#Gaps in #trading 101

Gap is essentially a change in prices levels between the close and the open of two consecutive days.

Gaps can be classified as under:

1. Common Gaps

2. Breakaway Gaps

3. Runaway Gaps

4. Exhaustion Gaps

(1/n)

Gap is essentially a change in prices levels between the close and the open of two consecutive days.

Gaps can be classified as under:

1. Common Gaps

2. Breakaway Gaps

3. Runaway Gaps

4. Exhaustion Gaps

(1/n)

#Gaps in #trading 101

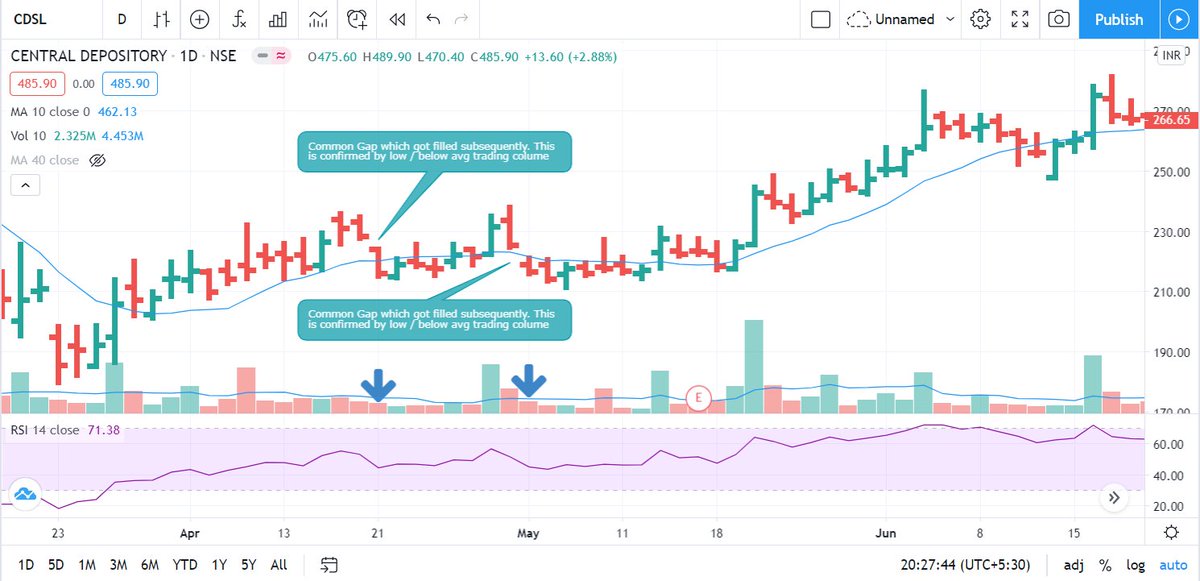

Common Gaps

These gaps are common & usually get filled quickly. "Getting filled" means the price action at a later time usually retraces at the least to the last day before the gap. The trading volume on such days is generally low / below average.

(2/n)

Common Gaps

These gaps are common & usually get filled quickly. "Getting filled" means the price action at a later time usually retraces at the least to the last day before the gap. The trading volume on such days is generally low / below average.

(2/n)

#Gaps in #trading 101

Breakaway Gaps

They occur when price action is breaking out of their trading range or congestion area. A good confirmation os such gaps is if they are associated with classic chart patterns (eg. Cup & Handle, Darvas Box, Ascending Triangle etc).

(3/n)

Breakaway Gaps

They occur when price action is breaking out of their trading range or congestion area. A good confirmation os such gaps is if they are associated with classic chart patterns (eg. Cup & Handle, Darvas Box, Ascending Triangle etc).

(3/n)

#Gaps in #trading 101

Breakaway Gaps

Volume will pick up significantly, for not only the increased enthusiasm, but many are holding positions on the wrong side of the breakout and need to cover or sell them.

(4/n)

Breakaway Gaps

Volume will pick up significantly, for not only the increased enthusiasm, but many are holding positions on the wrong side of the breakout and need to cover or sell them.

(4/n)

#Gaps in #trading 101

Runaway Gaps

Runaway gaps are also called measuring gapscaused by increased interest in the stock. Measuring gap will occur in the middle of, or half way through, the move. Note the significant increase in volume during and after the runaway gap.

(5/n)

Runaway Gaps

Runaway gaps are also called measuring gapscaused by increased interest in the stock. Measuring gap will occur in the middle of, or half way through, the move. Note the significant increase in volume during and after the runaway gap.

(5/n)

#Gaps in #trading 101

Exhaustion Gaps

Exhaustion gaps are those that happen near the end of a good up or downtrend. They are many times the first signal of the end of that move. Exhaustion gaps are quickly filled as prices reverse their trend.

(6/6)

#Nifty #TradingSignals

Exhaustion Gaps

Exhaustion gaps are those that happen near the end of a good up or downtrend. They are many times the first signal of the end of that move. Exhaustion gaps are quickly filled as prices reverse their trend.

(6/6)

#Nifty #TradingSignals

• • •

Missing some Tweet in this thread? You can try to

force a refresh