We recently revealed Masayoshi Son's SoftBank as the "Nasdaq Whale" that created a splash in the US options market, and contributed to the summer stock market melt-up. But there are millions of "Mini Masas" that in aggregate likely dwarf its impact. ft.com/content/b330e0…

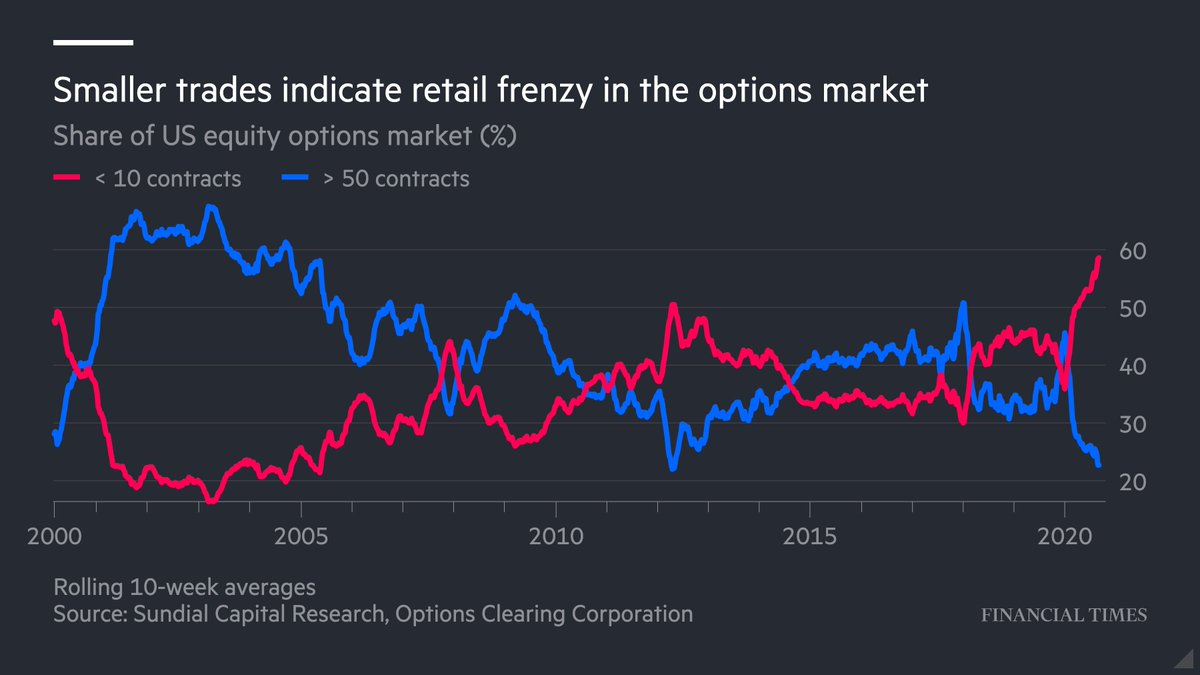

As the previous chart shows (a massive thanks to @jasongoepfert for the data), the volume of call premiums being traded in small retail-sized lots (10 contracts or less) has gone absolutely PARABOLIC lately.

@jasongoepfert Here is the share of small US equity options lots as a % of the whole market. Absolutely wild.

@jasongoepfert Importantly, retail traders tend to trade shorter-dated options than institutions like SoftBank. Options with maturities of under 10 days now account for about half of all options. One-day options account for roughly a quarter!

This matters because shorter-dated options - especially ones with strikes close to the current price - are more sensitive to price fluctuations. That means dealers have to hedge far more aggressively, and helps explain why rampant call-buying -> stock melt-up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh