How to get URL link on X (Twitter) App

https://twitter.com/dyer440/status/14175546435262464041- There’s very little substance in the thread, so not much to push back on. But note that he talks about weak Q1 FCF without having read the 10Q: it states that the hit to cashflow was a result of ~180k tons worth of coal shipment delays that will be deferred till later in 2021:

1- Coal has fallen out of favour in recent years for two main reasons:

1- Coal has fallen out of favour in recent years for two main reasons:

https://twitter.com/gsrevelator/status/13982795780874608681- Coal prices are up significantly this year as NatGas has rallied enough to trigger substantial coal/gas switching.

https://twitter.com/bvddycorleone/status/1383859373236121611

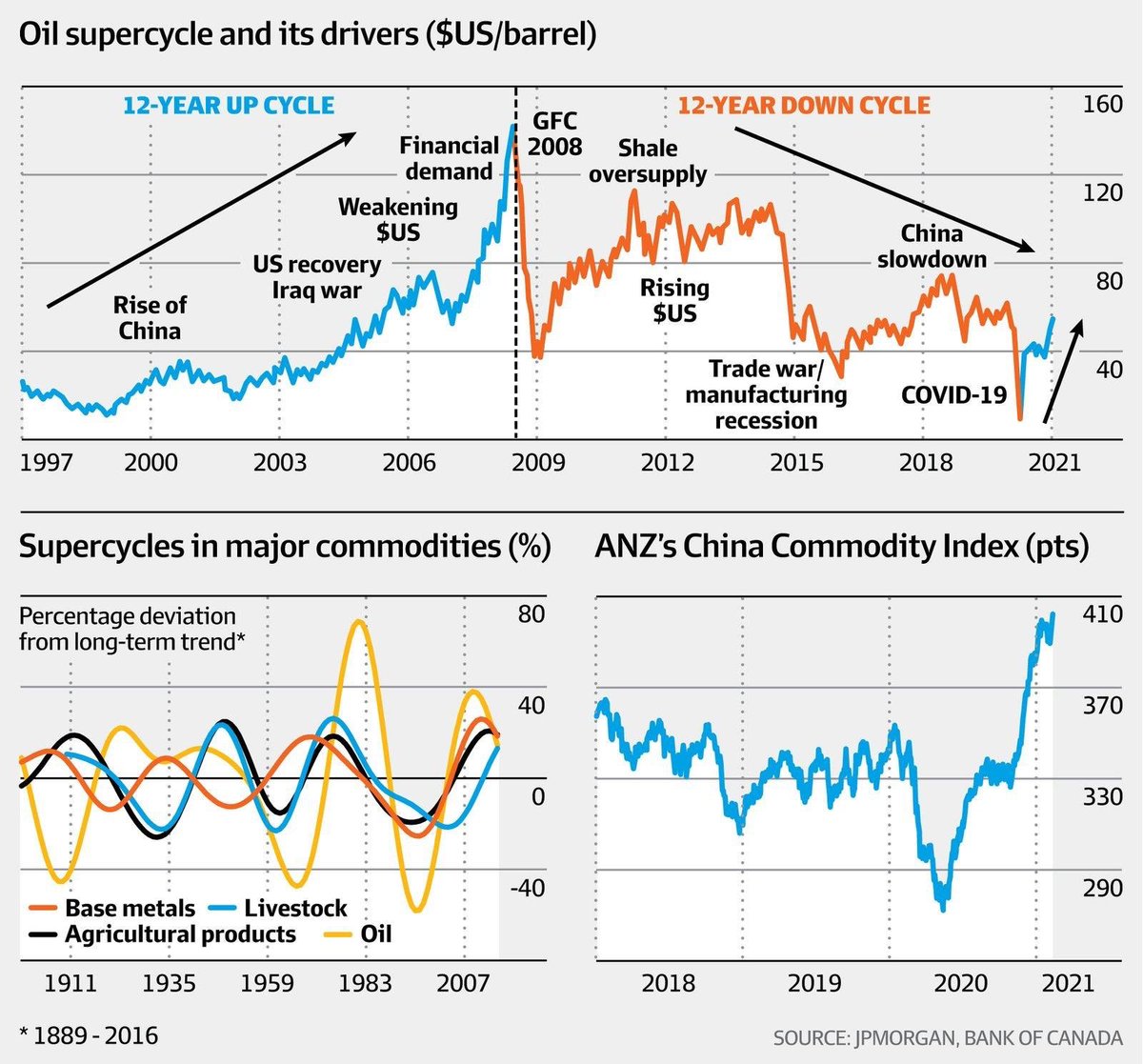

1- The US has become the top oil-producing country in the world, accounting for almost 75% of the increase in global oil production over the last decade or so.

1- The US has become the top oil-producing country in the world, accounting for almost 75% of the increase in global oil production over the last decade or so.

https://twitter.com/bvddycorleone/status/1354541615713574912Disclaimer: Nothing in this thread is original. The credit is owed entirely to @Josh_Young_1 @BisonInterests for discovering it. He was gracious enough to put it on my radar a few days ago.

https://twitter.com/bvddycorleone/status/1333199105951195139

1- Let’s first think about this purely from a fundamental valuation (DCF) perspective:

1- Let’s first think about this purely from a fundamental valuation (DCF) perspective:

https://twitter.com/BvddyCorleone/status/1316441107308457984See here for more.👇

https://twitter.com/bvddycorleone/status/1329915650555383817

https://twitter.com/macrovoices/status/13397283592580096041- Asked about inflation, Kyle said that he’s “offended by the fact that people out there don’t believe we have inflation already. We’ve seen enormous inflation,”

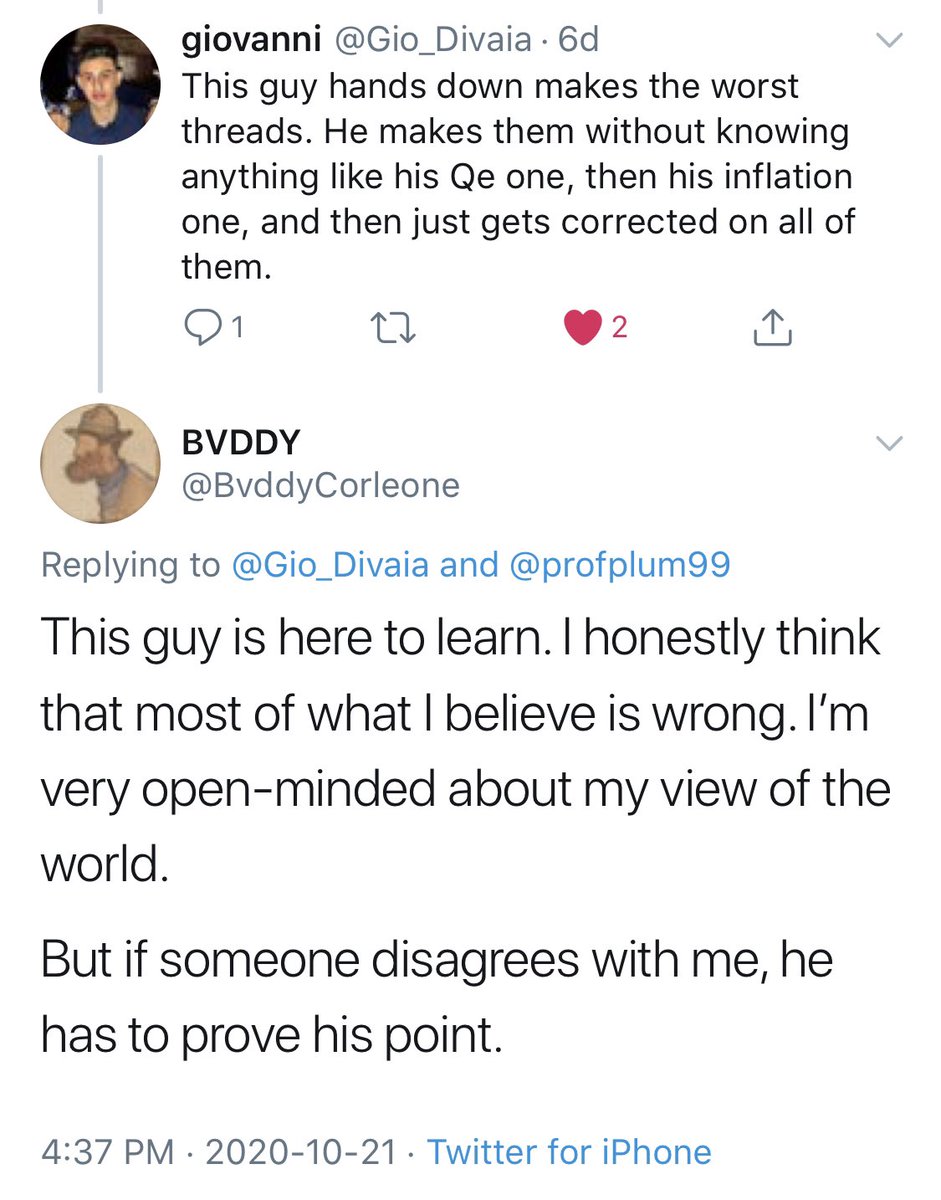

https://twitter.com/bvddycorleone/status/1333199105951195139As @profplum99 has noted, Growth & Momentum have become (temporary) partners, as have Value & Anti-Momentum.

https://twitter.com/profplum99/status/1331298161013362689

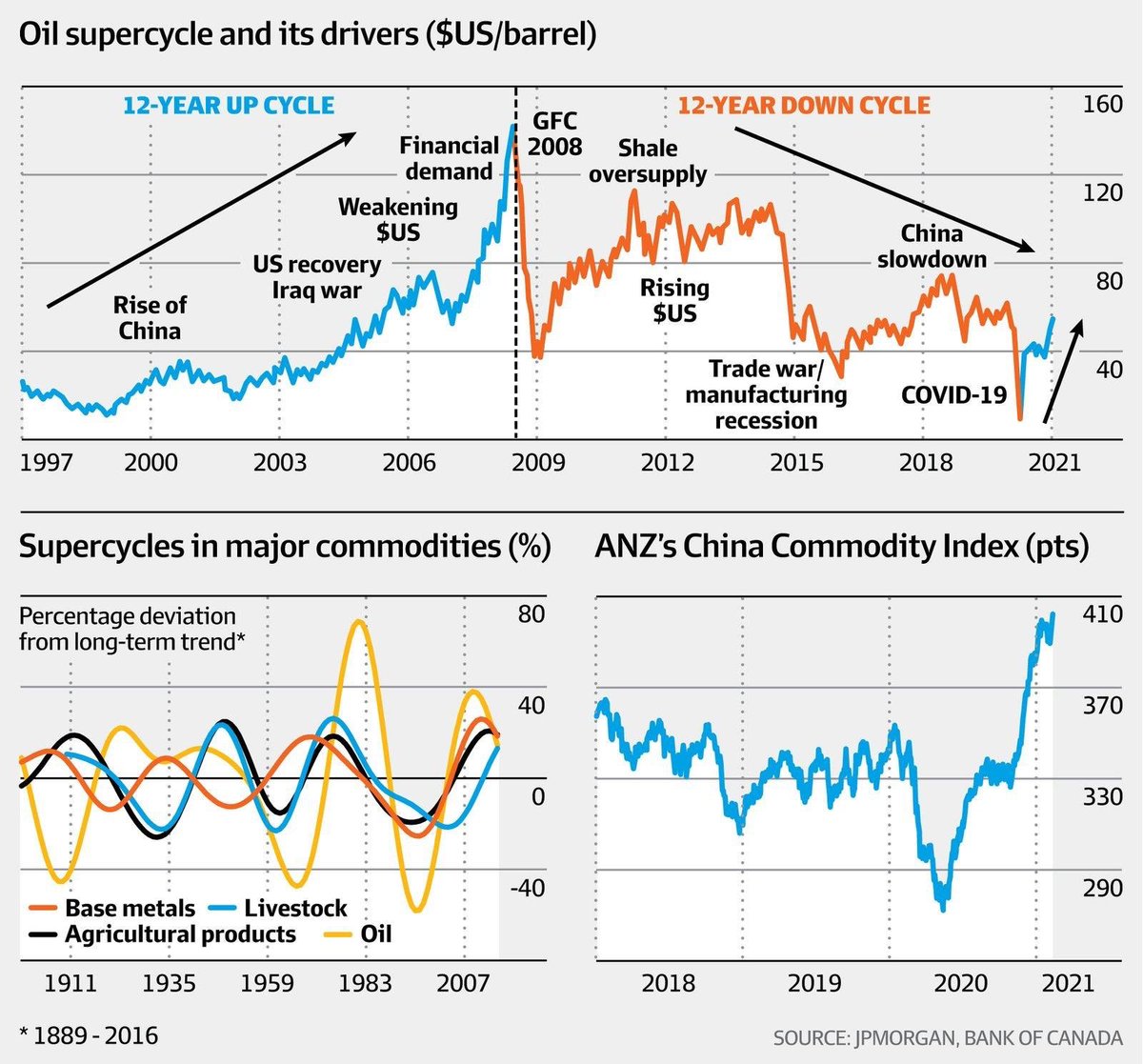

https://twitter.com/bvddycorleone/status/13073506162394931211- Over the summer, we got multiple “tremors” in the QQQ/IWN spread; there were multiple days in which the spread blew out by 250bps or more.

https://twitter.com/bvddycorleone/status/1312876360617136136

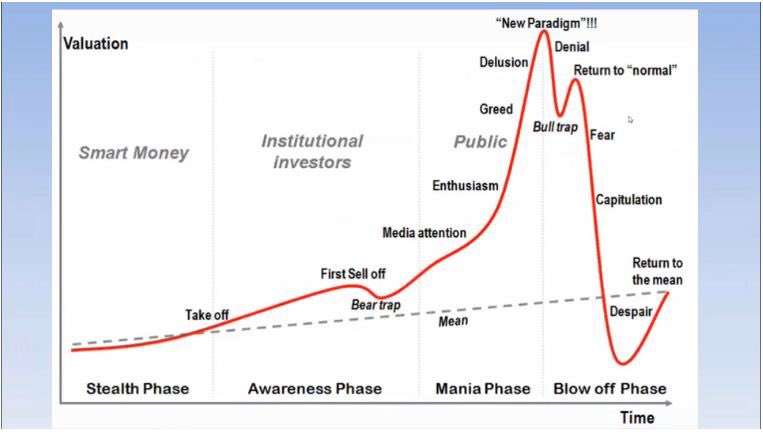

https://twitter.com/dopamine_uptake/status/13298887291090616362- Think back to the listing of $GLD; it’s a similar story. Pre-2005, it was almost impossible for institutions to own gold, as only option was physical.

https://twitter.com/bvddycorleone/status/1316441107308457984Let’s run through all the Old Guards of Wall Street who’ve recently morphed into Bitcoin advocates...

https://twitter.com/AitkenAdvisors/status/1326452210214051840Part 1-

https://twitter.com/macrovoices/status/13194101494680985601- Let’s start by dispelling common misperceptions. Many people don’t understand MMT yet think they do.

https://twitter.com/bvddycorleone/status/13193880615208099851- Injection into storage last week was only 29 Bcf, an incredible number.