Kenya borrowed Sh4.5 billion every 24 hours in the first three months of the Covid-19 pandemic, in a debt accumulation spree rarely witnessed in any East African country.

Backed by modelling simulations by @MOH_Kenya experts, who projected millions of corona infections, Kenya went all out to secure a financial war chest.

With a worst-case scenario of hundreds of thousands dead and millions affected by the end of the year, the @KeTreasury kept its foot firmly on the borrowing gas pedal - signing up for billions from global lenders, including the @WorldBank.

With the @MOH_Kenya as referee, the spending started with counties flooded with Covid-19 emergency funds.

But with the curve flattening way earlier than predicted at levels far lower than had been projected, the country is now emerging on the other end of the coronavirus crisis, counting the cost of the pandemic with a mountain of debt and millions of job losses.

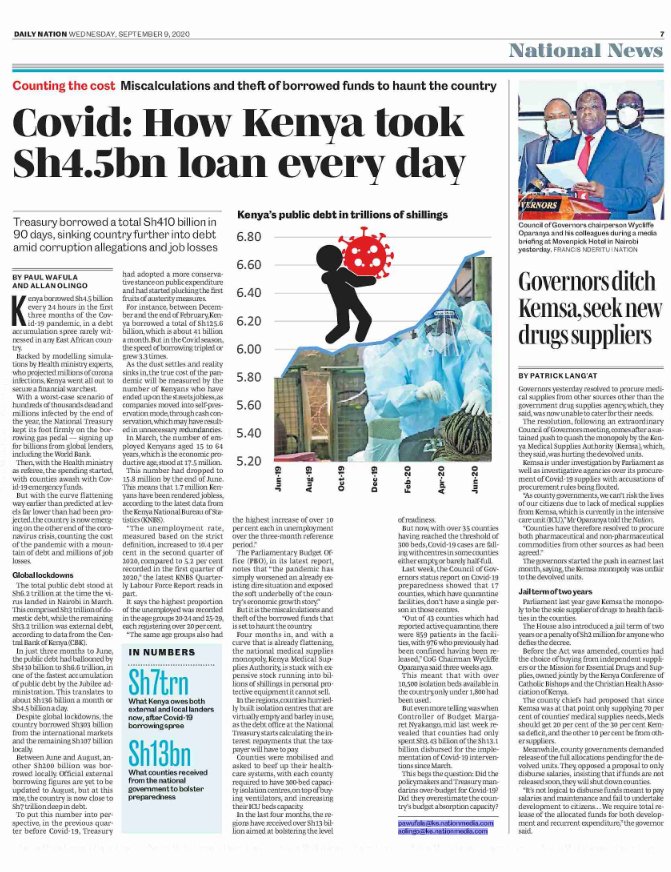

The total public debt stood at Sh6.2 trillion at the time the virus landed in Nairobi in March. This compromised Sh3 trillion of domestic debt, while the remaining 3.2 trillion was external debt, according to data from @CBKKenya .

In just three months to June, the public debt had ballooned by Sh410 billion to Sh6.6 trillion, in one of the fastest accumulation of public debt by the Jubilee administration. This translates to about Sh136 billion a month or Sh4.5 billion a day.

Despite global lockdowns, the country borrowed Sh303 billion from the international markets and the remaining Sh107 billion locally.

Between June and August, another Sh200 billion was borrowed locally. Official external borrowing figures are yet to be updated to August, but at this rate, the country is now close to Sh7 trillion deep in debt.

In the previous quarter before Covid-19, @KeTreasury had adopted a more conservative stance on public expenditure and had started plucking the first fruits of austerity measures.

Between December and the end of February, Kenya borrowed a total of Sh125.6 billion, which is about 41 billion a month. But in the Covid season, the speed of borrowing tripled or grew 3.3 times.

As the dust settles and reality sinks in, the true cost of the pandemic will be measured by the number of Kenyans who have ended up on the streets jobless, as companies moved into self preservation mode, through cash conservation, which may have led to unnecessary redundancies.

In March, the number of employed Kenyans aged 15 to 64 years, which is the economic productive age, stood at 17.5 million. This number has dropped to 15.8 million by the end of June.

This means that 1.7 million Kenyans have been rendered jobless, according to the latest data from the Kenya National Bureau of Statistics. (@KNBStats)

The highest proportion of the unemployed was recorded in the age groups 20-24 and 25-29, each registering over 20 per cent.

It's the miscalculations and theft of borrowed funds that is set to haunt the country.

Four months in, and with a curve that is already flattening, the national medical supply monopoly, @Kemsa_Kenya, is stuck with expensive stock running into billions of shillings in personal protective equipment it cannot sell.

In the regions, counties hurriedly built isolation centres that are virtually empty and barely in use, as the debt office at @KeTreasury starts calculating the interest repayments the taxpayer will have to pay.

In the last four months, regions have received over Sh13 billion aimed at bolstering the level of readiness.

• • •

Missing some Tweet in this thread? You can try to

force a refresh