#Statechains non-interactive novation👇

01/12

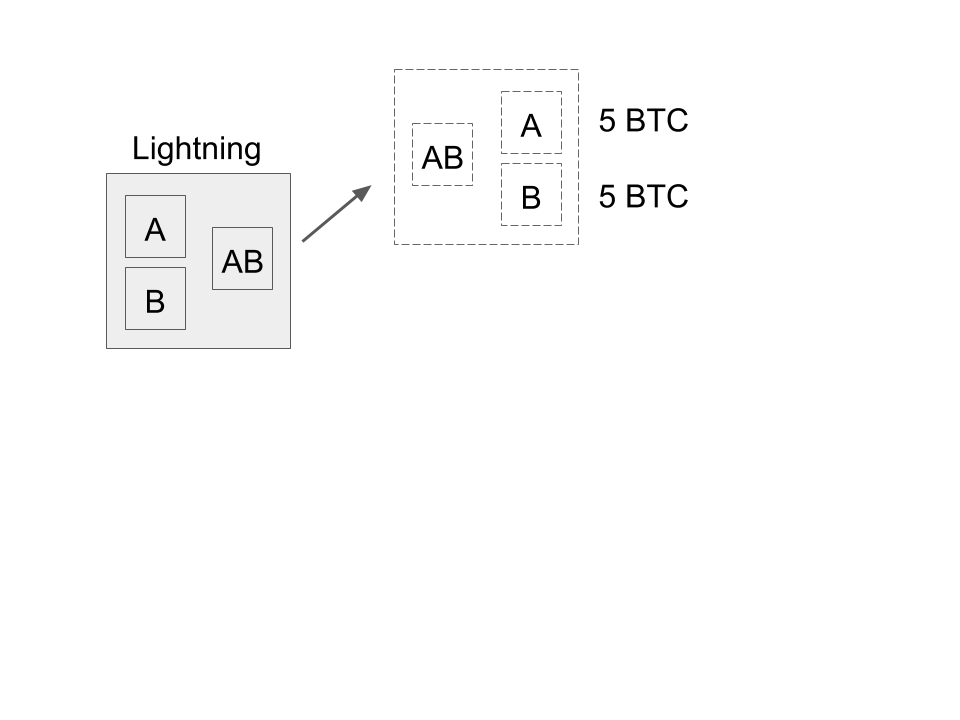

One aspect of #Bitcoin scaling is channels, e.g. 2-of-2 in Lightning or bigger groups in Lightning channel factories or payment pools.

The trade-off is that you can remain off-chain as long as you interact with the channel members.

01/12

One aspect of #Bitcoin scaling is channels, e.g. 2-of-2 in Lightning or bigger groups in Lightning channel factories or payment pools.

The trade-off is that you can remain off-chain as long as you interact with the channel members.

02/12

This interactivity is difficult to scale. If 1 person in a channel of 100 people goes offline, the only way to move your money is to go on-chain – quite the pickle!🥒

Luckily, #statechains provide a non-interactive way to swap out of a channel. No cooperation required!

This interactivity is difficult to scale. If 1 person in a channel of 100 people goes offline, the only way to move your money is to go on-chain – quite the pickle!🥒

Luckily, #statechains provide a non-interactive way to swap out of a channel. No cooperation required!

04/12

They update their balance (the bottom transaction replaces the top transaction).

Now Alice wants to leave the channel, but Bob happens to be offline. Can Alice swap places with Carol, without interacting with Bob?

They update their balance (the bottom transaction replaces the top transaction).

Now Alice wants to leave the channel, but Bob happens to be offline. Can Alice swap places with Carol, without interacting with Bob?

05/12

We can if Alice was using a statechain!

Everywhere where we once had key A, we now have key S (statechain) and T (transitory key, which is controlled by Alice).

Note: Bob cannot tell the difference between A and ST!

We can if Alice was using a statechain!

Everywhere where we once had key A, we now have key S (statechain) and T (transitory key, which is controlled by Alice).

Note: Bob cannot tell the difference between A and ST!

06/12

One more step is required in order to make this more secure. We want the final state to end with Alice being fully in control, so we add one more transaction.

This can be done without the help of Bob.

One more step is required in order to make this more secure. We want the final state to end with Alice being fully in control, so we add one more transaction.

This can be done without the help of Bob.

07/12

Now we can transfer the output to Carol as follows:

- Update the state so the money goes to Carol (see pic)

(Note: Carol has to check all previous states!)

- Give Carol control over the Statechain key (S)

- Hand the Transitory key (T) over to Carol

Bob was not involved!

Now we can transfer the output to Carol as follows:

- Update the state so the money goes to Carol (see pic)

(Note: Carol has to check all previous states!)

- Give Carol control over the Statechain key (S)

- Hand the Transitory key (T) over to Carol

Bob was not involved!

08/12

For a two-party channel this may not seem huge, but when you have many more users, this becomes increasingly important.

And this is particularly useful when we include channels for which interaction is generally not expected, such as bets! (e.g. Discreet Log Contracts)

For a two-party channel this may not seem huge, but when you have many more users, this becomes increasingly important.

And this is particularly useful when we include channels for which interaction is generally not expected, such as bets! (e.g. Discreet Log Contracts)

09/12

Imagine the following bet:

- Alice goes short BTC/USD with Bob

- Her position is worth $10k and resolves in 30 days

So 30 days from now Alice will receive $10k worth of BTC from Bob (If BTC went up, Bob profits, since he is long).

She essentially has a fiat position.

Imagine the following bet:

- Alice goes short BTC/USD with Bob

- Her position is worth $10k and resolves in 30 days

So 30 days from now Alice will receive $10k worth of BTC from Bob (If BTC went up, Bob profits, since he is long).

She essentially has a fiat position.

10/12

Using #statechains, Alice can sell part of her position (or everything) to Carol, without the help of Bob, while the bet is in progress.

Let's say Alice wants to give Carol $1k – Alice can non-interactively include Carol in the bet, and give her 10% of the bet outcome!

Using #statechains, Alice can sell part of her position (or everything) to Carol, without the help of Bob, while the bet is in progress.

Let's say Alice wants to give Carol $1k – Alice can non-interactively include Carol in the bet, and give her 10% of the bet outcome!

11/12

This type of non-interactive novation makes swapping derivative assets off-chain incredibly flexible.

You can do everything @BitMEX does, but entirely backed by off-chain Bitcoin contracts!

While the statechain and oracle are involved, neither will be aware of your bets.

This type of non-interactive novation makes swapping derivative assets off-chain incredibly flexible.

You can do everything @BitMEX does, but entirely backed by off-chain Bitcoin contracts!

While the statechain and oracle are involved, neither will be aware of your bets.

12/12

#Statechains does this and more.

Want more details? Watch my full recent talk below.

23m36s into the video I explain the points I made in this thread.

Enjoy!👇

#Statechains does this and more.

Want more details? Watch my full recent talk below.

23m36s into the video I explain the points I made in this thread.

Enjoy!👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh