India’s growth momentum picks up in September.

Check out our latest Macroeconomics of COVID in India series with @tulsipriya_rk

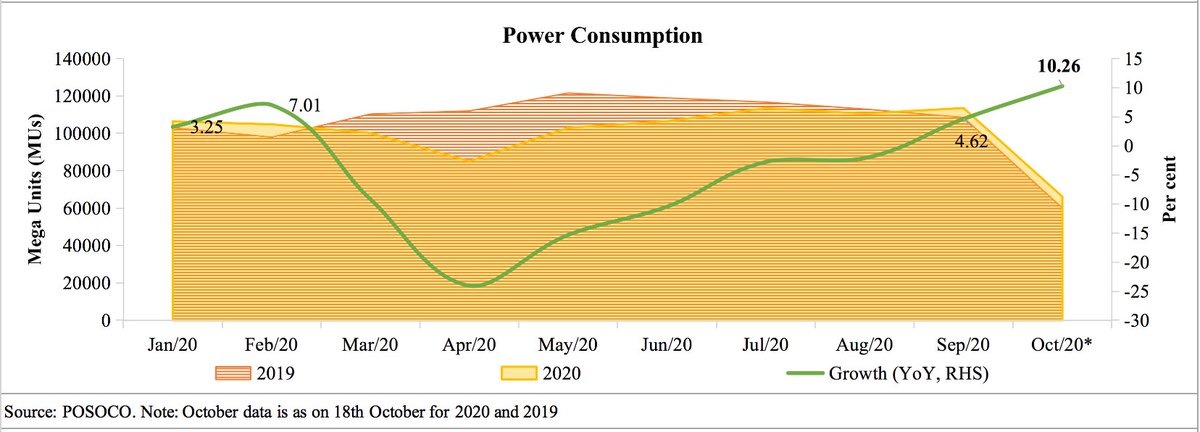

E-Way bills and consequent GST collections alluding to steady recovery as economy unlocks amid headwinds of sustained virus spread and rising prices.

Check out our latest Macroeconomics of COVID in India series with @tulsipriya_rk

E-Way bills and consequent GST collections alluding to steady recovery as economy unlocks amid headwinds of sustained virus spread and rising prices.

Rail freight clocking positive YoY growth for first time since March in August and early Sep, passenger earnings recovering, port cargo, domestic aviation traffic up- expected to pick up in upcoming festive months

Average daily ETC also increasing to pre Covid February levels in September, providing further evidence of economy gaining normalcy as E-way bills also pick up.

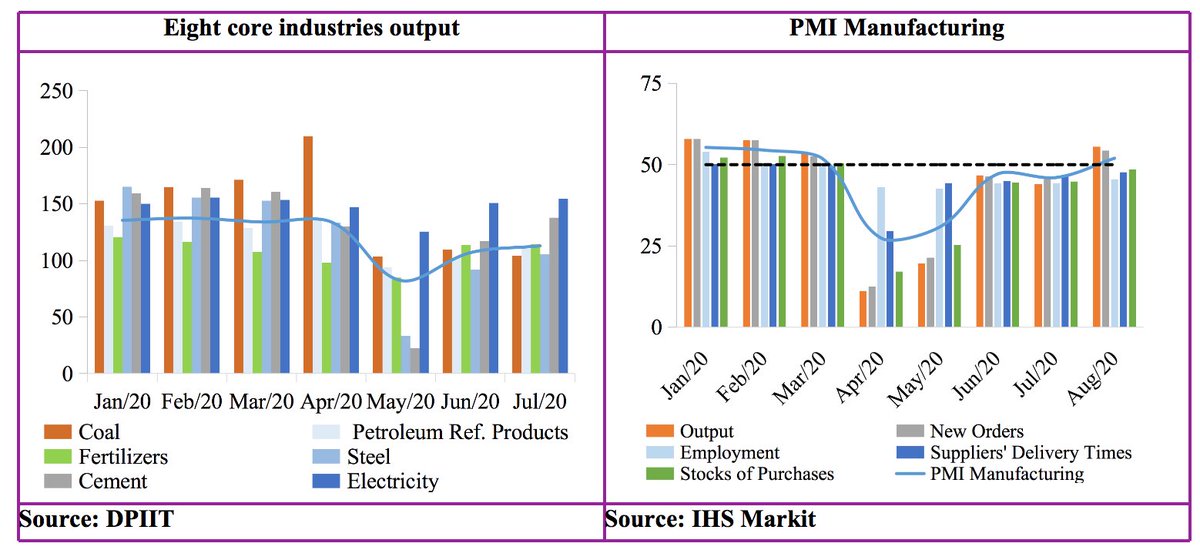

India’s manufacturing PMI in expansionary territory since 2 months, reaches eight year high in Sep- auguring well for economic expansion in coming months

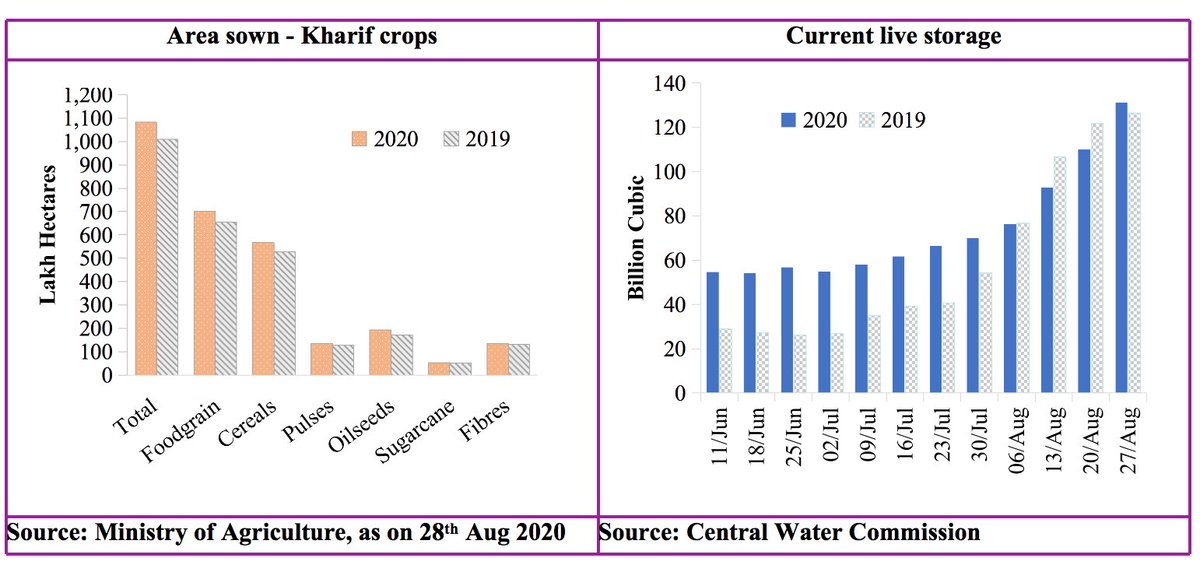

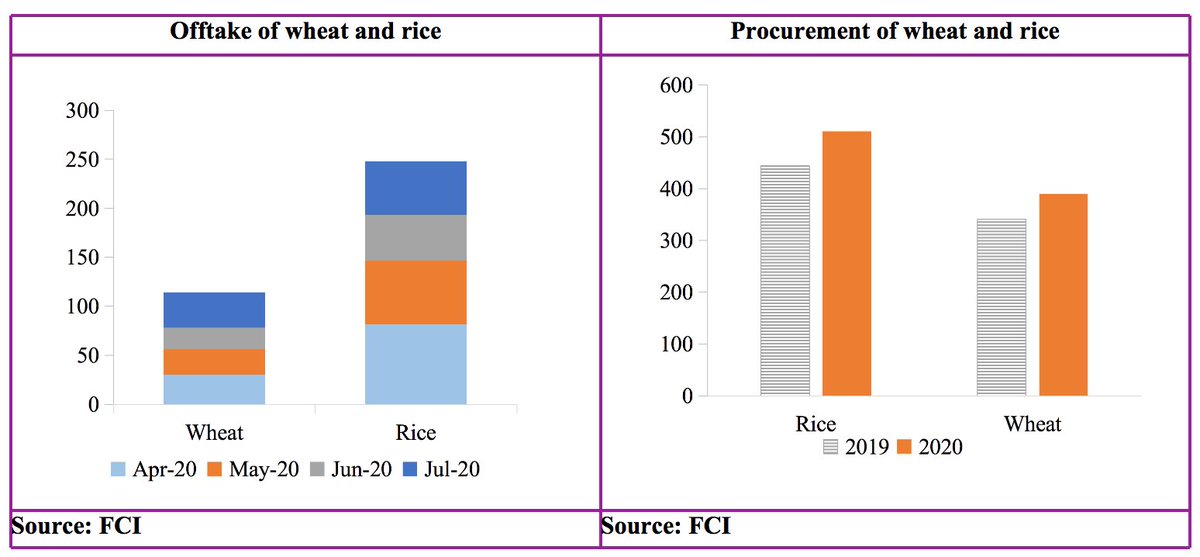

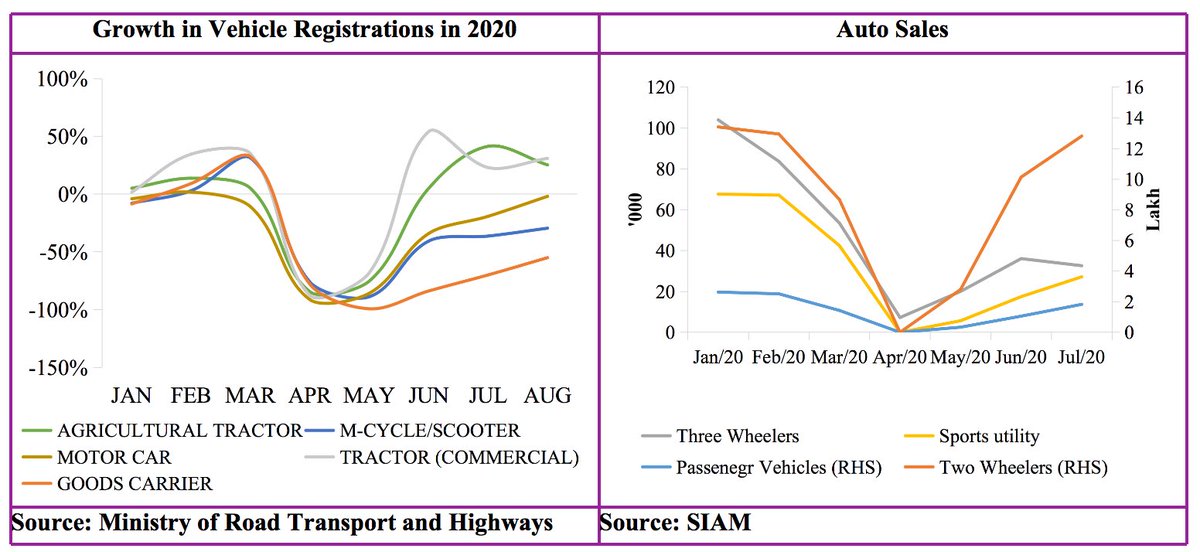

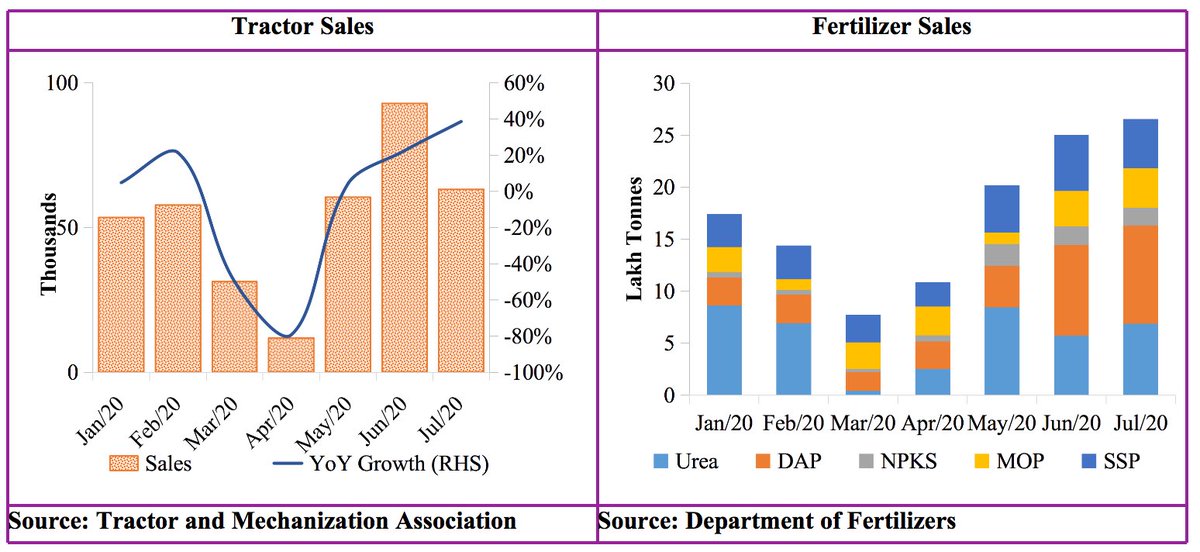

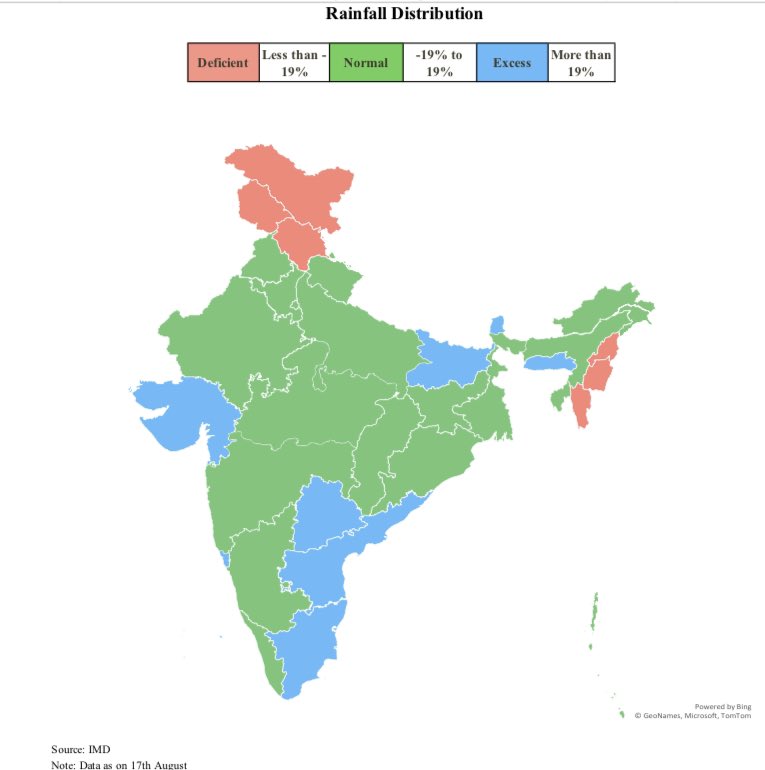

Agriculture remains economy’s sweet spots, strengthening prospects of rural demand, auto demand regaining previous year levels.

Recovery in oil markets remains shaky with consumption growth of petroleum products dipping in August and Sep and oil prices declining in Sep after mild recovery

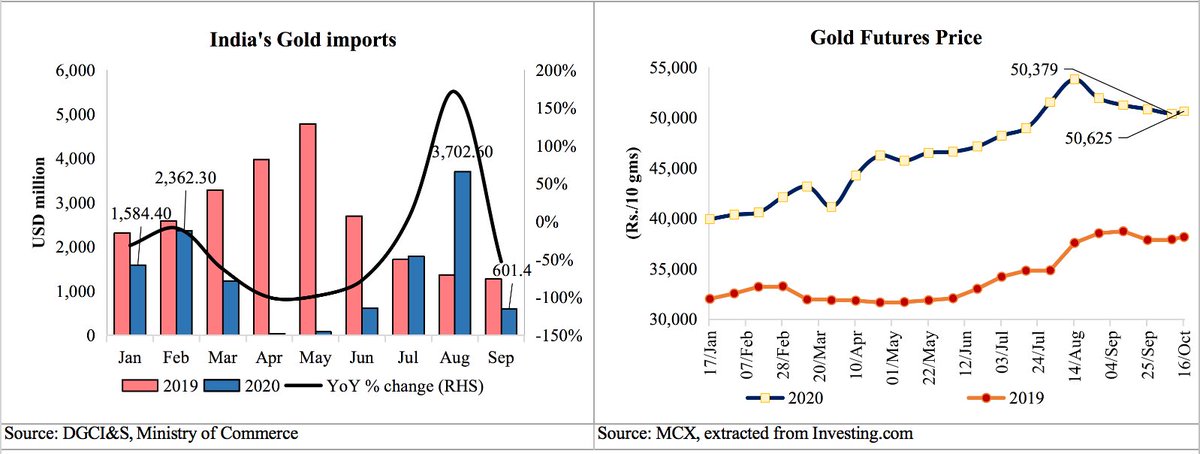

Increase in global demand translates into India’s exports growing at a positive rate of 5.3 per cent in Sep , for the first time since March. Imports growth contraction also reduces in Sep vis-à-vis Aug, trade deficit narrows with exports recovering faster than imports.

FER remain high at $542.02 bn under robust FDI inflows in July and resurgence in portfolio debt appetite in Sep. RBI continues to intervene to prevent excess rupee appr. and imported inflatn, FPI equity volatile, rupee depr. in late Sep under strong dollar and rising Covid risks

Domestic liquidity stays high- translating into high demand and time deposits, issue of rising precautionary savings which, are, in turn, limited personal consumption growth and acceleration in activity levels

Credit growth remains muted mirroring weak demand and high risk aversion, uptick in credit growth, however, to MSME enterprises and trade services, with the former partly attributed to Government’s ECLGS scheme under AN package

Increase in fiscal deficit to Rs. 8.70 lakh crore, 109.3 per cent of BE, an inevitable increase in government spending to arrest growth contraction and fall in gross tax revenue.

Prices under pressure in Aug amid local lockdown induced supply disruptions, likely to smoothen out as the economy opens up further. Bond yields remain in check despite rise in borrowing owing to RBI’s OT, TLTROs and relaxation in HTM limits,stiffening pressures in end-September

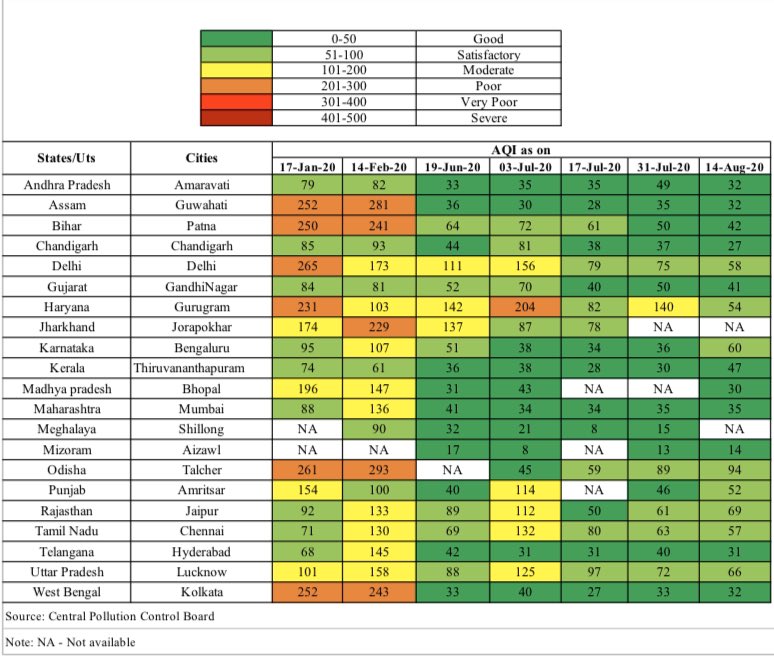

The sustained spread of the virus poses a downside risk to short-term and medium-term growth rate. Some hopes of peaking, however, arise.

To combat these risks, Government has strategically undertaken various structural reforms- expected to strengthen economy’s fundamentals.

To combat these risks, Government has strategically undertaken various structural reforms- expected to strengthen economy’s fundamentals.

*4.6 per cent YoY in Sep.

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh