What’s the macro-economic outlook for the second quarter of 2020 as India unlocks? Are we also unlocking behaviorally?

Check out our latest Macroeconomics of COVID-19 in India series with @tulsipriya_rk.

Q2 poised to return to economic normalcy.

Check out our latest Macroeconomics of COVID-19 in India series with @tulsipriya_rk.

Q2 poised to return to economic normalcy.

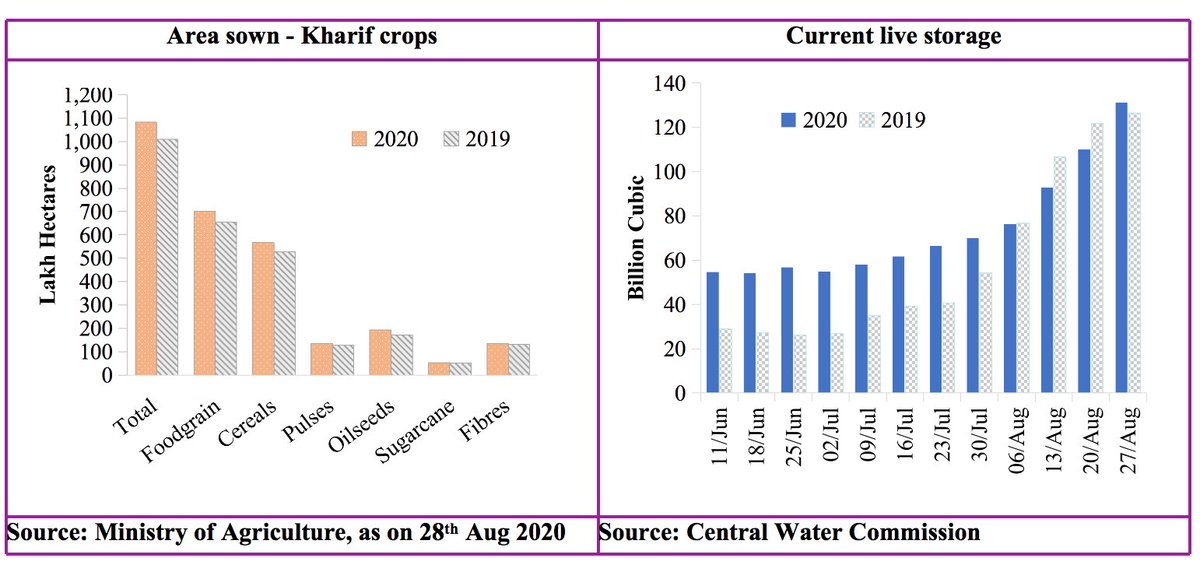

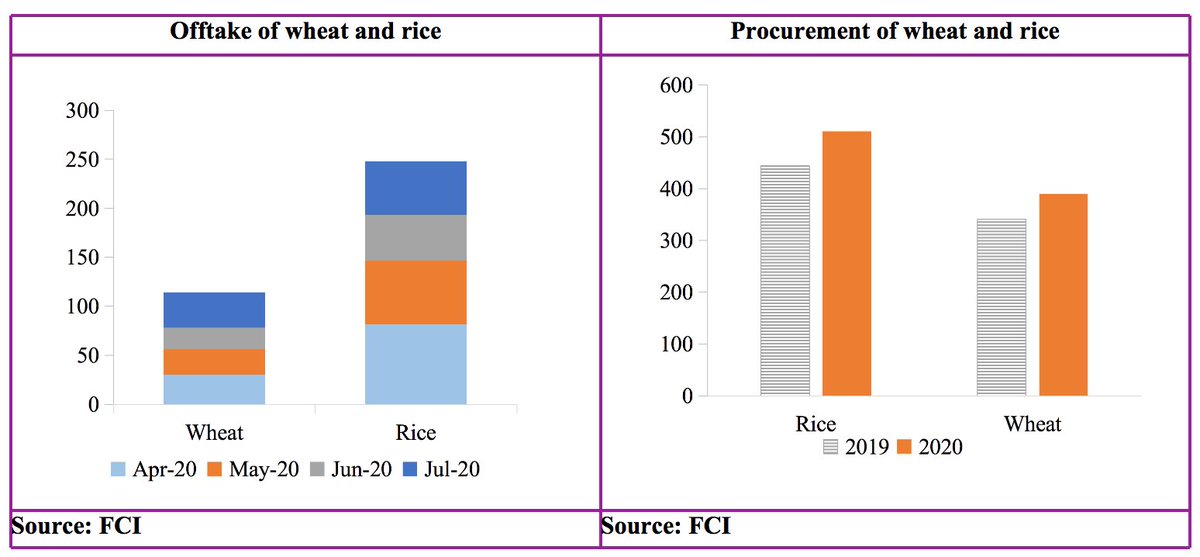

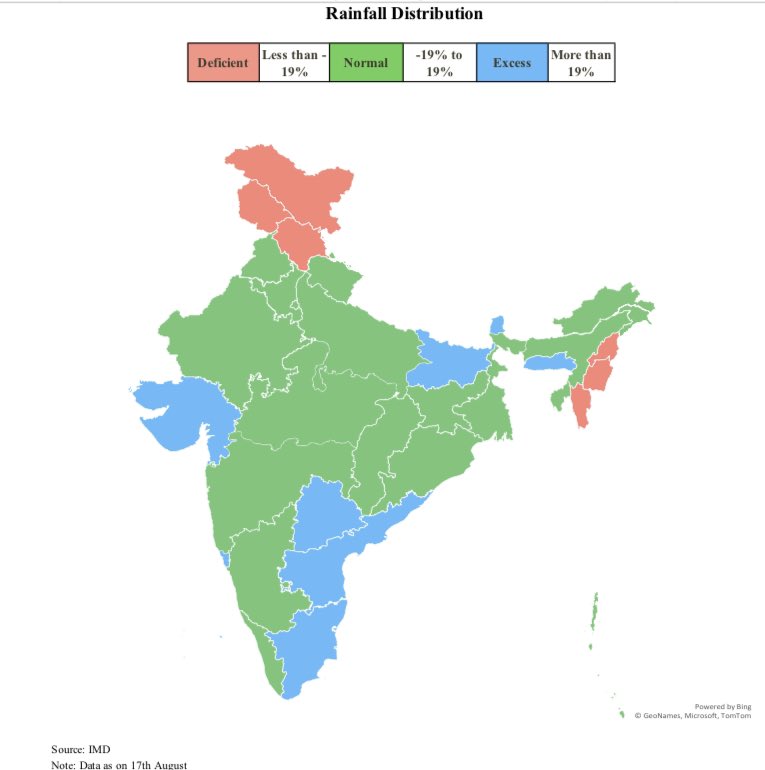

Record Kharif sowing and healthy monsoon augurs well for robust kharif harvest and ensuing rural demand. Continuous MGNREGA employment boost critical for sustaining rural demand and dampening uncertainty and also in assisting migrant’s rural-urban migration mental decision making

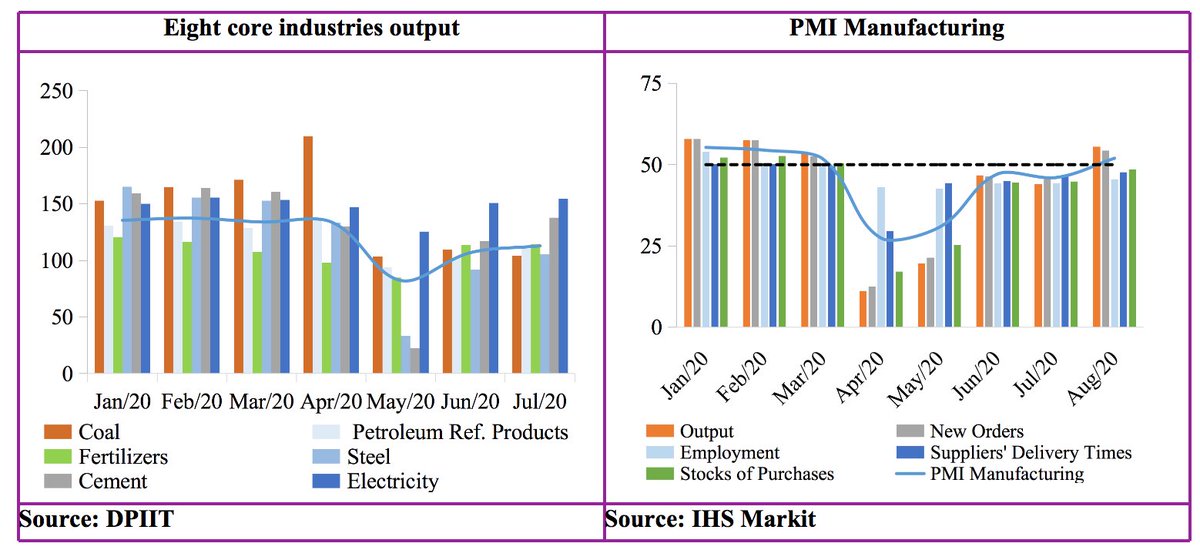

Engines of industrial activity unlocking quickly. Services, having endured a disproportionate Covid impact, given their greater dependence on physical interaction and informality, may take relatively longer to return to baseline.

Revenue freight surpasses previous year levels in August, passenger earnings, domestic aviation and cargo traffic also picking up.

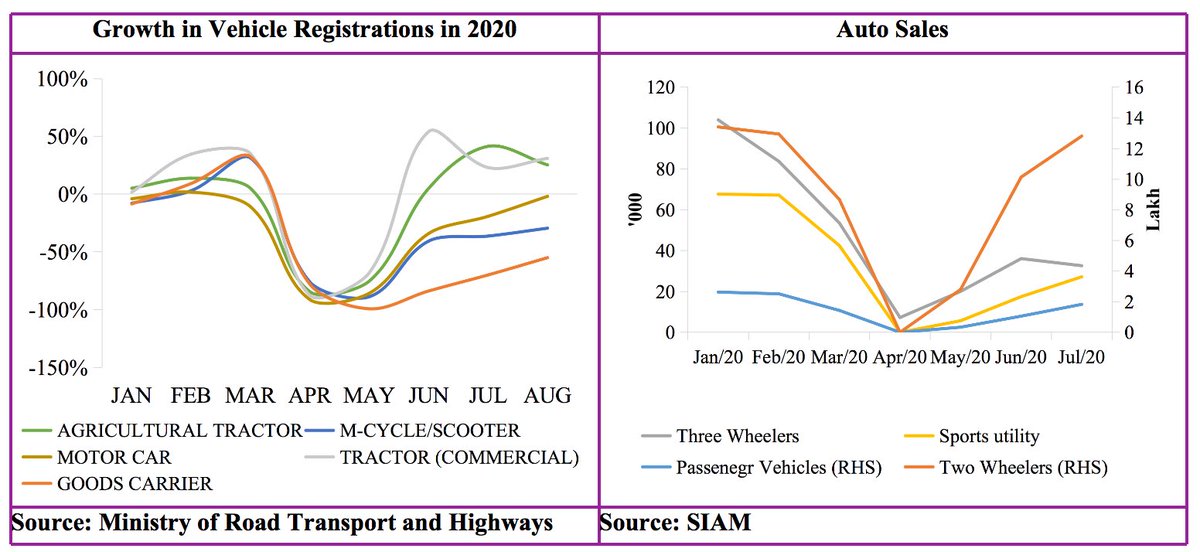

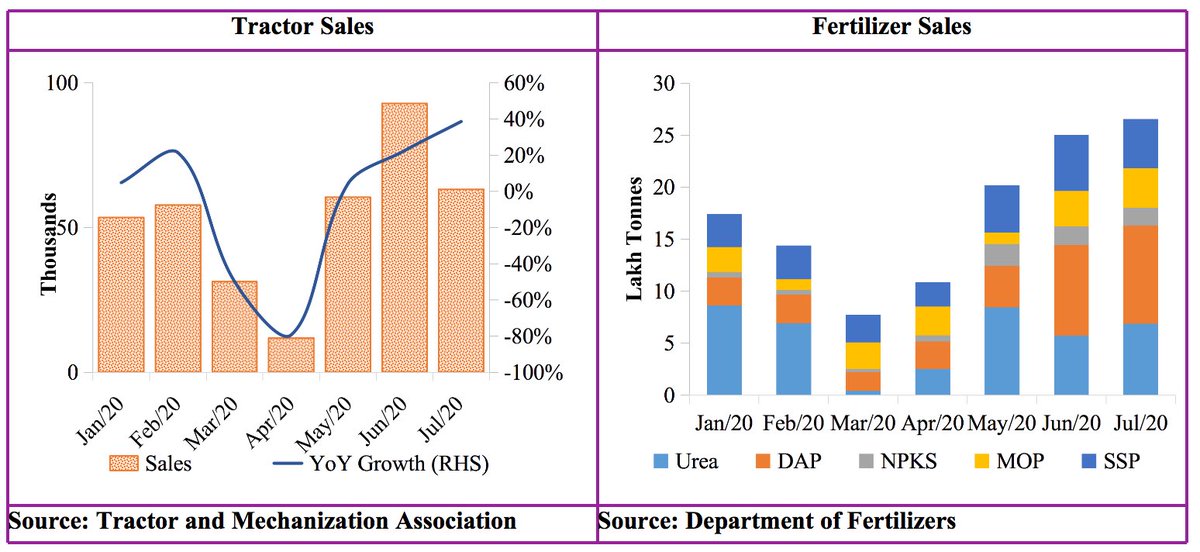

Signs of rising digital transactions, sales of passenger vehicle, two wheelers, SUVs and tractor registrations augur well for consumption sentiment. Three wheeler sales, however, drop in August, indicating possible pent up demand diminishing and persistent constraints on demand.

Price pressures emerge as a concern in Q2. Core also firm given higher gold prices and services inflation. Mandi arrivals drop amid supply chains not fully opening up-also possibly hinting at direct marketing sales and urgent need to track them

Rupee appreciating to 73 territory after staying range bound and stable in August under RBI forex dollar purchases, weak dollar and positive FII flows driven by debt albeit at lower levels than previous fortnight. Net outflow in equities.

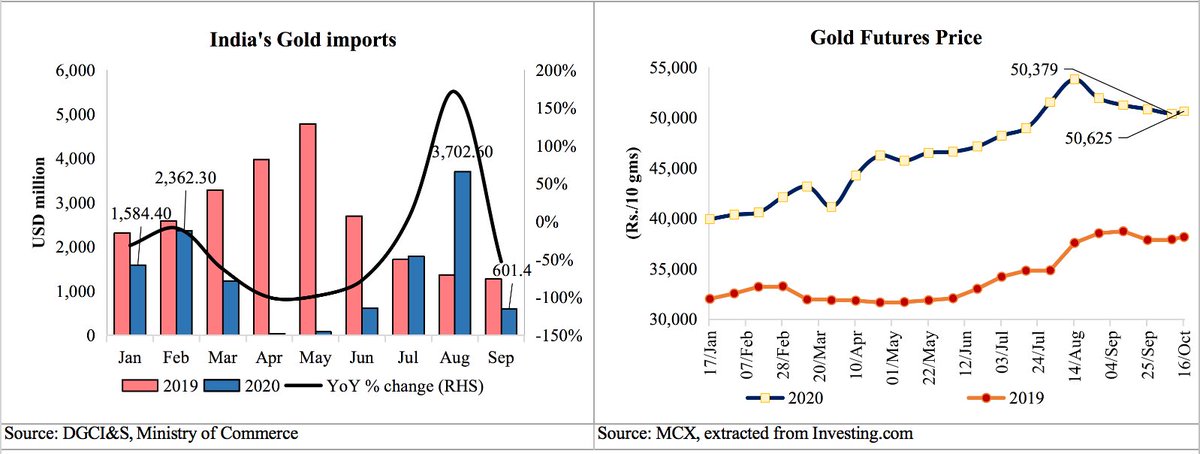

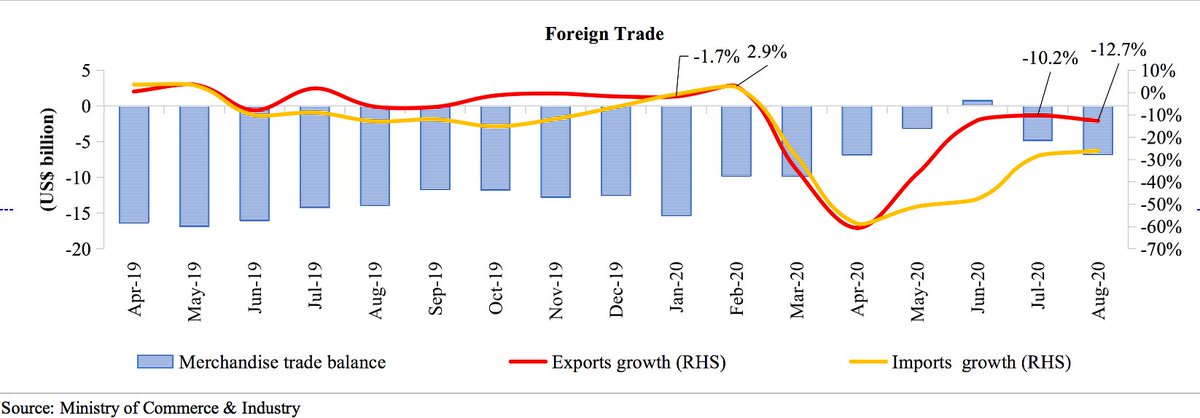

Oscillating recovery of oil markets and depressed consumption of petroleum products. Gold imports picked up sharply in August but gold prices didn’t pick up much owing to seasonal factors. Overall imports also pick up, export growth moderates. Gradual global recovery on cards

Investment demand expected to grow only gradually with bank credit growth staying lukewarm. Banks investing more in safe assets like government bonds. AAA yields spread decline post RBI operation twist after moderate pickup in August. SBI deposit rates decline by 20 bps.

Centre gross borrowing ramping up state gross borrowing elevated but stabilising YoY, sharp spike in short term borrowing of states however,

centre’s borrowing calendar for H2 slated at Sep end yields expected to face pressure. DBT transactions value lower in August, higher YoY.

centre’s borrowing calendar for H2 slated at Sep end yields expected to face pressure. DBT transactions value lower in August, higher YoY.

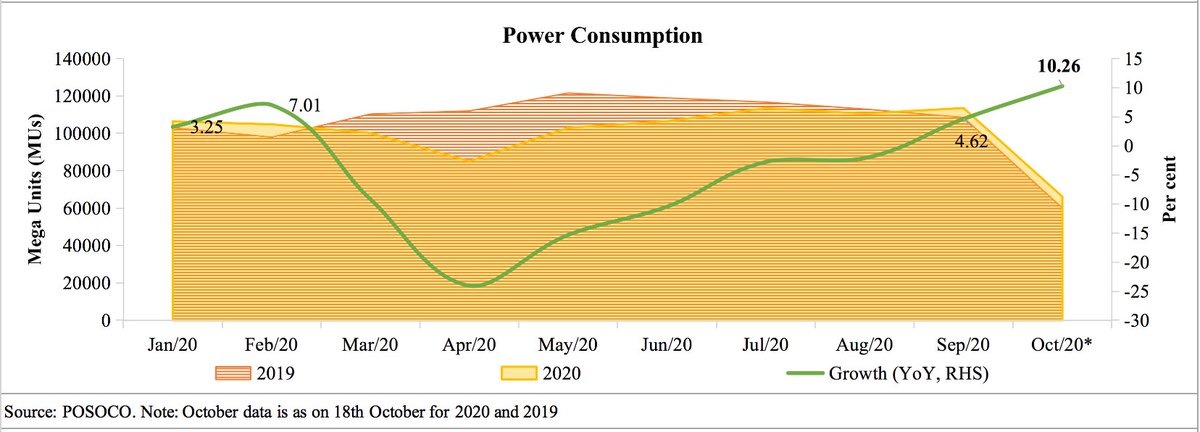

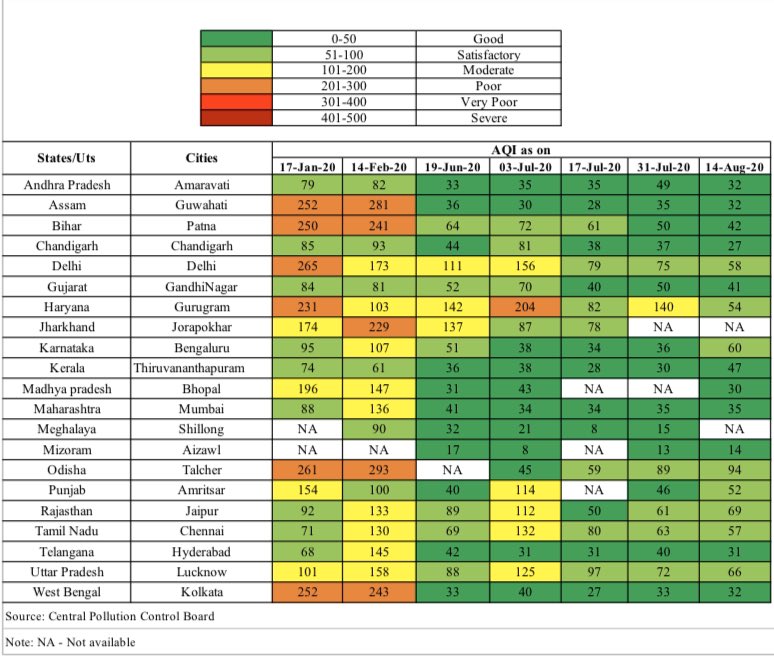

Geographical perspective to macro- Air quality fell in most cities in fortnight gone by signalling activity pick up, power consumption recovery in all states except KN, RA and TN. Broad based improvement in E way bills and ETC collections.

Covid-19, the obvious and serious downside risk. Pandemic perceptions and decision making under uncertainty expected to influence demand patterns. Healthy broad based Recoveries- more than 90 % in BH. High Punjab CFR and low MH testing rate concerning.

Q2 Outlook: Real activity indicators showing healthy recovery in converging to prev year and Pre Covid levels, manufacturing picking up fast, services growth to be gradual, healthy rural consumption sentiment signs, external demand picking up, price and fiscal strains emerging.

Expected recovery contingent on pandemic evolution. People’s perception to the pandemic is evolving while we unlock- critical factor for ensuing demand patterns.

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh