THREAD: More than 4,000 new #COVID19 cases in the UK in the past 24 hours. More than 14k in Spain.

These numbers are clearly making a lot of people scared.

But has anything changed since I said it's not yet time to panic?

Quick recap:

These numbers are clearly making a lot of people scared.

But has anything changed since I said it's not yet time to panic?

Quick recap:

I've been making three points:

1. yes cases are rising, but so far nowhere as fast as in spring.

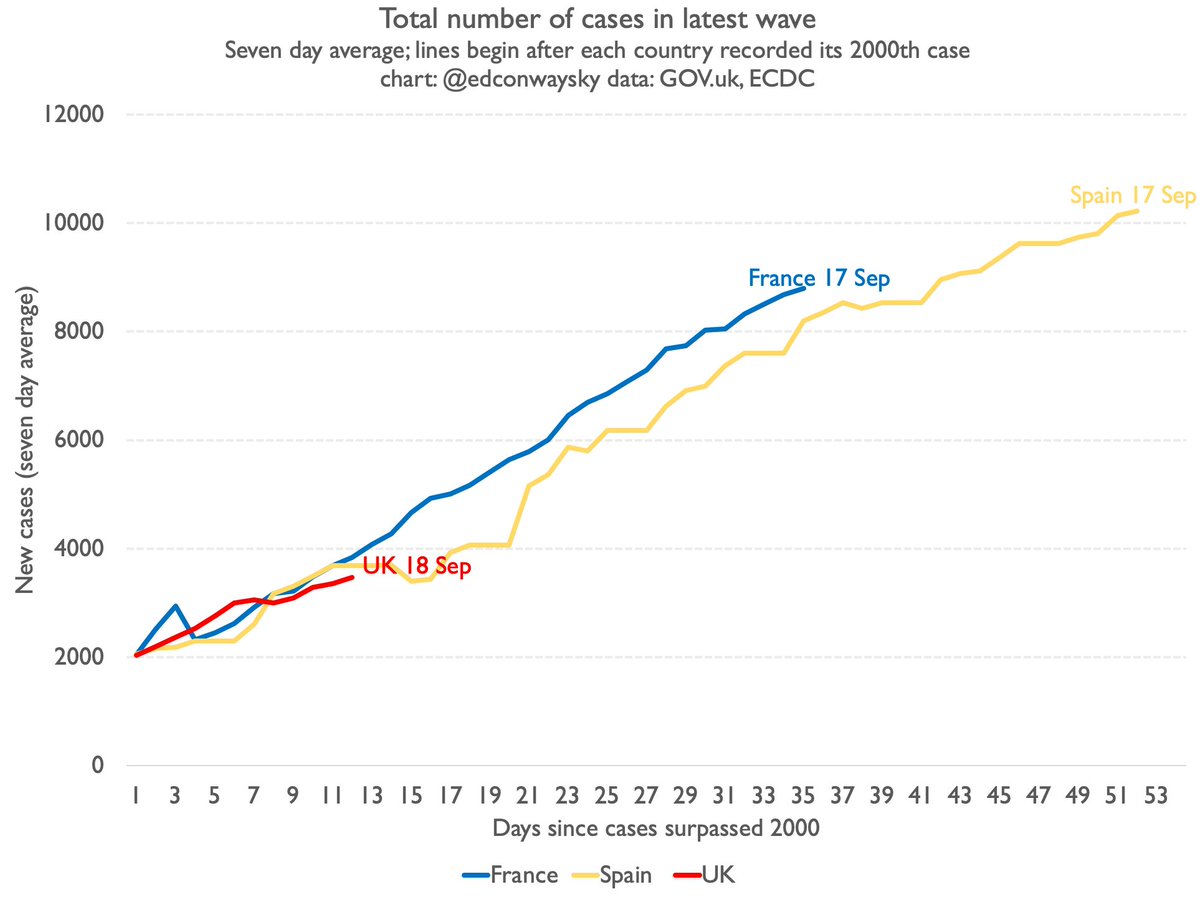

2. UK following v much in Spain & France's footsteps - so we get a sneak preview of where we're heading

3. News from France/Spain backs up point 1: #COVID not taking off like Spring

1. yes cases are rising, but so far nowhere as fast as in spring.

2. UK following v much in Spain & France's footsteps - so we get a sneak preview of where we're heading

3. News from France/Spain backs up point 1: #COVID not taking off like Spring

Has any of that changed? After all, we've had some big new numbers in this week.

And problems with the testing system prompted some to ask whether the case figures this is all based on can be trusted anyway - eg maybe #COVID19 is spreading far faster than the official UK figs.

And problems with the testing system prompted some to ask whether the case figures this is all based on can be trusted anyway - eg maybe #COVID19 is spreading far faster than the official UK figs.

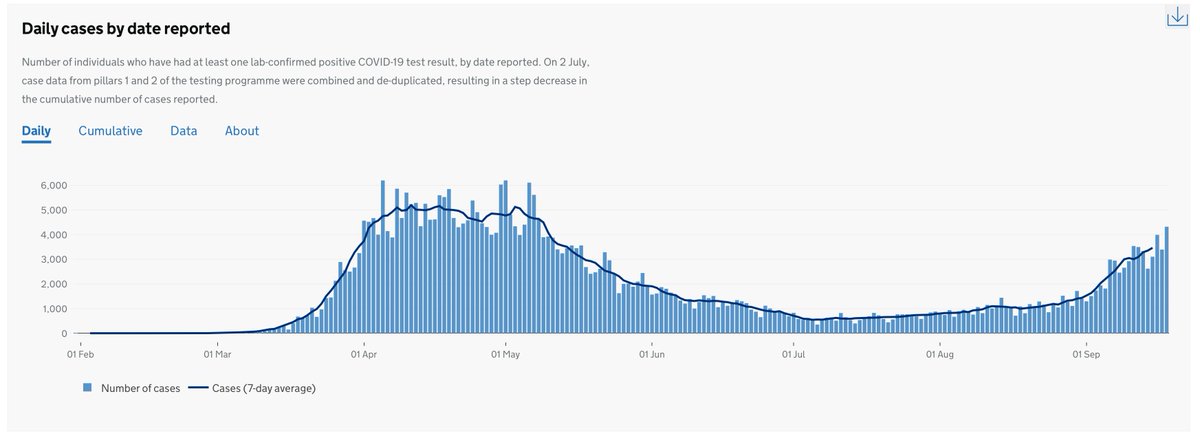

Let's take that last point first. So far, there's nothing to suggest official case numbers on @DHSCgovuk dashboard are wildly out of whack.

How do we know?

Because @ONS does its own survey and the growth rates it's seeing are pretty similar to those on the dashboard

How do we know?

Because @ONS does its own survey and the growth rates it's seeing are pretty similar to those on the dashboard

At the peak of the disease we were seeing 100k new #COVID19 cases a day (Imperial estimate).

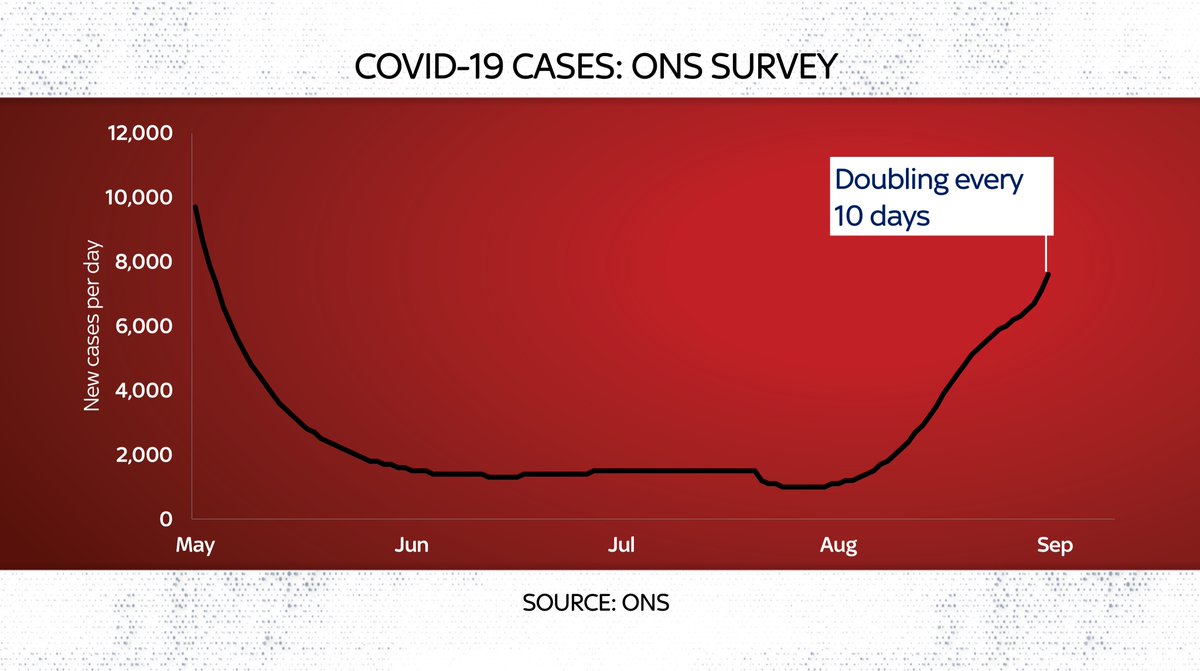

Currently acc to @ONS it's about 6-7k cases a day.

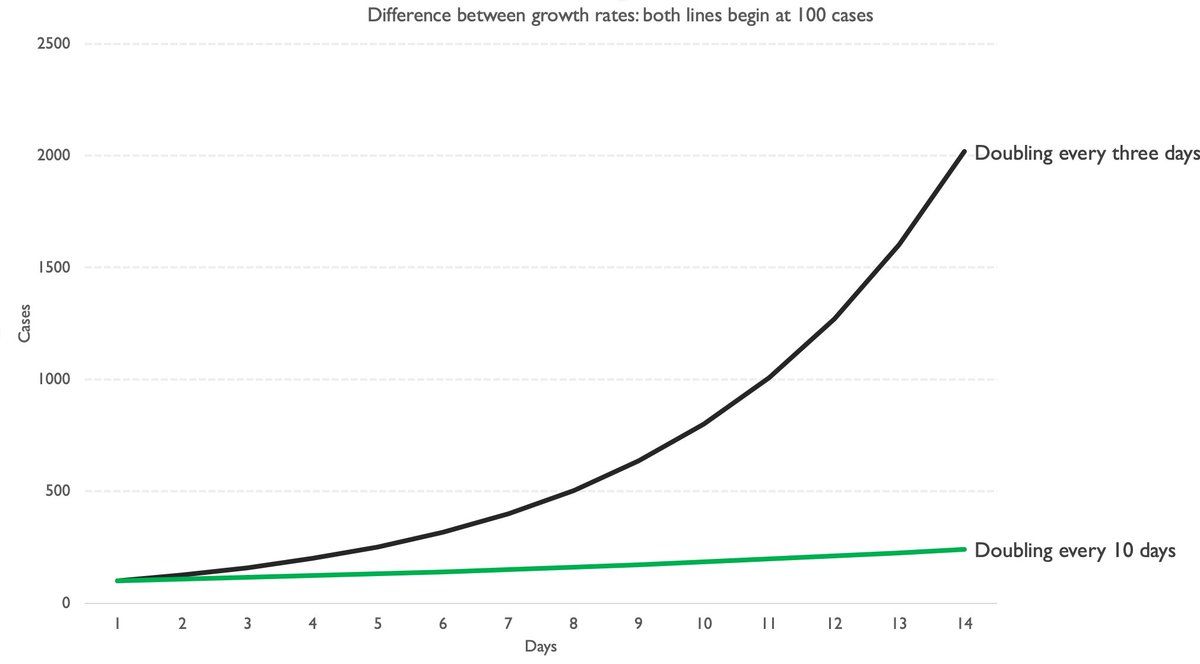

In spring disease was doubling every 2-3 days.

Currently it's doubling every 10+ days.

And that's a BIG difference (see charts)

Currently acc to @ONS it's about 6-7k cases a day.

In spring disease was doubling every 2-3 days.

Currently it's doubling every 10+ days.

And that's a BIG difference (see charts)

Is the UK's #COVID19 situation still in line with France & Spain? V much so. Here's the latest trajectories as of today. Note these are 7 day averages but they include today's 4,322 positive COVID tests in the UK.

All this implies we'll be up to 10k a day within a few weeks.

All this implies we'll be up to 10k a day within a few weeks.

Are there any positives to be taken from what's happening in France & Spain? It's very early to say but so far the data suggest case growth rates may be diminishing. So far it's nothing like spring. @danielhowdon wrote a good piece about that here: cebm.net/covid-19/does-…

Still: more UK cases will mean more UK hospitalisations and more deaths.

Next few weeks/months will be nervy.

But the lesson from last time is follow the data, not the anecdotes or the headlines.

And so far the data is still saying: don't panic.

If that changes I'll flash the 🚨

Next few weeks/months will be nervy.

But the lesson from last time is follow the data, not the anecdotes or the headlines.

And so far the data is still saying: don't panic.

If that changes I'll flash the 🚨

Final point:

"This isn't as bad as spring" isn't the same as "this isn't anything"

#COVID19 cases are rising. People are getting sick; some will die.

It is understandable why many are cautious & worried.

But the data so far suggests the outlook may not be as grim as you think

"This isn't as bad as spring" isn't the same as "this isn't anything"

#COVID19 cases are rising. People are getting sick; some will die.

It is understandable why many are cautious & worried.

But the data so far suggests the outlook may not be as grim as you think

A video update on what the #COVID19 data is telling us. Gratifyingly short this time around I'm delighted to report:

• • •

Missing some Tweet in this thread? You can try to

force a refresh