1/ $SUSHI Token Economics: The Impact of Inflation 🍣

Beyond the hype and FUD, what are the fundamentals behind the $SUSHI token's value?

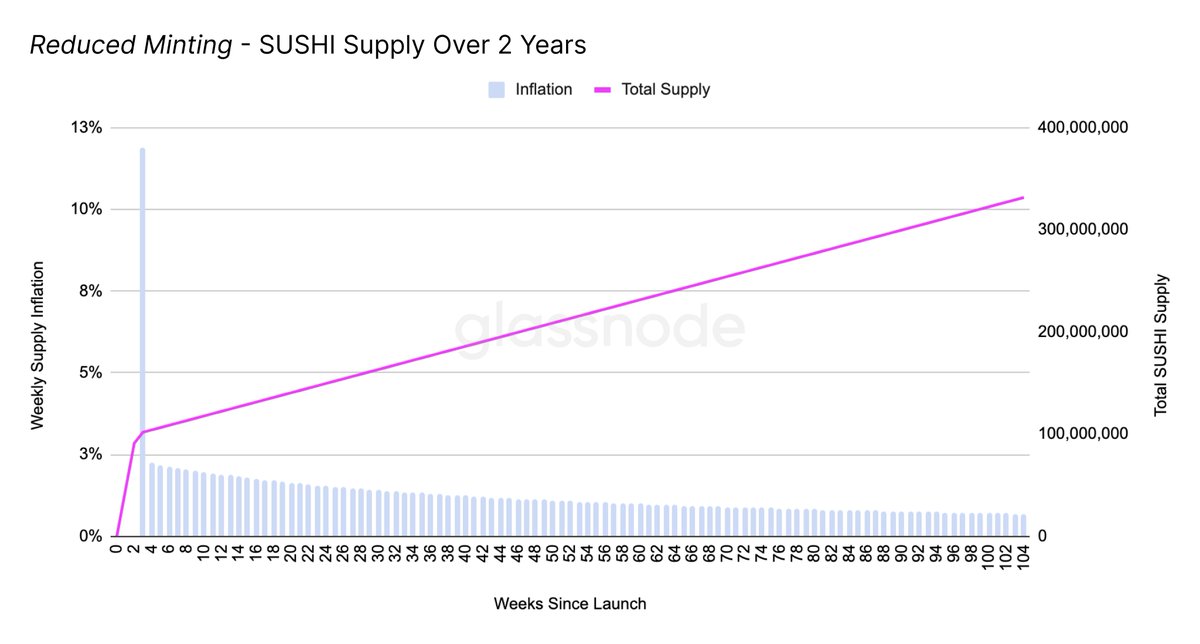

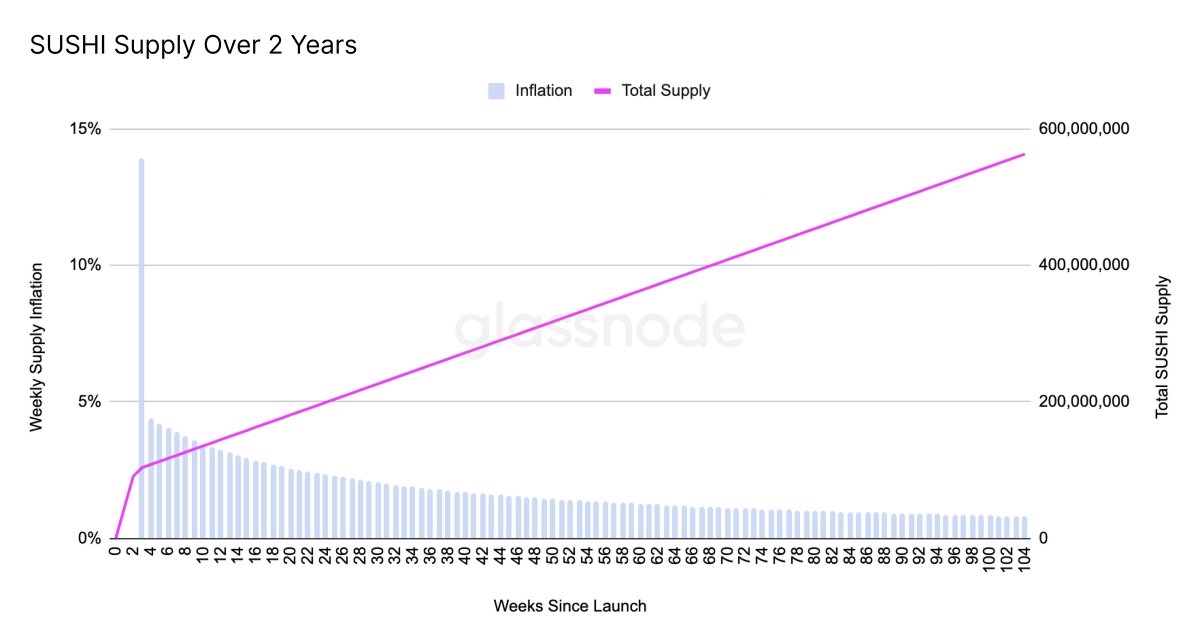

📈 Inflation: Two years from now, @SushiSwap's native token will have reached a supply of almost 600 million.

(data: @glassnode)

Beyond the hype and FUD, what are the fundamentals behind the $SUSHI token's value?

📈 Inflation: Two years from now, @SushiSwap's native token will have reached a supply of almost 600 million.

(data: @glassnode)

2/ Disclaimer: This analysis is not exhaustive & does not claim to predict the price of $SUSHI. It simply aims to provide a starting point to help investors develop their own informed opinion on SUSHI's value.

Read the article for full disclaimers 👇

insights.glassnode.com/sushi-token-ec…

Read the article for full disclaimers 👇

insights.glassnode.com/sushi-token-ec…

3/ Inflation: The SUSHI supply will inflate at a rate of 650,000 per day as the protocol mints more tokens. This newly minted SUSHI will be distributed to liquidity providers.

Once the @SushiSwap liquidity mining phase ends, the supply will more than double within 6 months.

Once the @SushiSwap liquidity mining phase ends, the supply will more than double within 6 months.

4/ Dilution: This minting mechanism incentivises SUSHI holders to become liquidity providers, because anyone holding $SUSHI without providing liquidity will be diluted.

This dilution will, in theory, drive the price down - unless demand matches the increase in supply.

This dilution will, in theory, drive the price down - unless demand matches the increase in supply.

5/ @SushiSwap does have a built-in demand generator: 0.05% of all trading volume will be used to buy back SUSHI from the market and distribute it to SUSHI holders.

For this demand to equal the amount of SUSHI minted, the ratio of price-to-trading-volume needs to be 1:1.3b

For this demand to equal the amount of SUSHI minted, the ratio of price-to-trading-volume needs to be 1:1.3b

6/ What this means: Assuming a daily volume of $400 million, for this built-in demand to equate to the 650,000 newly minted SUSHI, the price of SUSHI would need to be $0.31.

To support the current price of $2.69, daily trading volume would need to be $3.5 billion.

To support the current price of $2.69, daily trading volume would need to be $3.5 billion.

7/ Of course, this doesn't account for the token's governance value, nor for the fact that not all minted SUSHI will enter into circulation. It also doesn't factor in market sell- or buy-side demand.

But it does provide a starting point for understanding the impact of inflation.

But it does provide a starting point for understanding the impact of inflation.

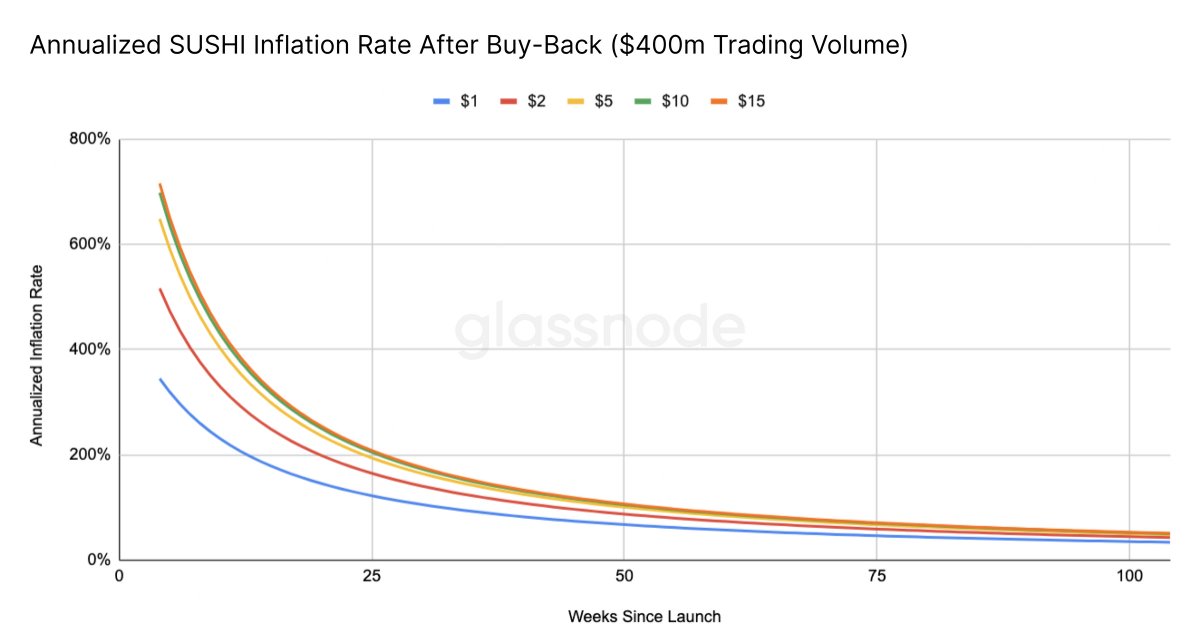

8/ Inflation rate: We can calculate the annualized inflation rate of SUSHI by subtracting the amount bought using the 0.05% fee from the amount minted.

Here we look at the annual inflation rate over time at different price points using the hypothetical $400m daily volume figure:

Here we look at the annual inflation rate over time at different price points using the hypothetical $400m daily volume figure:

9/ Especially in the first few months, the price of SUSHI will have a significant effect on the degree of inflation.

Investors should note that the inflationary impact of new SUSHI minted is disproportionately large in the earliest stages after the protocol is launched.

Investors should note that the inflationary impact of new SUSHI minted is disproportionately large in the earliest stages after the protocol is launched.

10/ As a result, unless trading volume grows extremely high or price dips below the "sustainable" point, the general rule to go by is this:

The potential for the price of SUSHI to rapidly decrease is highest right now.

The potential for the price of SUSHI to rapidly decrease is highest right now.

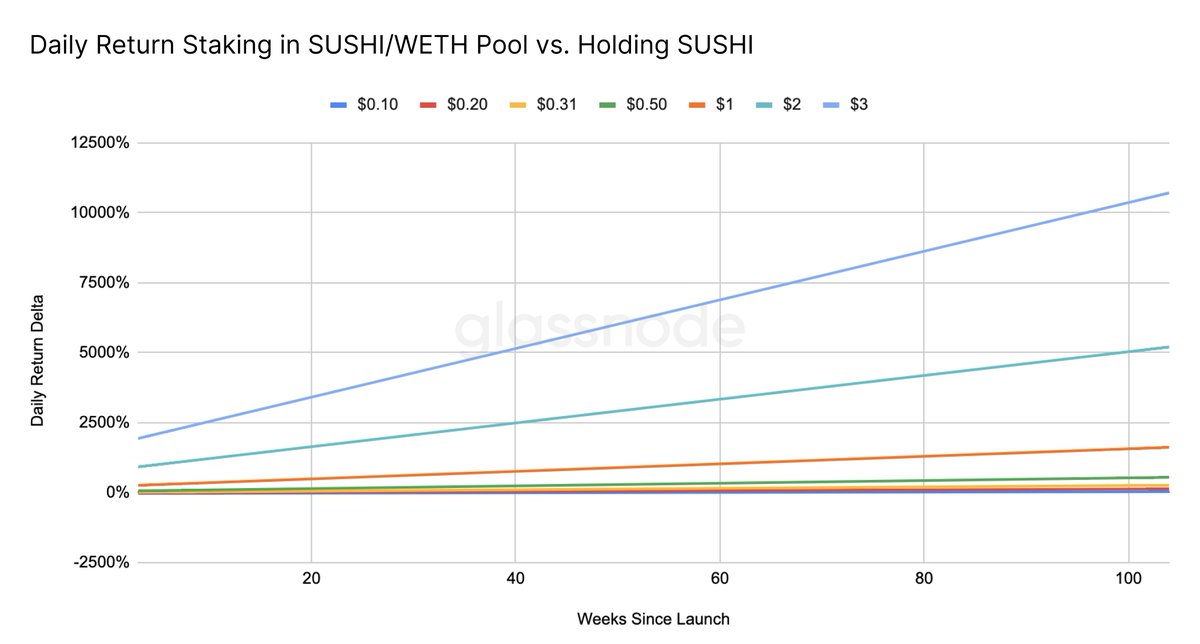

11/ 💰 Opportunity cost: The opportunity cost of holding SUSHI will also impact its value.

Depending on several variables, it will often be more profitable to sell half of one's SUSHI into ETH and become a liquidity provider, rather than holding the full value in SUSHI.

Depending on several variables, it will often be more profitable to sell half of one's SUSHI into ETH and become a liquidity provider, rather than holding the full value in SUSHI.

12/ Assuming that the SUSHI/WETH pool has a weight of 21% and liquidity & volume of $40m, we see a worrying reality:

It is almost always more profitable for an investor to sell half of their SUSHI to become an LP, rather than holding the full amount in SUSHI.

It is almost always more profitable for an investor to sell half of their SUSHI to become an LP, rather than holding the full amount in SUSHI.

13/ If the above assumptions (or similar) hold true, SUSHI holders will be able to make more money selling half of their SUSHI as opposed to holding it.

This will cause significant sell pressure, even if SUSHI stays at or below its "sustainable" price as determined by inflation.

This will cause significant sell pressure, even if SUSHI stays at or below its "sustainable" price as determined by inflation.

14/ This would increase the SUSHI/WETH pool's total liquidity.

But even at double the liquidity (i.e. $80m), becoming a SUSHI/WETH LP would still always be more profitable than holding SUSHI at any price over $0.48 - a price point which decreases continually as time goes on.

But even at double the liquidity (i.e. $80m), becoming a SUSHI/WETH LP would still always be more profitable than holding SUSHI at any price over $0.48 - a price point which decreases continually as time goes on.

15/ SUSHI's governance functionality will be important in counteracting these price-depressing factors.

Those who relinquish control of their SUSHI by selling some of it to become an LP risk being out-voted in governance proposals which impact their remaining SUSHI holdings.

Those who relinquish control of their SUSHI by selling some of it to become an LP risk being out-voted in governance proposals which impact their remaining SUSHI holdings.

16/ For example, a vote to reduce the pool weight of the SUSHI/WETH pair (i.e. the share of newly minted tokens allocated to that pool) would change the point at which it is more profitable to become an LP vs. holding SUSHI.

17/ Regardless, the combination of the @SushiSwap protocol's inflationary nature and the opportunity cost of holding $SUSHI tokens will likely cause the token price to drop until it reaches a sustainable level far lower than current market signals suggest.

18/ Alternative takes and additional factors I haven't considered would be much appreciated.

What do you think? Is there anything that could save $SUSHI from this downward spiral? 🍣📉🤔

Let me know your thoughts 👇

What do you think? Is there anything that could save $SUSHI from this downward spiral? 🍣📉🤔

Let me know your thoughts 👇

19/ I have updated these charts based on the new proposal to reduce the $SUSHI inflation rate.

https://twitter.com/liesleichholz/status/1303744972575961088

• • •

Missing some Tweet in this thread? You can try to

force a refresh