1/ Spent some time exploring the market implied distribution for #BTC options trading on @DeribitExchange. This was a bit trickier than I expected but learned some interesting things along the way...

2/ I came across a closed form risk-neutral probability density (RND) solution from @EGHaug's detailed book on options pricing. I was surprised to learn that the RND is just the 2nd derivative of the option value wrt strike price. For those interested below is the formula.

3/ The limited number of options for #BTC Dec-25-2020 required me to linearly interpolate the IV across theoretical strikes. Instead of just 18 actual IV values, now we are able to estimate nearly 3,000+ IV data points as shown below. This will allow for a smoother RND plot.

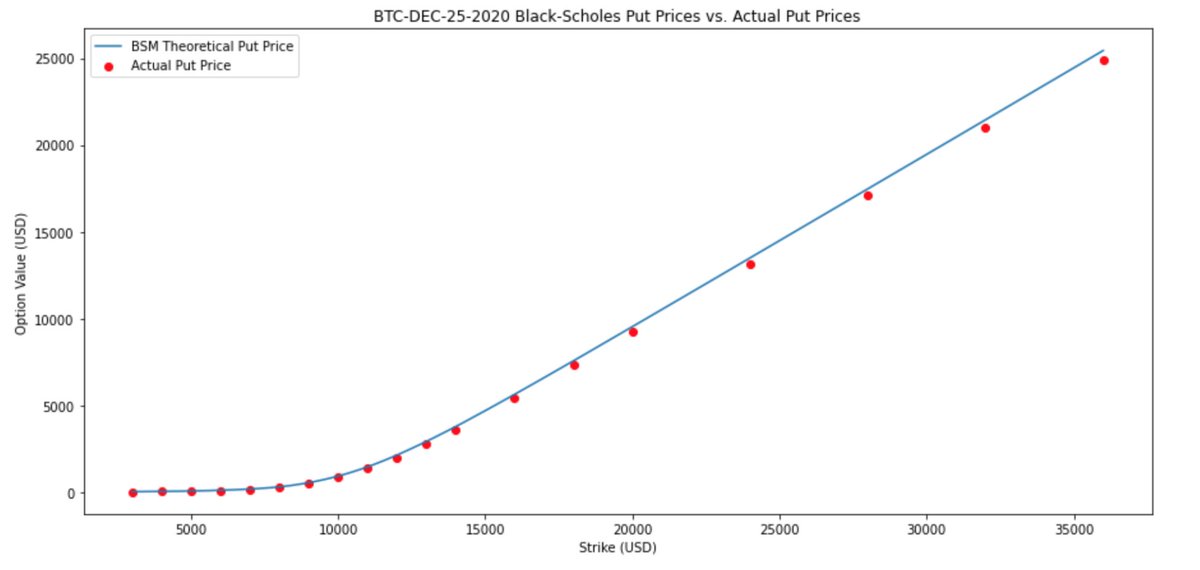

4/ Another way to look at it - taking our 3,000+ estimated IVs, we can throw them into BSM and see how theoretical put values compare to actual @deribit put prices. The estimation for IV was good at lower strikes but less accurate the farther we go out.

5/ Using the formula described in step 2, we can calculate the RND (assuming zero interest rates). After running this formula across each strike, we can see the end result is similar to a log-normal distribution.

6/ RND is the 2nd derivative of the option value wrt strike whereas gamma is the 2nd derivative of the option value wrt spot. As a result, it's nice to see both of them having similar shapes when plotted together.

7/ Thanks to @JSterz for suggesting to explore market implied distributions. Thoughts or suggestions on this analysis? @vkik94 , @rambo1stbld, @ConvexMonster, @BitcoinMises.

• • •

Missing some Tweet in this thread? You can try to

force a refresh