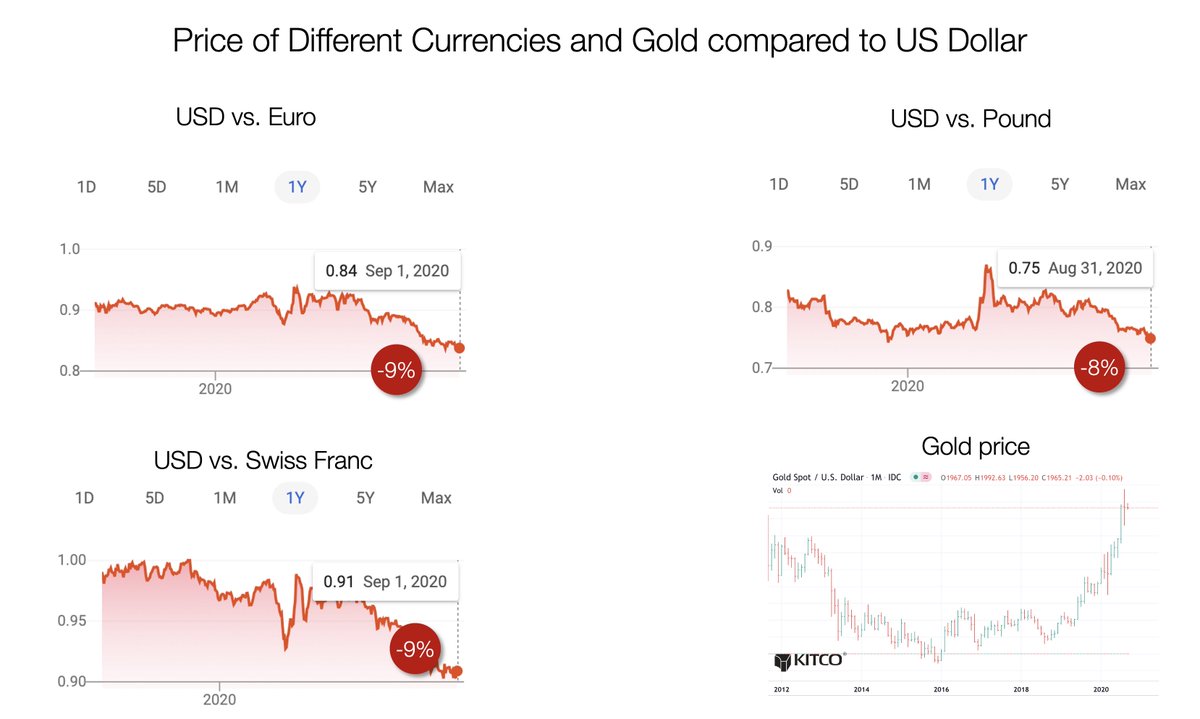

When a government prints money and lends it at 0% interest, it's as if it was giving $ away.

Those who get it are richer, and all the rest are poorer. But we don't notice because we're not tracking the USD value every day

[14/18]

[15/18]

But since 2010 the Fed has realized it can print $ without inflation, so it's off to the races.

wtfhappenedin1971.com

[16/18]

fred.stlouisfed.org/series/GFDEGDQ…

[17/18]

(But don't go investing all your $ right now. Go slow. There might be a crash coming. You never know. You can't time the market)

Sign up if you don't want to miss my future articles

mailchi.mp/b44a5f38b4f7/c…