New From Us: Nikola—How to Parlay An Ocean of Lies Into a Partnership With the Largest Auto OEM in America

hindenburgresearch.com/nikola $NKLA

(1/x)

hindenburgresearch.com/nikola $NKLA

(1/x)

Today, we reveal why we believe $NKLA is an intricate fraud built on dozens of lies over the course of its Founder and Executive Chairman Trevor Milton’s career.

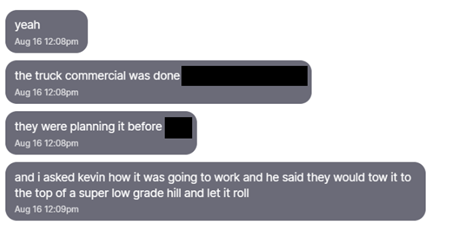

We have gathered extensive evidence—including recorded phone calls, text messages, private emails and behind-the-scenes photographs—detailing dozens of false statements by $NKLA Founder Trevor Milton. We have never seen this level of deception at a public company.

Trevor, has managed to parlay these false statements made over the course of a decade into a ~$20 billion public company.

He has inked partnerships with some of the top auto companies in the world, all desperate to catch up to Tesla and harness the EV wave. $NKLA

He has inked partnerships with some of the top auto companies in the world, all desperate to catch up to Tesla and harness the EV wave. $NKLA

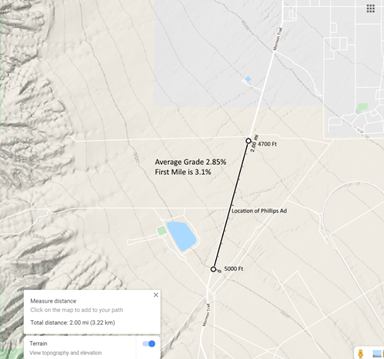

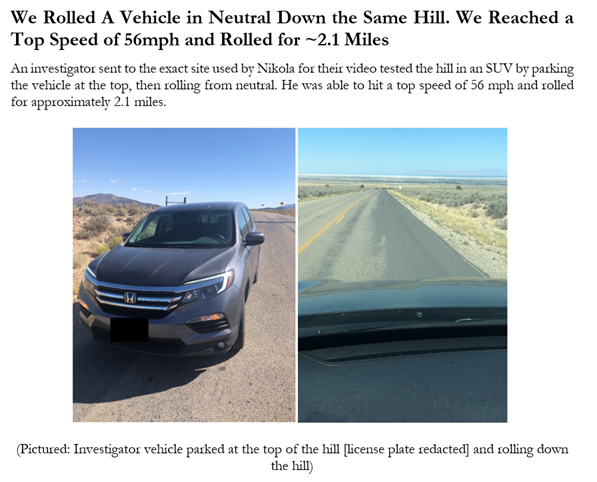

We reveal how, in the face of growing skepticism over the functionality of its truck, $NKLA staged a video called “Nikola One in Motion” which showed the Nikola One semi cruising on a road at a high rate of speed.

Our investigation of the site and text messages from a former employee reveal that the video was an elaborate ruse— $NKLA had the truck towed to the top of a hill on a remote stretch of road and simply filmed it rolling down the hill.

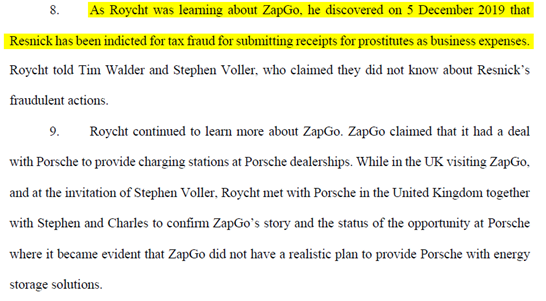

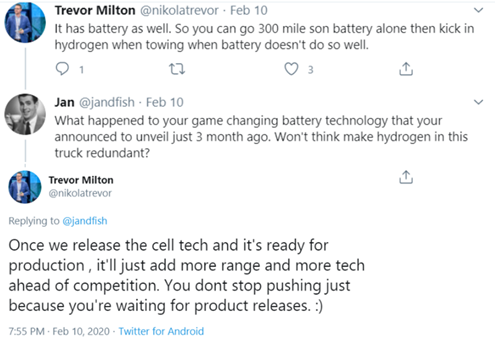

In Oct. $NKLA announced it would revolutionize the battery industry. We learned this was to be through an acquisition of a company called ZapGo, but that fell through when $NKLA realized (a) the tech was vaporware...

....and (b) the President of the battery company was indicted months earlier over allegations that he conned NASA by using his expense account to procure numerous prostitutes.

$NKLA has never walked back claims relating to its battery tech. Instead, Milton continued to publicly hype the tech even after becoming aware of the above issues. The revolutionary battery tech never existed – now, Nikola plans to use GM’s battery technology instead.

In addition to using GM’s battery tech, $NKLA's new partnership w $GM seeks to leverage GMs production & fuel cells. Nikola seems to be bringing nothing but concept designs, their brand & up to $700M they will be paying GM for capex related to production.

Cheap hydrogen is key to $NKLA's success. Trevor claimed in a presentation to hundreds of people and in multiple interviews to have succeeded at cutting the cost of hydrogen by ~81% compared to peers and to already be producing hydrogen.

When later pressed by a reporter, Trevor admitted $NKLA has not produced hydrogen at this price or at any price.

linkedin.com/pulse/intervie…

linkedin.com/pulse/intervie…

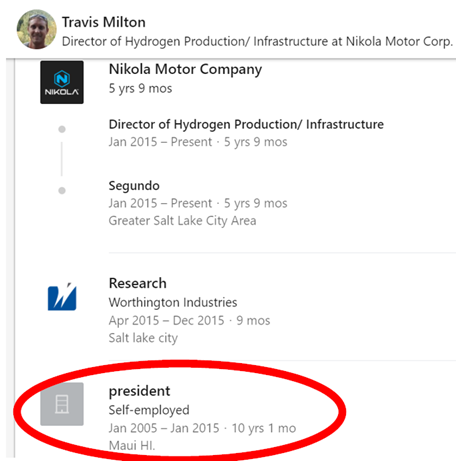

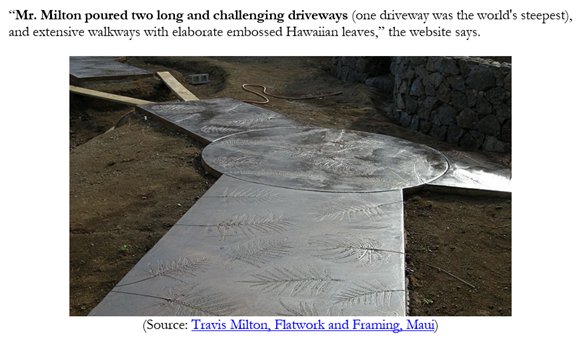

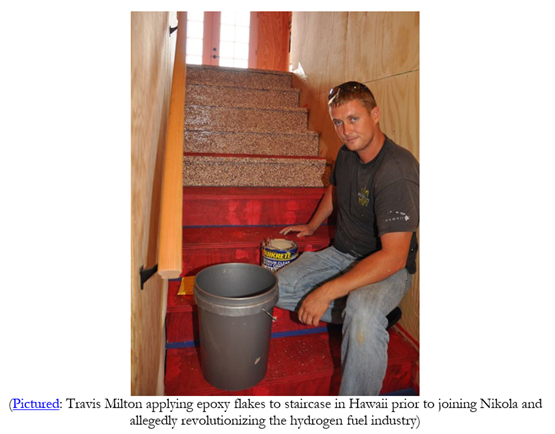

Trevor appointed his brother, Travis, as “Director of Hydrogen Production/Infrastructure” to oversee this critical part of the business. Travis’s prior experience appears to have largely consisted of pouring concrete driveways and doing subcontractor work in Hawaii. $NKLA

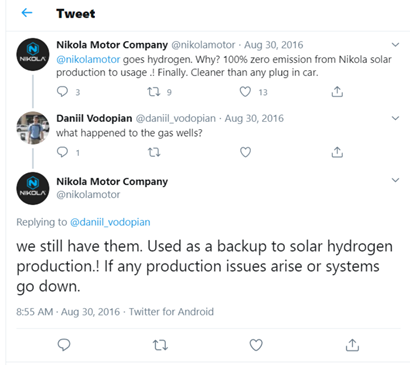

Claims of owning energy producing assets is not new for $NKLA.

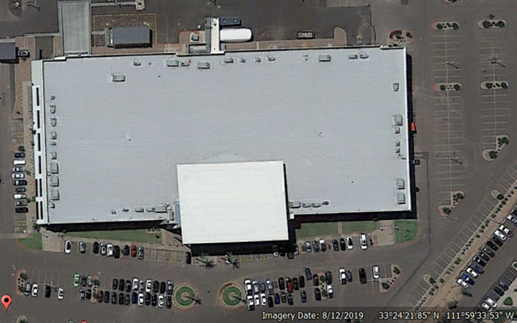

Trevor claimed $NKLA’s HQ has 3.5 megawatts of solar panels on its roof producing energy. Aerial photos and later media reports show they don’t exist.

Trevor claimed $NKLA’s HQ has 3.5 megawatts of solar panels on its roof producing energy. Aerial photos and later media reports show they don’t exist.

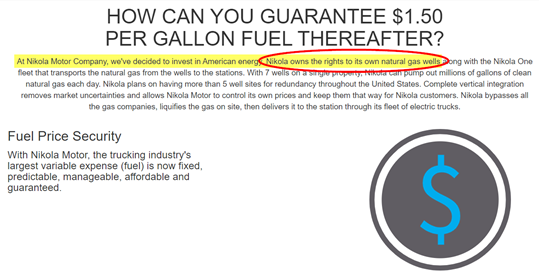

At one point $NKLA even claimed to own natural gas wells. There is no evidence in company filings that these ever existed.

web.archive.org/web/2016070121…

web.archive.org/web/2016070121…

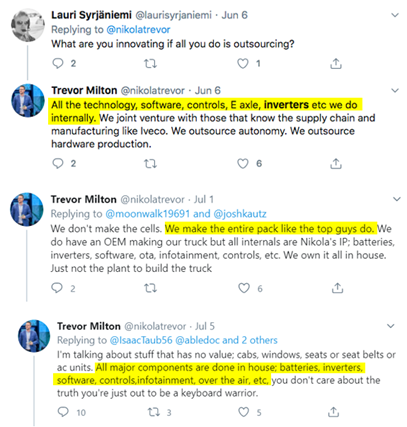

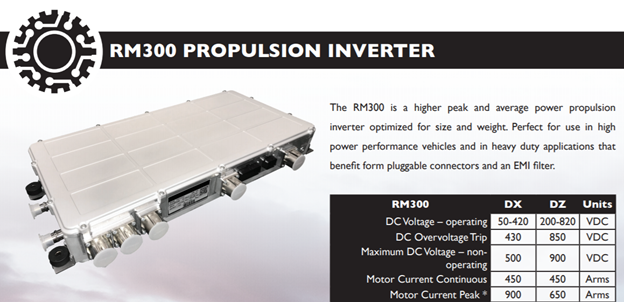

Trevor claims $NKLA designs all key components in-house, but they appear to simply be buying or licensing them from third-parties. One example is $NKLA’s claims about developing in-house inverters, a key truck component.

We found that $NKLA actually buys inverters off the shelf from a small company in Portland called Cascadia.

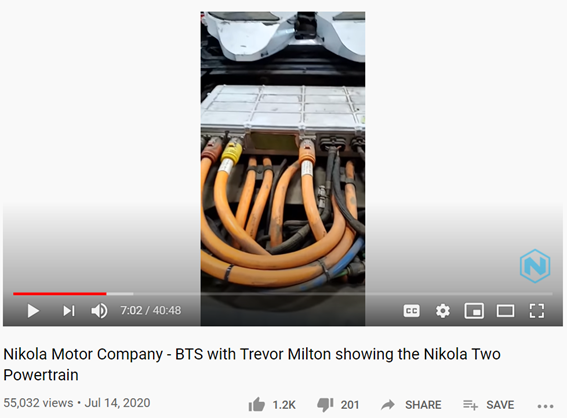

In the video showing off its “in-house” inverters, at the 7:02 mark we see a small piece of green masking tape on the inverter.

In the video showing off its “in-house” inverters, at the 7:02 mark we see a small piece of green masking tape on the inverter.

The masking tape covers the inverter’s label, which would have made it clear who actually developed the component.

We asked Cascadia whether the part was custom-built or open to the public, and they confirmed it is generally available.

We asked Cascadia whether the part was custom-built or open to the public, and they confirmed it is generally available.

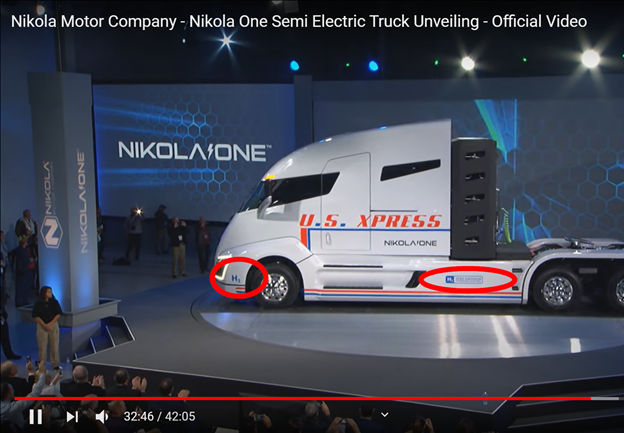

The $NKLA One “reveal” was a total farce. We corroborate Bloomberg’s prior work debunking Milton’s claims that “this thing fully functions and works…this is a real truck” and provide new evidence.

We present behind-the-scenes photos showing that $NKLA had an electricity cable snaked up from underneath the stage into the truck in order to falsely claim the Nikola One’s electrical systems functioned.

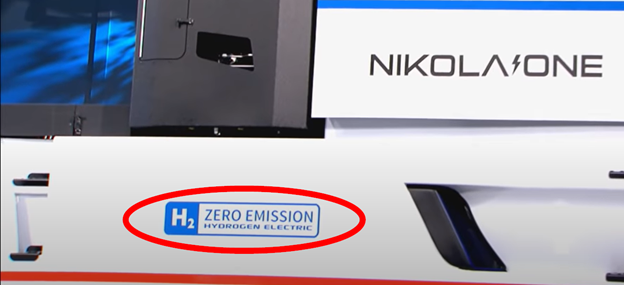

We learned through emails and interviews with former partners that Milton had an artist stencil “H2” and “Zero Emission Hydrogen Electric” on the side of the $NKLA One despite it having no hydrogen capabilities whatsoever; it was built with natural gas components.

We also present evidence that subsequent “reveals” were fictitious. In 2019, $NKLA revealed a “next generation” version of its off-road vehicle. It was scrapped within weeks due to manufacturing challenges. The redesign work was then quietly outsourced.

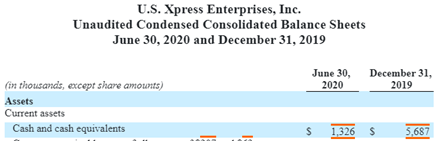

$NKLA's much touted multi-billion order book strikes us as more hot air. U.S. Xpress reportedly accounts for a third of its reservations, representing ~$3.5 billion in orders. U.S. Xpress had only $1.3 million in cash on hand last quarter.

We also do a deep dive on Trevor’s history. His first big success was an ~$20 million exit to Worthington.

A recorded conversation with a former employee shows how Trevor concealed potentially fatal product issues to close the deal.

A recorded conversation with a former employee shows how Trevor concealed potentially fatal product issues to close the deal.

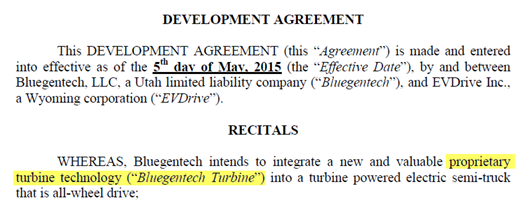

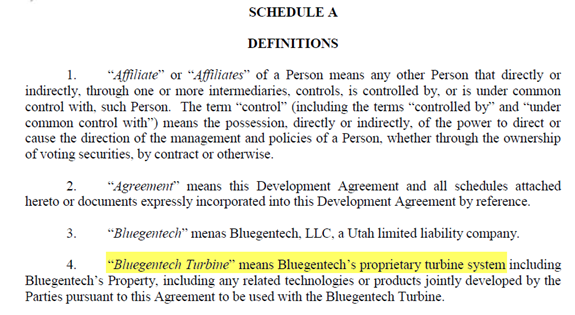

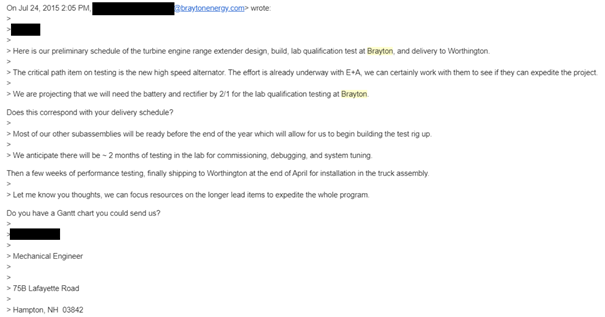

We show with email proof how Trevor claimed to have extensive proprietary turbine technology in a legally binding contract, then simply bought it later from a company that actually made the component.

(Note: Bluegentech was $NKLA’s prior co. name)

(Note: Bluegentech was $NKLA’s prior co. name)

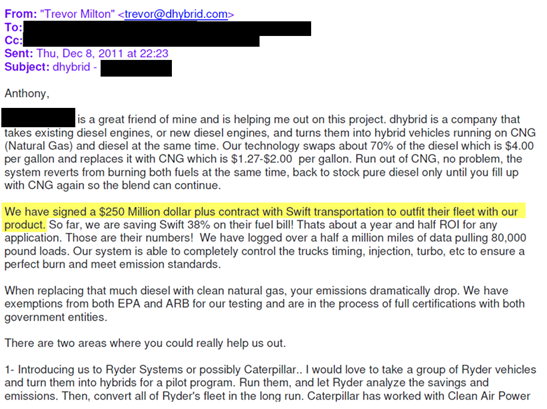

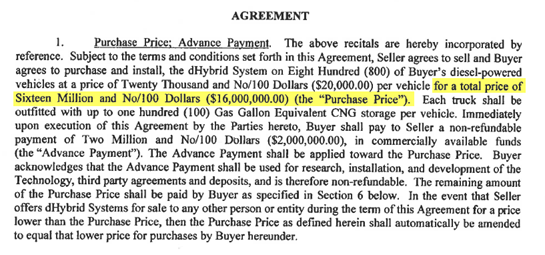

We show how in a previous venture Trevor falsely claimed a $16m contract was actually $250-$300m in order to lure in new investors.

We have both email evidence and the contract itself.

We have both email evidence and the contract itself.

$NKLA partners have been cashing out aggressively. Worthington, Bosch & ValueAct have all sold shares. Worthington sold $237m shares over a 2-day span in July & $250m in Aug. We think they know exactly what type of company $NKLA is and we expect key holders will continue to exit.

We think Trevor, through dozens of outright lies, was able to form partnerships with some of the largest legacy auto companies in the world in their desperation to catch up to Tesla’s EV leadership status. These partners did not do their homework. $NKLA

hindenburgresearch.com/nikola

hindenburgresearch.com/nikola

• • •

Missing some Tweet in this thread? You can try to

force a refresh