Btw, I am still mad at myself for sticking to my principle of not throwing money at unaudited projects and not buying $YFI.

Instead I bought in at $10k…

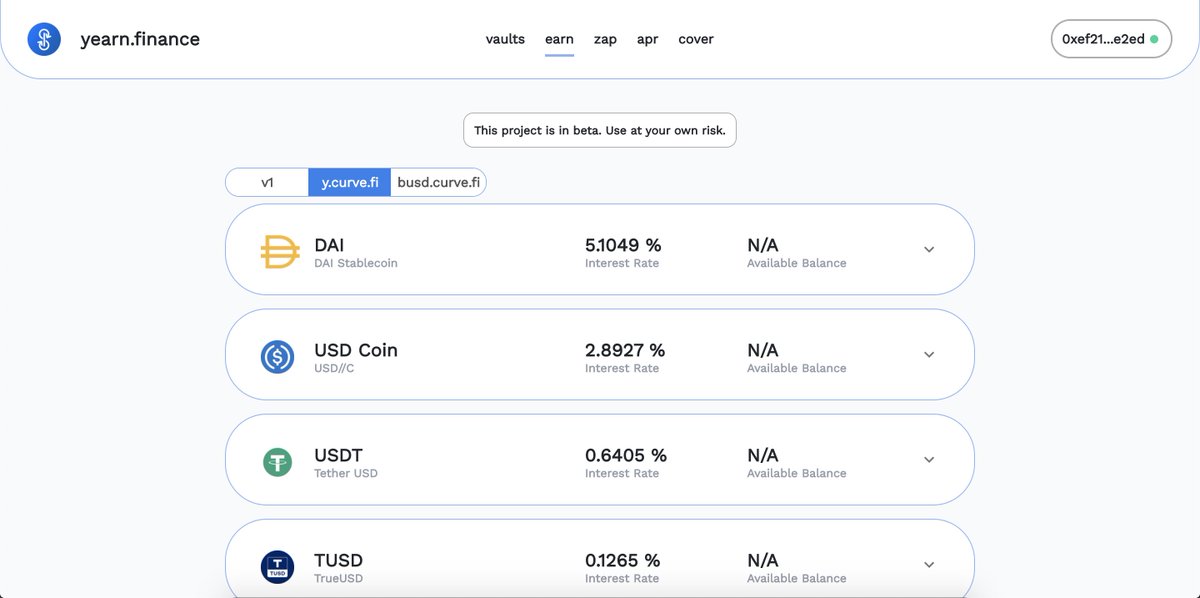

Instead of chasing yields by yourself (which is hard), give it to @iearnfinance, which will allocate it across various DeFi lending protocols to get you the BEST return.

@aave,

@compound,

@bzx and others.

This means they constantly re-iterate and re-allocate your funds based on the current optimal strategy.

It also takes some load off the Ethereum network, which is struggling to keep pace with the increasing interest in DeFi and yield farming.

Economies of scale 📈✅

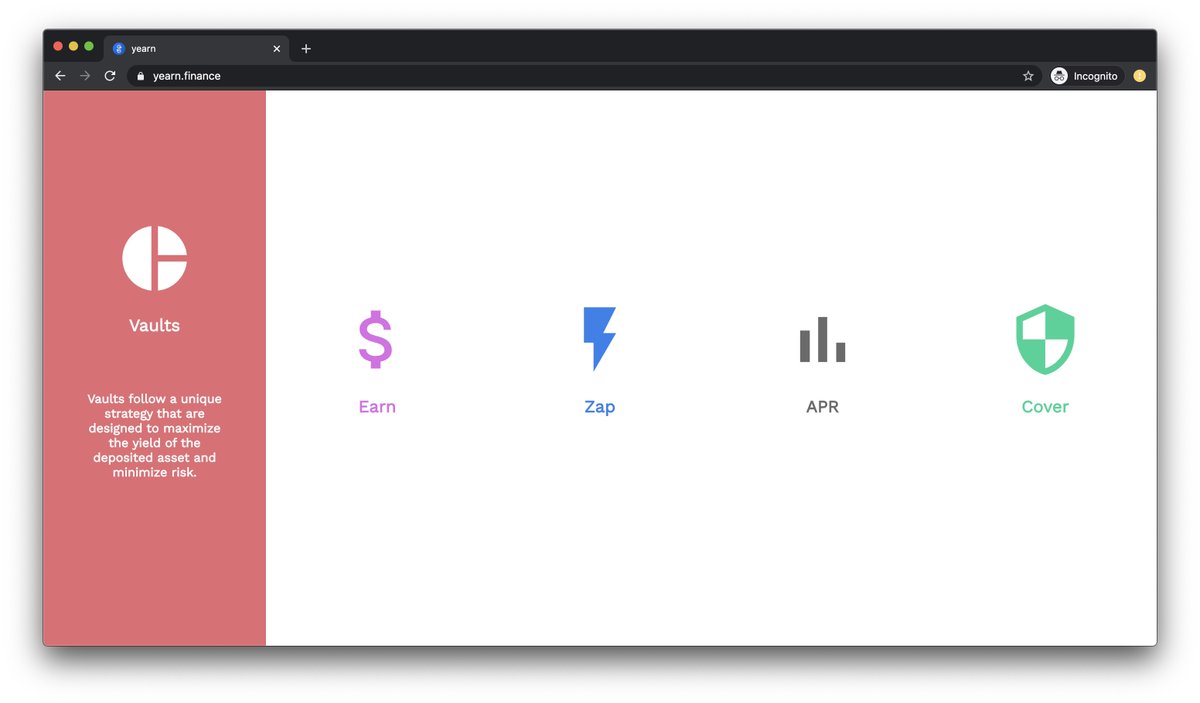

Now let's look at Vaults, iearn's cash cow product ⬇️

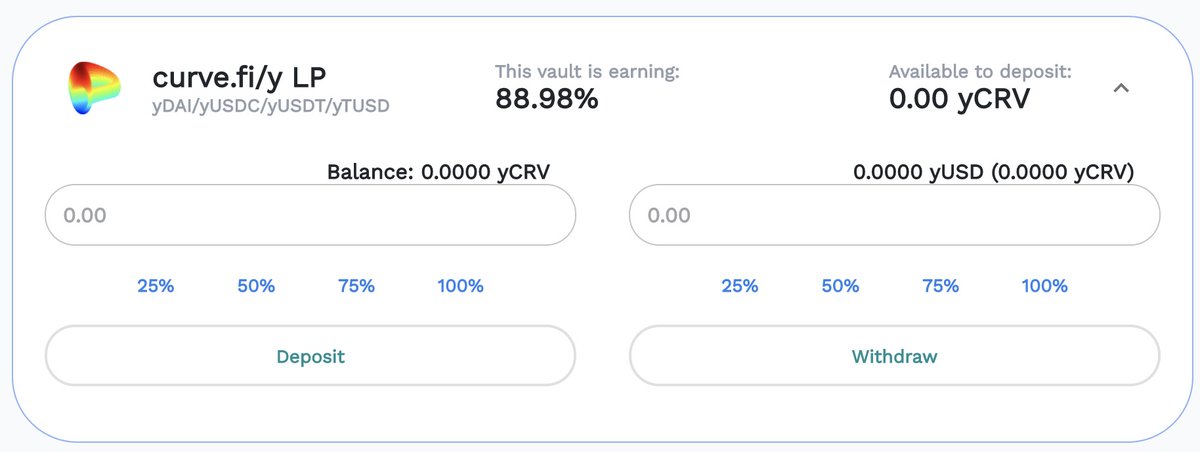

By allocating user funds to specific protocols that distribute governance tokens, which can be sold on DEX's, Vaults achieve much higher yields

To understand how it works we need to understand @CurveFinance.

Curve is a DEX that lets users swap stablecoins like USDC, USDT etc at extremely low costs and slippage.

To offer efficient and inexpensive swaps, Curve needs liquidity providers (LP’s) to provide stablecoins.

cryptotesters.com/blog/what-are-…

In return they receive a portion of the trading fees.

Curve is incredibly efficient at its job so these trading fees sum up and provide nice returns to LP’s.

When you deposit a stablecoin like $DAI or $USDT into Curve’s Y-Pool you get $yCRV in return.

You can redeem your $yCRV anytime against any of the stablecoins above.

It is an interest earning token.

But this is not all.

You can then take your $yCRV and go to yearn.finance and lock it in the $yCRV pool to earn ADDITIONAL rewards.

$CRV is Curve’s governance token which all liquidity providers receive.

Alternatively, you could lock your $yCRV in a Curve gauge yourself but iearn automates this process for you.

This is why the APY is so high.

The APY variable because it depends on many factors like the price of $CRV, the trading fees ..

This is just one Vault, there are many more and each has its own strategy.

$YFI is the governance token of the yearn protocol and it was distributed to early stakers over a 2 week time period.

30.000 $YFI 's went to the community of early stakers.

Although $YFI was presented as a “valueless token” by iearn’s founder @andrecronjetech its price is currently over $30.000.

The protocol levies a 5% withdrawal fee, every time a user withdraws from a vault, which is then used to buy $YFI on the market (similar to share buyback).

It’s truly amazing to see for example designers submit implementation-ready interfaces to improve the user experience of the protocol without being paid for it.

I'll turn this into a more comprehensive blog post on $YFI if there is demand

cryptotesters.com/blog/what-is-d…