Let me do a quick summary about yesterday's $GM / $NKLA announcement. This is related to the #Badger only. I will cover the class 7/8 trucks in a different /Thread

In my opinion, $GM is the big winner with a relatively low risk. They're getting a 11% stake in $NKLA currently worth a bit more than $2B. They can sell 33% of those shares in one year before Badger production starts and another 33% a year later.

$NKLA will have to pay $GM up to $700M of capital expenses to make available manufacturing capacity for up to 50k vehicles/yr. This requires an additional capital raise IMO as $NKLA will not have enough cash to pay for both their factory in Coolidge, AZ and the $GM capex.

$GM is going to manufacture the Badger and charges $NKLA based on a "cost-plus model". This means material cost, direct labor cost, and overhead costs plus a markup or in other words, $GM is going to make money on any Badger produced even though their capex is paid by $NKLA.

$NKLA on the other hand needs to establish a sales and service network or would have to find another partner that would handle that. Talking about vertical integration...

$GM will keep 80% of received regulatory credits for produced vehicles and has the exclusive right to supply $NKLA with batteries and fuel cells (except for Europe).

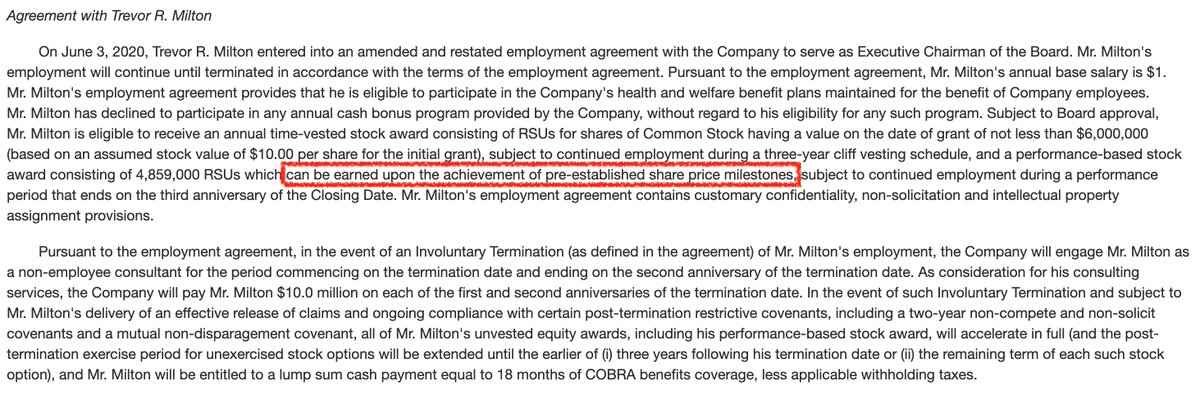

I honestly can't see how $NKLA will be able to sell the Badger at cost or even at a premium given those terms. As Trevor used to say, it's all marketing or in other words: "How to push the share price up!"

• • •

Missing some Tweet in this thread? You can try to

force a refresh