1/Respectfully disagree with much of the argument in op-ed by @S_HastingsSimon, @EdWhittingham, @DKeithClimate.

Key objection: the oil sands are more competitive than they suggest. Producers' own modelling, opex data, shows this.

#ABleg #OOT

theglobeandmail.com/opinion/articl…

Key objection: the oil sands are more competitive than they suggest. Producers' own modelling, opex data, shows this.

#ABleg #OOT

theglobeandmail.com/opinion/articl…

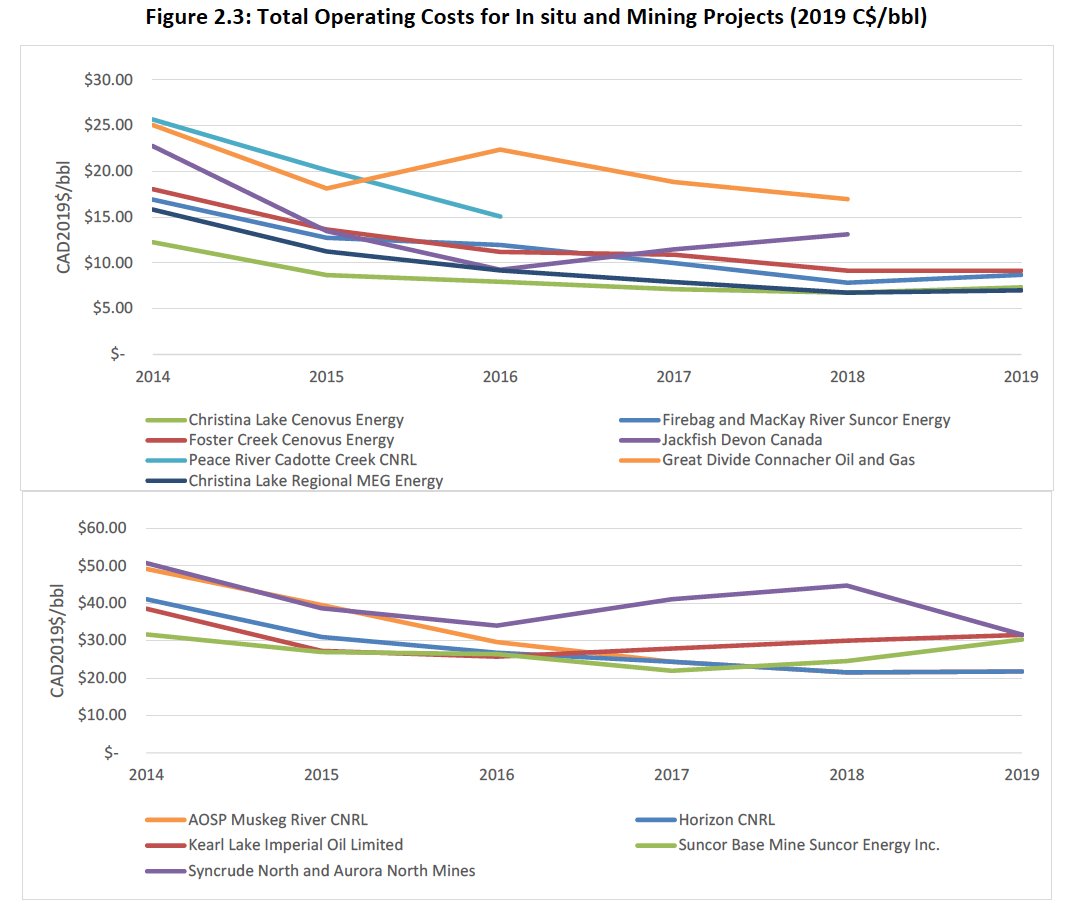

2/The graphs below are from CERI's 2020 Oil Sands Production and Emissions Outlook. Many of the projects are low-cost operations. In 2019, when prices were modest, oil sands producers generated considerable free cash flow and net earnings were high.

3/"All of this adds up to a not-too-distant future when Alberta producers will chase a diminishing market with declining prices," the authors argue.

But there is a good argument to be made that the oil sands can compete in a shrinking heavy crude market.

But there is a good argument to be made that the oil sands can compete in a shrinking heavy crude market.

4/Expect oil sands companies to use new digital technologies, clever engineering, and better management strategies to continue to drive down capex and opex throughout the 2020s.

The oil sands are a low-decline, long-life resource and shouldn't be compared to shale.

The oil sands are a low-decline, long-life resource and shouldn't be compared to shale.

5/IMO, the best strategy for Ms. Freeland and the Trudeau govt is to think about the oil sands (and the Alberta oil patch in general) as a strategic advantage.

How do we use hydrocarbons to produce more value in a low-carbon world?

Doom and gloom is the wrong narrative.

How do we use hydrocarbons to produce more value in a low-carbon world?

Doom and gloom is the wrong narrative.

• • •

Missing some Tweet in this thread? You can try to

force a refresh