Full-time trader. Head trader @Scaliuminvest. History, Politics, War, Literature aficionado. https://t.co/pwvoZa84oW

11 subscribers

How to get URL link on X (Twitter) App

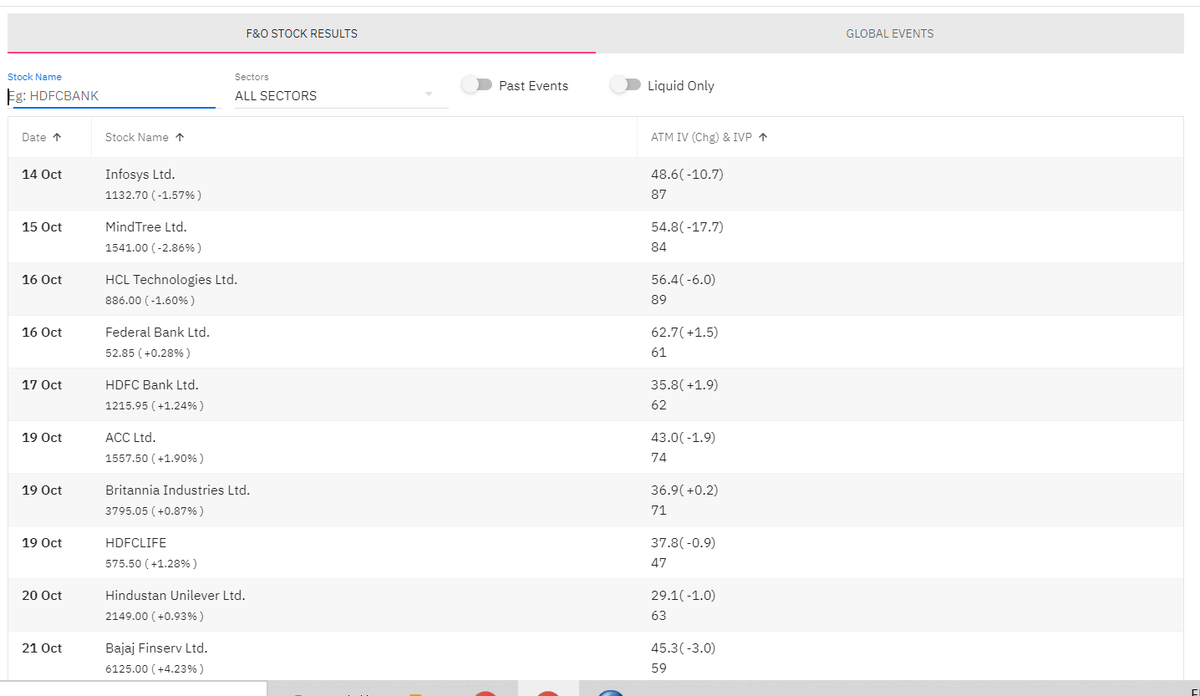

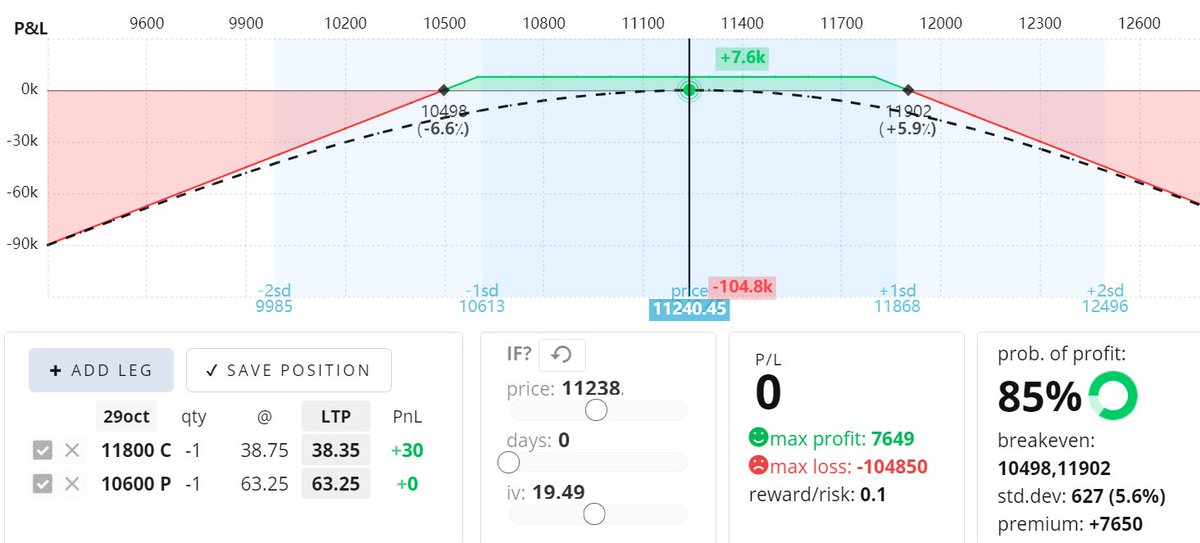

https://twitter.com/marketjaw/status/12844108425244221452018. Music stops with Kim rockets. Holding futures overnight was disastrous, especially February. Somehow I was managing to hold on to my capital but never made any money. Things continue same for another 3-4 months with me going to selling options.

This puts the reign of Louis XVI,and the impossible job he had to change anything for the better,into context,and paints him as quite a sympathetic character.The book also briefly covers the aftermath of the revolution, the rise of Napoleon and the post-revolutionary period

This puts the reign of Louis XVI,and the impossible job he had to change anything for the better,into context,and paints him as quite a sympathetic character.The book also briefly covers the aftermath of the revolution, the rise of Napoleon and the post-revolutionary period

#1 - The Gathering Storm

#1 - The Gathering Storm

I started trading in F&O space in August 2017, straight out of college, with a initial corpus of nothing more than this profit figure.

I started trading in F&O space in August 2017, straight out of college, with a initial corpus of nothing more than this profit figure.

Skin in the Game : I have a long at 660 taken two weeks back . I have it pledged for margin.

Skin in the Game : I have a long at 660 taken two weeks back . I have it pledged for margin.