Corero #CNS have sorted out their website now or at least the malware is a little more subtle - so here briefly is what they do and why I think this may be a pretty interesting UK GARP stock

https://twitter.com/hareng_rouge/status/1305786450827448320

Just the one tweet on what they do because, computers:

It's on-premises DDoS protection - Corero equipment (powered by $JNPR's MX - important) sits at the edge of the network, inspects and mitigates attacks.

Anything less than 10GB is dealt with locally. More, goes to cloud

It's on-premises DDoS protection - Corero equipment (powered by $JNPR's MX - important) sits at the edge of the network, inspects and mitigates attacks.

Anything less than 10GB is dealt with locally. More, goes to cloud

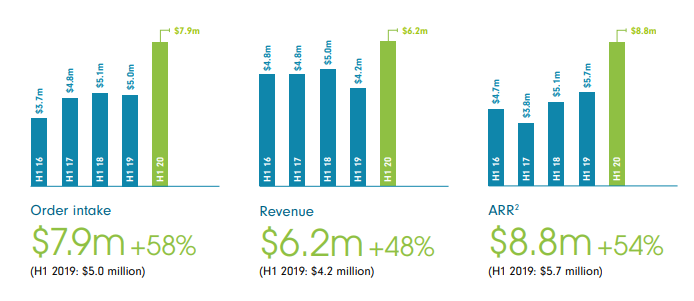

Why they're interesting is essentially that there has been quite a sudden step change in their performance.

And things like this: large post-period contract wins with telcos for DDoS protection. Not in the RNSs, not yet in the numbers.

Where's it coming from?

Where's it coming from?

In large part it looks like from Juniper. Here you see new customer count jump to 18 from 6 in the last HY.

Juniper are up to a 10% equity stake in #CNS but the thing to take from the below is the resale agreement where Juniper push Corero's offering. Corero is powered by $JNPR's MX card and JNPR is extremely motivated for it to succeed, it features often in their calls.

Here they talk on their latest earnings about the ramp in the MX range and later on, their focus and strength in the telco sector.

Finally, tech conference last week: 5g is the drive for telco security, where CNS are already finding success.

With Juniper pushing and an apparent inflection in their business, #CNS has some momentum and looks like an interesting idea to me as a UK security name and play on 5g

With Juniper pushing and an apparent inflection in their business, #CNS has some momentum and looks like an interesting idea to me as a UK security name and play on 5g

• • •

Missing some Tweet in this thread? You can try to

force a refresh