THREAD/

Good news: using a new(ish) measure of the labor share that Rognlie deems "the best measure," pay and productivity are growing together.

Bad news: there's a much bigger puzzle than supposed decline of the labor share

Good news: using a new(ish) measure of the labor share that Rognlie deems "the best measure," pay and productivity are growing together.

Bad news: there's a much bigger puzzle than supposed decline of the labor share

In an overlooked comment here ( mattrognlie.com/kn_comment_rog… ) Rognlie reviews common biases in measuring labor share and comes up with a preferred measure that addresses them: "the net labor share of domestic corporate factor income"

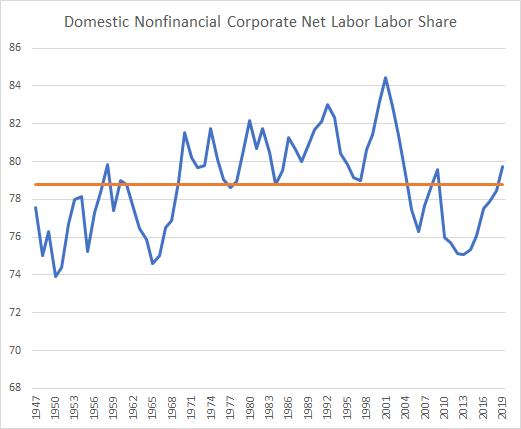

I take his definition and update it (using the nonfinancial corporate sector - more on that later). It has hovered between 74% and 84% since 1947 and now sits above historical average at 80%. In Rognlie's words "there is no postwar trend in the net corporate labor share"

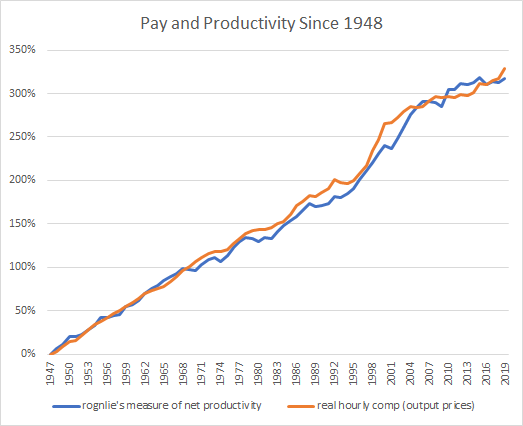

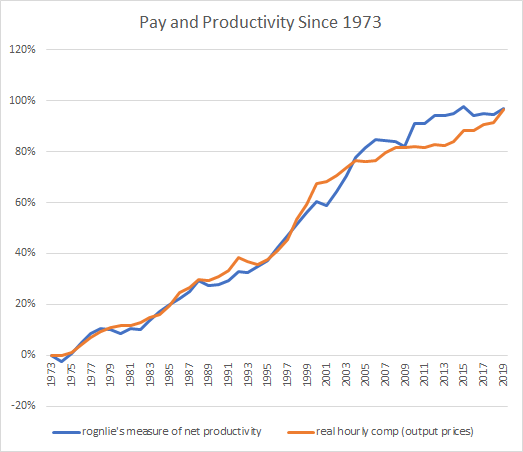

This matters b/c whether you use 1947 as a start date or 1973 (the supposed date of divergence) there's no decoupling of pay and productivity. I use the NFC sector rather than broader corp. sector because there's no hours worked series I can find for the former.

It is very good news that over long periods of time, businesses *on average* pay their workers an hourly wage that grows in line with their productivity (rendering the labor share roughly constant).

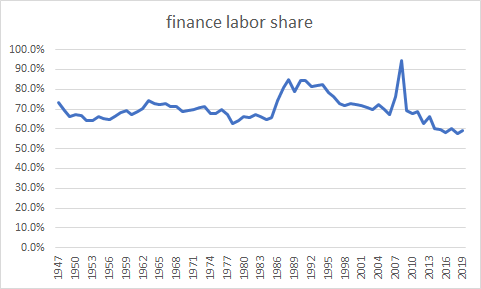

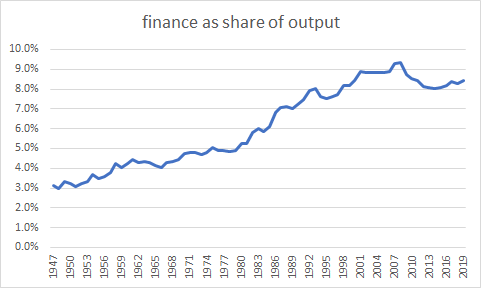

I will note an interesting wrinkle - the spread between the corporate and nonfinancial corporate sector caused by the financial sector. There's always been a spread in the capital shares across the two sectors but it started rising around 2014

The financial sector has been a drag on the broader labor share as its within industry labor share is below average, it has been heading down, all while finance is growing as a share of output

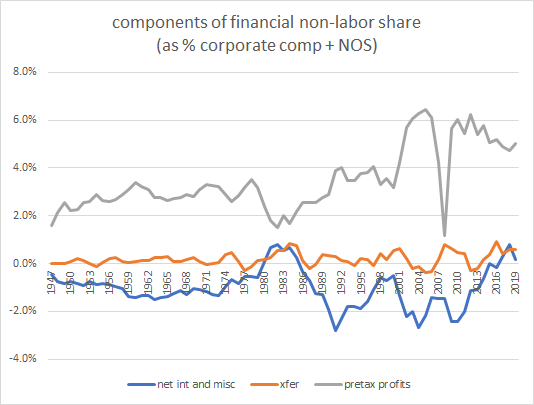

There is a post 2000 profits story but what's rising as of late is the net interest and miscellaneous category

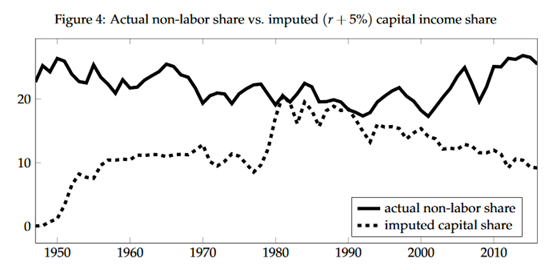

The bad news is that there's a bigger puzzle. The nonlabor share, what we think of as the capital share, doesn't follow the same trend as an imputed capital share (the real riskless rate plus an equity premium * ratio of capital to net income) under any set of reasonable assumpts

Nothing obvious jumps out at me when decomposing the non labor share though the rise of "net interest and misc." category is interesting in light of Karabarbounis & Neiman's work on the rise of factorless income

The silver lining of this, and part of what makes it so interesting, is that it casts doubt on the market power / rents argument that is in vogue. The market concentration --> rents pattern doesn't fit the data well. See highlights of Rognlie below

Also see here. We can't infer that the gap between the non-labor share and the imputed capital share is rents... in his words "this is not a story that stands up to scrutiny"

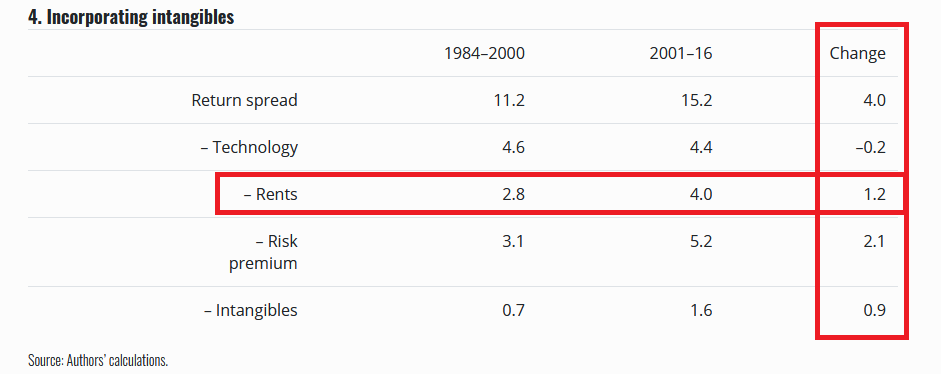

Some of the most important work being done in this space finds a role for market power but also downplays its effect. For example, research by Fahri (RIP) & @FrancoisGourio

In other words, an elevated risk premium seems to be keeping the private return on capital high

Paper here:

chicagofed.org/publications/c…

Paper here:

chicagofed.org/publications/c…

• • •

Missing some Tweet in this thread? You can try to

force a refresh