Franklin Templeton (FT) Update:

Lot of investors keep messaging me asking abt

a) Status of Court Hearing

b) Status of the 6 schemes that are being wound down

c) Four schemes being +ve. What does it mean?

So am starting this thread, which I will keep updating regularly

(1/n)

Lot of investors keep messaging me asking abt

a) Status of Court Hearing

b) Status of the 6 schemes that are being wound down

c) Four schemes being +ve. What does it mean?

So am starting this thread, which I will keep updating regularly

(1/n)

First : What is status of Court Hearings?

Court hearings are proceeding on a daily basis

Latest update is SEBI has agreed to give the court

a) Copy of Forensic report done of FT

b) Response of FT on this report

SEBI wants this to be confidential report. Court will decide

(2/n)

Court hearings are proceeding on a daily basis

Latest update is SEBI has agreed to give the court

a) Copy of Forensic report done of FT

b) Response of FT on this report

SEBI wants this to be confidential report. Court will decide

(2/n)

Court Update:

All parties except FT have completed their first set of arguments and responses. FT will give their responses also soon to the Court

With daily hearings, we do expect that by end of Sept or early Oct, there will be a conclusive decision for investors

(3/n)

All parties except FT have completed their first set of arguments and responses. FT will give their responses also soon to the Court

With daily hearings, we do expect that by end of Sept or early Oct, there will be a conclusive decision for investors

(3/n)

Q; What is meaning of 4 schemes have turned +ve. Isn't that a great thing?

Ans:

a) Schemes turning +ve means that FT has repaid borrowings in the scheme

b) All schemes, usually always are +ve. Borrowing is always a temporary measure

So it is return to normal, not great!

(4/n)

Ans:

a) Schemes turning +ve means that FT has repaid borrowings in the scheme

b) All schemes, usually always are +ve. Borrowing is always a temporary measure

So it is return to normal, not great!

(4/n)

Q: But there are so much cash inflows in the schemes - some thousands of crores? Isn't that great?

Ans:

a) These are normal maturities that were due

b) That money coming is as expected and would have come even if schemes were not wound up.

It is again normal, not great

(5/n)

Ans:

a) These are normal maturities that were due

b) That money coming is as expected and would have come even if schemes were not wound up.

It is again normal, not great

(5/n)

Q: C'mon, you are underplaying this great achievement of money being returned to FT?

Ans: No.

If you were to track any other scheme - of any other MF - especially Ultra Short of any other MF, you will see similar or better inflows

Seriously, this is just normal

(6/n)

Ans: No.

If you were to track any other scheme - of any other MF - especially Ultra Short of any other MF, you will see similar or better inflows

Seriously, this is just normal

(6/n)

Q: But why are these cash inflows not being returned to investors?

Ans: FT has taken a view that they need a unitholder vote to return these monies. They are hence holding it on ur behalf

They shud have clarified with SEBI/Court and pronto returned this to investors

(7/n)

Ans: FT has taken a view that they need a unitholder vote to return these monies. They are hence holding it on ur behalf

They shud have clarified with SEBI/Court and pronto returned this to investors

(7/n)

Q: Are the schemes listed as per the directive of SEBI?

Ans: FT is working on it for the last few months to comply with the listing of the schemes.

Hopefully they will be able to complete it before the court hearing ends

(8/n)

Ans: FT is working on it for the last few months to comply with the listing of the schemes.

Hopefully they will be able to complete it before the court hearing ends

(8/n)

Q: Wait, u said they are not returning money, but I did get some money of Vod?

Ans: It is a peculiar set of regulations and I will try to explain here

a) There is a main scheme and a segregated portfolio

b) Both Main Scheme + Segregated portfolio are under winding up

(9/n)

Ans: It is a peculiar set of regulations and I will try to explain here

a) There is a main scheme and a segregated portfolio

b) Both Main Scheme + Segregated portfolio are under winding up

(9/n)

c) Segregated portfolio - though under winding up - can pay money to u. Doesn't need any unitholder vote

d) Main scheme - is now become fully similar to segregated portfolio i.e. it cannot do any purchases or redemptions

But Main scheme cannot pay back money to u

(10/n)

d) Main scheme - is now become fully similar to segregated portfolio i.e. it cannot do any purchases or redemptions

But Main scheme cannot pay back money to u

(10/n)

It's an anomaly of regulations or an incorrect interpretation of regulations

That under similar circumstances - main scheme is constricted to pay money back but segregated portfolio (which is also under winding up) is paying money back

Court will decide on it soon!

(11/n)

That under similar circumstances - main scheme is constricted to pay money back but segregated portfolio (which is also under winding up) is paying money back

Court will decide on it soon!

(11/n)

I will keep updating this thread as and when there are material developments

If u have any Qs, pls feel free to keep asking here in the thread and I will try to answer

*** End ***

(12/n)

If u have any Qs, pls feel free to keep asking here in the thread and I will try to answer

*** End ***

(12/n)

Continuing Franklin Templeton Update @ 19Sept2020

a) Court Hearing continues on daily basis

b) Today i.e. 19th Sept, Court will hear FT arguments for entire day

c) It is an irony the way things are shaping. It is investors money at stake, and everything else is a secret

(1/n)

a) Court Hearing continues on daily basis

b) Today i.e. 19th Sept, Court will hear FT arguments for entire day

c) It is an irony the way things are shaping. It is investors money at stake, and everything else is a secret

(1/n)

So what all are secrets that cannot be disclosed?

a) SEBI says forensic audit - which should highlight if FT followed all regs while managing ur money. It is a secret document

b) Response of FT to above report about their stance- Is a secret document

(2/n)

a) SEBI says forensic audit - which should highlight if FT followed all regs while managing ur money. It is a secret document

b) Response of FT to above report about their stance- Is a secret document

(2/n)

Harish Salve representing FT says

c) Minutes of the Trustees meeting, which decided on the winding up of 6 schemes affecting 3 lac investors - It is also a secret document

These docs will only be shared in a sealed envelope to the Court with a request to not share it

(3/n)

c) Minutes of the Trustees meeting, which decided on the winding up of 6 schemes affecting 3 lac investors - It is also a secret document

These docs will only be shared in a sealed envelope to the Court with a request to not share it

(3/n)

So effectively

FT Trustees minutes of meeting which wound up 6 schemes - which should be a transparent document to all investors - as it impacts each of them.... cannot be shared with investors

Don't Trustees represent investors?

Hope Court makes all this public

*** End ***

FT Trustees minutes of meeting which wound up 6 schemes - which should be a transparent document to all investors - as it impacts each of them.... cannot be shared with investors

Don't Trustees represent investors?

Hope Court makes all this public

*** End ***

Franklin Templeton Update - 25th Sept 2020

a) Arguments from all parties have been completed

b) Court has gone thru the "secret" audit report and "secret" Trustee minutes

c) There will be no further hearings as it is completed

d) Court will now soon give it's judgement

(1/n)

a) Arguments from all parties have been completed

b) Court has gone thru the "secret" audit report and "secret" Trustee minutes

c) There will be no further hearings as it is completed

d) Court will now soon give it's judgement

(1/n)

In essence to summarise, in a single line, what everyone has argued

1. FT - We have followed all SEBI regulations

2. Petitioners - FT has violated the trust of investors and regulations

3. SEBI - We are clueless! But we have got audit done

(2/n)

1. FT - We have followed all SEBI regulations

2. Petitioners - FT has violated the trust of investors and regulations

3. SEBI - We are clueless! But we have got audit done

(2/n)

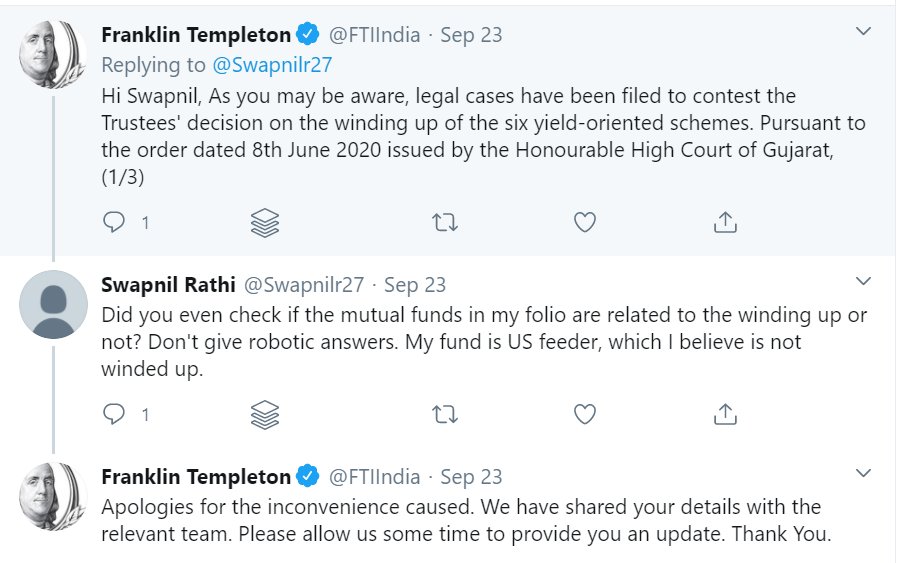

To digress, this is a real story, which will demonstrate how everyone is confused

Investor to FT: I redeemed? Not got redemption When will u pay

FT: We can't pay. Court has restrained us

Investor: Dude, I redeemed from your US fund? Is that also wound up?

FT: Oh!

(3/n)

Investor to FT: I redeemed? Not got redemption When will u pay

FT: We can't pay. Court has restrained us

Investor: Dude, I redeemed from your US fund? Is that also wound up?

FT: Oh!

(3/n)

Some analysts had tried to mislead u with following arguments

a) If u go to Court, the case will go on for years

b) Your money will be stuck forever

c) Courts will drag the cases forever

d) Indian judicial system does not work

Hope this tells u how u were being misled

(4/n)

a) If u go to Court, the case will go on for years

b) Your money will be stuck forever

c) Courts will drag the cases forever

d) Indian judicial system does not work

Hope this tells u how u were being misled

(4/n)

So what can you expect from the Court judgement

1. Remember, Courts will not make new laws

2. Court will direct SEBI with a clear direction

3. Put a time-frame to get ur money

4. SEBI will have to then act in favor of investors

Expect judgement in the next week

** End **

(5/5)

1. Remember, Courts will not make new laws

2. Court will direct SEBI with a clear direction

3. Put a time-frame to get ur money

4. SEBI will have to then act in favor of investors

Expect judgement in the next week

** End **

(5/5)

• • •

Missing some Tweet in this thread? You can try to

force a refresh