Start #trading?

A Thread.

So you want to make it as a trader, in short time?

I am going to sound discouraging but that’s how the reality will look like. I am just going to point out the main bumps ahead of you.

1/n

A Thread.

So you want to make it as a trader, in short time?

I am going to sound discouraging but that’s how the reality will look like. I am just going to point out the main bumps ahead of you.

1/n

1) Methodology

It’s a ocean of info and you’ll be overwhelmed instantly. Most probably duped for many months /years by tips/paid services, TV channels. It will take years to find out what works for you, considering your mindset and temperament.

2/n

It’s a ocean of info and you’ll be overwhelmed instantly. Most probably duped for many months /years by tips/paid services, TV channels. It will take years to find out what works for you, considering your mindset and temperament.

2/n

2) Capital - If you’re still left with capital, which will be insufficient in most cases, it is likely that you’ll never go through a cycle of trades. So yeah again chances of quitting here is very high, not trading itself but a methodology, you believed or developed.

3/n

3/n

3) Borrow Methodology-

I have nothing against workshops if it shortens your learning curve. But again if “you” didn’t spend time on a “method”, it’s likely that you’ll never deploy big capital on it, worse still, you might stop it after consecutive losses.

4/n

I have nothing against workshops if it shortens your learning curve. But again if “you” didn’t spend time on a “method”, it’s likely that you’ll never deploy big capital on it, worse still, you might stop it after consecutive losses.

4/n

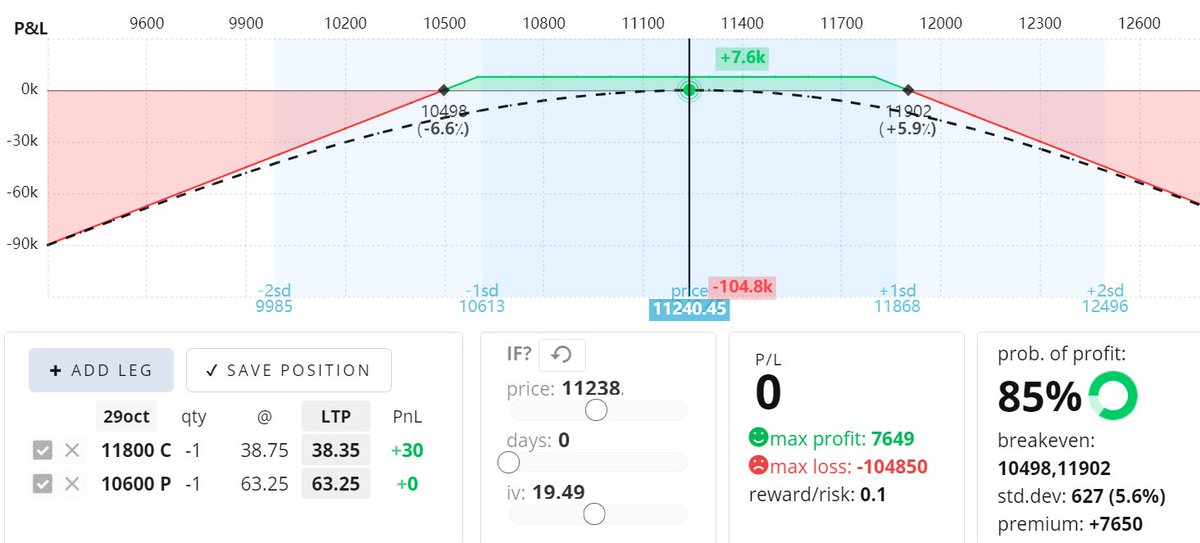

5) Risk Management-

All risk management comes with your position size. Trading is not a get rich scheme, which can be done on the side, it takes immense dedication and just like any other business, keep your expectations reasonable, and the market may reward you.

All the Best.

All risk management comes with your position size. Trading is not a get rich scheme, which can be done on the side, it takes immense dedication and just like any other business, keep your expectations reasonable, and the market may reward you.

All the Best.

• • •

Missing some Tweet in this thread? You can try to

force a refresh