#THREAD #RENTING Where should I rent a property? Shouod I rent a property? What should I consider when renting?

Well this is different for every person. Yes,you need safety,security, comfort and nayope.

But think about what you actually need.

Well this is different for every person. Yes,you need safety,security, comfort and nayope.

But think about what you actually need.

For example, don't rent a 12 bedroom home it a bachelor flat will do. Always live smaller and cheaper to what you gan do financially.

Rather invest that money and spend it later on important things like coffee.

Rather invest that money and spend it later on important things like coffee.

Rent payable is not everything. Weigh up money spent on commuting, lifestyle to eat your money (close restaurants, shebeens, schools, etc), security, pets, pests, drugdealers, perception, etc.

Rent where the rands reach a synergy on all factors above.

Rent where the rands reach a synergy on all factors above.

Security is important. I have a flat that is exceptionally safe, but it's not in the best suburb. I also know of places in the "best" subburb, that is very unsafe.

Ask questions.

Ask questions.

Don't move closer to work, unless you know for a fact you will continue to work there for the next 700 years. If they retrench you you're screwed!

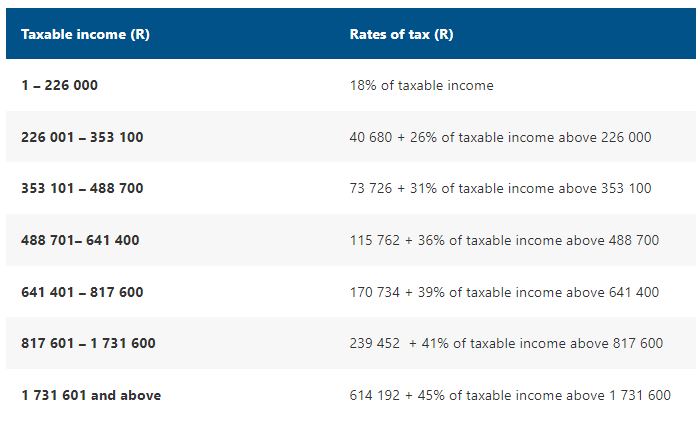

Weigh up renting and buying. Consider hidden buyers costs like bond/transfer costs, levies, nyaope, rates, taxes, maontenance, garden services, emergency levies, etc.

Could you save money renting?

Could you save money renting?

Lastly, consider how much time you'll spend at home. If you're a workaholic like me, note that you sleep there, and might spend all your free time cleaning the pool and washing dishes and paying for cleaning services etc etc.

• • •

Missing some Tweet in this thread? You can try to

force a refresh