This statement from Mnuchin is pretty infuriating.

https://twitter.com/AlterIgoe/status/1317094237473771521

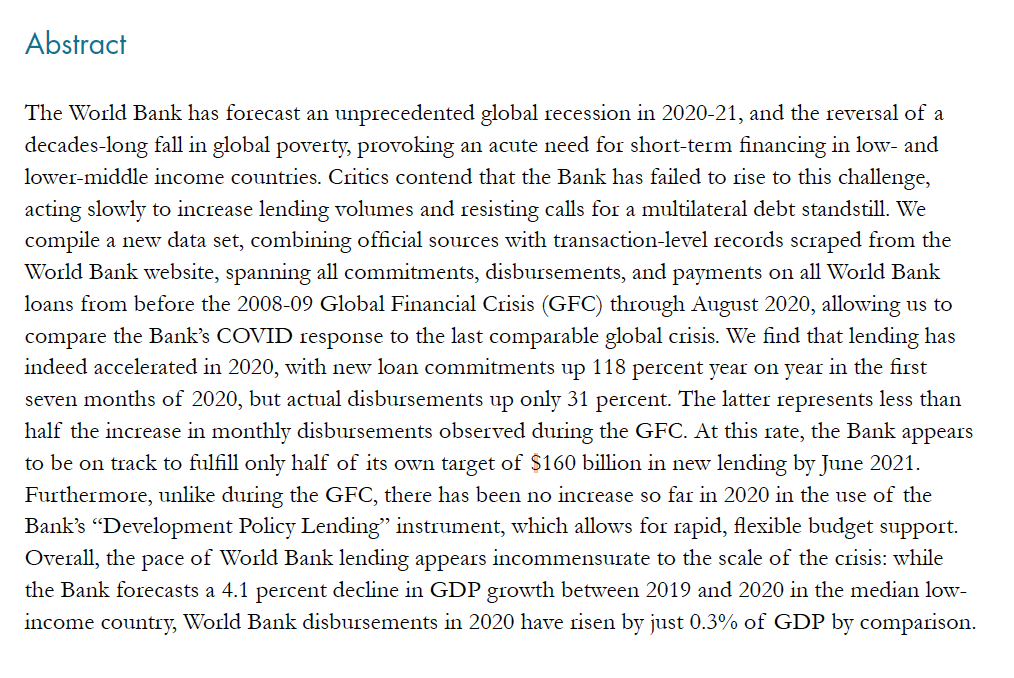

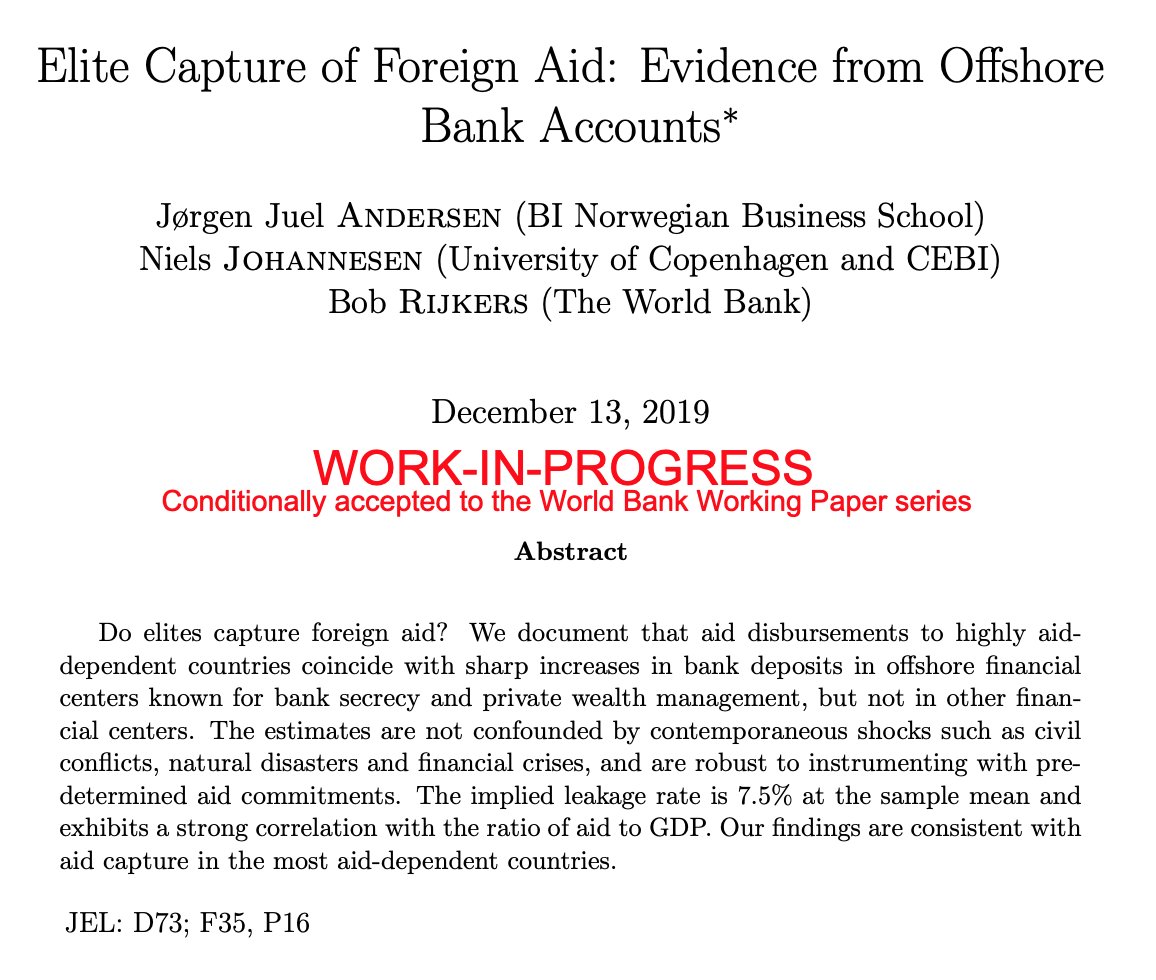

The poorest developing countries are confronting a huge rise in extreme poverty and hunger, alongside a looming debt crisis that limits their ability to do much fiscal stimulus.

But Mnuchin has no interest in any additional aid.

But Mnuchin has no interest in any additional aid.

The blithe double standard is just so plain here.

Mnuchin actually spends paragraphs boasting about the size of America's own fiscal and monetary response to COVID... while in the very next breath, ruling out the idea of a much smaller economic package for much poorer countries.

Mnuchin actually spends paragraphs boasting about the size of America's own fiscal and monetary response to COVID... while in the very next breath, ruling out the idea of a much smaller economic package for much poorer countries.

There is just zero recognition here of the acute economic crisis at hand.

https://twitter.com/a_presbitero/status/1317098742223376390

To add insult (and absurd geopolitics) to injury: this line really seems to align with rumors that the World Bank is blocking loans to crisis-affected poor countries who borrow from China.

And AYFKM? This sure reads like a suggestion to blacklist Huawei in World Bank procurement. That's Mnuchin's priority while 100m people fall into extreme poverty?

Just disgraceful.

Just disgraceful.

In his seemingly friendly remarks about debt relief, Mnuchin conspicuously avoids the big question of participation by private creditors -- which is key, and which the IMF has already endorsed. IMF gets no back up here.

https://twitter.com/DanielaGabor/status/1317104444987920393

• • •

Missing some Tweet in this thread? You can try to

force a refresh