@Chamath recently posted a great thread laying out the impact of the "risk-free rate" on public market valuations and investor behavior. It was, unsurprisingly, on point.

But what is the risk-free rate and how does it work?

Here's Risk-Free Rate 101!

👇👇👇

The risk-free rate of return is the (theoretical) rate of return of an investment with zero risk.

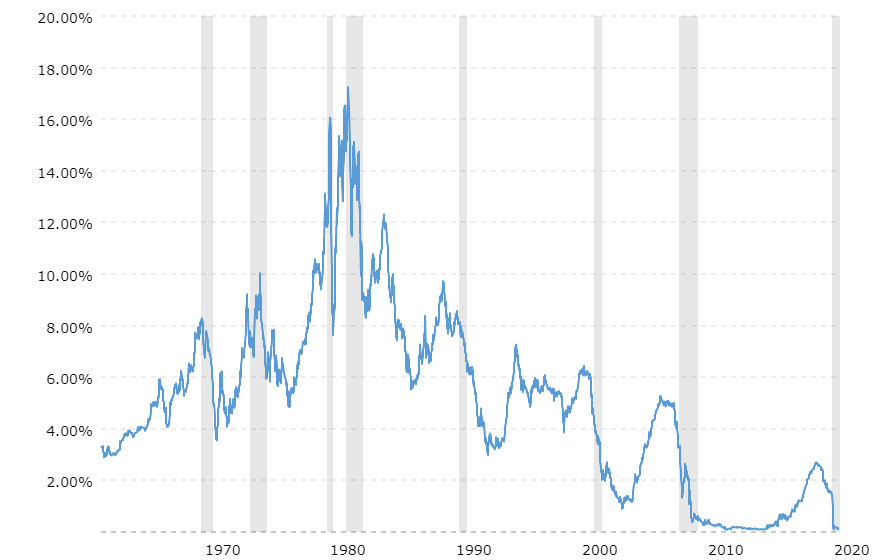

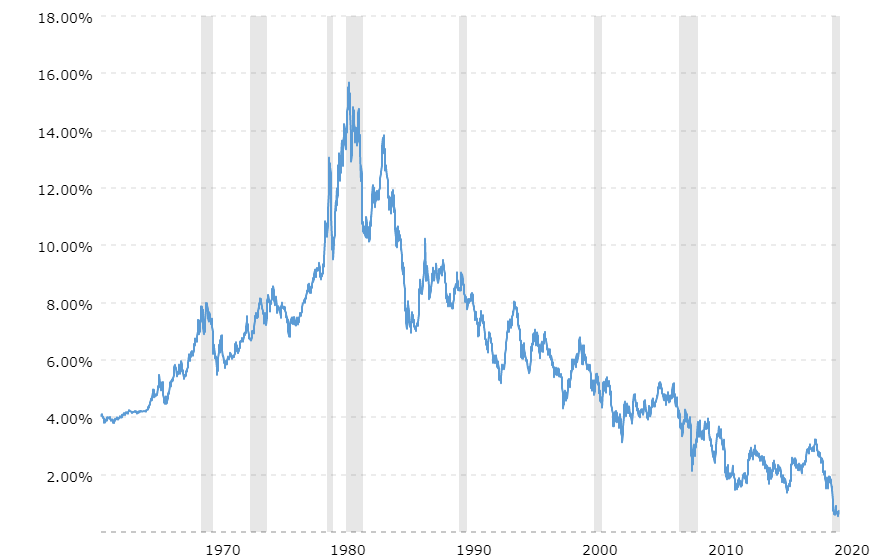

Typically, investors will look at a short-term US Treasury bill ("T-bill") discount rate or 10-year US government bond yield as the risk-free rate.

They are short-term and auctioned at a discount to par value. The investor is paid the par value at maturity.

They have no interest rate risk. The default risk of the US government is believed to be zero, hence its use for the risk-free rate.

The Capital Asset Pricing Model (CAPM), Black-Scholes model, and Modern Portfolio Theory (MPT) all use the risk-free rate.

But I'm more interested in practice than theory, so let's focus our energy there.

It's important because it establishes a baseline for the rate of return an investor would demand as they take incremental risk.

You would not take on a bunch of new risk to make 6% if you could get 6% in a T-bill or government bond!

These rates are essentially approaching zero. 0.13% on a 1-year T-bill and 0.72% on a 10-year government bond.

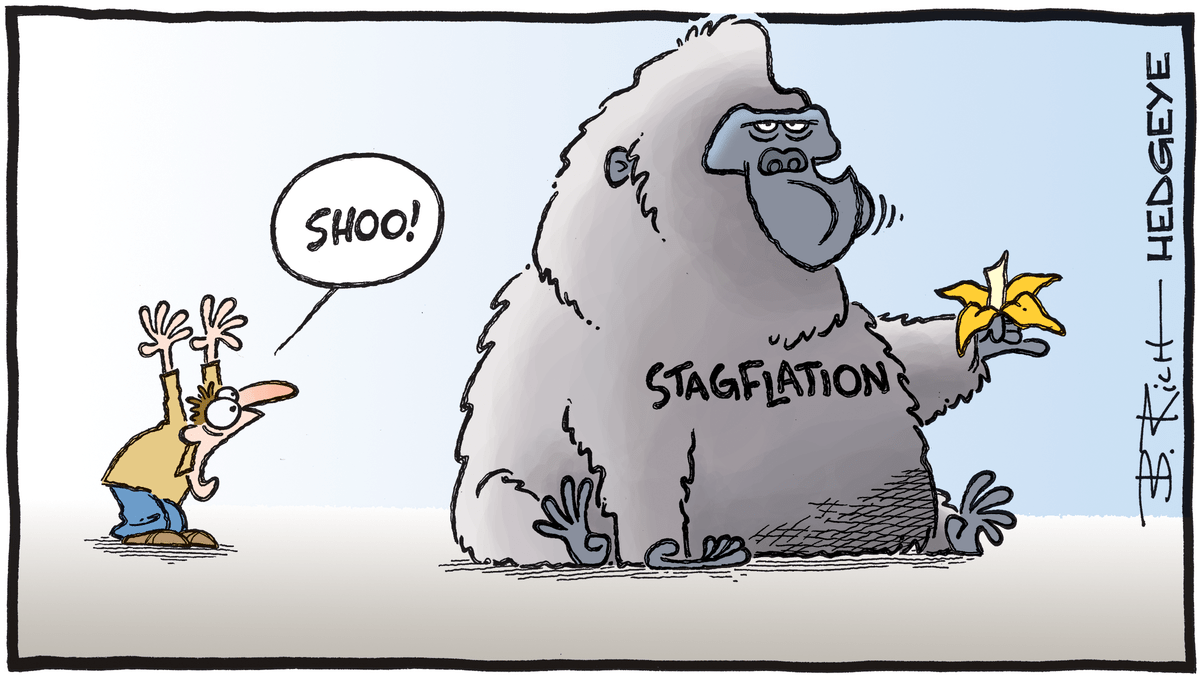

Real yields (nominal less inflation) are actually deeply-negative on the 10-yr.

This is where the TINA ("there is no alternative") mantra comes in.

The last option becomes more viable if it offers any potential return premium!

Other asset classes (precious metals, Bitcoin) do exist as options, though most traditional institutions remain slow-moving in that regard (at their own peril, if you ask me!).

There are also currency risks for foreign investors.

As @Chamath pointed out, when the dot-com bubble burst, the risk-free rate was at 6%+, which made the choice more difficult for investors.

Risk-free rates are essential for investors to determine the required return for taking on risk.

When investors compare potential equity returns against near zero risk-free rates, they may be inclined to look further out the risk spectrum for returns.

While there are a lot of complexities at play, these are the basics that are helpful to understand as a starting point.

Thanks to @Chamath for the inspiration. His thread can be found below.