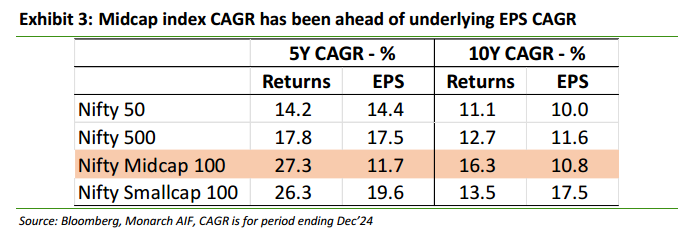

A quick take on new #SEBI Norms. 1/NLike it was mentioned yesterday - Lot of things can happen. 1) A Multi-Cap Fund may merge itself with a Large & Midcap Fund or any other category. 2) Outflows from Multi-Cap Funds to #LargeCaps which reduces the theoretical buying in #smallcaps

2/N 3) Close the Fund which may not be viable. Nobody likes losing AUM. 4) Another creative Solution or Loop. The Fact is #Smallcaps cannot digest 5000 Cr of Liquidity Gush, forget about 27000 cr. But all the solutions will lead to AUM leakage which AMCs may not like !!

N/N The LargeCap Polarization got accelerated by the categorization of Stocks by SEBI. Now that stance is shifting and that is where a lot of MFs will slowly start re-aligning to Smallcaps selectively. Bottomline -Do not go rush buy or sell stocks coz of the Circular!

Will maybe write a long post or a video in coming days after doing a little more work. One big shift I see - going forward the case for Direct Equity Investing gets a Big Push! Easy Acces to Trading, 25% is Mobile Trading, etc - more on that soon.

• • •

Missing some Tweet in this thread? You can try to

force a refresh