Hi, @7MaxxChatsko --

I agree with a lot of what you've laid out above. However, I think I should clarify some parts of my thread and offer counterpoints to a few of yours. I'm always game to trade notes.

I agree with a lot of what you've laid out above. However, I think I should clarify some parts of my thread and offer counterpoints to a few of yours. I'm always game to trade notes.

https://twitter.com/7MaxxChatsko/status/1308233179770298369

I disagree that the DNA sequencing market is worth $10 billion. Today, it’s less than that. Should Illumina (a) drive unit prices lower (w/ super resolution, see below) & (b) help customers up the platform upgrade cycle to realize bleeding-edge OpE...

https://twitter.com/sbarnettARK/status/1243630026203058178

…that the market could be worth much more. I’ll cede that this position isn’t ideal because, as you point out, the vastest TAM is within clinical genomics. Still, investors could be ‘headed for the exits’ because their time horizons may not be long enough.

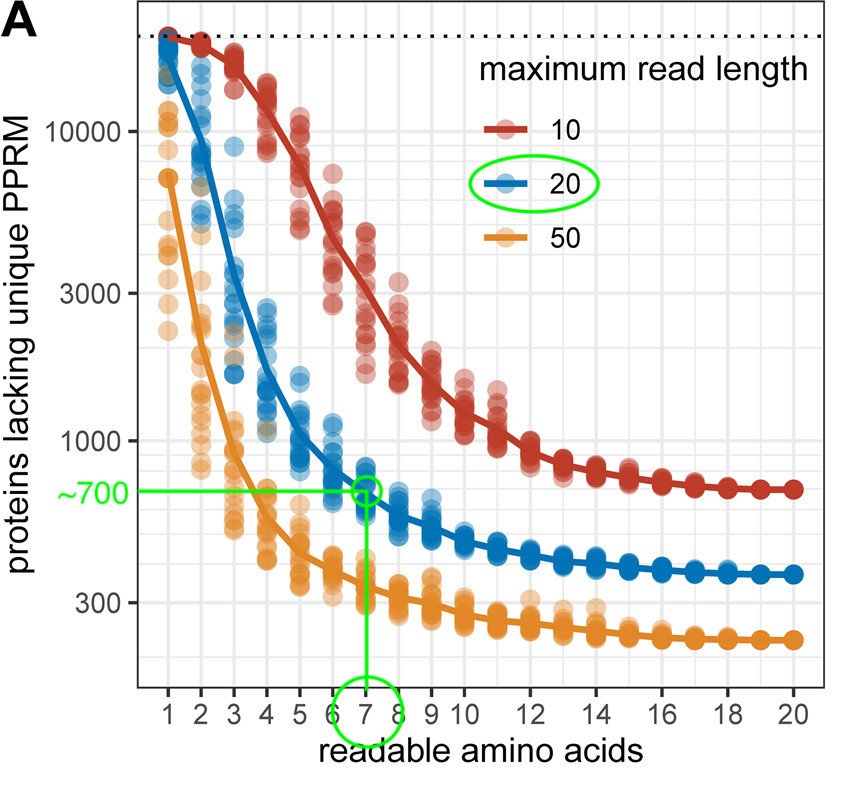

As much as I’ve written lovingly about long-reads, I think saying the market will converge to them isn’t quite right. Should all relevant hardware metrics (throughput, F-1 scores, $/GB, etc.) match/exceed today’s standard for short-read, then yes, big swaths may port over.

Which clinical NGS apps. go to long-read is arguable, and in many cases has biological constraints. FFPE cancer tissue, the most common sample, has fragmented (~200 bp) DNA—I’m unsure how that input would work in a Sequel II HiFi workflow. ctDNA presents a similar challenge.

We believe there’s plenty of opportunity for Illumina to expand upon its core franchise. We believe they are going about it the wrong way. I totally agree with you that leveraging its distributed install base is a great idea, hence why we like Invitae’s acquisition of ArcherDx.

In our view, Illumina should empower its customers, such as ArcherDx and FMI, to build IVDs for local use, helping to capture 80% of cancer patients. By competing with Dx customers, they may choose to leave Illumina. I’ll give one example:

Veracyte purchased NanoString’s FDA-cleared FLEX system to vertically-integrate the hardware component of its distributed Dx franchise. Is FLEX as robust as a NextSeq? No, but it gets the job done and allows Veracyte to play out price-elasticity-of-demand its own way.

While gaining access to methylation data isn’t unique, the (a) size of current+future training data and (b) existing ML classifier, I think, gives GRAIL an advantage over GH in the near-term, especially for a pan-cancer test. Bluntly, GRAIL (and others) have published data…

…whereas GH hasn’t initiated a pan-cancer trial. In the end, their commercial strategies are different (pan versus single-indication) and I think GH is strong, generally, as I stated in my original thread. Alright, so some more thoughts on methylation…

…What is it if not a novel biomarker for the *presence*, not *treatment* of cancer? Does it matter what’s feeding the machine if the clinical question is accurately answered? Fragmentomics hasn’t been clinically validated either, yet it’s also pulled into screening ML stacks.

The truth is, we think Illumina has great bones and that there’s a lot it can do to reinvigorate itself. In fact, we’ve written about it and praised it very recently. I’d also argue synthetic biology could’ve been an attractive option that would empower, not stifle, competition.

I’m not sure liquid biopsies would go to nanopore for numerous reasons, though I’d welcome input because I’m not as sure here. Firstly, the short (~200 bp) length of ctDNA could inhibit nanopore sample prep and hamstring $/GB, F-1, and other metrics.

I’m not aware of any well-studied ctDNA assays (from a 3rd party, not ONT) running on nanopore. You’re right ONT doesn’t need amplification, but amp isn’t as much of the enemy here as it is with CG-rich DNA. You can error-correct sequence artifacts, albeit w/ a depth penalty.

Third, ONT (historically) has required frequent software/hardware upgrades. If I were a clinical provider (especially in an IVD setting), I would NOT want to keep revalidating my protocol. I’ll agree that SNV F-1 is improving to ILMN-levels, but questionable at such low VAF.

I don’t think there’s any reason to believe ILMN is playing defense for liquid biopsy. Altogether, we saw this situation as an avoidable one with several path towards reaccelerating growth that did not involve squaring up directly against a crowded Dx market.

Thanks for reading, welcoming feedback/critique/etc.

• • •

Missing some Tweet in this thread? You can try to

force a refresh