Crypto derivatives quant researcher | Canadian CPL with Group 1 IFR

6 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/0xHamz/status/1623105360469843968

2. Let’s start with a brief overview of the DeFi options space - TVL in 2020 was virtually non-existent but blew up to nearly $1B at the start of 2022. This was primarily due to the surge of activity within the DeFi structured products space. Data Source: @DefiLlama

2. Let’s start with a brief overview of the DeFi options space - TVL in 2020 was virtually non-existent but blew up to nearly $1B at the start of 2022. This was primarily due to the surge of activity within the DeFi structured products space. Data Source: @DefiLlama

2. Why learn solidity in the first place? These were a few of my reasons:

2. Why learn solidity in the first place? These were a few of my reasons:

2. Full research report and repo for those interested in the details:

2. Full research report and repo for those interested in the details:

2. The current spread between these expiries seems larger expected especially for maturities 1-2 months out. This led me to look into the historical spreads for a range of maturities to assess how to think about the current spread.

2. The current spread between these expiries seems larger expected especially for maturities 1-2 months out. This led me to look into the historical spreads for a range of maturities to assess how to think about the current spread.

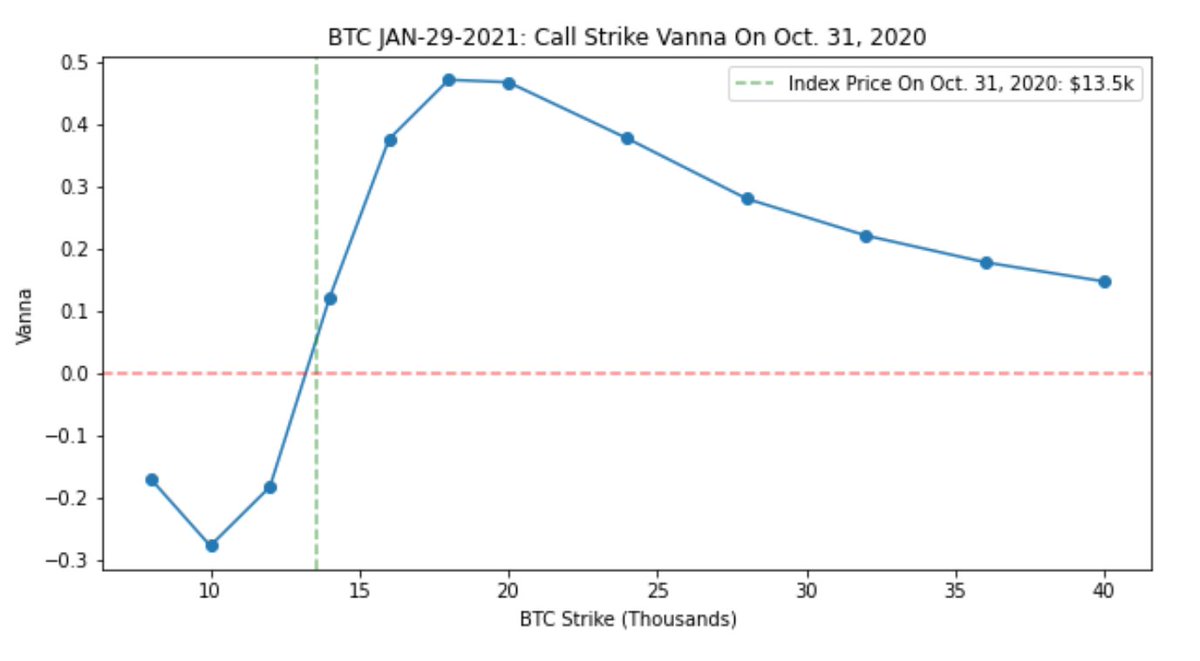

https://twitter.com/GenesisVol/status/13489843035485716502. The $36k JAN-29-2021 calls began trading on @DeribitExchange on Oct. 31, 2020 and had an initial delta of around 3%. At this time, BTC’s index price was trading around $13.5k. On this date, it seemed like a long shot that prices could do a ~3x within 90 days.

https://twitter.com/samchepal/status/1327493648032948224