I've been thinking about the dangers of shorting long-dated options. These options cost more mostly due to their additional time value. Recall an option’s value = intrinsic value + time-value, therefore options with more time left will cost more.

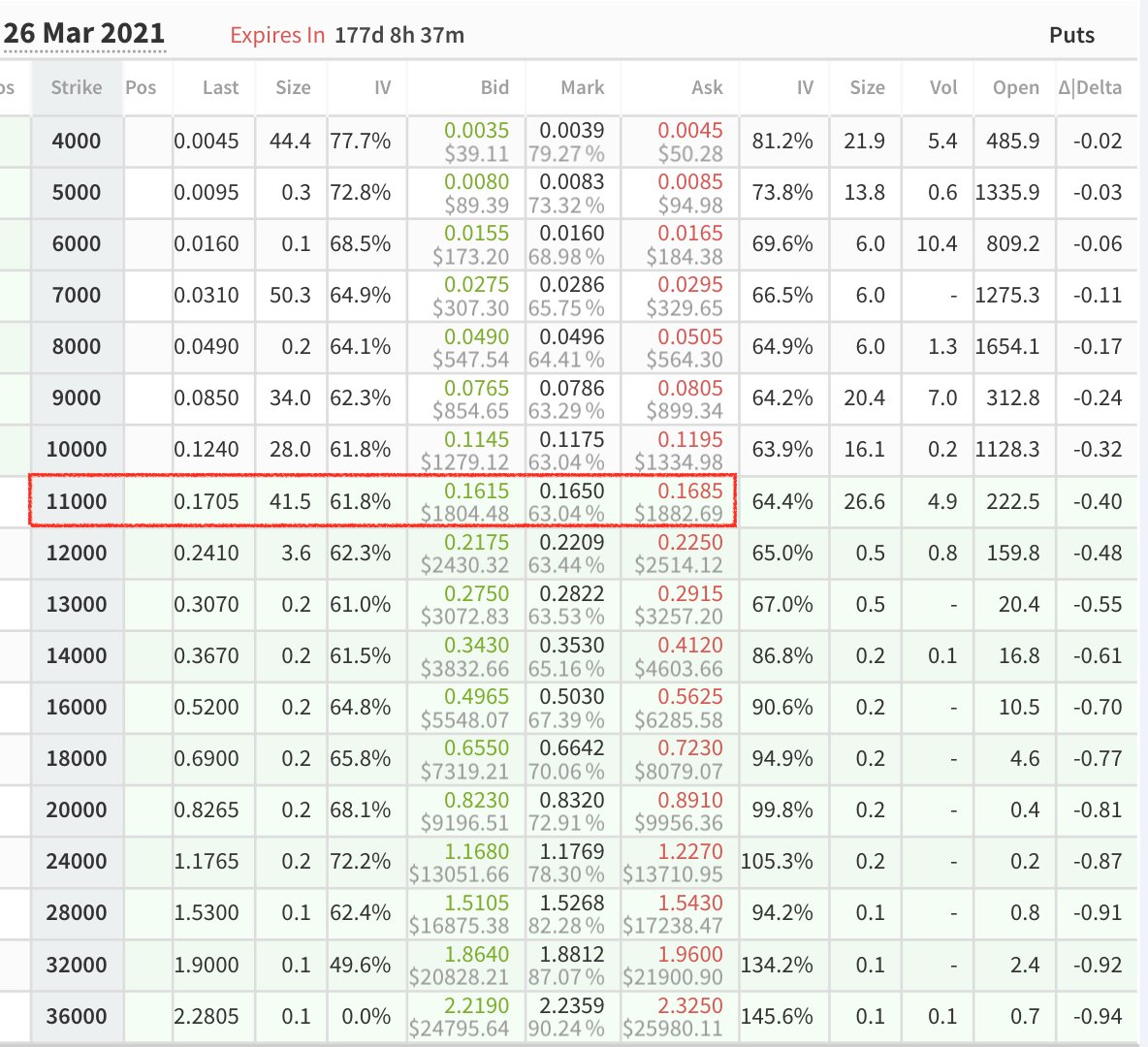

Below are put prices for Oct-2020/11k vs. March-2021/11k. Despite both being OTM, March costs ~3x more than Oct. This is because the March option has 177 days vs. Oct only having 30 days left. March allows us to have optionality for 147 more days which is reflected in its price.

It can be tempting to short these longer-dated options given their higher premium. If all goes to plan and these options expire OTM, then there is a nice premium which can be collected (or as the saying goes these days - we can "harvest" these premiums).

One key thing about longer dated options is they are much more sensitive to changes in implied vol (larger vega) relative to shorter maturities. If #BTC IV were to jump higher for any reason, shorting these longer dated options could be disastrous.

On the flip-side, if you think IV will go up, then you can use a ratio like vega/theta to assess which option will give you the best “bang for buck”.

In that case, we want to maximize vega and minimize theta. Vega is how much our option value changes for a small change in IV. Theta is how much time decay we incur on a daily basis. What we want here is to pay less in theta to bet on higher volatility.

Vega/theta ratios get progressively higher as we move to longer maturities near ATM. If the goal is to bet on higher IV, these longer maturities may offer the best value. Conversely, these maturities also represent the greatest risk in shorting based on an IV perspective.

Note: the scale on the y-axis is normalized to make this plot easier to visualize. Also, for easier interpretation, here we used the absolute value of the vega/theta ratio as theta is negative when buying options.

• • •

Missing some Tweet in this thread? You can try to

force a refresh