🚨NEW for WB/IMF annual meetings🚨

Is the World Bank’s COVID Response Big Enough, Fast Enough?

We scraped >1/2 million transactions from the Bank's website to judge.

Blog: cgdev.org/blog/new-data-…

Paper: cgdev.org/publication/wo…

with @duggan_julian

@Morris_ScottA & G Yang

1/

Is the World Bank’s COVID Response Big Enough, Fast Enough?

We scraped >1/2 million transactions from the Bank's website to judge.

Blog: cgdev.org/blog/new-data-…

Paper: cgdev.org/publication/wo…

with @duggan_julian

@Morris_ScottA & G Yang

1/

@duggan_julian @Morris_ScottA Why are we worried about the speed of World Bank response?

Well, the Bank's own projections show global poverty is rising for the first time in 2 decades -- and many poor countries have little or no fiscal space to respond.

2/

Well, the Bank's own projections show global poverty is rising for the first time in 2 decades -- and many poor countries have little or no fiscal space to respond.

2/

@duggan_julian @Morris_ScottA Meanwhile, World Bank President David Malpass (Trump's nominee) has dropped hints he's going to drag his feet -- and wants to make COVID relief conditional on "structural reforms".

Here's Malpass:

3/

Here's Malpass:

3/

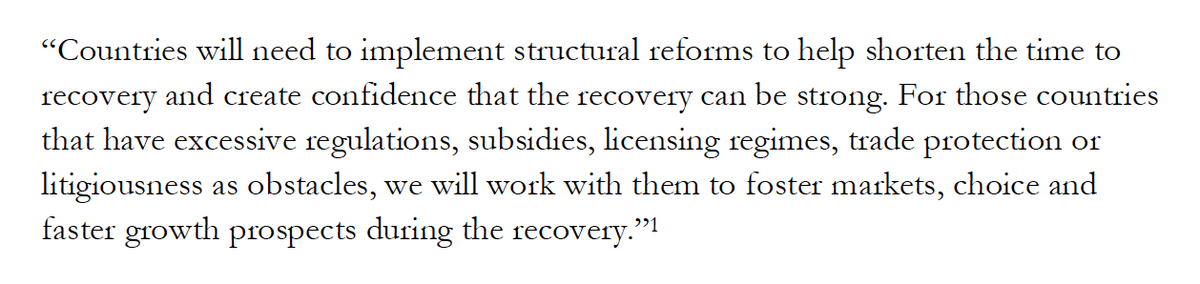

@duggan_julian @Morris_ScottA We see evidence of that foot dragging.

In February, the World Bank announced it would lend or grant $160 billion for COVID relief by June 2021 -- but right now, we find the Bank is on track to actually disburse only HALF that amount.

4/

In February, the World Bank announced it would lend or grant $160 billion for COVID relief by June 2021 -- but right now, we find the Bank is on track to actually disburse only HALF that amount.

4/

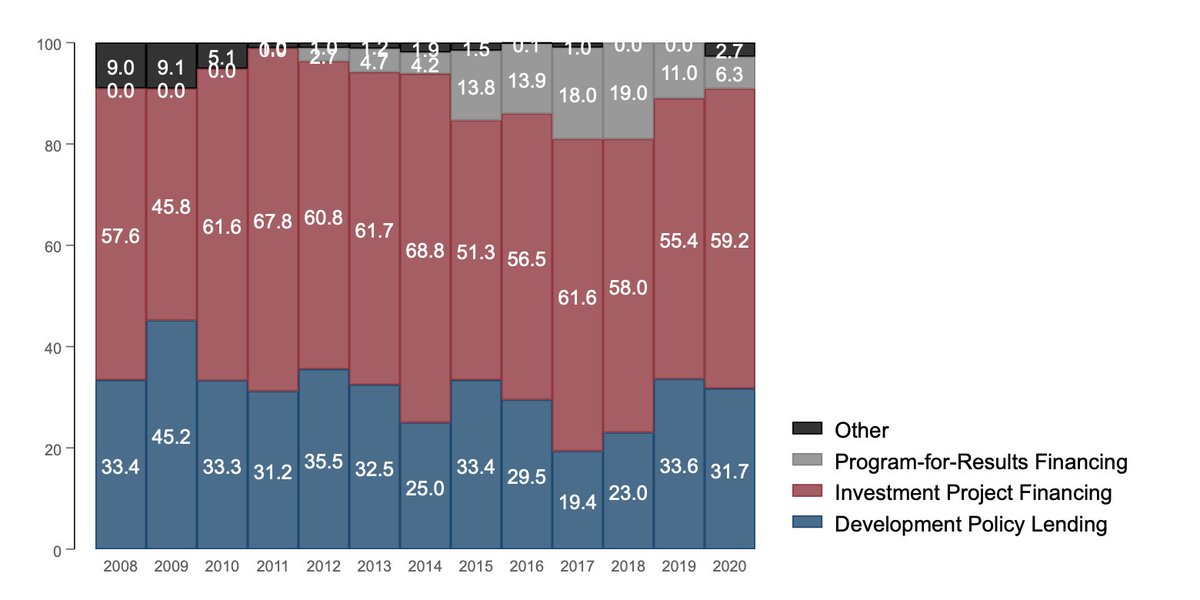

@duggan_julian @Morris_ScottA Why is the WB being so slow?

One reason is that unlike during the 2008-09 crisis, the WB has not pivoted to using its "development policy lending" instrument -- which can be disbursed quickly as general budget support.

It should!

5/

One reason is that unlike during the 2008-09 crisis, the WB has not pivoted to using its "development policy lending" instrument -- which can be disbursed quickly as general budget support.

It should!

5/

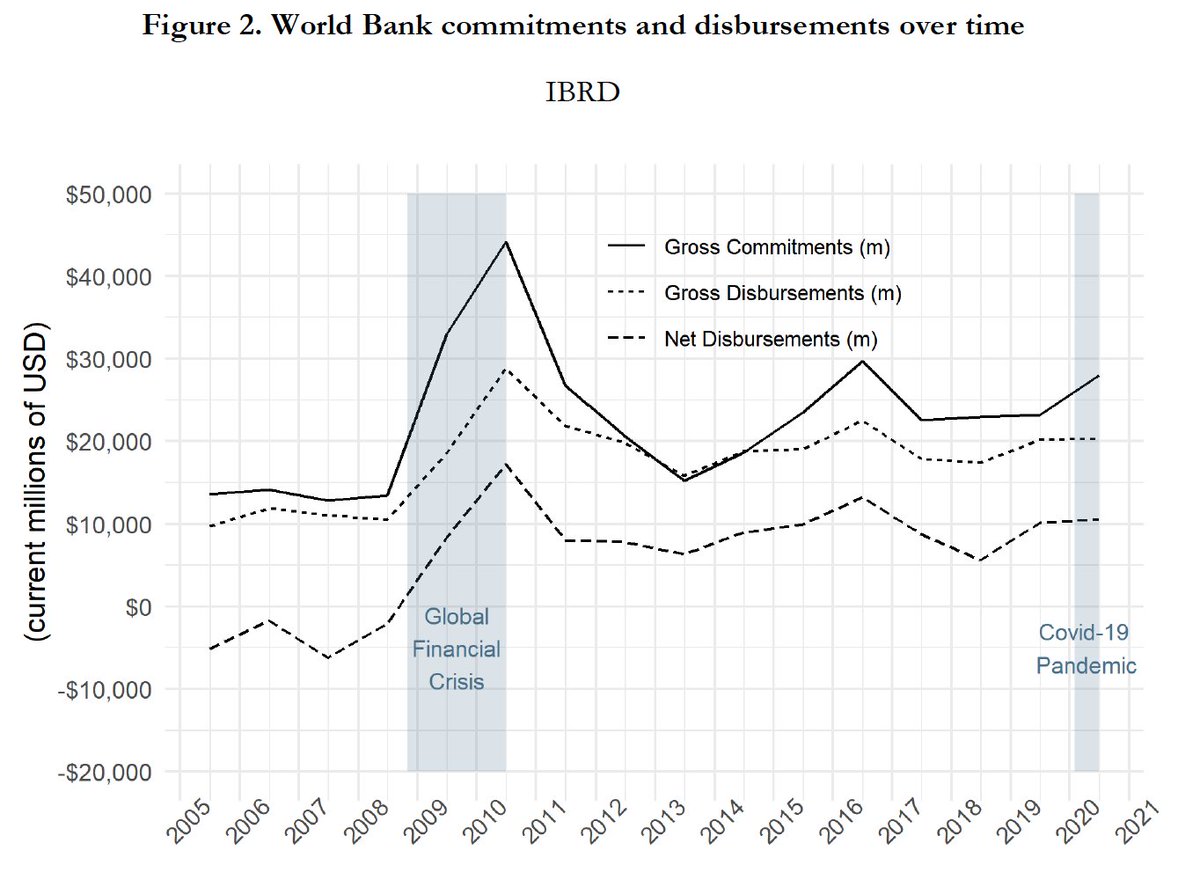

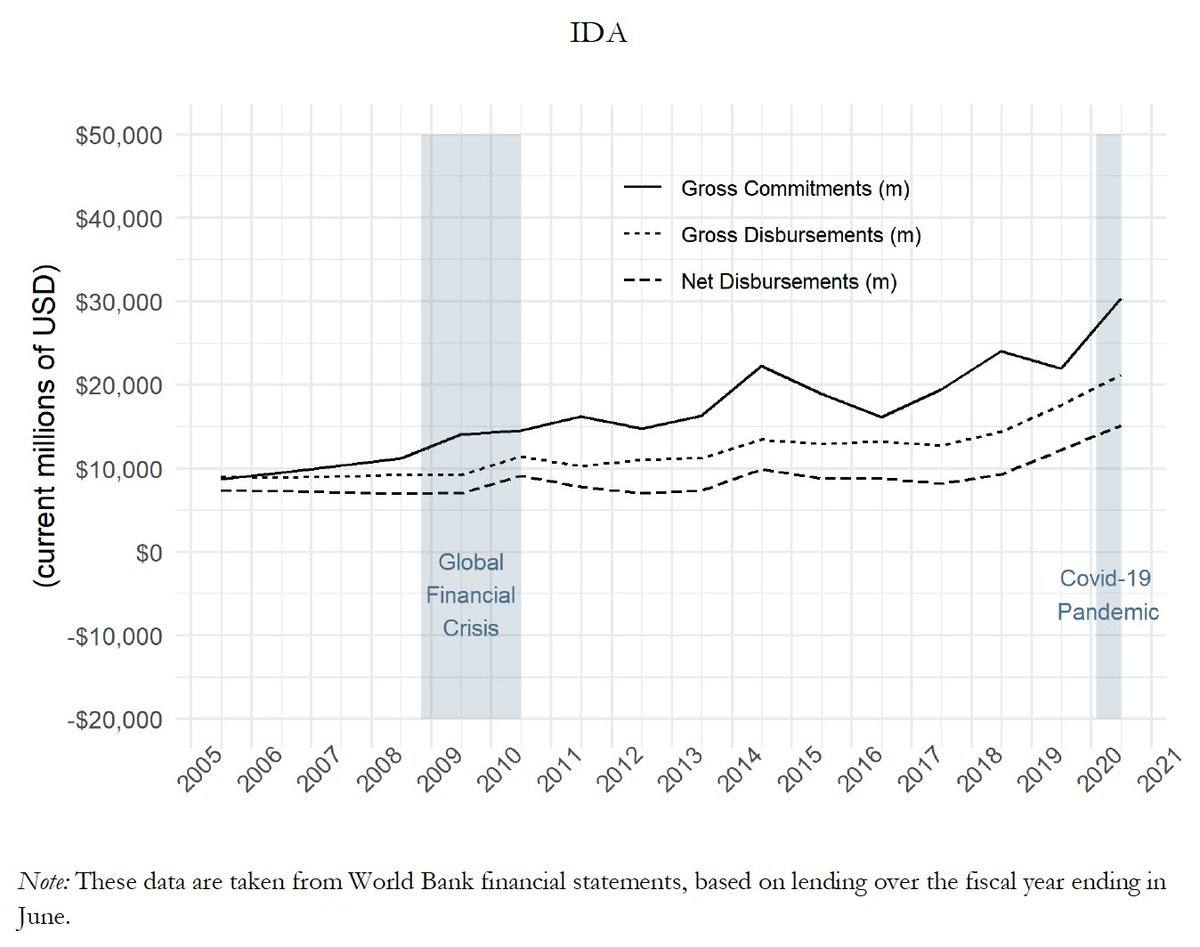

@duggan_julian @Morris_ScottA A positive point for the World Bank: relative to the 2008-09 crisis, the acceleration in IDA lending -- for the poorest countries -- appears to be faster this time. (Opposite is true for IBRD.)

Compare trajectories here:

6/

Compare trajectories here:

6/

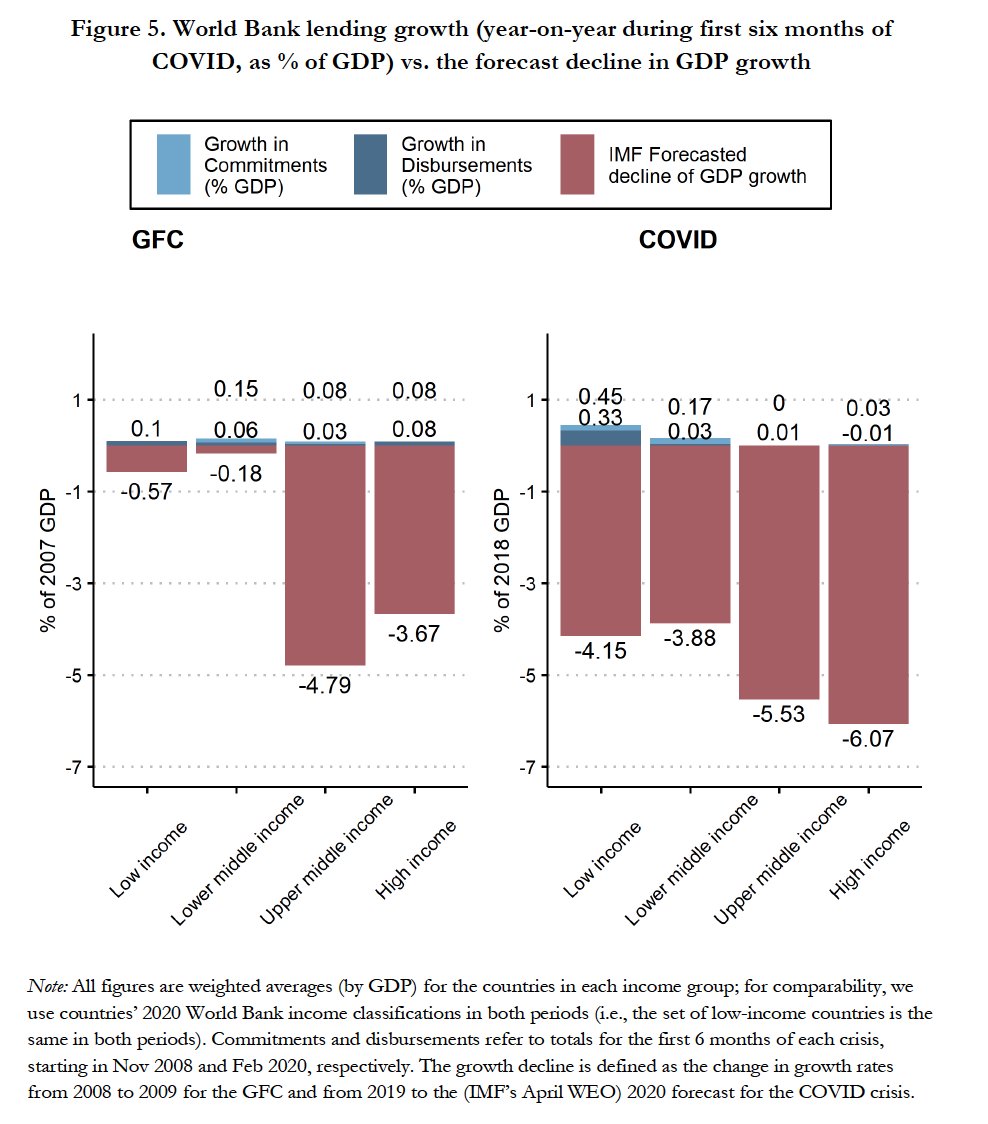

@duggan_julian @Morris_ScottA However, the poorest countries were relatively spared in 08-09 GFC. Not this time. So relative to the crisis -- e.g., relative to the forecast decline in growth -- the Bank's response looks fairly paltry right now.

Red: forecast growth decline.

Blue: WB response as % of GDP.

7/

Red: forecast growth decline.

Blue: WB response as % of GDP.

7/

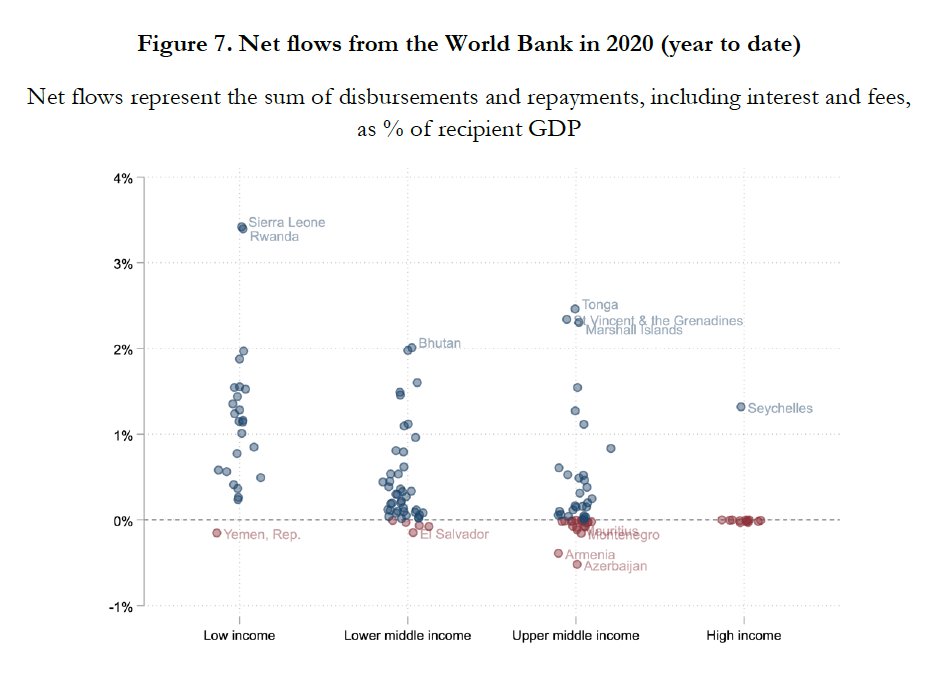

Finally, the World Bank has taken a lot of flak for boasting about its COVID lending -- while refusing to join the G20's debt standstill (aka DSSI) and freeze loan repayments from the same countries.

So we had a look at *net* flows to the World Bank.

8/

So we had a look at *net* flows to the World Bank.

8/

For the most part, poor borrowers are receiving quite a bit more in new loans than they're paying back to the World Bank right now. But there are exceptions (in red).

9/

9/

Evaluating the WB's argument that by collecting on debts now it preserves its AAA credit rating and retains the ability to lend more is beyond our scope -- but would be more credible if the Bank showed clearer signals of, um, actually lending more.

10/

10/

In sum, the World Bank exists in part to bail out poor countries in moments like this. We're facing the biggest global crisis since the Bank's creation. It's time to pull out all the stops.

So far, little sign that's happening.

11/11

So far, little sign that's happening.

11/11

P.S. Just learned @iamgeorgeyang is on twitter too. He and @duggan_julian did an onerous amount of data scraping and cleaning here.

Link to the full data set of WB transactions (commitments, disbursements, and repayments) over multiple decades is here: cgdev.org/publication/wo…

Link to the full data set of WB transactions (commitments, disbursements, and repayments) over multiple decades is here: cgdev.org/publication/wo…

Note the correction to Figure 1 which we’ve just posted to blog and paper. Data analysis is unchanged, but we misread the World Bank’s stated lending goal (it’s less ambitious than we thought). cgdev.org/blog/new-data-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh