I’m getting this question a lot. Where will inflation come from? What will cause it to rise?

I know the opinions on inflation are many and varied, but here’s my take.

A thread.

I know the opinions on inflation are many and varied, but here’s my take.

A thread.

https://twitter.com/floridafruitgod/status/1315046851314360321

1- We’re seeing a massive and unprecedented expansion of the money supply, and at at alarming rates. I don’t care what you think about M2, this sort of growth should not be dismissed.

Longer term, this will shape up to be ‘Project Zimbabwe’, as @hkuppy has coined it.

Longer term, this will shape up to be ‘Project Zimbabwe’, as @hkuppy has coined it.

2- While this sort of monetary inflation first manifests in the capital markets (most noticeably as a boom in stocks), it eventually raises the prices of goods & services too (imperfectly proxied by CPI).

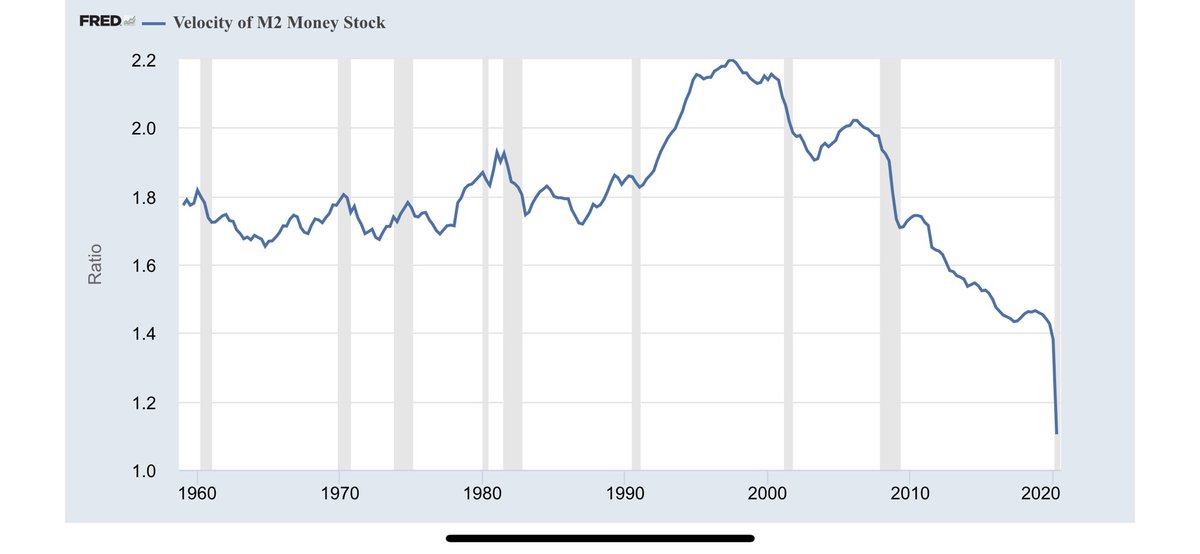

For this to happen, we need higher money velocity, now at an all-time low:

For this to happen, we need higher money velocity, now at an all-time low:

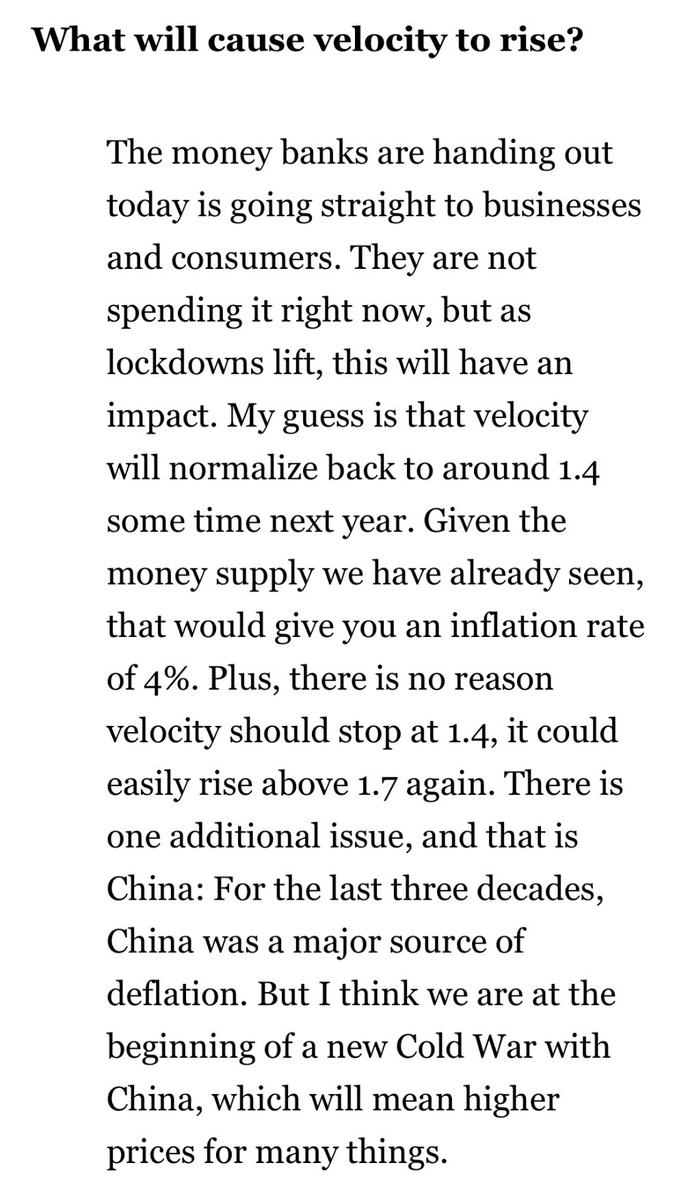

3- Looking ahead, I believe there are a few tailwinds for velocity.

For one, the shift from monetary stimulus (which doesn’t much contribute to velocity) to fiscal stimulus (which gets money moving) will push velocity higher and be more successful at stoking price inflation.

For one, the shift from monetary stimulus (which doesn’t much contribute to velocity) to fiscal stimulus (which gets money moving) will push velocity higher and be more successful at stoking price inflation.

3A- Russel Napier discusses this in greater detail in this linked article:

themarket.ch/interview/russ…

themarket.ch/interview/russ…

4- Also important is that velocity is not linear. By extension, neither is inflation.

That’s what the no-velocity guys overlook; people cause velocity. So what happens when people begin to suspect that prices will rise and continue rising in the future?

That’s what the no-velocity guys overlook; people cause velocity. So what happens when people begin to suspect that prices will rise and continue rising in the future?

4A- Well, they’ll probably start spending more on the things they‘ll need in the future in order to cut their losses.

This inclination to spend more now would then push money velocity higher and prices of goods & services would follow.

@GaricMoran says it well:

This inclination to spend more now would then push money velocity higher and prices of goods & services would follow.

@GaricMoran says it well:

https://twitter.com/garicmoran/status/1314686671632379911

5- In sum, higher price inflation is on the horizon, and longer term, everything’s going up up up, Zimbabwe-style:

HT @hkuppy @GaricMoran @jam_croissant @profplum99 @coloradotravis @SantiagoAuFund @vol_christopher

As usual, always appreciate criticisms/thoughts/feedback.

As usual, always appreciate criticisms/thoughts/feedback.

• • •

Missing some Tweet in this thread? You can try to

force a refresh