Everything you wanted to know about the #hydrogen economy but were too busy to research.

Part 2: International hydrogen markets could be a thing, but don’t bet on hydrogen shipping

1/18

Part 2: International hydrogen markets could be a thing, but don’t bet on hydrogen shipping

1/18

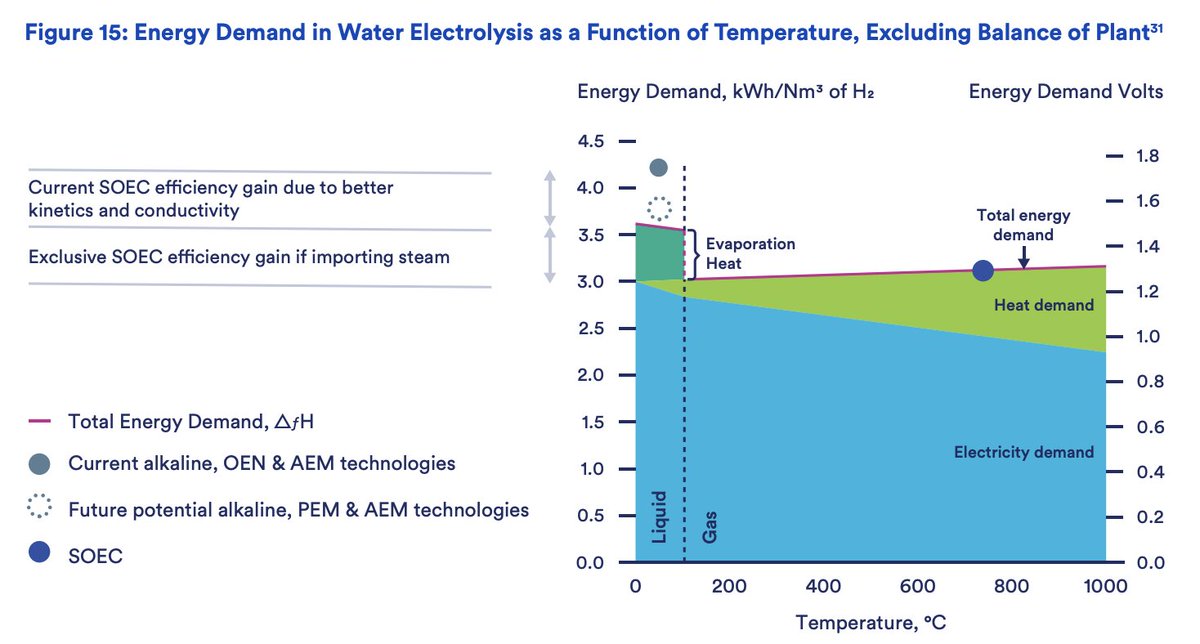

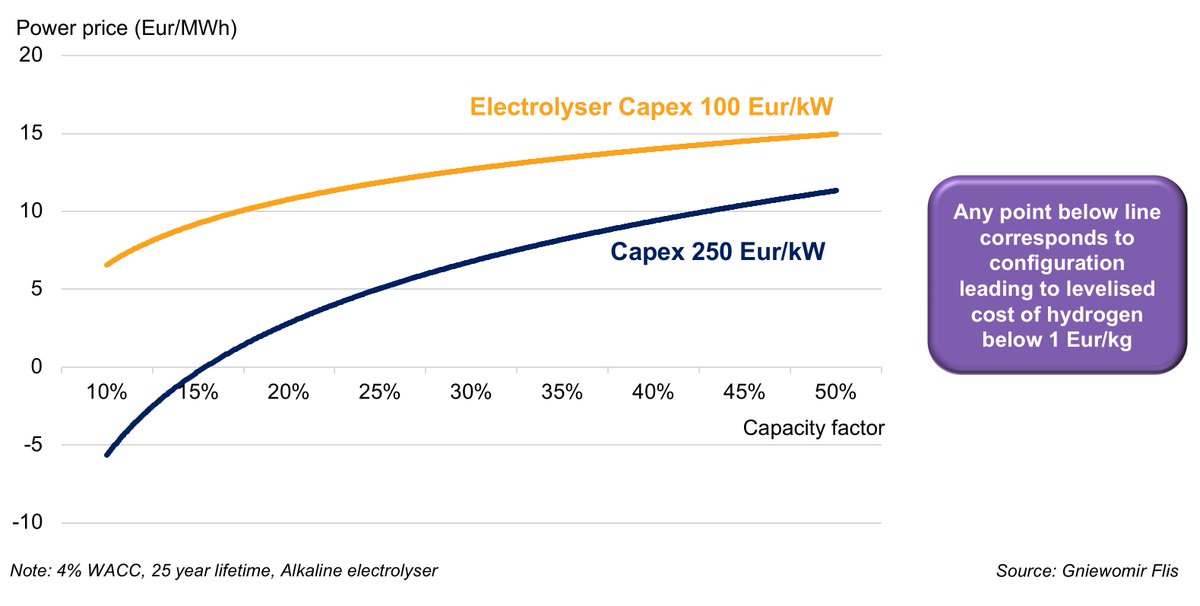

In February I argued green H2 could undercut fossil H2 as early as 2030, conditional on two points:

1) Driving electrolyser capex below $250/kW, but more importantly

2) 1,500 hours per year of zero-cost green power per electrolyser

2/18

1) Driving electrolyser capex below $250/kW, but more importantly

2) 1,500 hours per year of zero-cost green power per electrolyser

2/18

https://twitter.com/gnievchenko/status/1229760320555638787?s=20

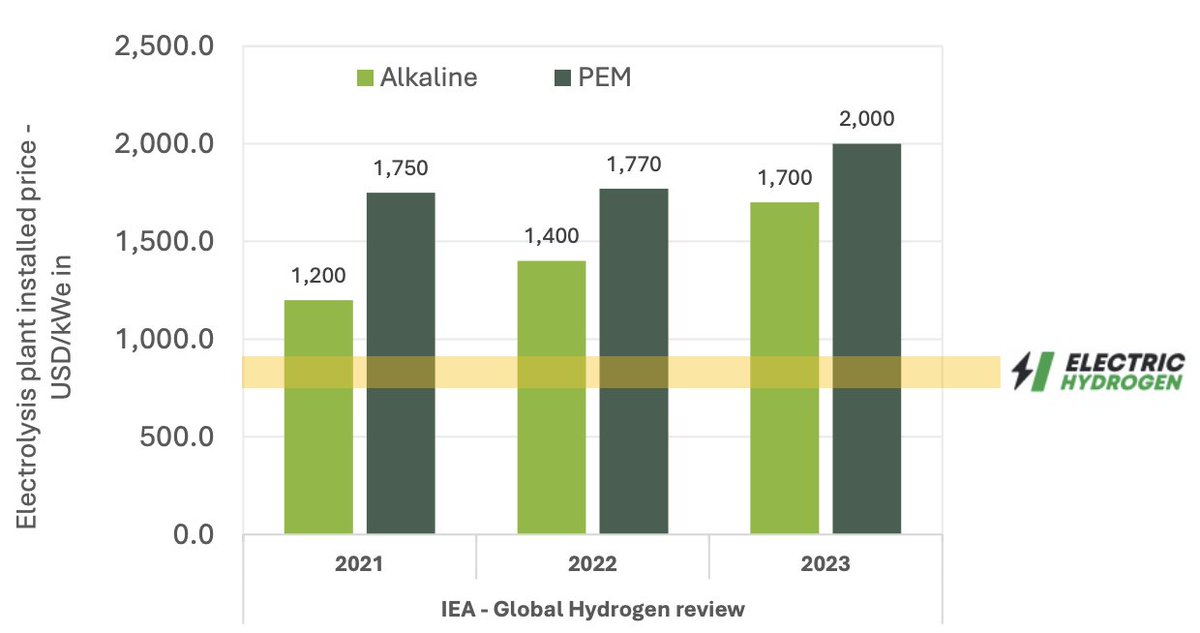

If the recent EU Hydrogen strategy comes to fruition, the first point should be easy.

But as hydrogen scales, 1,500 hours per year of free power per electrolyser would become increasingly hard to find.

3/18

But as hydrogen scales, 1,500 hours per year of free power per electrolyser would become increasingly hard to find.

3/18

https://twitter.com/gnievchenko/status/1295300446467366912?s=20

The thing is, free power is not a hard requirement. The variables you need to optimise for are capacity factor as well as price. As electrolyser capex falls driven by economies of scale, the range of competitive price points increases.

4/18

4/18

All the while renewable energy is getting dirt cheap, recently as low as 1.1 euro cents for kWh in Portugal!

There are many places in the world which are blessed with plentiful and cheap renewable resources; Australia, Chile, Morocco, U.S. etc.

5/18

reuters.com/article/portug…

There are many places in the world which are blessed with plentiful and cheap renewable resources; Australia, Chile, Morocco, U.S. etc.

5/18

reuters.com/article/portug…

But in places like Germany, there is limited potential for domestic green hydrogen. The German hydrogen strategy estimates only 14 TWh of local electrolytic potential vs. expected demand of >100 TWh by 2030.

The remainder is to be made up with imports. Where from and how?

6/18

The remainder is to be made up with imports. Where from and how?

6/18

The idea of international hydrogen markets has been at the centre of EU and German hydrogen strategies. At the moment, the spotlight is on Iberia and North Africa. Two transport options exist:

1) Shipping

2) Pipelines

Let’s delve into the economics!

7/18

1) Shipping

2) Pipelines

Let’s delve into the economics!

7/18

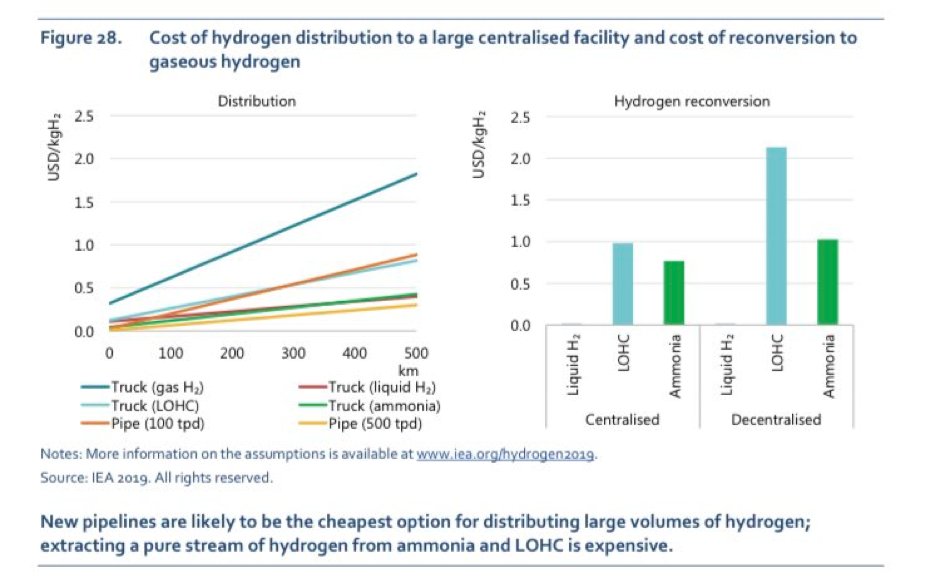

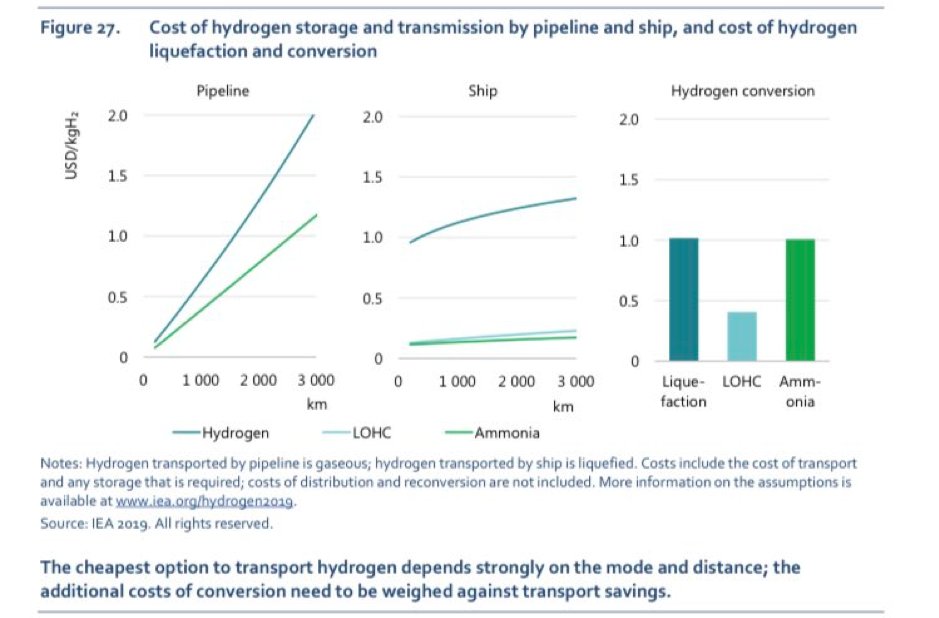

First, shipping, in form of liquid hydrogen (LH2) or using a vector such as ammonia or LOHC.

Former is similar to LNG, but LH2 has lower energy density and needs to be cooled to a chilling -252C. Ammonia and LOHC are easier to transport, but need expensive reconversion.

8/18

Former is similar to LNG, but LH2 has lower energy density and needs to be cooled to a chilling -252C. Ammonia and LOHC are easier to transport, but need expensive reconversion.

8/18

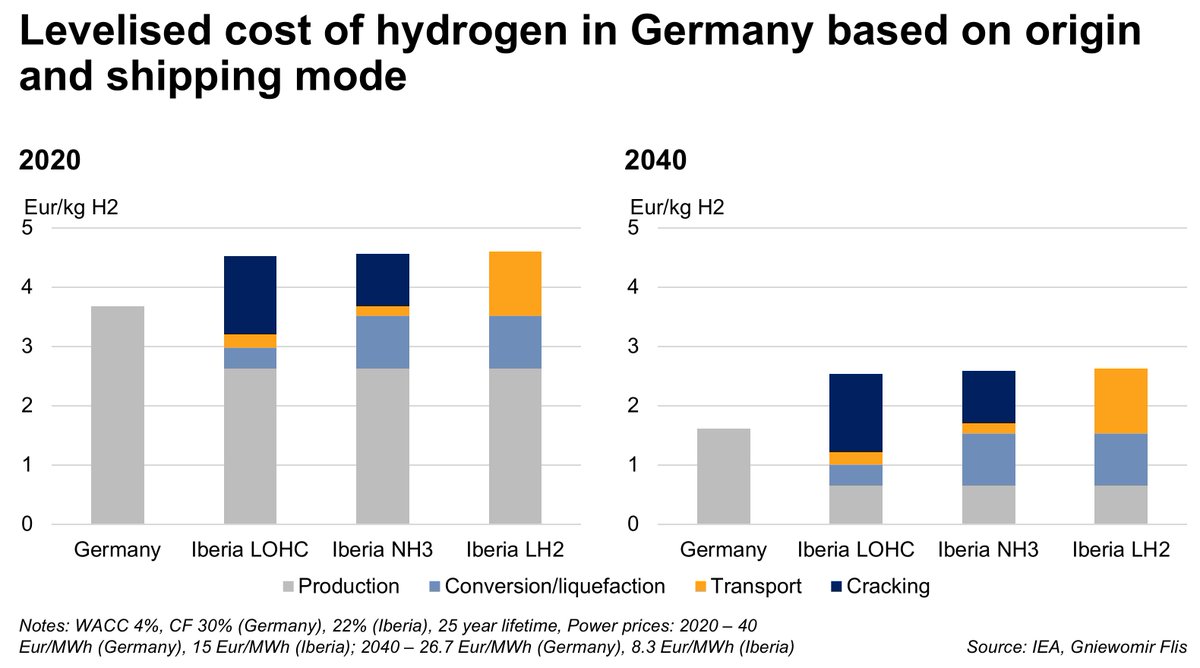

If you believe my calculations, it would be cheaper to produce hydrogen locally in Germany than to ship it from Iberia, whatever the shipping method. The economics favour local production even more over time!

9/18

9/18

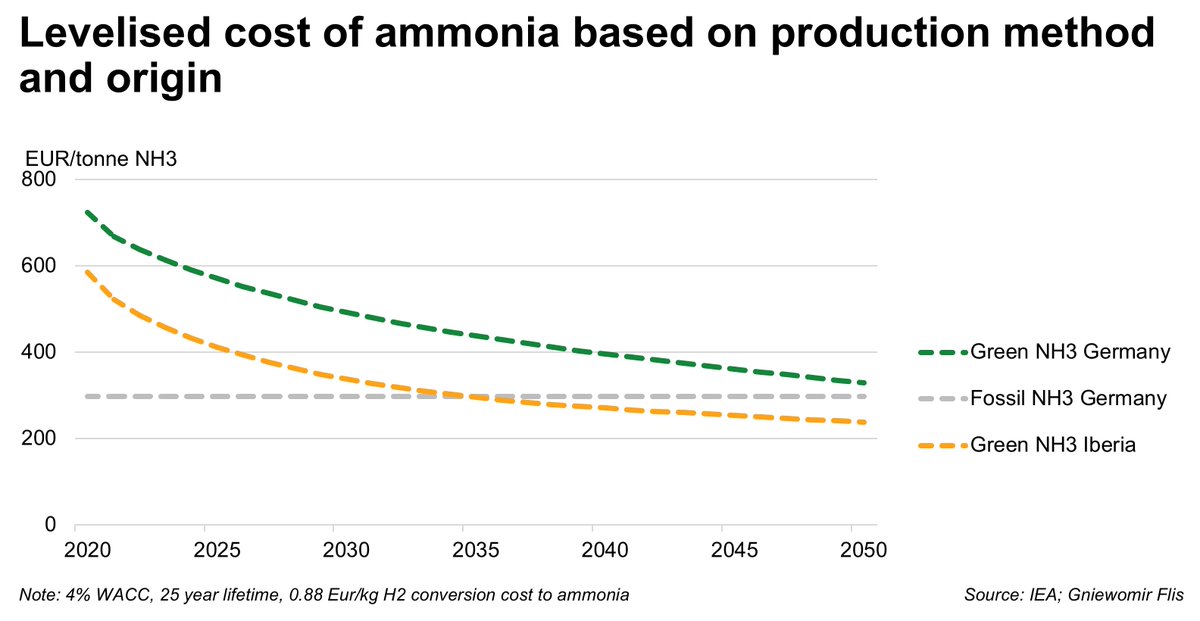

But forget about ammonia as a vector for a second, and treat it as a commodity instead. For instance, in Germany alone 22 TWh of ammonia are consumed per year.

Importing green ammonia from Iberia or North Africa is cheaper by 2035 than producing it domestically from gas!

10/18

Importing green ammonia from Iberia or North Africa is cheaper by 2035 than producing it domestically from gas!

10/18

So the first takeaway is that hydrogen as an end product does not lend itself well to shipping.

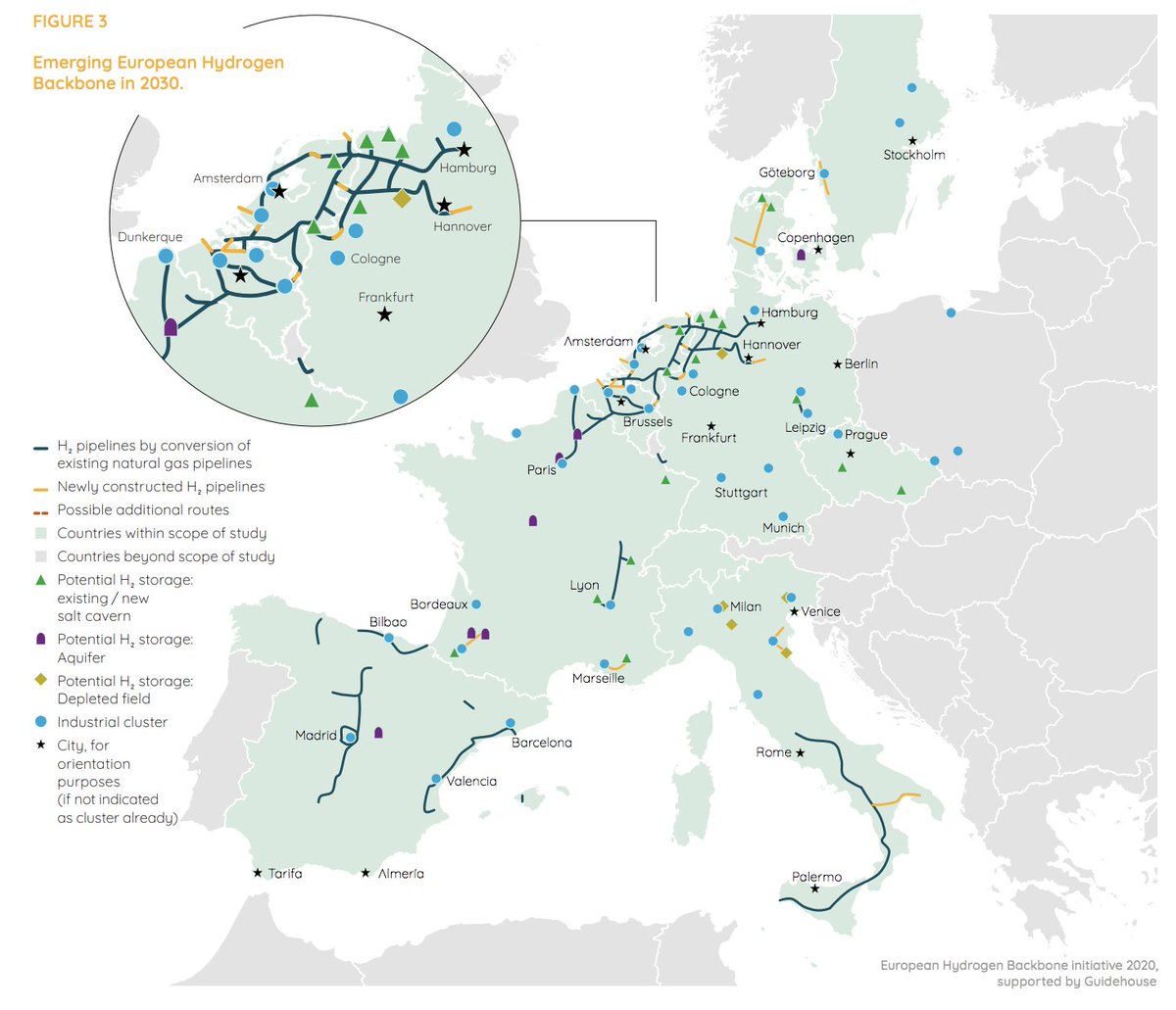

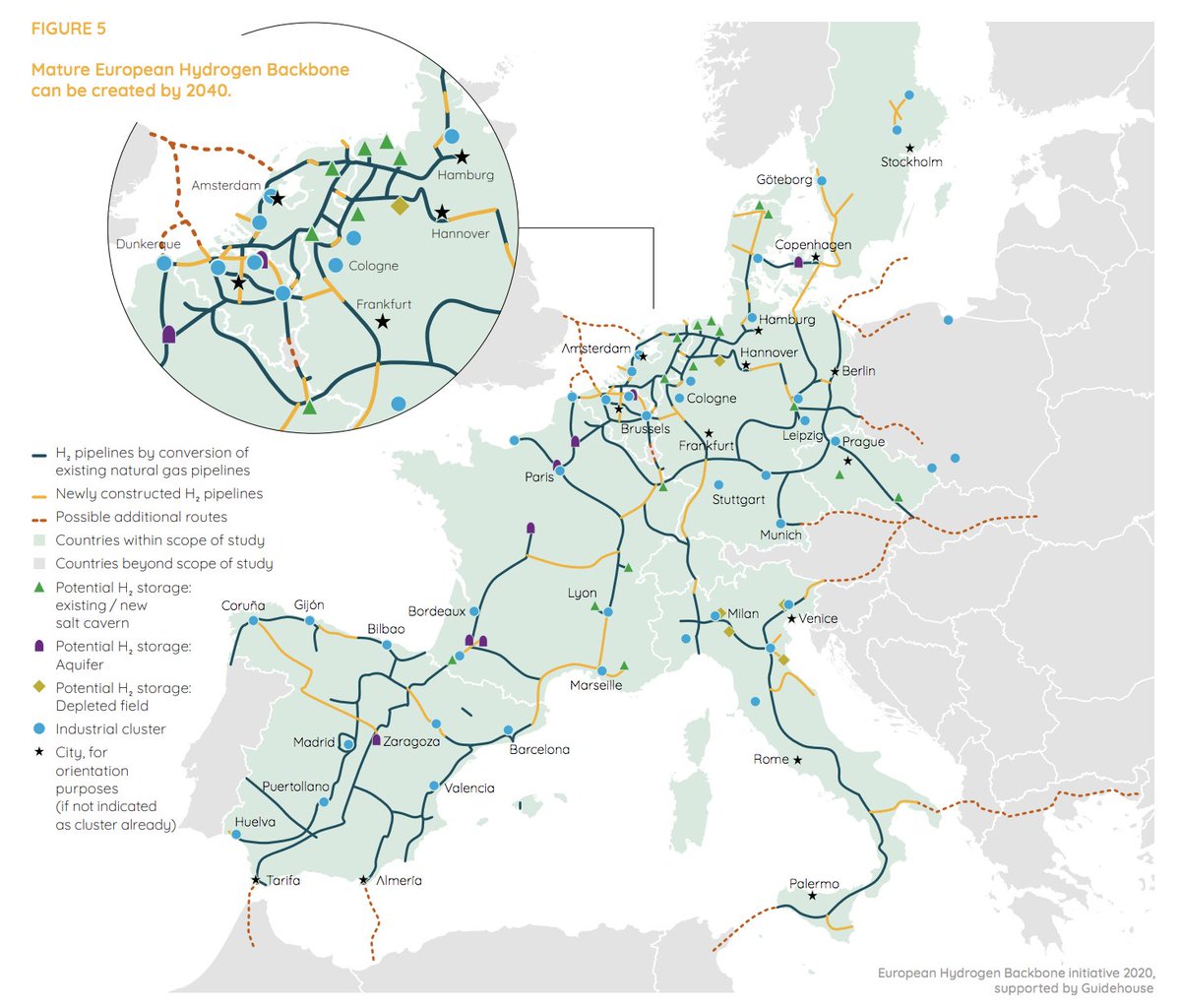

What about pipelines? In July a group of European TSOs came out with their suggestion of an European Hydrogen Backbone.

11/18

What about pipelines? In July a group of European TSOs came out with their suggestion of an European Hydrogen Backbone.

11/18

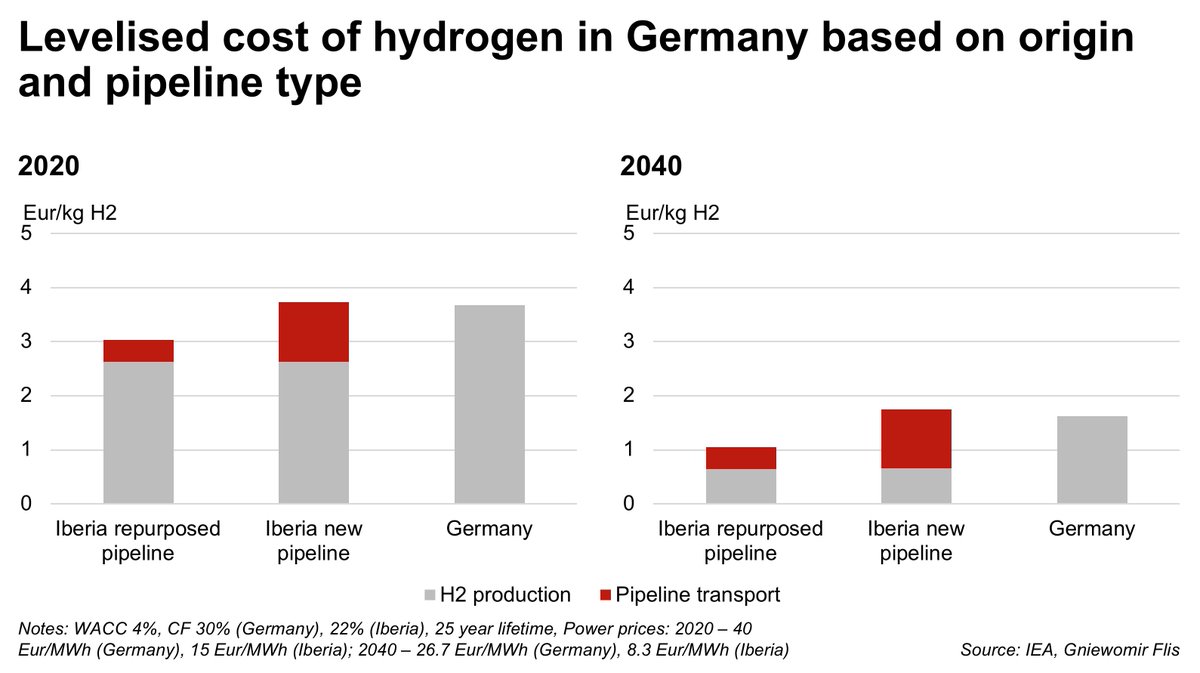

If the Backbone were all new-build, local production would be just slightly cheaper than Iberian imports. But repurposing the current European gas transmission network is, economically speaking, the cheapest of all.

So is the second takeaway pipelines are here to stay?

12/18

So is the second takeaway pipelines are here to stay?

12/18

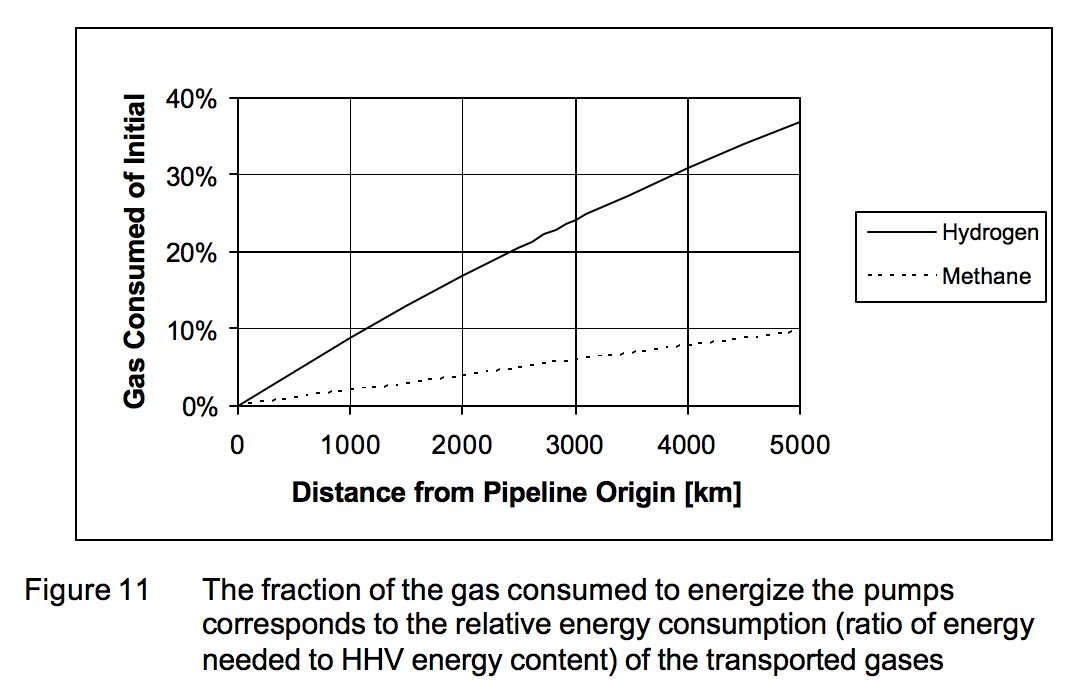

That’s one way of looking at it. But the energy transition is more than just economics. One of my concerns is the amount of energy lost along the way.

Additionally, Backbone remains unfinished until 2040. Will Europe wait this long to unlock full potential of hydrogen?

13/18

Additionally, Backbone remains unfinished until 2040. Will Europe wait this long to unlock full potential of hydrogen?

13/18

I’d like you to consider an alternative pathway, one where hydrogen plays a more distributed role. In my thinking, I am guided by this amazing animation from @BloombergNEF which shows how the average size of plant is shifting.

list.solar/news/bnefs-new…

14/18

list.solar/news/bnefs-new…

14/18

First, distributed plants like this Siemens project could satisfy local industry and power markets while relieving electrical grid bottlenecks. The benefits are more likely to remain local rather than exported. So important for a just transition.

15/18

15/18

https://twitter.com/h2_view/status/1309498993882398720

And what if the demand for hydrogen from building heat simply won’t materialise, even in North Europe? I’m not a heating expert, so take it from @heatpolicyrich : out of currently available options for heating, H2 is the most dubious.

16/18

16/18

https://twitter.com/heatpolicyrich/status/1309148768982437888

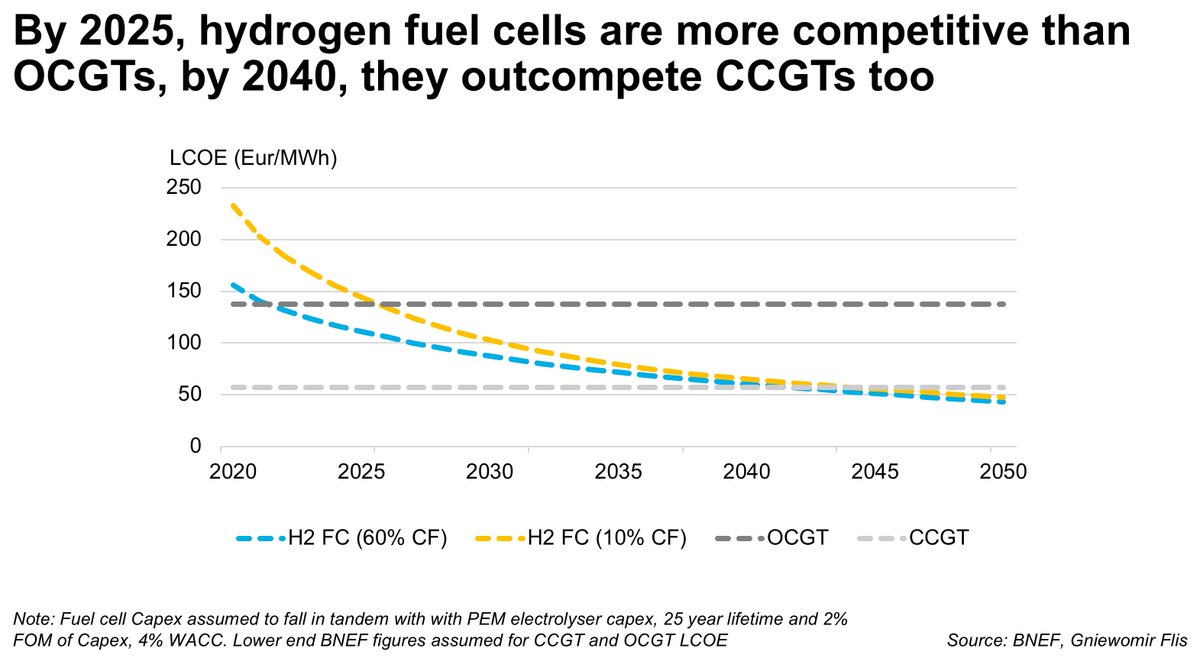

Finally, fuel cells might have the potential to outcompete gas turbines. I can imagine MW scale fuel cells scaled with local electrolysers to decarbonise power, and, where networks are available, district heating, well before the completion of the Backbone.

17/18

17/18

#H2 future looks good regardless. Ultimately time will tell if we end up with more distributed or centralised system. There are good arguments for both, which I urge you to consider next time you hear about H2 economy. Just don’t count on H2 shipping, at least in Europe.

18/18

18/18

If you liked this thread and want to stay ahead on hydrogen, I recently partnered with @terradotdo for a short course, starting October 5th. Scholarships available!

https://twitter.com/terradotdo/status/1310484137732571136?s=20

You'll find this thread interesting

@MLiebreich @ramez @AukeHoekstra @colinmckerrache @kobadb @JigarShahDC @azeem @simonahac @KetanJ0 @andreasgraf @ddiazpilas @AkshatRathi @Noahpinion @AlexSteffen @JMGlachant @Joaogalamba @jmpandera @noevanhulst @MathisWilliam @bryworthington

@MLiebreich @ramez @AukeHoekstra @colinmckerrache @kobadb @JigarShahDC @azeem @simonahac @KetanJ0 @andreasgraf @ddiazpilas @AkshatRathi @Noahpinion @AlexSteffen @JMGlachant @Joaogalamba @jmpandera @noevanhulst @MathisWilliam @bryworthington

An honourable mention here for @JustinHGillis who made the connection which led to this 😌

You too will find this thread interesting

@adam_tooze @bjornsimonsen @nworbmot @SamJamesMorgan @skorusARK @RichardHCNourse @RichardMeyerDC @Thorsten_H2 @AssaadRazzouk @hausfath @DrSimEvans @JKempEnergy @Josh_Gabbatiss @TristanEdis @Ed_Crooks

@adam_tooze @bjornsimonsen @nworbmot @SamJamesMorgan @skorusARK @RichardHCNourse @RichardMeyerDC @Thorsten_H2 @AssaadRazzouk @hausfath @DrSimEvans @JKempEnergy @Josh_Gabbatiss @TristanEdis @Ed_Crooks

• • •

Missing some Tweet in this thread? You can try to

force a refresh