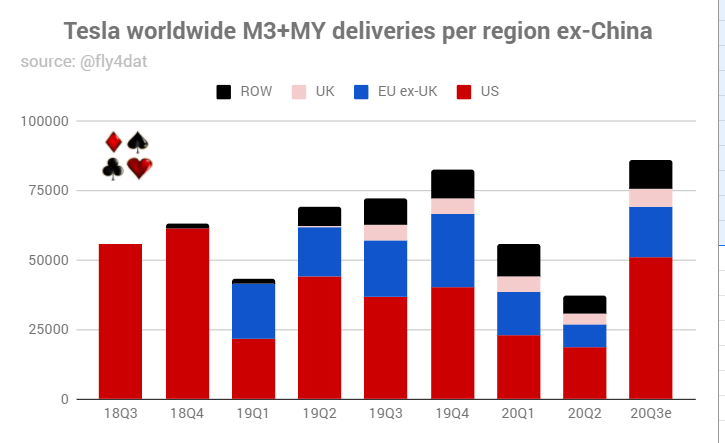

1/ #Tesla reported 124.1k M3Y deliveries in Q3. A year ago it was 79.6k, a growth of 44.5k. Without China, these #'s would be ~86.1 vs 72k, a growth of 14.1k.

But wait, that includes Model Y!

$TSLA $TSLAQ

But wait, that includes Model Y!

$TSLA $TSLAQ

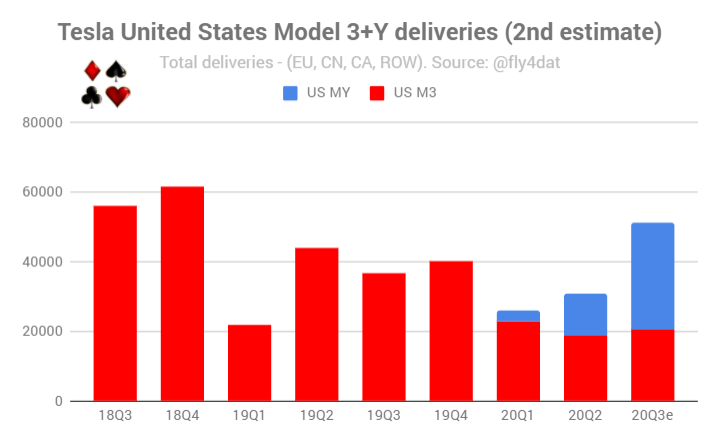

2/ Y was sold in the US only.

Based on reliable sources, around 60% of US sales was MY. That leaves us with the 2nd worst M3 figure for the US 2018 Q2, besting only pandemic-influenced 20Q2 by a hair.

Based on reliable sources, around 60% of US sales was MY. That leaves us with the 2nd worst M3 figure for the US 2018 Q2, besting only pandemic-influenced 20Q2 by a hair.

3/ $TSLA got a pass in Q2 because of COVID shutdowns. If that left a backlog (real, as orders couldn't have been filled, or implied, as many buyers could have delayed purchases), that means that even with MY, Tesla couldn't grow in the US.

4/ Europe saw a ~100% YoY BEV market growth (and a ~200% PHEV growth). Yet, Tesla likely couldn't repeat 19Q3.

ROW is around flat.

$TSLA could only grow in China.

$TSLAQ

ROW is around flat.

$TSLA could only grow in China.

$TSLAQ

5/ Tesla made <90k M3Y in Fremont. They have a capacity of 100-125k.

$TSLA isn't production constrained.

$TSLAQ is demand constrained.

No growth in US, EU, ROW, despite price cuts. China will see base YoY comps in 21Q2. Tons of competition in EU and CN, US bit later. Good luck.

$TSLA isn't production constrained.

$TSLAQ is demand constrained.

No growth in US, EU, ROW, despite price cuts. China will see base YoY comps in 21Q2. Tons of competition in EU and CN, US bit later. Good luck.

* since 2018 Q2.

6/ ERRATA: MY was sold in North America, not only the US. Honestly, from Europe, Canada looks just like the US without Trump and Miami.

• • •

Missing some Tweet in this thread? You can try to

force a refresh