Some good news: 🥂

1/ Health Insurance becomes better, clearer, cooler from today😎

A quick thread that explains the changes.

#Thread

1/ Health Insurance becomes better, clearer, cooler from today😎

A quick thread that explains the changes.

#Thread

2/ **Why was this needed**

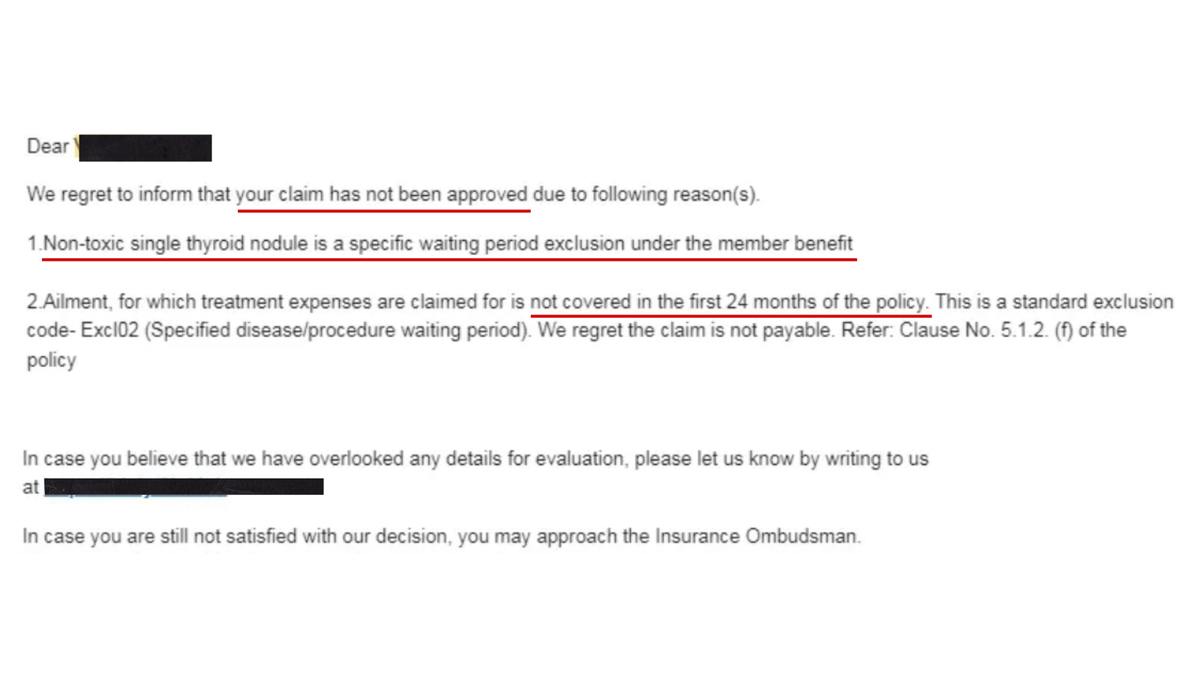

Every plan has its own independently designed terms and conditions, especially exclusions. 🙄

It was difficult to understand & compare many of these wordings. This also resulted in unpleasant surprises & grievances during claims.

Every plan has its own independently designed terms and conditions, especially exclusions. 🙄

It was difficult to understand & compare many of these wordings. This also resulted in unpleasant surprises & grievances during claims.

3/ IRDAI has been taking massive efforts to standardize health insurance products, making them easier to understand and compare, helping reducing confusion and grievances.

This is another effort from IRDAI. 💪💪

This is another effort from IRDAI. 💪💪

4/ **Important**

These changes are applicable to all policies - existing and new from today - 1st October 2020.

In case you already own a policy that is due for renewal, these changes may take effect at the time of renewal.

These changes are applicable to all policies - existing and new from today - 1st October 2020.

In case you already own a policy that is due for renewal, these changes may take effect at the time of renewal.

5/ **Standard definitions for 18 exclusions**

IRDAI standardized definitions of the 18 most common exclusions like pre-existing diseases etc.

These terms will now have standard wordings across all health insurance plans across the country.

IRDAI standardized definitions of the 18 most common exclusions like pre-existing diseases etc.

These terms will now have standard wordings across all health insurance plans across the country.

6/ **Disallow❌ambiguous definitions**

For exclusions that do not form part of the standard definitions - IRDAI now disallows ambiguous words in defining exclusions - for instance, the exclusions now cannot use open-ended words like "such as", "indirectly related to"

For exclusions that do not form part of the standard definitions - IRDAI now disallows ambiguous words in defining exclusions - for instance, the exclusions now cannot use open-ended words like "such as", "indirectly related to"

7/ **Disallow❌ insurers to put certain exclusions**

Health insurance will now cover treatments like mental illnesses, artificial life maintenance, Internal congenital diseases, genetic disorders (these were earlier excluded)

Health insurance will now cover treatments like mental illnesses, artificial life maintenance, Internal congenital diseases, genetic disorders (these were earlier excluded)

8/ **8 years⏲️of moratorium**

Earlier, insurers canceled policies, rejected claims on the grounds of misrepresentation even after customers had paid premium for decades.

Now, insurers cannot contest the policy or its declarations after 8 yrs, unless they prove a fraud.

Earlier, insurers canceled policies, rejected claims on the grounds of misrepresentation even after customers had paid premium for decades.

Now, insurers cannot contest the policy or its declarations after 8 yrs, unless they prove a fraud.

9/ *Widening access to health insurance*

Insurers found it unviable to give insurance with preexisting cover to ppl with a history of Cancer, Epilepsy even with 48 mth waiting period

Now, such people may get access to health insurance with a permanent exclusion on the disease

Insurers found it unviable to give insurance with preexisting cover to ppl with a history of Cancer, Epilepsy even with 48 mth waiting period

Now, such people may get access to health insurance with a permanent exclusion on the disease

10/ **Modern😎Treatment like Stem Cell Therapy included**

Many insurers did not cover Oral Chemo, robotic surgeries, stem cell therapy, and many more modern treatments.

IRDAI lists down 12 modern treatments that will now be covered under all health insurance policies.

Many insurers did not cover Oral Chemo, robotic surgeries, stem cell therapy, and many more modern treatments.

IRDAI lists down 12 modern treatments that will now be covered under all health insurance policies.

IRDAI right now.

If you have any questions, please ask here.

beshak.org/forum

(Average time to get an answer: 3 hrs - you will get a notification)

beshak.org/forum

(Average time to get an answer: 3 hrs - you will get a notification)

• • •

Missing some Tweet in this thread? You can try to

force a refresh